i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

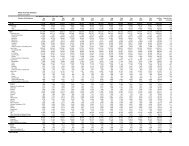

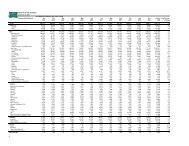

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

Available-for-sale financial assets<br />

Certain equity instruments held by STB are classified as being available for sale and are stated at fair value. Fair value<br />

is determined in the manner described in Note 4(b). Gains and losses arising from changes in fair value are recognized<br />

in other comprehensive income with the exception of impairment losses, interest calculated using the effective interest<br />

method and foreign exchange gains and losses on monetary assets which are recognised directly in income or expense.<br />

Where the investment is disposed of or is determined to be impaired, the cumulative gain or loss previously recognised<br />

in other comprehensive income and accumulate in revaluation reserve is reclassified to income or expense. Dividends<br />

on available-for-sale equity instruments are recognised in income or expense when STB’s right to receive payments is<br />

established. The fair value of available-for-sale monetary assets denominated in a foreign currency is determined in that<br />

foreign currency and translated at the spot rate at end of the reporting period. The change in fair value attributable to<br />

translation differences that result from a change in amortised cost of the asset is recognised in income or expense, and<br />

other changes are recognised in other comprehensive income.<br />

Impairment of financial assets<br />

Financial assets, other than those at fair value through profit or loss, are assessed for indicators of impairment at the end<br />

of each reporting period. Financial assets are impaired where there is objective evidence that, as a result of one or more<br />

events that occurred after the initial recognition of the financial asset, the estimated future cash flows of the financial assets<br />

have been impacted.<br />

For available-for-sale equity instruments, a significant or prolonged decline in the fair value of the investment below its cost<br />

is considered to be objective evidence of impairment.<br />

For financial assets carried at amortised cost, the amount of the impairment is the difference between the asset’s carrying<br />

amount and the present value of estimated future cash flows, discounted at the original effective interest rate.<br />

The carrying amount of the financial asset is reduced by the impairment loss directly for all financial assets with the<br />

exception of trade receivables where the carrying amount is reduced through the use of an allowance account. When<br />

a trade receivable is uncollectible, it is written off against the allowance account. Subsequent recoveries of amounts<br />

previously written off are credited against the allowance account. Changes in the carrying amount of the allowance<br />

account are recognised in income or expense.<br />

When an available-for-sale financial asset is considered to be impaired, cumulative gains or losses previously recognised<br />

in other comprehensive income are reclassified to income or expense.<br />

With the exception of available-for-sale equity instruments, if, in a subsequent period, the amount of the impairment loss<br />

decreases and the decrease can be related objectively to an event occurring after the impairment loss was recognised,<br />

the previously recognised impairment loss is reversed through income or expense to the extent that the carrying amount<br />

of the investment at the date the impairment is reversed does not exceed what the amortised cost would have been had<br />

the impairment loss not been recognised.<br />

67