Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements Continued<br />

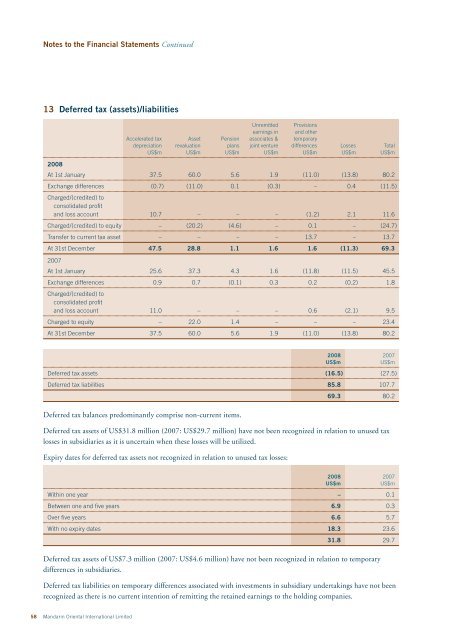

13 Deferred tax (assets)/liabilities<br />

58 <strong>Mandarin</strong> <strong>Oriental</strong> <strong>International</strong> <strong>Limited</strong><br />

Unremitted Provisions<br />

earnings in and other<br />

Accelerated tax Asset Pension associates & temporary<br />

depreciation revaluation plans joint venture differences Losses Total<br />

US$m US$m US$m US$m US$m US$m US$m<br />

2008<br />

At 1st January 37.5 60.0 5.6 1.9 (11.0 ) (13.8 ) 80.2<br />

Exchange differences<br />

Charged/(credited) to<br />

consolidated profit<br />

(0.7 ) (11.0 ) 0.1 (0.3 ) – 0.4 (11.5 )<br />

and loss account 10.7 – – – (1.2 ) 2.1 11.6<br />

Charged/(credited) to equity – (20.2 ) (4.6 ) – 0.1 – (24.7 )<br />

Transfer to current tax asset – – – – 13.7 – 13.7<br />

At 31st December 47.5 28.8 1.1 1.6 1.6 (11.3 ) 69.3<br />

2007<br />

At 1st January 25.6 37.3 4.3 1.6 (11.8 ) (11.5 ) 45.5<br />

Exchange differences<br />

Charged/(credited) to<br />

consolidated profit<br />

0.9 0.7 (0.1 ) 0.3 0.2 (0.2 ) 1.8<br />

and loss account 11.0 – – – 0.6 (2.1 ) 9.5<br />

Charged to equity – 22.0 1.4 – – – 23.4<br />

At 31st December 37.5 60.0 5.6 1.9 (11.0 ) (13.8 ) 80.2<br />

2008 2007<br />

US$m US$m<br />

Deferred tax assets (16.5 ) (27.5 )<br />

Deferred tax liabilities 85.8 107.7<br />

Deferred tax balances predominantly comprise non-current items.<br />

69.3 80.2<br />

Deferred tax assets of US$31.8 million (2007: US$29.7 million) have not been recognized in relation to unused tax<br />

losses in subsidiaries as it is uncertain when these losses will be utilized.<br />

Expiry dates for deferred tax assets not recognized in relation to unused tax losses:<br />

2008 2007<br />

US$m US$m<br />

Within one year – 0.1<br />

Between one and five years 6.9 0.3<br />

Over five years 6.6 5.7<br />

With no expiry dates 18.3 23.6<br />

31.8 29.7<br />

Deferred tax assets of US$7.3 million (2007: US$4.6 million) have not been recognized in relation to temporary<br />

differences in subsidiaries.<br />

Deferred tax liabilities on temporary differences associated with investments in subsidiary undertakings have not been<br />

recognized as there is no current intention of remitting the retained earnings to the holding companies.