TOP ESTONIAN ENTERPRISES

TOP ESTONIAN ENTERPRISES

TOP ESTONIAN ENTERPRISES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

What was the year 2008 generally<br />

like for Swedbank?<br />

Actually, the most important thing was that within<br />

a year, we managed to turn an organisation, the<br />

entire culture of which is built on growth, into an<br />

organisation which could adequately correspond<br />

to the needs of a shrinking market demand without<br />

revolutions and excesses, while at the same<br />

time preserving efficiency. Our revenue decreased<br />

by 2% before provisions and the level of expenditure<br />

remained the same. The operating profit only<br />

decreased by 3% before the provisions, and the<br />

revenue and expenditure ratio, which at the best<br />

times has been 38%, was slightly over 39%. We<br />

have also maintained this figure in 2009. Thus,<br />

within 2008 we managed to create a basis to further<br />

operate as efficiently in the banking environment<br />

in 2009 as before.<br />

In which ways have the world’s financial<br />

markets and the poor state of economy<br />

in Estonia influenced Swedbank?<br />

I remember that at the beginning of 2008, we<br />

held an information day for the employees and<br />

after my first presentation as the manager of<br />

the bank, I felt as if a mean Santa Claus had entered<br />

the room and taken away all the presents.<br />

We then talked at length about the negative outlook<br />

on the developments in the economy and it<br />

was certainly similar to shock – on the one<br />

hand, the increasingly worsening foreign economy<br />

and on the other, the economy in Estonia<br />

after the burst of the real estate bubble. All this<br />

was discussed in the first presentation and the<br />

consequence was not a quick mental turnaround<br />

of the organisation – the change in internal<br />

attitudes to match the environment was a<br />

long and time-consuming process.<br />

What are the most important activities<br />

that you paid the most attention to last year?<br />

It is very easy to answer this question. Those<br />

three main activities were: Credit, Costs and Customers<br />

– three capital C-s. We obviously also had<br />

to respond to changes in the credit portfolio quality<br />

and compensate the decrease in revenue by<br />

decreasing expenditure. The growing market,<br />

which was based on providing services and products,<br />

had now become a customer-friendly market<br />

increasingly more complexly focused on the<br />

needs of the customer. For us, since the spring in<br />

2008 inside the organisation this meant a strong<br />

shift towards the customer-friendly management<br />

model. We have also worked very seriously on improving<br />

service.<br />

How should Estonian manufacturing<br />

enterprises be feeling at the moment?<br />

The worst period for Estonian manufacturers<br />

was this spring, when no more orders were<br />

coming in. If you have no orders but there are<br />

employees and a bank loan, what do you do?<br />

This is a situation in which the society should<br />

have some answers in store to the question:<br />

what to do in difficult times? I am generally not<br />

in favour of aid packages but this was a really<br />

extraordinary situation. In the automobile industry,<br />

for instance, if nobody buys cars today, it<br />

is clear that the cars already purchased will<br />

wear off within about five years and people will<br />

start buying again. The question is what is the<br />

manufacturer supposed to do for the following<br />

two years? In several Estonian manufacturing<br />

enterprises, the situation was similar. By now<br />

the exporters I have been in contact with recently<br />

are saying that there is more work than in<br />

spring. It seems that recovery is taking place at<br />

the moment – I dare not predict whether there<br />

will be growth. The recovery of manufacturing<br />

does certainly not necessarily mean that the<br />

level of unemployment will not increase. We<br />

were afraid of July, but July was not actually<br />

that bad. It was probably the influence of the<br />

summer – some people went home to enjoy<br />

their holiday pay, others did seasonal work. We<br />

will now see in autumn whether the fall will be<br />

painful or not.<br />

What would the economic forecast<br />

of the Swedbank manager be?<br />

I think that it is currently most important that the<br />

situation will probably not get any worse. If there<br />

was a relatively sharp increase in the world’s<br />

stock markets in spring and there were no macro<br />

indicators to back it up, by now macro indicators<br />

have started to support the upturn. It is naturally<br />

different by regions. At the same time, the external<br />

environment has improved, capital markets<br />

have recovered and the availability of money is increasingly<br />

on the rise. It is interesting that the situation<br />

on the capital and money market is<br />

improving on a weekly basis and the credit risk<br />

prices keep falling. This means that the external<br />

environment, particularly the mood in the external<br />

environment, is positive.<br />

If we look at the immediate future in Estonia,<br />

the prices of real estate, for instance, have<br />

dropped so much that the average price per<br />

square metre and the average salary are starting<br />

to come close to each other – this is a level<br />

that could be sustainable. I have talked to developers<br />

and according to them, this is the level<br />

at which we could start building again.<br />

But everyone is currently probably waiting to<br />

see what is going to happen and when the economy<br />

in Finland or Sweden, for instance, will recover.<br />

We might be at a breaking point at the<br />

moment, but we will first have to wait for the autumn<br />

to arrive, it is too early to make far-reaching<br />

conclusions yet. I have previously rather<br />

been known as a person with a negative outlook<br />

but at the moment, I am positively minded about<br />

the future. •<br />

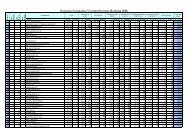

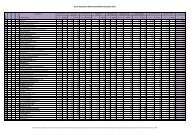

Financial Brokerage Enterprises<br />

Place<br />

Sales Change Net profit Change Return Labour costs Efficiency per Investments %<br />

Enterprise in sales in net profit on equity per employee employee of the first<br />

*group<br />

th. EEK place % place th. EEK place % place % place EEK/month place th. EEK place th. EEK place (0...100)<br />

1 SWEDBANK AS* 15,553,500 1 103.3 10 6,109,100 1 82.9 9 18.8 9 29,579 5 1,868 5 886,200 1 100.0%<br />

2 SMS LAEN AS* 90,415 8 125.4 4 25,186 6 236.2 1 64.0 2 52,377 2 4,305 2 1,429 8 89.2%<br />

3 GILD PARTNERS AS* 156,108 5 116.5 5 67,534 4 83.9 8 63.4 4 56,408 1 2,439 3 3,688 6 65.6%<br />

4 3 STEP IT OÜ 212,103 4 99.5 11 4,242 7 88.1 6 29.5 6 46,055 3 9,222 1 12 61.2%<br />

5 GVANDRON OÜ 2,228 14 144.0 1 525 10 154.0 2 64.6 1 13,370 14 557 12 1,316 10 59.3%<br />

6 MEGARAM OÜ 2,969 12 129.7 2 38 12 100 5 63.8 3 16,748 13 371 14 14 47.4%<br />

7 TAVID AS* 122,173 7 113.3 6 65,710 5 102.1 4 41.5 5 24,360 8 1,164 8 1,332 9 40.6%<br />

8 EESTI KREDIIDIPANK AS 358,390 3 111.0 8 71,421 3 86.4 7 20.5 7 26,640 7 1,765 6 7,883 4 36.0%<br />

9 ERGO KINDLUSTUSE AS* 924,357 2 99.2 12 124,615 2 117.2 3 17.3 10 19,997 10 1,675 7 10,049 3 30.1%<br />

10 PÕLVAMAA HOIU-LAENUÜHISTU TUÜ 2,460 13 111.8 7 122 11 50.0 10 4.5 12 29,430 6 615 11 9 13 26.2%<br />

11 TALLINNA ÄRIPANGA AS* 129,700 6 99.1 13 -7,500 14 -2.2 13 34,766 4 2,027 4 21,900 2 23.2%<br />

12 KINDLUSTUSEST KINDLUSTUSMAAKLER OÜ 15,384 11 108.9 9 532 9 30.0 12 19.2 8 21,542 9 440 13 99 11 21.5%<br />

13 IIZI KINDLUSTUSMAAKLER AS* 84,613 9 126.6 3 -2,911 13 -30.5 14 19,075 12 631 10 4,064 5 17.8%<br />

14 EUREX CAPITAL OÜ* 28,822 10 98.6 14 4,038 8 33.6 11 14.4 11 19,901 11 721 9 2,381 7 15.5%<br />

www.konkurents.ee<br />

1 EUR = 15.6466 EEK; 1 EEK = 0.0639 EUR; based on 2008 data<br />

62