annual report 2011-12 - Heavy Engineering Corporation Limited

annual report 2011-12 - Heavy Engineering Corporation Limited

annual report 2011-12 - Heavy Engineering Corporation Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

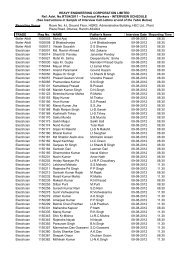

41<br />

ANNUAL REPORT <strong>2011</strong>-<strong>12</strong><br />

Cash Flow Statement Annexed to the Balance Sheet<br />

For the period April <strong>2011</strong> - March 20<strong>12</strong><br />

` in Lakhs<br />

<strong>2011</strong>-<strong>12</strong> 2010-11<br />

A. CASH FLOW FROM OPERATING ACTIVITIES<br />

Net Profit before Tax 858.41 3813.98<br />

Adjustments for:<br />

Depreciation 431.47 406.28<br />

Interest Expenses 515.30 92.37<br />

Deffered Revenue Expenditure 154.13 86.89<br />

Lease Income (467.54) (467.54)<br />

Incremental Provisions 2338.79 2972.15 2196.54 2314.54<br />

Operating Profit before Working Capital Changes 3830.56 6<strong>12</strong>8.52<br />

Adjustments for:<br />

Trade and Other Receivables (2005.79) (16769.53)<br />

Inventories (3919.44) (7524.59)<br />

Trade Payables 3658.64 6348.50<br />

Loans & Advances (439.87) (2706.46) (791.24) (18736.86)<br />

Cash Generated from Operations 1<strong>12</strong>4.10 (<strong>12</strong>608.34)<br />

Net Cash from Operating Activities 1<strong>12</strong>4.10 (<strong>12</strong>608.34)<br />

B. CASH FLOW FROM INVESTING ACTIVITIES<br />

Purchase of Fixed Assets (349.59) (283.09)<br />

Sale/Adjustment of Fixed Assets 45.87 0.35<br />

Adjustment in Capital Work-in-Progress (91.85) (42.60)<br />

Lease income 467.54 467.54<br />

Net Cash from Investing Activities 71.97 142.20<br />

C. CASH FLOW FROM FINANCING ACTIVITIES<br />

Interest Payment (515.30) (92.37)<br />

Short Term Loans 475.21 (2240.88)<br />

Liability for leased assets (467.54) (451.47)<br />

Net cash from financing activities (507.63) (2784.72)<br />

Net increase /(Decrease) in cash and cash equivalents 688.44 (15250.86)<br />

Opening Balance of Cash and Cash Equivalents 2447.86 17698.72<br />

Closing Balance of Cash and Cash Equivalents 3136.30 2447.86<br />

688.44 (15250.86)<br />

Note:- Cash Flow has been prepared by following Indirect method<br />

Note - 1:<br />

Details of Opening Balance of Cash and Cash Equivalents<br />

Cash, Cheques and Draft in hand 7.18 15.41<br />

Cheques - in- Transit 47.88 181.54<br />

Balance with Schedule Bank in Current Account 755.47 320.72<br />

Balance with Schedule Bank in Short Term Deposit 1500.00 17050.00<br />

Balance with Other Bank in Short Term Deposit 137.33 131.05<br />

Total 2447.86 17698.72<br />

Note - 2:<br />

Details of Closing Balance of Cash and Cash Equivalents<br />

Cash, Cheques and Draft in hand 4.84 7.18<br />

Cheques - in- Transit 10.48 47.88<br />

Balance with Schedule Bank in Current Account 260.77 755.47<br />

Balance with Schedule Bank in Cash Credit Account<br />

Balance with Schedule Bank in Short Term Deposit 0.00 1500.00<br />

Balance with Other Bank in Short Term Deposit 2860.21 137.33<br />

Total 3136.30 2447.86<br />

A.K.Kanth<br />

Company Secretary<br />

S.K. Chakraborty<br />

General Manager (Finance)<br />

Kushal Saha<br />

Director (Production) &<br />

R.Misra<br />

Chairman Cum Managing Director<br />

Director Mktg. (Additional Charge)<br />

In terms of our <strong>report</strong> of even date<br />

For Anjali Jain Associates, Chartered Accountants<br />

Place : Ranchi<br />

(ANJALI JAIN)<br />

Date : 06/09/20<strong>12</strong> Partner, M No. 72022

![Year 2012 Issue 7 [File Type: PDF, ~1.8 MB] - Heavy Engineering ...](https://img.yumpu.com/49920122/1/190x253/year-2012-issue-7-file-type-pdf-18-mb-heavy-engineering-.jpg?quality=85)

![August 2010 Issue [File Type: PDF, ~3.45 MB] - Heavy Engineering ...](https://img.yumpu.com/44031350/1/190x253/august-2010-issue-file-type-pdf-345-mb-heavy-engineering-.jpg?quality=85)

![Year 2011 Issue 5 [File Type: PDF, ~5.39 MB] - Heavy Engineering ...](https://img.yumpu.com/41772822/1/190x253/year-2011-issue-5-file-type-pdf-539-mb-heavy-engineering-.jpg?quality=85)