Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

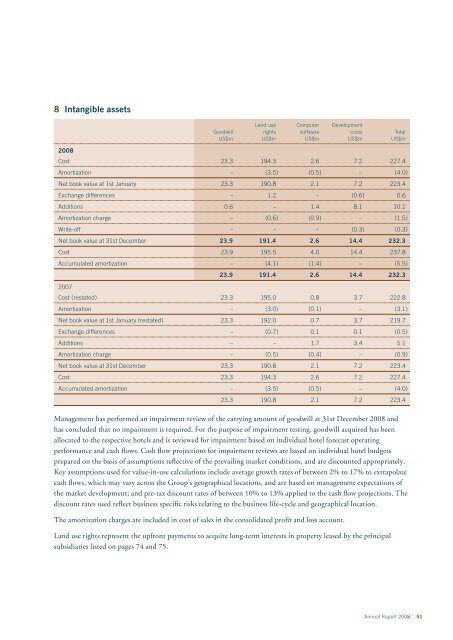

8 Intangible assets<br />

Land use Computer Development<br />

Goodwill rights software costs Total<br />

US$m US$m US$m US$m US$m<br />

2008<br />

Cost 23.3 194.3 2.6 7.2 227.4<br />

Amortization – (3.5 ) (0.5 ) – (4.0 )<br />

Net book value at 1st January 23.3 190.8 2.1 7.2 223.4<br />

Exchange differences – 1.2 – (0.6 ) 0.6<br />

Additions 0.6 – 1.4 8.1 10.1<br />

Amortization charge – (0.6 ) (0.9 ) – (1.5 )<br />

Write-off – – – (0.3 ) (0.3 )<br />

Net book value at 31st December 23.9 191.4 2.6 14.4 232.3<br />

Cost 23.9 195.5 4.0 14.4 237.8<br />

Accumulated amortization – (4.1 ) (1.4 ) – (5.5 )<br />

23.9 191.4 2.6 14.4 232.3<br />

2007<br />

Cost (restated) 23.3 195.0 0.8 3.7 222.8<br />

Amortization – (3.0 ) (0.1 ) – (3.1 )<br />

Net book value at 1st January (restated) 23.3 192.0 0.7 3.7 219.7<br />

Exchange differences – (0.7 ) 0.1 0.1 (0.5 )<br />

Additions – – 1.7 3.4 5.1<br />

Amortization charge – (0.5 ) (0.4 ) – (0.9 )<br />

Net book value at 31st December 23.3 190.8 2.1 7.2 223.4<br />

Cost 23.3 194.3 2.6 7.2 227.4<br />

Accumulated amortization – (3.5 ) (0.5 ) – (4.0 )<br />

23.3 190.8 2.1 7.2 223.4<br />

Management has performed an impairment review of the carrying amount of goodwill at 31st December 2008 and<br />

has concluded that no impairment is required. For the purpose of impairment testing, goodwill acquired has been<br />

allocated to the respective hotels and is reviewed for impairment based on individual hotel forecast operating<br />

performance and cash flows. Cash flow projections for impairment reviews are based on individual hotel budgets<br />

prepared on the basis of assumptions reflective of the prevailing market conditions, and are discounted appropriately.<br />

Key assumptions used for value-in-use calculations include average growth rates of between 2% to 17% to extrapolate<br />

cash flows, which may vary across the Group’s geographical locations, and are based on management expectations of<br />

the market development; and pre-tax discount rates of between 10% to 13% applied to the cash flow projections. The<br />

discount rates used reflect business specific risks relating to the business life-cycle and geographical location.<br />

The amortization charges are included in cost of sales in the consolidated profit and loss account.<br />

Land use rights represent the upfront payments to acquire long-term interests in property leased by the principal<br />

subsidiaries listed on pages 74 and 75.<br />

Annual Report 2008 51