Notes to the Consolidated Financial Statements - Seylan Bank

Notes to the Consolidated Financial Statements - Seylan Bank

Notes to the Consolidated Financial Statements - Seylan Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

North Bound > <strong>Seylan</strong> <strong>Bank</strong> Annual Report 2011<br />

293<br />

BANK<br />

GROUP<br />

2011 2010 2011 2010<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

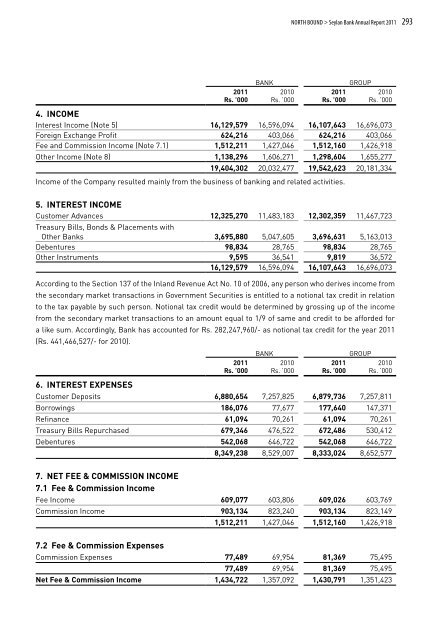

4. Income<br />

Interest Income (Note 5) 16,129,579 16,596,094 16,107,643 16,696,073<br />

Foreign Exchange Profit 624,216 403,066 624,216 403,066<br />

Fee and Commission Income (Note 7.1) 1,512,211 1,427,046 1,512,160 1,426,918<br />

O<strong>the</strong>r Income (Note 8) 1,138,296 1,606,271 1,298,604 1,655,277<br />

19,404,302 20,032,477 19,542,623 20,181,334<br />

Income of <strong>the</strong> Company resulted mainly from <strong>the</strong> business of banking and related activities.<br />

5. Interest Income<br />

Cus<strong>to</strong>mer Advances 12,325,270 11,483,183 12,302,359 11,467,723<br />

Treasury Bills, Bonds & Placements with<br />

O<strong>the</strong>r <strong>Bank</strong>s 3,695,880 5,047,605 3,696,631 5,163,013<br />

Debentures 98,834 28,765 98,834 28,765<br />

O<strong>the</strong>r Instruments 9,595 36,541 9,819 36,572<br />

16,129,579 16,596,094 16,107,643 16,696,073<br />

According <strong>to</strong> <strong>the</strong> Section 137 of <strong>the</strong> Inland Revenue Act No. 10 of 2006, any person who derives income from<br />

<strong>the</strong> secondary market transactions in Government Securities is entitled <strong>to</strong> a notional tax credit in relation<br />

<strong>to</strong> <strong>the</strong> tax payable by such person. Notional tax credit would be determined by grossing up of <strong>the</strong> income<br />

from <strong>the</strong> secondary market transactions <strong>to</strong> an amount equal <strong>to</strong> 1/9 of same and credit <strong>to</strong> be afforded for<br />

a like sum. Accordingly, <strong>Bank</strong> has accounted for Rs. 282,247,960/- as notional tax credit for <strong>the</strong> year 2011<br />

(Rs. 441,466,527/- for 2010).<br />

BANK<br />

GROUP<br />

2011 2010 2011 2010<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

6. Interest expenses<br />

Cus<strong>to</strong>mer Deposits 6,880,654 7,257,825 6,879,736 7,257,811<br />

Borrowings 186,076 77,677 177,640 147,371<br />

Refinance 61,094 70,261 61,094 70,261<br />

Treasury Bills Repurchased 679,346 476,522 672,486 530,412<br />

Debentures 542,068 646,722 542,068 646,722<br />

8,349,238 8,529,007 8,333,024 8,652,577<br />

7. Net Fee & Commission Income<br />

7.1 Fee & Commission Income<br />

Fee Income 609,077 603,806 609,026 603,769<br />

Commission Income 903,134 823,240 903,134 823,149<br />

1,512,211 1,427,046 1,512,160 1,426,918<br />

7.2 Fee & Commission Expenses<br />

Commission Expenses 77,489 69,954 81,369 75,495<br />

77,489 69,954 81,369 75,495<br />

Net Fee & Commission Income 1,434,722 1,357,092 1,430,791 1,351,423