Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Review Continued<br />

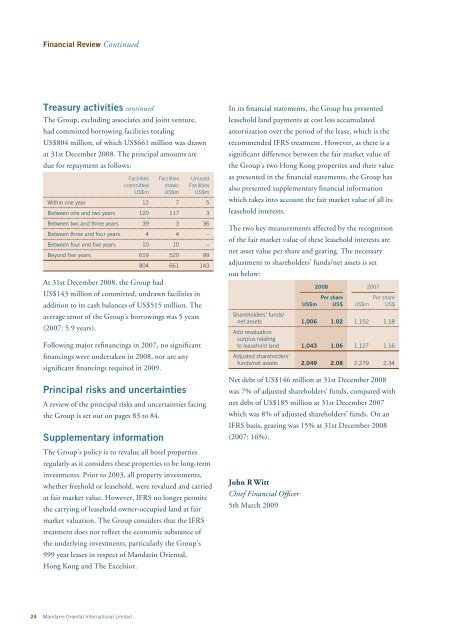

Treasury activities continued<br />

The Group, excluding associates and joint venture,<br />

had committed borrowing facilities totaling<br />

US$804 million, of which US$661 million was drawn<br />

at 31st December 2008. The principal amounts are<br />

due for repayment as follows:<br />

Facilities Facilities Unused<br />

committed drawn Facilities<br />

US$m US$m US$m<br />

Within one year 12 7 5<br />

Between one and two years 120 117 3<br />

Between two and three years 39 3 36<br />

Between three and four years 4 4 –<br />

Between four and five years 10 10 –<br />

Beyond five years 619 520 99<br />

804 661 143<br />

At 31st December 2008, the Group had<br />

US$143 million of committed, undrawn facilities in<br />

addition to its cash balances of US$515 million. The<br />

average tenor of the Group’s borrowings was 5 years<br />

(2007: 5.9 years).<br />

Following major refinancings in 2007, no significant<br />

financings were undertaken in 2008, nor are any<br />

significant financings required in 2009.<br />

Principal risks and uncertainties<br />

A review of the principal risks and uncertainties facing<br />

the Group is set out on pages 83 to 84.<br />

Supplementary information<br />

The Group’s policy is to revalue all hotel properties<br />

regularly as it considers these properties to be long-term<br />

investments. Prior to 2003, all property investments,<br />

whether freehold or leasehold, were revalued and carried<br />

at fair market value. However, IFRS no longer permits<br />

the carrying of leasehold owner-occupied land at fair<br />

market valuation. The Group considers that the IFRS<br />

treatment does not reflect the economic substance of<br />

the underlying investments, particularly the Group’s<br />

999 year leases in respect of <strong>Mandarin</strong> <strong>Oriental</strong>,<br />

Hong Kong and The Excelsior.<br />

24 <strong>Mandarin</strong> <strong>Oriental</strong> <strong>International</strong> <strong>Limited</strong><br />

In its financial statements, the Group has presented<br />

leasehold land payments at cost less accumulated<br />

amortization over the period of the lease, which is the<br />

recommended IFRS treatment. However, as there is a<br />

significant difference between the fair market value of<br />

the Group’s two Hong Kong properties and their value<br />

as presented in the financial statements, the Group has<br />

also presented supplementary financial information<br />

which takes into account the fair market value of all its<br />

leasehold interests.<br />

The two key measurements affected by the recognition<br />

of the fair market value of these leasehold interests are<br />

net asset value per share and gearing. The necessary<br />

adjustment to shareholders’ funds/net assets is set<br />

out below:<br />

2008 2007<br />

Per share Per share<br />

US$m US$ US$m US$<br />

Shareholders’ funds/<br />

net assets 1,006 1.02 1,152 1.18<br />

Add revaluation<br />

surplus relating<br />

to leasehold land 1,043 1.06 1,127 1.16<br />

Adjusted shareholders’<br />

funds/net assets 2,049 2.08 2,279 2.34<br />

Net debt of US$146 million at 31st December 2008<br />

was 7% of adjusted shareholders’ funds, compared with<br />

net debt of US$185 million at 31st December 2007<br />

which was 8% of adjusted shareholders’ funds. On an<br />

IFRS basis, gearing was 15% at 31st December 2008<br />

(2007: 16%).<br />

John R Witt<br />

Chief Financial Officer<br />

5th March 2009