cfs retail property trust group (cfx) - First State Investments

cfs retail property trust group (cfx) - First State Investments

cfs retail property trust group (cfx) - First State Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Responsible Entity:<br />

Commonwealth Managed <strong>Investments</strong> Limited<br />

ABN 33 084 098 180<br />

AFSL 235384<br />

Colonial <strong>First</strong> <strong>State</strong> Property Retail Pty Limited<br />

ABN 19 101 384 294<br />

Manager of CFS Retail Property Trust Group<br />

Registered Address:<br />

Ground Floor, Tower 1, 201 Sussex Street<br />

Sydney NSW 2000 Australia<br />

Principal Office of the Manager:<br />

Level 4, Tower 1, 201 Sussex Street<br />

Sydney NSW 2000 Australia<br />

Telephone: 02 9303 3500<br />

Facsimile: 02 9303 3622<br />

27 June 2013<br />

CFS RETAIL PROPERTY TRUST GROUP (CFX)<br />

June 2013 valuations and Emporium Melbourne update<br />

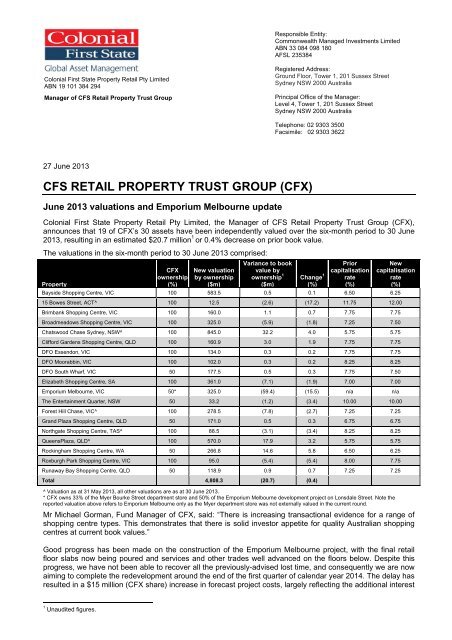

Colonial <strong>First</strong> <strong>State</strong> Property Retail Pty Limited, the Manager of CFS Retail Property Trust Group (CFX),<br />

announces that 19 of CFX’s 30 assets have been independently valued over the six-month period to 30 June<br />

2013, resulting in an estimated $20.7 million 1 or 0.4% decrease on prior book value.<br />

The valuations in the six-month period to 30 June 2013 comprised:<br />

Property<br />

CFX<br />

ownership<br />

(%)<br />

New valuation<br />

by ownership<br />

($m)<br />

Variance to book<br />

value by<br />

ownership 1<br />

($m)<br />

Change 1<br />

(%)<br />

Prior<br />

capitalisation<br />

rate<br />

(%)<br />

New<br />

capitalisation<br />

rate<br />

(%)<br />

Bayside Shopping Centre, VIC 100 583.5 0.5 0.1 6.50 6.25<br />

15 Bowes Street, ACT^ 100 12.5 (2.6) (17.2) 11.75 12.00<br />

Brimbank Shopping Centre, VIC 100 160.0 1.1 0.7 7.75 7.75<br />

Broadmeadows Shopping Centre, VIC 100 325.0 (5.9) (1.8) 7.25 7.50<br />

Chatswood Chase Sydney, NSW^ 100 845.0 32.2 4.0 5.75 5.75<br />

Clifford Gardens Shopping Centre, QLD 100 160.9 3.0 1.9 7.75 7.75<br />

DFO Essendon, VIC 100 134.0 0.3 0.2 7.75 7.75<br />

DFO Moorabbin, VIC 100 102.0 0.3 0.2 8.25 8.25<br />

DFO South Wharf, VIC 50 177.5 0.5 0.3 7.75 7.50<br />

Elizabeth Shopping Centre, SA 100 361.0 (7.1) (1.9) 7.00 7.00<br />

Emporium Melbourne, VIC 50* 325.0 (59.4) (15.5) n/a n/a<br />

The Entertainment Quarter, NSW 50 33.2 (1.2) (3.4) 10.00 10.00<br />

Forest Hill Chase, VIC^ 100 278.5 (7.8) (2.7) 7.25 7.25<br />

Grand Plaza Shopping Centre, QLD 50 171.0 0.5 0.3 6.75 6.75<br />

Northgate Shopping Centre, TAS^ 100 88.5 (3.1) (3.4) 8.25 8.25<br />

QueensPlaza, QLD^ 100 570.0 17.9 3.2 5.75 5.75<br />

Rockingham Shopping Centre, WA 50 266.8 14.6 5.8 6.50 6.25<br />

Roxburgh Park Shopping Centre, VIC 100 95.0 (5.4) (5.4) 8.00 7.75<br />

Runaway Bay Shopping Centre, QLD 50 118.9 0.9 0.7 7.25 7.25<br />

Total 4,808.3 (20.7) (0.4)<br />

^ Valuation as at 31 May 2013, all other valuations are as at 30 June 2013.<br />

* CFX owns 33% of the Myer Bourke Street department store and 50% of the Emporium Melbourne development project on Lonsdale Street. Note the<br />

reported valuation above refers to Emporium Melbourne only as the Myer department store was not externally valued in the current round.<br />

Mr Michael Gorman, Fund Manager of CFX, said: “There is increasing transactional evidence for a range of<br />

shopping centre types. This demonstrates that there is solid investor appetite for quality Australian shopping<br />

centres at current book values.”<br />

Good progress has been made on the construction of the Emporium Melbourne project, with the final <strong>retail</strong><br />

floor slabs now being poured and services and other trades well advanced on the floors below. Despite this<br />

progress, we have not been able to recover all the previously-advised lost time, and consequently we are now<br />

aiming to complete the redevelopment around the end of the first quarter of calendar year 2014. The delay has<br />

resulted in a $15 million (CFX share) increase in forecast project costs, largely reflecting the additional interest<br />

1<br />

Unaudited figures.

costs to be incurred, bringing the revised total forecast project cost to $590 million (CFX share). Leasing has<br />

progressed significantly in recent months, with approximately 75% of income now secured. However, in light of<br />

the subdued <strong>retail</strong> leasing market, we have revised down our income forecasts. The combination of lower<br />

income and increased costs has resulted in a revised target year-one yield on costs of approximately 5%. The<br />

adjusted project metrics have now been factored into the independent valuation, resulting in a writedown of<br />

$59.4 million of the project book value being reported.<br />

Mr Gorman said: “Notwithstanding the tough leasing environment, we remain excited about the world class<br />

<strong>retail</strong> destination that we are creating in the heart of Melbourne, widely regarded as Australia’s most fashion<br />

conscious city. The project will incorporate a range of concept and large flagship stores housing some of the<br />

world’s best international and luxury brands. We are focused on having the project fully leased on opening.”<br />

Excluding the impact of the Emporium Melbourne valuation, the portfolio had a modest uptick in asset values.<br />

Key assets Chatswood Chase Sydney and QueensPlaza showed solid increases driven by income growth,<br />

and Rockingham Shopping Centre was driven by a combination of income growth and a tightening in the<br />

capitalisation rate. Partially offsetting these gains were decreases at Forest Hill Chase and Elizabeth Shopping<br />

Centre driven by softer income assumptions, and Broadmeadows Shopping Centre driven by a softening in<br />

the capitalisation rate. Generally speaking the Victorian assets were negatively impacted by more<br />

conservative outgoings assumptions based on the impending Victorian Fire Services Levy and changes in<br />

land tax calculations.<br />

As a consequence of these valuations, the portfolio weighted average capitalisation rate 2 tightened slightly to<br />

6.43% at 30 June 2013 from 6.44% at 31 December 2012. CFX’s total assets are estimated to be $8.6 billion<br />

at 30 June 2013, up from $8.5 billion as at 31 December 2012, predominantly reflecting development<br />

expenditure.<br />

Net Tangible Asset backing per stapled security is expected to decrease slightly to $2.04 at 30 June 2013<br />

from $2.05 at 31 December 2012. Gearing 3 is expected to be around 28.9% at 30 June 2013, up from 27.9%<br />

at 31 December 2012, largely as a result of development expenditure and remains comfortably within CFX’s<br />

target gearing range of 25% to 35%.<br />

2. Excluding DFO <strong>retail</strong> outlet centres, Myer Melbourne and 15 Bowes Street, Woden.<br />

3. Gearing equals total drawn debt to total assets. For this calculation total assets exclude the fair value of derivatives.<br />

For further information please contact:<br />

ENDS<br />

Michael Gorman<br />

Angus McNaughton<br />

Fund Manager<br />

Managing Director, Property<br />

CFS Retail Property Trust Group<br />

Colonial <strong>First</strong> <strong>State</strong> Global Asset Management<br />

Phone: +612 9303 3448 Phone: +612 9303 3765<br />

Email: mgorman@colonialfirststate.com.au<br />

Email: amcnaughton@colonialfirststate.com.au<br />

Investor and media contacts:<br />

Penny Berger<br />

Troy Dahms<br />

Head of Investor Relations and Communications<br />

Investor Relations and Communications Manager<br />

Colonial <strong>First</strong> <strong>State</strong> Global Asset Management<br />

Colonial <strong>First</strong> <strong>State</strong> Global Asset Management<br />

Phone: +61 2 9303 3516 or +61 402 079 955 Phone: +61 2 9303 3491 or +61 412 055 996<br />

Email: pberger@colonialfirststate.com.au<br />

Email: tdahms@colonialfirststate.com.au<br />

About CFS Retail Property Trust Group (CFX)<br />

CFX is a <strong>retail</strong> sector-specific Australian Real Estate Investment Trust (A-REIT) which invests in high quality<br />

<strong>retail</strong> assets including super-regional, regional and sub-regional shopping centres and DFO <strong>retail</strong> outlet<br />

centres across Australia. CFX is managed by entities within CFSGAM Property on behalf of more than 17,000<br />

investors from 23 countries with a portfolio comprised of 30 assets and a total asset value estimated at<br />

$8.6 billion at 30 June 2013.<br />

About CFSGAM Property<br />

CFSGAM Property is the specialist <strong>property</strong> division of Colonial <strong>First</strong> <strong>State</strong> Global Asset Management, and is<br />

one of the largest real estate fund managers in Australia with $17 billion in funds under management.<br />

CFSGAM Property offers a fully integrated real estate investment platform including investment management,<br />

asset management, development management, origination and execution. CFSGAM Property manages a<br />

suite of wholesale investment products, as well as three listed real estate investment <strong>trust</strong>s in Australia and<br />

New Zealand.<br />

2