annual report 2011-12 - Heavy Engineering Corporation Limited

annual report 2011-12 - Heavy Engineering Corporation Limited

annual report 2011-12 - Heavy Engineering Corporation Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

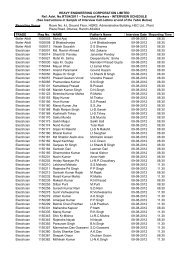

9. Statutory Dues<br />

A. According to the information and explanations given by the Company, undisputed<br />

statutory dues including Provident Fund, Income Tax, Sales Tax, Wealth Tax,<br />

Service Tax, Customs Duty, Excise Duty, Cess and other statutory dues are generally<br />

deposited regularly and no undisputed dues were outstanding as at 31st March,<br />

20<strong>12</strong> for a period of more than six months from the date of becoming payable<br />

except the cases which are stated below:<br />

Name of the Act Type Amount Period<br />

Municipal Tax<br />

Oct 1999 to Dec<br />

Municipal Tax 49,50,000.00<br />

Act<br />

‘2005<br />

The company is paying ` 50,000 per quarter for clearance of dues along with the<br />

current Municipal Tax.<br />

9. B. NotedAccording to the information and explanations given by the Company, there<br />

is no disputed dues of Income Tax, Sales Tax, wealth Tax, Service Tax, Custom Duty,<br />

Excise, Cess that have not been deposited on account of matters pending before<br />

appropriate authorities except the cases which are stated as below.-<br />

Name of the Act Tribunal(`) Total (`)<br />

Provident Fund Act 95,01,53,513.00 95,01,53,513.00<br />

10. Cash Losses<br />

The Accumulated loss of the Company as on 31st March, 20<strong>12</strong> exceeds 50% of its<br />

net worth. The company has not incurred cash losses during the current financial year<br />

covered by our audit and also in the immediately preceding financial year.<br />

11. Repayment of Dues<br />

In our opinion and according to the information and explanations given to us, the<br />

Company has not defaulted in repayment of dues to financial institutions, banks or<br />

debenture holders.<br />

<strong>12</strong>. According to the information and explanation given to us, the company has not granted<br />

any loan or advances on the basis of security, by way of pledge of shares, debentures<br />

and other securities.<br />

13. In our opinion and according to the information and explanations given to us, the<br />

Company is not a chit fund or a Nidhi/Mutual benefit fund/society. Therefore, clause<br />

4(xiii) of the Companies (Auditor’s Report) Order, 2003 is not applicable to the Company,<br />

14. The Company has not done any transactions for trading in Shares, securities, debentures<br />

and other investments during the financial year under audit.<br />

15. According to the information and explanation given to us, the Company has not given<br />

guarantees for loans taken by others for Banks or financial institutions, the terms and<br />

conditions, whereof, in our opinion, are prima facie prejudicial to the interest of the<br />

company.<br />

16. According to the information and explanation given to us and on an overall examination<br />

of the Balance Sheet of the Company, We are of the opinion that the term loans were<br />

applied for the purpose for which the loans were obtained.<br />

ANNUAL REPORT <strong>2011</strong>-<strong>12</strong><br />

Payment is being made every quarter against old<br />

dues based on the agreement with Municipal<br />

<strong>Corporation</strong>.<br />

Disclosed in Notes on accounts<br />

As per Accounts of the company it transpires that<br />

the company has earned a cash profit of Rs <strong>12</strong>.90<br />

crore during financial year <strong>2011</strong>-<strong>12</strong>.<br />

No comments<br />

No comments<br />

No comments<br />

No comments<br />

No comments<br />

No comments<br />

17

![Year 2012 Issue 7 [File Type: PDF, ~1.8 MB] - Heavy Engineering ...](https://img.yumpu.com/49920122/1/190x253/year-2012-issue-7-file-type-pdf-18-mb-heavy-engineering-.jpg?quality=85)

![August 2010 Issue [File Type: PDF, ~3.45 MB] - Heavy Engineering ...](https://img.yumpu.com/44031350/1/190x253/august-2010-issue-file-type-pdf-345-mb-heavy-engineering-.jpg?quality=85)

![Year 2011 Issue 5 [File Type: PDF, ~5.39 MB] - Heavy Engineering ...](https://img.yumpu.com/41772822/1/190x253/year-2011-issue-5-file-type-pdf-539-mb-heavy-engineering-.jpg?quality=85)