Notes to the Consolidated Financial Statements - Seylan Bank

Notes to the Consolidated Financial Statements - Seylan Bank

Notes to the Consolidated Financial Statements - Seylan Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

North Bound > <strong>Seylan</strong> <strong>Bank</strong> Annual Report 2011<br />

297<br />

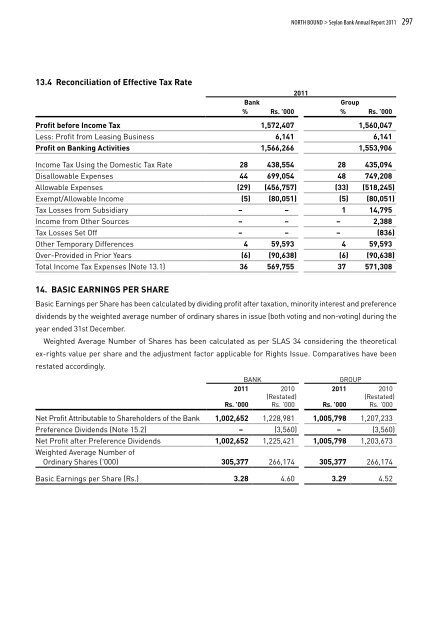

13.4 Reconciliation of Effective Tax Rate<br />

2011<br />

<strong>Bank</strong><br />

Group<br />

% Rs. ’000 % Rs. ’000<br />

Profit before Income Tax 1,572,407 1,560,047<br />

Less: Profit from Leasing Business 6,141 6,141<br />

Profit on <strong>Bank</strong>ing Activities 1,566,266 1,553,906<br />

Income Tax Using <strong>the</strong> Domestic Tax Rate 28 438,554 28 435,094<br />

Disallowable Expenses 44 699,054 48 749,208<br />

Allowable Expenses (29) (456,757) (33) (518,245)<br />

Exempt/Allowable Income (5) (80,051) (5) (80,051)<br />

Tax Losses from Subsidiary – – 1 14,795<br />

Income from O<strong>the</strong>r Sources – – – 2,388<br />

Tax Losses Set Off – – – (836)<br />

O<strong>the</strong>r Temporary Differences 4 59,593 4 59,593<br />

Over-Provided in Prior Years (6) (90,638) (6) (90,638)<br />

Total Income Tax Expenses (Note 13.1) 36 569,755 37 571,308<br />

14. Basic Earnings Per Share<br />

Basic Earnings per Share has been calculated by dividing profit after taxation, minority interest and preference<br />

dividends by <strong>the</strong> weighted average number of ordinary shares in issue (both voting and non-voting) during <strong>the</strong><br />

year ended 31st December.<br />

Weighted Average Number of Shares has been calculated as per SLAS 34 considering <strong>the</strong> <strong>the</strong>oretical<br />

ex-rights value per share and <strong>the</strong> adjustment fac<strong>to</strong>r applicable for Rights Issue. Comparatives have been<br />

restated accordingly.<br />

BANK<br />

GROUP<br />

2011 2010 2011 2010<br />

(Restated)<br />

(Restated)<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Net Profit Attributable <strong>to</strong> Shareholders of <strong>the</strong> <strong>Bank</strong> 1,002,652 1,228,981 1,005,798 1,207,233<br />

Preference Dividends (Note 15.2) – (3,560) – (3,560)<br />

Net Profit after Preference Dividends 1,002,652 1,225,421 1,005,798 1,203,673<br />

Weighted Average Number of<br />

Ordinary Shares ('000) 305,377 266,174 305,377 266,174<br />

Basic Earnings per Share (Rs.) 3.28 4.60 3.29 4.52