i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

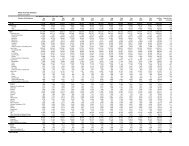

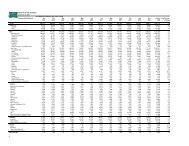

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

Cash and cash equivalents<br />

Cash and cash equivalents comprise cash at bank and demand deposits that are readily convertible to a known amount<br />

of cash and are subject to an insignificant risk of changes in value.<br />

Loans and receivables<br />

Trade and other receivables, loans and finance lease receivable that have fixed or determinable payments and are not quoted<br />

in an active market are classified as “loans and receivables”. Loans and receivables are measured at amortised cost using<br />

the effective interest method less impairment. Interest is recognised by applying the effective interest method, except for<br />

short-term receivables when the recognition of interest would be immaterial.<br />

Financial assets at fair value through profit or loss (FVPL)<br />

Financial assets are classified as FVPL where the financial asset is either held for trading or it is designated as FVPL.<br />

A financial asset is classified as held for trading if:<br />

(i)<br />

(ii)<br />

(iii)<br />

it has been acquired principally for the purpose of selling in the near future; or<br />

it is a part of an identified portfolio of financial instruments that STB manages and has a recent actual pattern of<br />

short-term profit-taking; or<br />

it is a derivative that is not designated as effective hedging instrument.<br />

A financial asset other than a financial asset held for trading may be designated as FVPL upon initial recognition if:<br />

(a)<br />

(b)<br />

(c)<br />

such designation eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise<br />

arise; or<br />

the financial asset forms part of a group of financial assets or financial liabilities or both, which is managed and<br />

its performance is evaluated on a fair value basis, in accordance with STB’s documented risk management or<br />

investment strategy, and information about the grouping is provided internally on that basis; or<br />

it forms part of a contract containing one or more embedded derivatives, and SB-FRS 39 permits the entire combined<br />

contract (asset or liability) to be designated as FVPL.<br />

Financial assets at fair value through profit or loss are stated at fair value, with any resultant gain or loss recognised in<br />

income or expenses. The net gain or loss recognised in income or expense incorporates any dividend or interest earned<br />

on the financial asset. Fair value is determined in the manner described in Note 4(b).<br />

66