Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

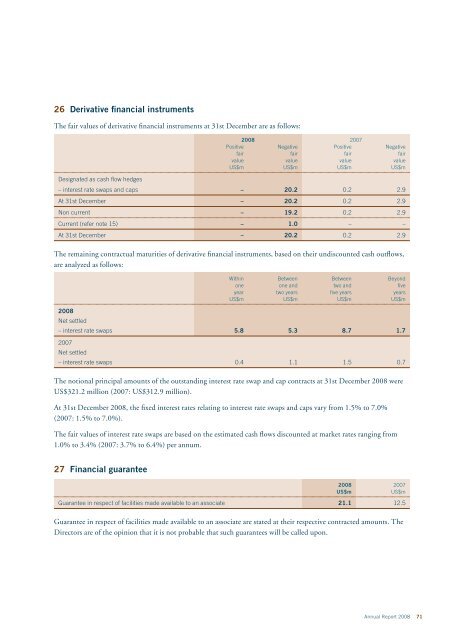

26 Derivative financial instruments<br />

The fair values of derivative financial instruments at 31st December are as follows:<br />

2008 2007<br />

Positive Negative Positive Negative<br />

fair fair fair fair<br />

value value value value<br />

US$m US$m US$m US$m<br />

Designated as cash flow hedges<br />

– interest rate swaps and caps – 20.2 0.2 2.9<br />

At 31st December – 20.2 0.2 2.9<br />

Non current – 19.2 0.2 2.9<br />

Current (refer note 15) – 1.0 – –<br />

At 31st December – 20.2 0.2 2.9<br />

The remaining contractual maturities of derivative financial instruments, based on their undiscounted cash outflows,<br />

are analyzed as follows:<br />

Within Between Between Beyond<br />

one one and two and five<br />

year two years five years years<br />

US$m US$m US$m US$m<br />

2008<br />

Net settled<br />

– interest rate swaps 5.8 5.3 8.7 1.7<br />

2007<br />

Net settled<br />

– interest rate swaps 0.4 1.1 1.5 0.7<br />

The notional principal amounts of the outstanding interest rate swap and cap contracts at 31st December 2008 were<br />

US$321.2 million (2007: US$312.9 million).<br />

At 31st December 2008, the fixed interest rates relating to interest rate swaps and caps vary from 1.5% to 7.0%<br />

(2007: 1.5% to 7.0%).<br />

The fair values of interest rate swaps are based on the estimated cash flows discounted at market rates ranging from<br />

1.0% to 3.4% (2007: 3.7% to 6.4%) per annum.<br />

27 Financial guarantee<br />

2008 2007<br />

US$m US$m<br />

Guarantee in respect of facilities made available to an associate 21.1 12.5<br />

Guarantee in respect of facilities made available to an associate are stated at their respective contracted amounts. The<br />

Directors are of the opinion that it is not probable that such guarantees will be called upon.<br />

Annual Report 2008 71