2007-2008 Catalog (PDF) - Colorado State University-Pueblo

2007-2008 Catalog (PDF) - Colorado State University-Pueblo

2007-2008 Catalog (PDF) - Colorado State University-Pueblo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Office of Financial Services<br />

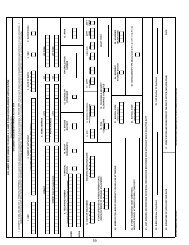

Student Loan Amounts<br />

The Stafford Loan interest rate is at a fixed rate of 6.8%.<br />

You’ll be notified of interest rate changes throughout the<br />

life of your loans.<br />

You’ll pay a fee of up to 4% of the loan, deducted<br />

proportionately from each loan disbursement.<br />

Annual Loan Limits for Stafford Loans<br />

Dependent<br />

Undergraduate<br />

Student<br />

Independent<br />

Undergraduate<br />

Student<br />

1st Year $3,500 $6,625—Only $3,500<br />

may be subsidized<br />

2nd Year $4,500 $7,500—Only $4,500<br />

may be subsidized<br />

3rd & 4th Years $5,500 $10,500—Only $5,500<br />

may be subsidized<br />

Maximum Total<br />

Debt Allowed $23,000 $46,000—Only $23,000<br />

may be subsidized<br />

*Graduate students may borrow up to $20,500 each<br />

academic year. Only $8,500 of this amount be<br />

subsidized. Aggregate limits are also higher.<br />

Federal Stafford Loan Check Distribution<br />

Loan funds are sent directly to the school approximately<br />

a week before the beginning of each semester.<br />

A 3% origination fee and up to 1% guarantee fee may<br />

be deducted from the amount sent to the school.<br />

Electronic Funds Transfer is available to students<br />

whose loans are serviced by Sallie Mae or College<br />

Assist. Funds received will be credited to the student’s<br />

account and any remaining funds will be electronically<br />

transferred to the student’s designated checking<br />

account.<br />

Out-of-state lending institutions send loan checks to<br />

Student Financial Services. The student’s satisfactory<br />

progress, enrollment status, and eligibility are reviewed<br />

before the check will be released to the student.<br />

The school is required to disburse loan funds within<br />

three (3) working days. If the student is ineligible for<br />

disbursement the funds must be returned to the lender<br />

immediately.<br />

Federal PLUS-Parent Loan for Undergraduate<br />

Students<br />

PLUS enables parents who do not have an adverse<br />

credit history to borrow to pay the education expenses<br />

of each child who is a dependent undergraduate<br />

student enrolled at least half-time. The interest rate is<br />

a fixed rate of 8.5%. Credit checks are conducted by<br />

the lender to determine loan approval. If the loan is<br />

denied the lender is responsible for notifying the parent<br />

(borrower).<br />

The borrower (parent) must begin monthly payments of<br />

a Federal Plus loan 60 days after the final disbursement<br />

of a loan.<br />

Parents may request deferment of repayment under<br />

certain conditions established by the lender.<br />

Short-Term Loans<br />

The Short-Term Loan is primarily requested to<br />

purchase books at the start of the semester. Financial<br />

emergencies that present extreme hardship may also<br />

be considered.<br />

Students must be enrolled for at least 6 semester<br />

credits, must be in good standing and must have a<br />

pending Financial Aid disbursement for that semester<br />

that will be used to pay the loan back. Maximum loan<br />

amount is $450 per semester.<br />

Loans are to be repaid within a short period of time<br />

(normally within 60 days). If the loan has not been<br />

repaid or arrangements made for its repayment by the<br />

due date, the delinquent loan will be treated as an<br />

overdue student account and handled in accordance<br />

with <strong>University</strong> policy. Applications for Student<br />

Success Loans are available in the Office of Student<br />

Financial Services. A $3 fee, assessed for processing<br />

the loan, will be deducted from the loan amount.<br />

SCHOLARSHIPS<br />

<strong>State</strong> and Institutional Scholarships<br />

CSU-<strong>Pueblo</strong> offers a wide variety of scholarships to<br />

incoming freshmen and transfer students. Scholarships<br />

are awarded based on achievement and<br />

financial need. Admissions and financial aid<br />

applications are reviewed by a <strong>University</strong> committee to<br />

determine recipients. Scholarships are also available<br />

for first generation students and international students.<br />

27