Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

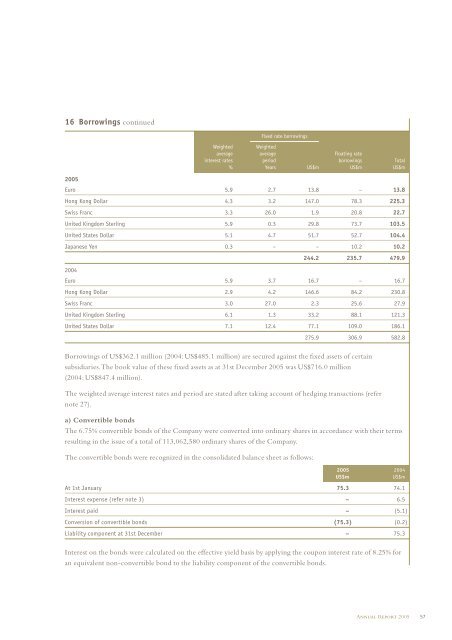

16 Borrowings continued<br />

2005<br />

Weighted<br />

Fixed rate borrowings<br />

Weighted<br />

average average Floating rate<br />

interest rates period borrowings Total<br />

% Years US$m US$m US$m<br />

Euro 5.9 2.7 13.8 – 13.8<br />

Hong Kong Dollar 4.3 3.2 147.0 78.3 225.3<br />

Swiss Franc 3.3 26.0 1.9 20.8 22.7<br />

United Kingdom Sterling 5.9 0.3 29.8 73.7 103.5<br />

United States Dollar 5.1 4.7 51.7 52.7 104.4<br />

Japanese Yen 0.3 – – 10.2 10.2<br />

244.2 235.7 479.9<br />

2004<br />

Euro 5.9 3.7 16.7 – 16.7<br />

Hong Kong Dollar 2.9 4.2 146.6 84.2 230.8<br />

Swiss Franc 3.0 27.0 2.3 25.6 27.9<br />

United Kingdom Sterling 6.1 1.3 33.2 88.1 121.3<br />

United States Dollar 7.1 12.4 77.1 109.0 186.1<br />

275.9 306.9 582.8<br />

Borrowings of US$362.1 million (2004: US$485.1 million) are secured against the fixed assets of certain<br />

subsidiaries.The book value of these fixed assets as at 31st December 2005 was US$716.0 million<br />

(2004: US$847.4 million).<br />

The weighted average interest rates and period are stated after taking account of hedging transactions (refer<br />

note 27).<br />

a) Convertible bonds<br />

The 6.75% convertible bonds of the Company were converted into ordinary shares in accordance with their terms<br />

resulting in the issue of a total of 113,062,580 ordinary shares of the Company.<br />

The convertible bonds were recognized in the consolidated balance sheet as follows:<br />

2005 2004<br />

US$m US$m<br />

At 1st January 75.3 74.1<br />

Interest expense (refer note 3) – 6.5<br />

Interest paid – (5.1)<br />

Conversion of convertible bonds (75.3) (0.2)<br />

Liability component at 31st December – 75.3<br />

Interest on the bonds were calculated on the effective yield basis by applying the coupon interest rate of 8.25% for<br />

an equivalent non-convertible bond to the liability component of the convertible bonds.<br />

ANNUAL REPORT 2005 57