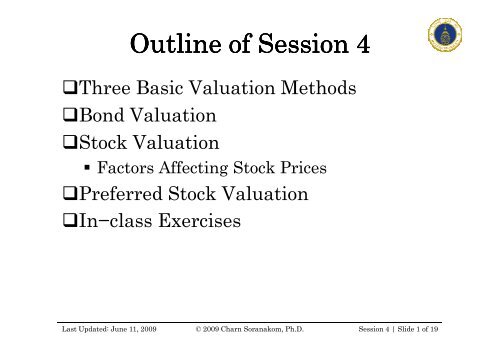

Outline of Session Outline of Session 4

Outline of Session Outline of Session 4

Outline of Session Outline of Session 4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Outline</strong> <strong>of</strong> <strong>Session</strong> 4<br />

Three Basic Valuation Methods<br />

Bond Valuation<br />

Stock Valuation<br />

Factors Affecting Stock Prices<br />

Preferred Stock Valuation<br />

In−class Exercises<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 1 <strong>of</strong> 19

A Few Words on Valuation<br />

There are three basic valuation methods, namely,<br />

Discounted Cash Flow (DCF) Method<br />

Relative Valuation Method<br />

Contingent−Claim Method<br />

Values <strong>of</strong> securities rarely stay constant.<br />

Valuation is not a one−time job. Re−valuation is always<br />

needed.<br />

We usually don’t observe the discount rates. We<br />

observe prices instead and infer discount rates from<br />

changes in prices. The return is the discount rate.<br />

In a well−functioning financial market, we can<br />

estimate a discount rate for each type <strong>of</strong> security <strong>of</strong><br />

varying degree <strong>of</strong> risk.<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 2 <strong>of</strong> 19

Bonds<br />

Bonds are one type <strong>of</strong> fixed income security.<br />

Various types <strong>of</strong> bonds<br />

Government bonds<br />

Corporate bonds<br />

Pure discount (or Zero−coupon) bonds<br />

Console<br />

A typical bond has the following information<br />

on it.<br />

Maturity date<br />

Coupon rate (can be fixed or floating rate)<br />

Frequency <strong>of</strong> interest payments per year<br />

Face value<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 3 <strong>of</strong> 19

Bond Valuation<br />

We use the DCF method to value a bond and<br />

get the bond price.<br />

To value a bond, we just discount periodic<br />

interest payments and face value <strong>of</strong> a bond at<br />

the prevailing market interest rate<br />

appropriate for its risk class.<br />

Bond Price =<br />

Int<br />

1<br />

+<br />

2<br />

( 1 + YTM) ( ) ( ) N<br />

Yield−to−Maturity (YTM) is a discount rate<br />

that solves the above equation.<br />

Int<br />

Bond price and its yield is jointly determined.<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 4 <strong>of</strong> 19<br />

2<br />

1 + YTM<br />

Int<br />

+ ... +<br />

N<br />

+ Face Value<br />

1 + YTM

Calculation <strong>of</strong> Bond Price<br />

Example:<br />

A 5−year 5%−coupon government bond is<br />

being issued.<br />

This bond pays interest annually.<br />

Its face value is 100,000 Baht.<br />

The prevailing market interest rate for a<br />

5−year risk−free bond is 5%.<br />

5,000 5,000 5,000 5,000 5,000 + 100,000<br />

Bond Price = + + + +<br />

5<br />

2<br />

3<br />

4<br />

( 1 + 5% ) ( 1 + 5% ) ( 1 + 5% ) ( 1 + 5% ) ( 1 + 5% )<br />

= 100,000 Baht<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 5 <strong>of</strong> 19

What−if the Interest Rate Changes<br />

If the prevailing market interest rate for a<br />

5−year risk−free bond is 6%, then<br />

5,000 5,000 5,000 5,000 5,000 + 100,000<br />

Bond Price = + + + +<br />

5<br />

2<br />

3<br />

4<br />

( 1 + 6% ) ( 1 + 6% ) ( 1 + 6% ) ( 1 + 6% ) ( 1 + 6% )<br />

= 95,787.64 Baht<br />

If the prevailing market interest rate for a<br />

5−year risk−free bond is 4%, then<br />

5,000 5,000 5,000 5,000 5,000 + 100,000<br />

Bond Price = + + + +<br />

5<br />

2<br />

3<br />

4<br />

( 1 + 4% ) ( 1 + 4% ) ( 1 + 4% ) ( 1 + 4% ) ( 1 + 4% )<br />

= 104,451.82 Baht<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 6 <strong>of</strong> 19

These curves<br />

are convex.<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 7 <strong>of</strong> 19

Bond Price Relationship to YTM<br />

When the coupon rate = the market<br />

interest rate (YTM), a bond will sell at<br />

par.<br />

When the coupon rate > the YTM, a<br />

bond will sell at a premium.<br />

When the coupon rate < the YTM, a<br />

bond will sell at a discount.<br />

But why?<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 8 <strong>of</strong> 19

Interest Rate Risk (or Price Risk)<br />

Interest Rate Risk sometimes is called “Price Risk”.<br />

Investment in bonds (even in a risk−free bond like a<br />

government bond) can be risky due to fluctuation in<br />

the market interest rates.<br />

As you can see, when the market interest rate goes up,<br />

bond price declines, and vice versa, resulting in a gain<br />

or loss.<br />

Notes:<br />

Bond price does not decline in linear fashion.<br />

The longer the maturity <strong>of</strong> a bond, the greater the<br />

price risk, other things being equal. Why?<br />

The lower the coupon rate <strong>of</strong> a bond, the greater the<br />

price risk, other things being equal. Why?<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 9 <strong>of</strong> 19

Common Stock<br />

Common Stock (or just “Stock”) is a security,<br />

which represents ownership in a company.<br />

Owning a stock entitles you to some share <strong>of</strong> a<br />

company’s pr<strong>of</strong>its (or dividends).<br />

Shareholders are last in line to claim against a<br />

company’s assets in the event <strong>of</strong> bankruptcy.<br />

Investment in stocks therefore is considered<br />

more risky than investment in bonds.<br />

Investment returns in stocks include capital<br />

gains/losses and dividends.<br />

© 2009 Charn Soranakom, Ph.D.<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 10 <strong>of</strong> 19

Stocks and the Stock Market<br />

Stocks are traded in the stock market.<br />

You need a broker to trade stocks.<br />

Know the differences between<br />

Primary market and Secondary market<br />

Auction market and Dealer market<br />

Capital gains/losses and dividends<br />

Understand<br />

Bids, asks, and prices<br />

P/E and P/B ratios<br />

Dividend yield<br />

Commissions and taxes<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 11 <strong>of</strong> 19

Stock Valuation<br />

Same DCF concept applies.<br />

To value a stock and get a stock price, you<br />

simply discount expected dividend and stock<br />

price next year at the rate <strong>of</strong> return<br />

appropriate for its risk class.<br />

For example:<br />

ABC stock will pay 10−Baht dividend next year.<br />

You expect the stock price to be 110 Baht next year.<br />

What should be the current stock price?<br />

P<br />

0<br />

=<br />

Div<br />

1<br />

+<br />

( 1 + r ) ( 1 + r )<br />

S<br />

P<br />

1<br />

10 + 110<br />

=<br />

S<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 12 <strong>of</strong> 19

P<br />

P<br />

0<br />

1<br />

=<br />

=<br />

Div<br />

1<br />

( 1 + r ) ( 1 + r )<br />

Div<br />

S<br />

2<br />

+<br />

P<br />

1<br />

S<br />

( 1 + r ) ( 1 + r )<br />

S<br />

+<br />

P<br />

2<br />

S<br />

P<br />

P<br />

0<br />

0<br />

1<br />

⎡<br />

⎢<br />

Div<br />

⎣<br />

⎛ Div<br />

2<br />

+ P<br />

+<br />

⎜<br />

⎝ +<br />

S<br />

2<br />

=<br />

=<br />

1<br />

( 1 + r<br />

) ⎜<br />

( 1 r<br />

)<br />

Div<br />

S<br />

1<br />

2<br />

( 1 + r ) ( ) ( ) 2<br />

S<br />

+<br />

Div<br />

1 + r<br />

S<br />

2<br />

+<br />

P<br />

2<br />

1 + r<br />

S<br />

⎞⎤<br />

⎟<br />

⎥<br />

⎠⎦<br />

P<br />

0<br />

=<br />

Div<br />

1<br />

+<br />

+<br />

+ ...<br />

2<br />

3<br />

( 1 + r ) ( ) ( ) ( ) ∞<br />

S<br />

Div<br />

1 + r<br />

S<br />

2<br />

Div<br />

1 + r<br />

S<br />

3<br />

Div<br />

1 + r<br />

S<br />

∞<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 13 <strong>of</strong> 19

Stock Valuation (cont…)<br />

Case 1: Assuming no growth in dividends<br />

Div1<br />

Div1<br />

P<br />

0<br />

=<br />

r<br />

S<br />

=<br />

r or P<br />

S<br />

Case 2: Assuming a constant growth in dividends (g%)<br />

Div1<br />

Div1<br />

P<br />

0<br />

=<br />

r<br />

S =<br />

+<br />

g<br />

r<br />

−<br />

g or<br />

P<br />

S<br />

Case 3: Assuming a non−constant growth in dividends<br />

P<br />

0<br />

=<br />

Div<br />

1<br />

2<br />

( 1 + r ) ( 1 + r ) ( 1 + r )<br />

S<br />

+<br />

Div<br />

S<br />

2<br />

+ ... +<br />

Div<br />

S<br />

t<br />

t<br />

+<br />

0<br />

0<br />

⎡Div<br />

⎢<br />

⎣ r<br />

t<br />

S<br />

( 1 + g)<br />

−g<br />

( 1 + r ) t<br />

S<br />

⎤<br />

⎥<br />

⎦<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 14 <strong>of</strong> 19

Where Does g Come From?<br />

Year<br />

1 2 3 4<br />

BV <strong>of</strong> Equity per Share 100.00 105.00 110.25 115.76<br />

Return on Equity (ROE) 10.00% 10.00% 10.00% 10.00%<br />

Earnings per Share (EPS) 10.00 10.50 11.03 11.58<br />

Payout Ratio 50.00% 50.00% 50.00% 50.00%<br />

Retention Ratio (1−Payout<br />

Ratio) 50.00% 50.00% 50.00% 50.00%<br />

Dividend per Share (DPS) 5.00 5.25 5.51 5.79<br />

Growth Rate in Dividends (g) 5.00% 5.00% 5.00%<br />

Growth Rate in EPS (g) 5.00% 5.00% 5.00%<br />

Growth Rate in Stock Price (g) 5.00% 5.00% 5.00%<br />

Stock Price (assuming PE=20) 200.00 210.00 220.50 231.53<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 15 <strong>of</strong> 19

Factors Affecting Stocks’ Prices<br />

Change in forecast <strong>of</strong> earnings and<br />

dividends (EPS and DPS)<br />

Change in forecast <strong>of</strong> growth (g)<br />

Change in expectation <strong>of</strong> rate <strong>of</strong> return<br />

(r S )<br />

Supply and demand<br />

Price manipulation<br />

Psychology factor<br />

Market sentiment<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 16 <strong>of</strong> 19

Preferred stock<br />

is classified as equity.<br />

Preferred Stock<br />

owner usually cannot vote, but may be allowed to vote if<br />

dividends have not been paid for some time.<br />

(usually) pays fixed dividends as a percentage <strong>of</strong> par value.<br />

has higher priority <strong>of</strong> claims against company’s assets and<br />

pr<strong>of</strong>its (dividends) over common stock.<br />

dividends can be cumulative or noncumulative.<br />

has characteristics <strong>of</strong> a debt, but dividend is not<br />

tax−deductible.<br />

is not popular among investors. Therefore, corporations do not<br />

want to issue this type <strong>of</strong> security.<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 17 <strong>of</strong> 19

Preferred Stock Valuation<br />

Use DCF method.<br />

Discount preferred dividends at the<br />

appropriate discount rate to obtain the<br />

price <strong>of</strong> preferred stock.<br />

For example:<br />

XYZ preferred stock pays 1−Baht dividend. If you<br />

discount at 10%, you get a price <strong>of</strong> 10 Baht per share.<br />

1 1<br />

Preferred Stock Price<br />

+<br />

2<br />

=<br />

( 1 + 10% ) ( 1 + 10% ) ( 1 + 10% )<br />

1<br />

10%<br />

= 10 Baht<br />

+ ... +<br />

=<br />

∞<br />

1<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 18 <strong>of</strong> 19

In−class Exercises<br />

Let’s do some exercises in class together.<br />

Last Updated: June 11, 2009 © 2009 Charn Soranakom, Ph.D. <strong>Session</strong> 4 | Slide 19 <strong>of</strong> 19