i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

i'mpact Singapore Tourism Board Annual Report 2010/2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

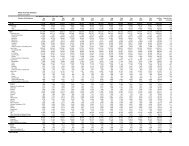

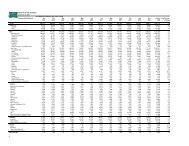

NOTES TO THE FINANCIAL STATEMENTS<br />

31 March <strong>2011</strong><br />

SB-FRS 24 (Revised) Related Party Disclosures is effective for annual periods beginning on or after January 1, <strong>2011</strong>.<br />

The revised standard clarifies the definition of a related party and consequently additional parties may be identified as<br />

related to the reporting entity.<br />

Where the exemption applies for government related entities (in relation to the disclosure of transactions, outstanding<br />

balances and commitments) the reporting entity has to make additional disclosure, including the nature of the relationship<br />

between STB and the government related entities and information on significant transactions or group of transactions<br />

involved.<br />

In the period of initial adoption, the changes to related party disclosures, if any, will be applied retrospectively with<br />

restatement of the comparative information.<br />

Management has considered and is of the view that the adoption of the SB-FRSs, INT SB-FRSs and Amendments to<br />

SB-FRSs that were issued at the date of authorisation of these financial statements but not effective until future periods<br />

will have no material impact on the financial statements in the period of their initial adoption.<br />

(b)<br />

FINANCIAL INSTRUMENTS<br />

Financial assets and financial liabilities are recognised in the statement of financial position when STB becomes a party to<br />

the contractual provisions of the instrument.<br />

Effective interest method<br />

The effective interest method is a method of calculating the amortised cost of a financial instrument and of allocating<br />

interest income or expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated<br />

future cash receipts or payments (including all fees paid or received that form an integral part of the effective interest<br />

rate, transaction costs and other premium or discounts) through the expected life of the financial instrument, or where<br />

appropriate, a shorter period. Income and expenses are recognised on an effective interest basis for debt instruments.<br />

Financial assets<br />

Investments are recognised and de-recognised on a trade date where the purchase or sale of an investment is under a<br />

contract whose terms require delivery of the investment within the timeframe established by the market concerned, and<br />

are initially measured at fair value plus transaction costs, except for those financial assets classified as at fair value through<br />

profit or loss which are initially measured at fair value.<br />

Other financial assets are classified into the following specified categories: financial assets “at fair value through profit<br />

or loss, “available-for-sale” financial assets and “loans and receivables”. The classification depends on the nature and<br />

purpose of financial assets and is determined at the time of initial recognition.<br />

65