Colonial First State Property Trusts - First State Investments

Colonial First State Property Trusts - First State Investments

Colonial First State Property Trusts - First State Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited ACN 006 464 428<br />

<strong>Colonial</strong><br />

<strong>First</strong> <strong>State</strong><br />

<strong>Property</strong> <strong>Trusts</strong><br />

Notices of Meeting and<br />

Explanatory Memorandum<br />

• • • • • • • •<br />

Comprising the following trusts:<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust<br />

This document is important.<br />

If you do not understand it or are in any doubt about the action to be taken, you should consult<br />

your stockbroker, accountant, investment adviser or other professional adviser immediately.<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited<br />

ACN 006 464 428<br />

in its capacity as the Manager of the <strong>Trusts</strong><br />

The Notices of Meeting and Explanatory Memorandum are dated 13 November 1999

Contents<br />

Page<br />

1 Notices of Meeting 1<br />

2 Action Required By Unitholders 5<br />

3 Explanatory Memorandum 6<br />

4 <strong>Property</strong> Portfolio and Market Overview 13<br />

5 Financial Information 49<br />

6 Voting & Eligibility 64<br />

7 Experts’ Reports 66<br />

8 Trust Deed Amendments 151<br />

9 Additional Information 156<br />

10 Glossary 159<br />

Key Dates<br />

Last day for lodgement of Proxy Forms 15 December 1999<br />

Last day for receipt of Election Forms<br />

(unitholders elect to receive the<br />

Cash Alternative or <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

<strong>Property</strong> Trust Group Securities) 15 December 1999<br />

Last day of trading in existing units (1) 16 December 1999<br />

Meetings of unitholders of<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust,<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust,<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust<br />

and <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust 17 December 1999<br />

Trading of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong><br />

Trust Group Stapled Securities commences (2) 20 December 1999<br />

Announcement of Bookbuild Price 7 February 2000<br />

(1) Assuming Merger Proposal proceeds.<br />

(2) Estimate only – will only occur if Merger Proposal proceeds.<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited (ACN 006 464 428) is the manager of each of the <strong>Trusts</strong>. Permanent Trustee Australia Limited is the<br />

trustee of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust, <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust and <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong><br />

Trust whilst Perpetual Trustee Company Limited is the trustee of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust.<br />

An investment in the Stapled Securities of the <strong>Trusts</strong> does not represent a deposit or other liability of <strong>Colonial</strong> <strong>State</strong> Bank or any other<br />

member of the <strong>Colonial</strong> Group. The investment is subject to investment risk which can include delays in repayment, loss of income and the<br />

loss of the principal invested. None of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited, <strong>Colonial</strong> <strong>State</strong> Bank or any member of the <strong>Colonial</strong> Group,<br />

guarantees the performance of the <strong>Trusts</strong>, the repayment of capital or the payment of a particular return on the Stapled Securities.<br />

Permanent Trustee Australia Limited and Perpetual Trustee Company Limited ("Trustees") were not involved in the preparation of any part of<br />

this document. The Trustees have not issued this document. The role of each Trustee has been limited to reviewing the relevant Notice of<br />

Meeting and Explanatory Memorandum to ensure that they contain a summary of information relating to the matters to be considered at<br />

the meeting of unitholders and the resolutions to be put at the meeting of which they are aware that is relevant to the decision of the<br />

unitholders on how to vote at the meeting. In all other respects in relation to the Notices of Meeting and Explanatory Memorandum, the<br />

Trustees have relied upon information provided by <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited, the Manager of the <strong>Trusts</strong>.

1. Notice of Meeting<br />

of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust<br />

Notice is given that a meeting of the unitholders of the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust (the ‘Trust’) will be held at<br />

the offices of Mallesons Stephen Jaques, Level 60, Governor Phillip Tower, 1 Farrer Place, Sydney on 17 December 1999<br />

commencing at 10am.<br />

Business<br />

The business of the meeting will consist of the following:<br />

Appointment of the Chairperson<br />

To appoint a person to act as Chairperson of the meeting in accordance with section 1069C(1) of the Corporations Law.<br />

Approval of Merger Proposal<br />

Resolution 1: Approval of Merger Proposal<br />

To consider and, if thought fit, pass an Ordinary Resolution on the following terms:<br />

‘That the Trustee and Manager are authorised to proceed with the Merger Proposal as described in the Explanatory<br />

Memorandum (‘Explanatory Memorandum’) that accompanies the Notice of Meeting dated 13 November 1999<br />

(‘Notice of Meeting’) and to do all things necessary or appropriate to implement the Merger Proposal.’<br />

Approval of Issue of Units<br />

Resolution 2: Approval of Issue of Units in the Trust<br />

To consider and, if thought fit, pass a Special Resolution on the following terms:<br />

‘That, subject to Resolution 1 and Resolution 3 set out in the Notice of Meeting being duly passed, and subject to<br />

unitholders in the Trust being contemporaneously issued units in each of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust,<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust and <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust at a price of $0.01 per unit and<br />

in the ratios set out in the Explanatory Memorandum, the following issues of units in the Trust be and are hereby approved:<br />

(i) the issue of up to 174,400,000 units in the Trust at a price of $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Industrial <strong>Property</strong> Trust;<br />

(ii) the issue of up to 148,290,000 units in the Trust at a price of $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Commercial <strong>Property</strong> Trust; and<br />

(iii) the issue of up to 72,830,000 units in the Trust at a price of $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Development Trust.’<br />

Approval of Amendments to the Trust Deed<br />

Resolution 3: Approval of Amendments to the Trust Deed of the Trust<br />

To consider and, if thought fit, pass a Special Resolution on the following terms:<br />

‘That, subject to Resolution 1 and Resolution 2 set out in the Notice of Meeting being duly passed, the Trust Deed of the<br />

Trust be amended as described in Section 8 of the Explanatory Memorandum with such changes and additions (if any) as<br />

may be required by the Australian Securities and <strong>Investments</strong> Commissions (‘ASIC’) or Australian Stock Exchange Limited<br />

or as may be considered appropriate by the Trustee or Manager and the Trustee and the Manager are authorised and<br />

directed to execute a Supplemental Deed and to lodge the Supplemental Deed with ASIC to give effect to the amendments.’<br />

Michelene Hart<br />

Company Secretary<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited (ACN 006 464 428)<br />

13 November 1999<br />

Information on Voting and Proxies<br />

For information on voting and proxies, please refer to Section 6 of this booklet.<br />

1

1. Notice of Meeting<br />

of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust<br />

Notice is given that a meeting of the unitholders of the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust (the ‘Trust’)<br />

will be held at the offices of Mallesons Stephen Jaques, Level 60, Governor Phillip Tower, 1 Farrer Place, Sydney on<br />

17 December 1999 commencing at 10am.<br />

Business<br />

The business of the meeting will consist of the following:<br />

Appointment of the Chairperson<br />

To appoint a person to act as Chairperson of the meeting in accordance with section 1069C(1) of the Corporations Law.<br />

Approval of Merger Proposal<br />

Resolution 1: Approval of Merger Proposal<br />

To consider and, if thought fit, pass an Ordinary Resolution on the following terms:<br />

‘That the Trustee and Manager are authorised to proceed with the Merger Proposal as described in the Explanatory<br />

Memorandum (‘Explanatory Memorandum’) that accompanies the Notice of Meeting dated 13 November 1999<br />

(‘Notice of Meeting’) and to do all things necessary or appropriate to implement the Merger Proposal.’<br />

Approval of Issue of Units<br />

Resolution 2: Approval of Issue of Units in the Trust<br />

To consider and, if thought fit, pass a Special Resolution on the following terms:<br />

‘That, subject to Resolution 1 and Resolution 3 set out in the Notice of Meeting being duly passed, and subject to<br />

unitholders in the Trust being contemporaneously issued units in each of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust, <strong>Colonial</strong><br />

<strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust and <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust at a price of $0.01 per unit and in the<br />

ratios set out in the Explanatory Memorandum, the following issues of units in the Trust be and are hereby approved:<br />

(i) the issue of up to 190,410,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail<br />

<strong>Property</strong> Trust;<br />

(ii) the issue of up to 148,290,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Commercial <strong>Property</strong> Trust; and<br />

(iii) the issue of up to 72,830,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Development Trust.’<br />

Approval of Amendments to the Trust Deed<br />

Resolution 3: Approval of Amendments to the Trust Deed of the Trust<br />

To consider and, if thought fit, pass a Special Resolution on the following terms:<br />

‘That, subject to Resolution 1 and Resolution 2 set out in the Notice of Meeting being duly passed, the Trust Deed of the<br />

Trust be amended as described in Section 8 of the Explanatory Memorandum with such changes or additions (if any) as<br />

may be required by the Australian Securities and <strong>Investments</strong> Commission (‘ASIC’) or Australian Stock Exchange Limited<br />

or may be considered appropriate by the Trustee or Manager and the Trustee and the Manager are authorised and directed<br />

to execute a Supplemental Deed and to lodge the Supplemental Deed with ASIC to give effect to the amendments.’<br />

Michelene Hart<br />

Company Secretary<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited (ACN 006 464 428)<br />

13 November 1999<br />

Information on Voting and Proxies<br />

For information on voting and proxies, please refer to Section 6 of this booklet.<br />

2

1. Notice of Meeting<br />

of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust<br />

Notice is given that a meeting of the unitholders of the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust (the ‘Trust’) will be<br />

held at the offices of Mallesons Stephen Jaques, Level 60, Governor Phillip Tower, 1 Farrer Place, Sydney on 17 December<br />

1999 commencing at 10am.<br />

Business<br />

The business of the meeting will consist of the following:<br />

Appointment of the Chairperson<br />

To appoint a person to act as Chairperson of the meeting in accordance with section 1069C(1) of the Corporations Law.<br />

Approval of Merger Proposal<br />

Resolution 1: Approval of Merger Proposal<br />

To consider and, if thought fit, pass an Ordinary Resolution on the following terms:<br />

‘That the Trustee and Manager are authorised to proceed with the Merger Proposal as described in the Explanatory<br />

Memorandum (‘Explanatory Memorandum’) that accompanies the Notice of Meeting dated 13 November 1999<br />

(‘Notice of Meeting’) and to do all things necessary or appropriate to implement the Merger Proposal’.<br />

Approval of Issue of Units<br />

Resolution 2: Approval of Issue of Units in the Trust<br />

To consider and, if thought fit, pass a Special Resolution on the following terms:<br />

‘That, subject to Resolution 1 and Resolution 3 set out in the Notice of Meeting being duly passed, and subject to<br />

unitholders in the Trust being contemporaneously issued units in each of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust, <strong>Colonial</strong><br />

<strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust and <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust at a price of $0.01 per unit and in the<br />

ratios set out in the Explanatory Memorandum, the following issues of units in the Trust be and are hereby approved:<br />

(i) the issue of up to 190,410,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Retail <strong>Property</strong> Trust;<br />

(ii) the issue of up to 174,400,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Industrial <strong>Property</strong> Trust; and<br />

(iii) the issue of up to 72,830,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Development Trust.’<br />

Approval of Amendments to the Trust Deed<br />

Resolution 3: Approval of Amendments to the Trust Deed of the Trust<br />

To consider and, if thought fit, pass a Special Resolution on the following terms:<br />

‘That, subject to Resolution 1 and Resolution 2 set out in the Notice of Meeting being duly passed, the Trust Deed of the<br />

Trust be amended as described in Section 8 of the Explanatory Memorandum with such changes or additions (if any) as<br />

may be required by the Australian Securities and <strong>Investments</strong> Commission (‘ASIC’) or Australian Stock Exchange Limited<br />

or as may be considered appropriate by the Trustee or Manager and the Trustee and the Manager are authorised and<br />

directed to execute a Supplemental Deed and to lodge the Supplemental Deed with ASIC to give effect to the amendments.’<br />

Michelene Hart<br />

Company Secretary<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited (ACN 006 464 428)<br />

13 November 1999<br />

Information on Voting and Proxies<br />

For information on voting and proxies, please refer to Section 6 of this booklet.<br />

3

1. Notice of Meeting<br />

of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust<br />

Notice is given that a meeting of the unitholders of the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust (the ‘Trust’) will be held at<br />

the offices of Mallesons Stephen Jaques, Level 60, Governor Phillip Tower, 1 Farrer Place, Sydney on 17 December 1999<br />

commencing at 10am.<br />

Business<br />

The business of the meeting will consist of the following:<br />

Appointment of the Chairperson<br />

To appoint a person to act as Chairperson of the meeting in accordance with section 1069C(1) of the Corporations Law.<br />

Approval of Merger Proposal<br />

Resolution 1: Approval of Merger Proposal<br />

To consider and, if thought fit, pass an Ordinary Resolution on the following terms:<br />

‘That the Trustee and Manager are authorised to proceed with the Merger Proposal as described in the Explanatory<br />

Memorandum (‘Explanatory Memorandum’) that accompanies the Notice of Meeting dated 13 November 1999<br />

(‘Notice of Meeting’) and to do all things necessary or appropriate to implement the Merger Proposal’.<br />

Approval of Issue of Units<br />

Resolution 2: Approval of Issue of Units in the Trust<br />

To consider and, if thought fit, pass a Special Resolution on the following terms:<br />

‘That, subject to Resolution 1 and Resolution 3 set out in the Notice of Meeting being duly passed, and subject to<br />

unitholders in the Trust being contemporaneously issued units in each of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust, <strong>Colonial</strong><br />

<strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust and <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust at a price of $0.01 per unit and in<br />

the ratios set out in the Explanatory Memorandum, the following issues of units in the Trust be and are hereby approved:<br />

(i) the issue of up to 190,410,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail<br />

<strong>Property</strong> Trust;<br />

(ii) the issue of up to 174,400,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Industrial <strong>Property</strong> Trust; and<br />

(iii) the issue of up to 148,290,000 units in the Trust at $0.01 per unit to unitholders in <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Commercial <strong>Property</strong> Trust.’<br />

Approval of Amendments to the Trust Deed<br />

Resolution 3: Approval of Amendments to the Trust Deed of the Trust<br />

To consider and, if thought fit, pass a Special Resolution on the following terms:<br />

‘That, subject to Resolution 1 and Resolution 2 set out in the Notice of Meeting being duly passed, the Trust Deed of the<br />

Trust be amended as described in Section 8 of the Explanatory Memorandum with such changes or additions (if any) as<br />

may be required by the Australian Securities and <strong>Investments</strong> Commission (‘ASIC’) or Australian Stock Exchange Limited<br />

or as may be considered appropriate by the Trustee or Manager and the Trustee and the Manager are authorised and<br />

directed to execute a Supplemental Deed and to lodge the Supplemental Deed with ASIC to give effect to the amendments.’<br />

Michelene Hart<br />

Company Secretary<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited (ACN 006 464 428)<br />

13 November 1999<br />

Information on Voting and Proxies<br />

For information on voting and proxies, please refer to Section 6 of this booklet.<br />

4

2. Action Required by Unitholders<br />

Step 1: Read the Documents Forwarded to You<br />

The Notices of Meeting and Explanatory Memorandum set out the proposal to merge:<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust;<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust;<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust; and<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust.<br />

The Explanatory Memorandum contains details of the Merger Proposal and sets out the benefits that it offers to<br />

unitholders, as well as potential arguments against it. It also contains a report by Arthur Andersen Corporate Finance Pty<br />

Limited (an independent expert) that has been prepared for unitholders.<br />

This information is important in deciding how you should vote on the resolutions at the unitholders’ meeting.<br />

Step 2: Vote on the Resolutions<br />

The unitholders’ meetings of each of the <strong>Trusts</strong> are scheduled for 17 December 1999. You are encouraged to attend and<br />

vote at the unitholders’ meeting of your Trust or, if you are unable to do so, to complete the personalised proxy form that<br />

accompanies this booklet. You may nominate someone to vote on your behalf at the meeting and indicate how you wish<br />

that person to vote on the proxy form. For details on the completion and lodgement of Proxy Forms refer to Section 6 of<br />

this booklet headed ‘Voting and Eligibility’.<br />

Proxy forms should be sent in the envelope provided as follows:<br />

Address for mail:<br />

c/- Computershare Registry Services Pty Limited<br />

Reply Paid 2975<br />

Melbourne VIC 8060<br />

Proxy forms must be returned so as to be received at least two days before the meeting (ie the latest time and date for return<br />

of proxy forms is midnight on 15 December 1999).<br />

Arthur Andersen Corporate Finance Pty Limited, an independent expert, has considered the Merger Proposal and<br />

concluded that the Merger Proposal is fair and reasonable and in the best interests of unitholders in each of the four <strong>Trusts</strong><br />

proposed to be merged.<br />

Step 3 : Elect to Receive Stapled Securities or the Cash Alternative<br />

If your address is in Australia or New Zealand you are strongly encouraged to return the personalised Election Form<br />

accompanying this booklet. Unitholders need to choose whether they want to receive Stapled Securities in the <strong>Colonial</strong> <strong>First</strong><br />

<strong>State</strong> <strong>Property</strong> Trust Group or the Cash Alternative.<br />

Election forms may be returned in the envelope provided to the Trust’s Registry, whose address is set out above. Election<br />

Forms must arrive not later than midnight on 15 December 1999.<br />

You are encouraged to return the Election Form even if you intend to vote against the Resolutions. If you do not lodge your<br />

Election Form or if it is not properly completed and received by midnight on 15 December 1999, you will automatically<br />

receive cash under the Cash Alternative if the Merger Proposal proceeds.<br />

For your choice to be effective, you must lodge your Election Form by midnight on 15 December 1999.<br />

5

3. Explanatory Memorandum<br />

The Merger Proposal<br />

Overview<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Limited currently manages four listed property <strong>Trusts</strong>, namely:<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Retail <strong>Property</strong> Trust (which has a portfolio of nine retail investments and one office investment,<br />

having a total book value of approximately $512 million);<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Commercial <strong>Property</strong> Trust (which has a portfolio of seven office investments with a total book<br />

value of approximately $350 million);<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Industrial <strong>Property</strong> Trust (which has a portfolio of 23 industrial investments and one office<br />

investment, having a total book value of approximately $463 million); and<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Development Trust (which was established to develop two Sydney office buildings which are now<br />

complete and substantially let and have a combined book value of approximately $275 million).<br />

Information on the assets of each of the <strong>Trusts</strong> is contained in Section 4 – <strong>Property</strong> Portfolio.<br />

Each of these <strong>Trusts</strong> currently has a strategy to invest in specific sectors of the property market. Until recently, this strategy<br />

was considered appropriate. However, the listed property trust market is undergoing significant rationalisation through<br />

mergers and take-overs with the larger vehicles enjoying greater market support and delivering benefits that are not<br />

generally available to the smaller vehicles.<br />

Accordingly, the Manager proposes that the four <strong>Trusts</strong> be merged to create a large diversified property group.<br />

The Current Position<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Retail <strong>Property</strong><br />

Trust unitholders<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Industrial <strong>Property</strong><br />

Trust unitholders<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Commercial <strong>Property</strong><br />

Trust unitholders<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Development<br />

Trust unitholders<br />

100% 100% 100% 100%<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Retail<br />

<strong>Property</strong> Trust<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Industrial<br />

<strong>Property</strong> Trust<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Commercial<br />

<strong>Property</strong> Trust<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Development<br />

Trust<br />

Predominantly Retail<br />

<strong>Investments</strong><br />

Predominantly Industrial<br />

<strong>Investments</strong><br />

Office <strong>Investments</strong><br />

Undertook 2 office<br />

developments,<br />

now complete<br />

Merger Proposal<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Retail <strong>Property</strong> Trust<br />

unitholders prior to<br />

Merger Proposal<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Commercial <strong>Property</strong> Trust<br />

unitholders prior to<br />

Merger Proposal<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Industrial <strong>Property</strong> Trust<br />

unitholders prior to<br />

Merger Proposal<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

Development <strong>Property</strong><br />

Trust unitholders prior to<br />

Merger Proposal<br />

32.5% 25.3% 29.8% 12.4%<br />

Stapled Securities<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

<strong>Property</strong> Trust Group<br />

Large Diversified <strong>Property</strong> Portfolio<br />

6

Why Merge?<br />

The Merger Proposal has the potential to increase the value of an investment held in each of the <strong>Trusts</strong> and to provide<br />

benefits that are not presently available to the <strong>Trusts</strong> and their unitholders.<br />

Price Re-rating.<br />

If the Merger Proposal is implemented, it is expected to generate an annualised distribution yield of 9.0% (based on<br />

the notional price of $2.00 per Stapled Security) for the six months ending 30 June 2000. As the weighted average<br />

distribution yield of large diversified property vehicles is 7.7%, the Manager anticipates a price re-rating (increase in the<br />

value of securities) if the Merger Proposal is implemented. The chart below illustrates that, based on current forecasts,<br />

upon implementation of the Merger Proposal, <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group will provide the highest 2000<br />

distribution yield of its peer group.<br />

2000 Distribution Yield<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group<br />

Advance <strong>Property</strong> Fund<br />

BT <strong>Property</strong> Trust<br />

AMP Diversified <strong>Property</strong> Trust<br />

Stockland Trust Group<br />

Sector Weighted Average<br />

National Mutual <strong>Property</strong> Trust<br />

Mirvac Group<br />

General <strong>Property</strong> Trust<br />

6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5<br />

Yield %<br />

Market Capitalisation<br />

($m)<br />

Source: Warburg Dillon Read, <strong>Property</strong> & Tourism Forecasts & Analysis – week ending 24 October 1999.<br />

Notes:<br />

(1) As at 22 October 1999. The market capitalisation in respect of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group has been<br />

estimated using a notional price of $2.00 per Stapled Security.<br />

(2) Sector weighted average excludes <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group.<br />

Market Capitalisation and Liquidity<br />

If the Merger Proposal is implemented, unitholders will have an investment in a much larger property investment vehicle.<br />

The Merged Group is expected to have a market capitalisation of approximately $1.17 billion (based on a notional price<br />

of $2.00 per Stapled Security) and will represent approximately 3.90% of the <strong>Property</strong> Trust Index of the ASX.<br />

The Manager believes the larger market capitalisation will improve liquidity and widen the potential investor base.<br />

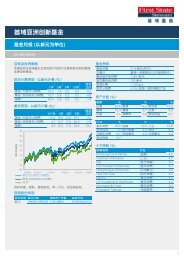

The chart below illustrates the relative price performance from January 1996 of property investment vehicles with a market<br />

capitalisation in excess of $600 million compared to those below $600 million. Clearly, in recent years the larger vehicles<br />

have outperformed the smaller vehicles.<br />

1,172<br />

641<br />

430<br />

994<br />

1,386<br />

1,421<br />

918<br />

1,692<br />

3,885<br />

Price Index Performance<br />

1.7<br />

1.6<br />

1.5<br />

1.4<br />

1.3<br />

1.2<br />

1.1<br />

1.0<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

Jan-96<br />

Mar-96<br />

Jun-96<br />

Sep-96<br />

Dec-96<br />

Feb-97<br />

May-97<br />

Aug-97<br />

Nov-97<br />

Jan-98<br />

Apr-98<br />

Jul-98<br />

Oct-98<br />

Dec-98<br />

Mar-99<br />

Jun-99<br />

Sep-99<br />

Market Capitalisation < $600m<br />

Market Capitalisation > $600m<br />

Source:<br />

Warburg Dillon Read.<br />

7

3. Explanatory Memorandum<br />

The Merger Proposal (continued)<br />

Funding Flexibility and Cost of Capital<br />

Being part of a larger investment vehicle with a broader investor base should provide greater funding flexibility through<br />

improved access to debt and equity markets. This should lead to a relatively lower cost of capital in funding new<br />

acquisitions or restructuring existing funding arrangements.<br />

The expansion of the capital base will enable the Merged Group to compete more effectively with other large investors<br />

and open up investment opportunities not currently available to the existing <strong>Trusts</strong> due to their smaller size and relative<br />

cost of funding.<br />

Size and Diversification<br />

If the Merger Proposal is implemented, the Merged Group will be the sixth largest (by total assets) property investment<br />

vehicle listed on the ASX, with 43 properties and over 1,100 tenants in all mainland <strong>State</strong>s and the ACT.<br />

The Manager believes that substantially increasing the size and diversification of the property portfolio should reduce any<br />

cyclical impact of the current sector specific property exposure and will reduce the dependence on a few large tenants.<br />

The Merger Proposal<br />

The proposal to merge the <strong>Trusts</strong> will be achieved by ‘stapling’ units in each of the <strong>Trusts</strong> so that unitholders will have an<br />

interest in each of the <strong>Trusts</strong>.<br />

The merger of the <strong>Trusts</strong> will primarily be achieved by amending the Trust Deeds of each Trust to enable the Trustee and<br />

Manager of a Trust to issue units in the Trust to unitholders in each other Trust and provide for ‘stapling’ the units in each<br />

Trust to units in each other Trust. On completion of the Merger Proposal, investors will hold <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong><br />

Trust Group Stapled Securities, each comprising one Consolidated CMF Unit, one Consolidated CIP Unit, one Consolidated<br />

COC Unit and one Consolidated CFD Unit. These four securities will be quoted and traded together as Stapled Securities in<br />

the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group on the ASX and will not be able to be traded or dealt with separately.<br />

Stapling will be achieved by including provisions in the Trust Deed of each Trust designed to ensure that units in the four<br />

<strong>Trusts</strong> are always dealt with as though they comprised a single security and, in particular, to provide that:<br />

a transfer of units in any of the <strong>Trusts</strong> can only be completed if it is accompanied by a transfer of an equal number of<br />

units in each of the other <strong>Trusts</strong>; and<br />

any issue of new units by a Trust must be matched by an issue of an equal number of units in each of the other <strong>Trusts</strong>.<br />

KPMG has advised that the recommendations comprised within the Review of Business Taxation undertaken by the Ralph<br />

Committee should not impact the stapled security structure proposed as, based on draft legislation, none of the <strong>Trusts</strong><br />

forming the Stapled Securities should be tax paying entities. Refer to Section 7.<br />

Mallesons Stephen Jaques have advised that the implementation of the Merger Proposal will not give rise to a<br />

stamp duty imposition for the Trust although some stamp duty will be paid on the transfer of Stapled Securities to<br />

the Cash Alternative Nominee and this will be deducted from the Cash Alternative proceeds paid to unit holders<br />

who do not receive Stapled Securities.<br />

Unitholders need to choose whether they want to receive Stapled Securities in the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group<br />

or the Cash Alternative.<br />

In addition to having common investors, it is expected that each Trust will have common objectives and strategies.<br />

The <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group will be run as a single economic entity having a diversified property<br />

investment portfolio.<br />

In implementing the Merger Proposal, the following steps will occur in relation to unitholders in each of the four <strong>Trusts</strong><br />

on the merger date:<br />

each existing unit in each Trust will be consolidated in the following ratios rounded up to the nearest whole number:<br />

0.585 Consolidated CMF Units for each existing CMF Unit;<br />

0.950 Consolidated CIP Units for each existing CIP Unit;<br />

0.965 Consolidated COC Units for each existing COC Unit;<br />

0.850 Consolidated COC Units for each existing COC Capital Entitlement Unit; and<br />

1.025 Consolidated CFD Units for each existing CFD Unit;<br />

8

each Unitholder in each Trust will receive a special distribution of $0.03 per Consolidated Unit which will be<br />

wholly applied to subscribe for equal numbers of fully paid Consolidated Units in each of the three other <strong>Trusts</strong><br />

for $0.01 each. This special distribution is a deferred tax distribution (for a more detailed review of tax consequences,<br />

see Section 7 of this Explanatory Memorandum);<br />

the stapling provisions in each of the Trust Deeds will take effect and the Consolidated Units will become<br />

Stapled Securities;<br />

the Stapled Securities held by unitholders receiving the Cash Alternative (i.e. unitholders who have not elected to have<br />

Stapled Securities or who have registered addresses outside Australia and New Zealand) will be transferred to the Cash<br />

Alternative Nominee;<br />

the Stapled Securities transferred to the Cash Alternative Nominee will be sold through the Bookbuild – see below.<br />

In addition to the above steps, if the Merger Proposal is implemented:<br />

the final instalment of $1.00 per unit payable in respect of each unit in CFD will be cancelled; and<br />

the terms of issue of the Capital Entitlement Units in COC will be varied so as to render those units the same<br />

as ordinary units with effect from the merger date.<br />

The record date for determining entitlements to the income distribution for each Trust for the quarter ending 31 December<br />

1999 will be brought forward to 16 December 1999 (ie. the day before the meeting). The effect of this amendment is that<br />

unit holders in each of the <strong>Trusts</strong> will be entitled to the income of the relevant Trust for the quarter ending 31 December<br />

1999 based on their unit holding on 16 December 1999. Their entitlement to income from the Trust in which they held<br />

units prior to the Merger for the quarter ending 31 December 1999 will therefore not be affected by the Merger Proposal.<br />

Implementation<br />

The Merger Proposal is conditional on the passing of resolutions at a meeting of unitholders of each of the <strong>Trusts</strong> to be held<br />

on 17 December 1999, (the Notices of Meeting for which are set out in Section 1 of this booklet).<br />

The Bookbuild<br />

Where a unitholder does not elect to receive Stapled Securities by lodging the duly completed Election Form on or before<br />

midnight on 15 December 1999 or has a registered address outside Australia and New Zealand, their Stapled Securities will<br />

automatically be transferred to the Cash Alternative Nominee. The Stapled Securities will then be sold under the Bookbuild.<br />

Warburg Dillon Read and Deutsche Bank have been appointed by the Manager as Joint Managers of the sale of Stapled<br />

Securities under the Bookbuild.<br />

The Stapled Securities transferred to the Cash Alternative Nominee will be sold through the Bookbuild. The price achieved<br />

on sale of Stapled Securities through the Bookbuild is not fixed or underwritten, and accordingly, may be lower or higher<br />

than the notional $2.00 per Stapled Security. Further, expenses (including stamp duty), and brokerage of 0.75% will be<br />

deducted. Unitholders receiving the Cash Alternative will receive a sale price equal to the average price achieved on the<br />

sale of all of the Stapled Securities less expenses and brokerage.<br />

The sale of all Stapled Securities through the Bookbuild will be undertaken in the first week of February 2000 unless<br />

market conditions are unfavourable, in which case the sale of the Stapled Securities will take place no later than 24 March<br />

2000. Once the sale of all the Stapled Securities is completed, the sale price for Unitholders receiving the Cash Alternative<br />

will be determined and paid within 14 days of completion of the Bookbuild.<br />

The number of Stapled Securities to be sold in the Bookbuild will depend upon how many unitholders participate in the<br />

Cash Alternative or who have registered addresses outside Australia or New Zealand.<br />

Institutional investors will be invited to submit bids for Stapled Securities to be sold in the Bookbuild. Bids must be made<br />

to either of the Joint Managers for Stapled Securities to a value of at least $500,000. Participants in the Bookbuild may<br />

bid for Stapled Securities at various prices. The price at which the Stapled Securities are sold under the Bookbuild will be<br />

determined by the Manager in consultation with the Joint Managers. The price will be determined having regard to the<br />

primary objective of obtaining the best price for Stapled Securities reasonably obtainable, it being recognised that this will<br />

be assisted if bidders into the Bookbuild have an expectation that there will be an orderly secondary market for Stapled<br />

Securities. A secondary objective is to obtain a spread of investors in the Stapled Securities.<br />

Accordingly, the price at which the Stapled Securities are sold under the Bookbuild may not necessarily be the highest price<br />

at which all Stapled Securities can be sold and may be higher or lower than $2.00 per Stapled Security.<br />

If the Proposal is Not Implemented<br />

If the proposal is not implemented then each of the <strong>Trusts</strong> will continue to operate as it currently does. The Manager will<br />

continue to seek to maximise returns to unitholders.<br />

9

3. Explanatory Memorandum<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group<br />

Overview<br />

The merger of the <strong>Trusts</strong>, through stapling the units of each of the <strong>Trusts</strong>, will create a diversified property group with total<br />

assets in excess of $1.6 billion. The Group will have investments in the retail, office and industrial sectors of the property<br />

market. The portfolio will be well diversified by property, property type and geographic location.<br />

Price Re-rating<br />

If the Merger Proposal is implemented, the Manager forecasts the Group will have an annualised distribution yield of<br />

9.0% (based on the notional price of $2.00 per Stapled Security) for the six months ending 30 June 2000. As the weighted<br />

average distribution yield of large diversified property vehicles is 7.7%, the Manager believes that there will be a price<br />

re-rating (increase in the value of securities) if the Merger Proposal is implemented.<br />

Asset Diversification and Average Age<br />

The Merger Proposal will increase the size and diversity of the property portfolio.<br />

As represented in the charts below, the diversification of property type by value and earnings distribution from the merged<br />

portfolio is well balanced, thereby alleviating any adverse impact of sector specific investment and earnings cycles.<br />

Asset Type<br />

Earnings Distribution<br />

Office<br />

40%<br />

Industrial<br />

28%<br />

Office<br />

42%<br />

Industrial<br />

32%<br />

Retail<br />

32%<br />

Retail<br />

26%<br />

The geographic spread of assets by value after the proposed merger is set out below.<br />

Geographic Spread of CPG After Merger Proposal<br />

QLD 20%<br />

WA 8%<br />

NSW 45%<br />

ACT 0.5%<br />

SA 10%<br />

VIC 16.5%<br />

After implementation of the Merger Proposal, the largest geographical weighting of properties will be in New South Wales,<br />

the largest Australian state by population.<br />

The average age of the portfolio (weighted by value) will be 10 years on completion of the Merger Proposal with a total net<br />

lettable area in excess of 838,000 square metres.<br />

Tenant Diversification<br />

On completion of the Merger Proposal, <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group will have in excess of 1,100 tenants.<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group’s exposure to its 10 largest tenants (in terms of total income) will be 28%.<br />

10

Lease Maturity Profile<br />

The graph below illustrates the lease maturity profile, by total net income, after the Merger. After implementation of the<br />

Merger Proposal, the average remaining lease term is 5 years.<br />

Lease Maturity Profile<br />

%<br />

50<br />

40<br />

43%<br />

30<br />

20<br />

10<br />

4%<br />

13% 14%<br />

8%<br />

11%<br />

7%<br />

0<br />

Holding over<br />

1 year<br />

2 years<br />

3 years<br />

4 years<br />

5 years<br />

5 years +<br />

The property portfolio will be well diversified in terms of lease maturity profile.<br />

Vacancies<br />

After implementation of the Merger Proposal, the vacancy rate will be 2.8%.<br />

Strategy and Key Policies<br />

Manager’s Strategy<br />

The strategy of the Manager will be to seek to provide stable, growing distributions to investors in the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

<strong>Property</strong> Trust Group.<br />

This will be achieved by adhering to a sound investment philosophy and implementing a disciplined and continuous<br />

action plan.<br />

The investment philosophy will be to:<br />

invest in a portfolio of properties, diversified by property type and geographic location;<br />

invest in sectors of the property market that the Manager considers will deliver the best overall performance; and<br />

avoid having a large exposure to any particular market sector or individual property.<br />

The key elements of the action plan will be:<br />

the ongoing active management of the existing property portfolio with a focus on enhancing the income stream;<br />

to maintain a broad diversified property portfolio;<br />

to improve the quality of the portfolio over time by:<br />

(a) the acquisition of additional properties that meet the investment criteria and enhance returns to investors; and<br />

(b) the disposal of properties which no longer satisfy the investment criteria in terms of quality, size and outlook<br />

for returns;<br />

the active management of interest rates; and<br />

to focus on the cost of capital and management of investors’ capital.<br />

As shown above, the property portfolio will be well diversified both geographically and by asset type. The Manager will<br />

look to maintain a well diversified portfolio, but at times the Manager may increase weightings in certain sectors and<br />

geographic locations that it expects to outperform.<br />

11

3. Explanatory Memorandum<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group (continued)<br />

Distributions<br />

Investors in the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group will receive distributions from each of the <strong>Trusts</strong>. It is intended that<br />

the combined distribution will be paid to investors quarterly, no later than two months after the end of the relevant period.<br />

Gearing<br />

The pro-forma gearing (debt to total assets) for the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group at the time of merging is<br />

approximately 27%. It is the current intention of the Manager that the long term gearing be 20%-30%. It is intended that<br />

the Group’s distribution reinvestment plan be activated to reduce gearing and fund capital expenditure.<br />

The Manager will implement an interest rate hedging policy that fixes most of the Group’s debt for a period of 3-5 years.<br />

Valuations<br />

The Manager will arrange to value the properties at approximately annual intervals.<br />

Management<br />

The Manager will draw on the resources of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong>. A diagram showing the management structure for the<br />

<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group is shown below:<br />

Board of Directors<br />

Chief Executive Officer<br />

Chris Cuffe<br />

Head of Listed <strong>Property</strong><br />

Sandy Calder<br />

Investment Manager Retail<br />

Conrad Sinclair<br />

Investment Manager<br />

Commercial<br />

Justin Lynch<br />

Investment Manager Industrial<br />

Chris Judd<br />

Portfolio Research Manager<br />

Asset Manager Retail<br />

Roger Stapleton<br />

Asset Manager Commercial<br />

Lachlan Gyde<br />

Asset Manager Industrial<br />

Matthew Meredith<br />

<strong>Property</strong> Management<br />

The profiles of the board of directors are set out below:<br />

Directors of the CPG Manager<br />

P L Polson BCom MBL PMD (Chairman) is Managing Director of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Investments</strong> Group Limited and a<br />

director of other <strong>Colonial</strong> Group subsidiaries. He joined <strong>Colonial</strong> Group in October 1994. Previous positions included<br />

Managing Director of National Mutual Funds Management (International) Ltd and Managing Director of Standard Bank<br />

Financial Services in South Africa.<br />

A Carstens BCom (Hons) CA (SA) is Chief Financial Officer of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Investments</strong> Group Limited and is<br />

responsible for overseeing the finance and administration functions of <strong>Colonial</strong>’s investment management operations. Before<br />

joining <strong>Colonial</strong> in 1994, he held senior management positions in the financial services industry and with Ernst & Young.<br />

F S Grimwade LLB (Hons) BCom MBA (Columbia) is General Manager Corporate Development of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong><br />

<strong>Investments</strong> Group Limited. He joined <strong>Colonial</strong> in January 1996 as Group Company Secretary and General Manager Legal<br />

Affairs from WMC Ltd where he spent six years as Company Secretary and General Manager Shareholder Relations. He<br />

also worked with international investment bank Goldman, Sachs and Co. and as a lawyer with Mallesons Stephen Jaques.<br />

G S Ray LLB BCom FCPA FTIA is General Counsel and Group Solicitor of the <strong>Colonial</strong> Group. He has acted in this<br />

capacity for more than 20 years and has been involved in most of the major contracts undertaken by the <strong>Colonial</strong> Group.<br />

C E Cuffe BCom, ACA, ASIA is Chief Executive Officer of <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> Investment Managers (Australia) Limited.<br />

Following a five year period with a major firm of Chartered Accountants, Peat Marwick Mitchell & Co (now KPMG),<br />

Chris entered the funds management industry where he has held various senior positions since 1985, assuming the role<br />

of Chief Executive Officer of <strong>First</strong> <strong>State</strong> Fund Managers Limited in 1990.<br />

A Bird, BSc (Urban Land Admin) ARICS is Director – <strong>Property</strong> <strong>Investments</strong>. He has over 20 years’ experience in the<br />

property industry. Prior to joining <strong>Colonial</strong> in 1991 he held professional appointments in London, Jakarta and Melbourne.<br />

12

4. <strong>Property</strong> Portfolio<br />

The Portfolio<br />

With 43 properties, over 1,100 tenants, investments in all mainland states and the ACT and a total property investment<br />

portfolio in excess of $1.6 billion, the <strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Property</strong> Trust Group will be the sixth largest (by total assets)<br />

property investment vehicle listed on the ASX.<br />

The property assets in the portfolio are set out below:<br />

<strong>State</strong> Book Value ($)<br />

<strong>Property</strong> at 30 September 1999<br />

Retail – 32% of portfolio by book value<br />

Brimbank Central VIC 83,006,072<br />

Corio Village VIC 48,300,410<br />

Golden Grove Village SA 50,867,697<br />

Castle Plaza SA 58,046,592<br />

Thornlie Square WA 22,165,534<br />

Grand Plaza QLD 71,398,331<br />

Runaway Bay Shopping Village QLD 59,529,913<br />

Clifford Gardens Shopping Centre QLD 88,154,586<br />

Rockingham City Shopping Centre WA 22,543,663<br />

Sub Total – Retail 504,012,798<br />

Office – 40% of portfolio by book value<br />

Brandon Office Park VIC 41,563,552<br />

<strong>Colonial</strong> <strong>State</strong> Bank Tower, 150 George Street, Parramatta NSW 77,818,923<br />

Abbotsford Office Park, 675-674 Victoria Street, Abbotsford VIC 19,878,741<br />

Hongkong Bank Building, 300 Queen Street, Brisbane QLD 67,500,000<br />

197 St Georges Terrace & 1-5 Mill Street, Perth WA 87,012,237<br />

Mercantile Mutual Centre, 45 Pirie Street, Adelaide SA 51,761,391<br />

SRA Building, 32 Lee Street, Sydney NSW 5,404,732<br />

15 Bowes Street, Woden ACT 8,010,801<br />

60 Castlereagh Street, Sydney NSW 160,000,000<br />

339-345 Military Road, Cremorne NSW 12,737,099<br />

56 Pitt Street, Sydney NSW 115,000,000<br />

Sub Total – Office 646,687,476<br />

Industrial – 28% of portfolio by book value<br />

Alexandria Industrial Estate NSW 35,056,393<br />

Boundary Industrial Park QLD 21,000,000<br />

Brodie Industrial Park, Rydalmere NSW 17,400,000<br />

390 Eastern Valley Way, Chatswood NSW 8,250,000<br />

71-95 Roberts Road, Chullora NSW 28,000,000<br />

85 Epping Road & 376 Lane Cove Road, North Ryde NSW 19,000,000<br />

14 Aquatic Drive, Frenchs Forest NSW 26,300,000<br />

Gateway Estate, Arndell Park NSW 28,506,139<br />

8 Giffnock Avenue, North Ryde NSW 2,400,000<br />

Kmart Distribution Centre, Hoppers Crossing VIC 40,000,000<br />

100-128 Bridge Road, Keysborough VIC 8,800,000<br />

Mascot Central, Mascot NSW 28,806,632<br />

197-205 Fitzgerald Road, Laverton North VIC 11,725,000<br />

13-15 Lyon Park Road, North Ryde NSW 16,304,623<br />

91 Mars Road, Lane Cove NSW 10,600,000<br />

17 O’Riordan Street, Alexandria NSW 8,238,421<br />

25 Pavesi Street, Smithfield NSW 7,450,000<br />

80 Turner Street, Port Melbourne VIC 11,617,000<br />

Slough Business Park, Silverwater NSW 80,072,130<br />

Smithfield Industrial Estate (Stage 1) NSW 11,414,294<br />

Smithfield Industrial Estate (Stage 2) NSW 10,308,145<br />

60 Enterprise Place, Tingalpa QLD 12,140,000<br />

299 Montague Road, West End QLD 8,479,212<br />

Sub Total – Industrial 451,867,989<br />

Total 1,602,568,263<br />

13

4. <strong>Property</strong> Portfolio<br />

The Portfolio (continued)<br />

Brandon Office Park, Glen Waverley, Victoria<br />

Date Completed In stages from 1988 to 1990<br />

Net Lettable Area 16,862.30 sqm<br />

Typical Floor Area 1,100 sqm<br />

Car Parking<br />

657 spaces<br />

Occupancy 95.80%<br />

Current Valuation $41,500,000<br />

Valuation Date 15 May 1999<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

NEC Australia Pty Ltd 6,791 40.30 November 2000<br />

Telstra Corporation Ltd 6,869 40.70 May 1999 (agreed to<br />

renew) & February 2000<br />

Pacific Dunlop Ltd 1,166 6.90 August 2003<br />

Jones Lang La Salle 586 3.50 August 2004<br />

Location: The property is located on the north east corner of Springvale and Ferntree Gully Roads, Glen Waverley,<br />

approximately 20 kilometres south-east of the Melbourne CBD.<br />

Title Details: The property is on three titles, with a total site area of 37,660 square metres.<br />

Description:<br />

The property is an office park development comprising five office buildings in three separate structures, set<br />

amongst landscaped gardens and recreation facilities. The structures provide office accommodation in<br />

varying levels between two and four storeys in height.<br />

The Manager has now received planning approval which allows the development of additional floor space of<br />

approximately 11,500 square metres on the site. Construction of any building would only commence if a<br />

leasing pre-commitment over part of the space was secured.<br />

56 Pitt Street, Sydney<br />

Date Completed Significantly refurbished over 1998<br />

Net Lettable Area 20,910 sqm<br />

Typical Floor Area 820 sqm<br />

Car Parking<br />

80 spaces<br />

Occupancy 77.57%<br />

Current Valuation $115,000,000<br />

Valuation Date 30 September 1999<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

Perpetual Trustees 2,474 11.80 June 2005<br />

Paladin Australia 1,649 7.90 August 2005<br />

Location: The property is prominently located within Sydney’s financial district.<br />

Title Details: The property is held within one title, having a site area of approximately 1,784 square metres.<br />

Description: The building has undergone an extensive refurbishment, which was completed in October 1998 and provides<br />

Grade A office accommodation over 26 levels<br />

14

150 George Street, Parramatta, NSW<br />

Date Completed 1992<br />

Net Lettable Area 21,964 sqm<br />

Typical Floor Area 1,200 sqm<br />

Car Parking<br />

492 spaces<br />

Occupancy 100%<br />

Current Valuation $77,800,000<br />

Valuation Date 15 November 1998<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

<strong>Colonial</strong> <strong>State</strong> Bank 21,964 100 November 2005<br />

Location: The property is located in the Parramatta CBD. Parramatta is a major regional centre in New South Wales<br />

located approximately 23 kilometres west of the Sydney CBD.<br />

Title Details: The property is on a single title, with a site area of 5,124 square metres.<br />

Description:<br />

A modern commercial office building incorporating ground floor retail/showroom space, loading dock and<br />

carpark entry, six upper levels of car parking, mezzanine offices and a further 16 upper levels of commercial<br />

office accommodation.<br />

The whole building is leased to the <strong>State</strong> Bank of New South Wales Limited (<strong>Colonial</strong> <strong>State</strong> Bank) for a<br />

period of 10 years expiring on 21 November 2005. Rent reviews are two-yearly to market. <strong>Colonial</strong> <strong>State</strong><br />

Bank is a member of the <strong>Colonial</strong> Group.<br />

15

4. <strong>Property</strong> Portfolio<br />

The Portfolio (continued)<br />

300 Queen Street, Brisbane, Queensland<br />

Date Completed 1984<br />

Net Lettable Area<br />

Office 18,301 sqm 96%<br />

Retail 751 sqm 4%<br />

Total 19,052 sqm 100%<br />

Typical Floor Area 798 – 833 sqm<br />

Car Parking<br />

134 spaces<br />

Occupancy 93.90%<br />

Current Valuation $67,500,000<br />

Valuation Date 15 September 1999<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

Macquarie Bank Limited 2,394 12.70 December 2006<br />

Kendalls KBM Service Pty Ltd 1,666 8.70 July 2005<br />

Douglas Heck & Burrell 1,220 6.50 July 2009<br />

Hong Kong Bank of Australia 870 4.60 September 2001<br />

BDO <strong>Property</strong> & Administration<br />

(Qld) Pty Ltd 833 4.40 October 2004<br />

Ports Corporation of Qld 830 4.40 January 2004<br />

Knight Frank (Queensland) 798 4.20 June 2003<br />

Nicol Robinson & Kidd 798 4.20 December 2002<br />

Location: The property is located in a prime position on the north-western side of Queen Street in the Brisbane CBD,<br />

adjacent to Post Office Square.<br />

Title Details: The property is on two titles, a freehold site with an area of 2,034 square metres and a leasehold site of<br />

151 square metres expiring in March 2063.<br />

Description:<br />

The property comprises a commercial office building, which is a 28 level building incorporating three<br />

basement carpark levels, lower ground floor food court (which links directly to Post Office Square),<br />

ground floor foyer and 24 upper levels of office accommodation.<br />

16

675-679 Victoria St, Abbotsford, Melbourne, Victoria<br />

Date Completed 1984 to 1987<br />

Net Lettable Area<br />

Office 9,356.50 sqm 98.80%<br />

Retail 117 sqm 1.20%<br />

Total 9,473.50 sqm 100.00%<br />

Typical Floor Area 600 – 1,500 sqm<br />

Car Parking<br />

365 spaces<br />

Occupancy<br />

Office 100%<br />

Retail 100%<br />

Total 100%<br />

Current Valuation $19,800,000<br />

Valuation Date 15 October 1998<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

Pacific Access Pty Limited 2,969.00 31.50 September 2002<br />

British Aerospace 2,471.00 26.20 December 2001<br />

Honeywell Limited 2,041.50 21.60 December 2003<br />

Location: The property is located on the northern side of Victoria Street and is bounded by the Yarra River, some<br />

4.5 kilometres east of the Melbourne CBD.<br />

Title Details: The property is on three separate titles on a site area of 17,679 square metres.<br />

Description: The property is a complex of three freestanding, low rise office buildings. The buildings offer office<br />

accommodation across two to four levels, and are fully let.<br />

60 Castlereagh Street, Sydney<br />

Date Completed September 1999<br />

Net Lettable Area 26,935 sqm<br />

Typical Floor Area 1,180 sqm<br />

Car Parking<br />

62 spaces<br />

Occupancy 84.50%<br />

Current Valuation $160,000,000<br />

Valuation Date 30 September 1999<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

BNP 10,784 40 June 2010<br />

Holding Redlich 1,191 4 June 2008<br />

Location: The property is prominently located in Castlereagh Street within the CBD of Sydney.<br />

Title Details: The property is held within four titles, having a site area of approximately 2,487 square metres.<br />

Description: The development provides 20 levels of office accommodation, ground floor retail space and basement<br />

car parking.<br />

17

4. <strong>Property</strong> Portfolio<br />

The Portfolio (continued)<br />

197 St Georges Terrace, Perth, WA<br />

5 Mill Street, Perth, WA<br />

1 Mill Street, Perth, WA<br />

Date Completed<br />

197 St Georges Terrace 1983<br />

5 Mill Street 1972<br />

1 Mill Street 1986<br />

Net Lettable Area 39,675 sqm<br />

Typical Floor Area<br />

197 St Georges Terrace 833 sqm<br />

5 Mill Street 737 sqm<br />

1 Mill Street 1,833 – 1,995 sqm<br />

Car Parking<br />

282 spaces<br />

Occupancy<br />

197 St Georges Terrace 99.10%<br />

5 Mill Street 90.40%<br />

1 Mill Street 93.60%<br />

Current Valuation $86,400,000<br />

Valuation Date 15 December 1998<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

Government of WA 20,672 52.10 June 2007<br />

Fluor Daniel 5,870 14.80 August 1999 – February 2003<br />

Location: The property is located in Perth’s prime business district upon a large and prominent site, close to a number<br />

of established multi-storey office buildings. It has frontages to St Georges Terrace, Mill Street and Mounts<br />

Bay Road.<br />

Title Details: The property is on one title totalling an area of 8,726 square metres.<br />

Description: The property consists of three separate buildings:<br />

197 St Georges Terrace: The building comprises a 29 level office tower with net lettable area of 26,303 square metres.<br />

The premises are currently 99.1% leased, 78.66% of which is to the <strong>State</strong> Government until 2007.<br />

5 Mill Street: 5 Mill Street was completed in 1972 as the first stage of the development. The building comprises<br />

a basement, ground and 10 upper floors with a net lettable area of 7,100 square metres. The<br />

premises are currently 90.4% leased to a variety of tenants.<br />

1 Mill Street: 1 Mill Street was completed in 1986 and comprises a four level office building with net lettable<br />

area of 6,273 square metres. The building is 93.6% leased to Fluor Daniel.<br />

18

45 Pirie Street, Adelaide, South Australia<br />

Date Completed 1989<br />

Net Lettable Area<br />

Office 19,102.90 sqm 96.50%<br />

Retail 702.60 sqm 3.50%<br />

Total 19,805.50 sqm 100.00%<br />

Typical Floor Area 1,110 sqm<br />

Car Parking<br />

57 spaces<br />

Occupancy<br />

Office 100%<br />

Retail 100%<br />

Total 100%<br />

Current Valuation $51,500,000<br />

Valuation Date 15 November 1998<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

Attorney General’s Department 7,646.00 38.60 September 2007<br />

Department for Industrial Affairs 2,939.00 14.80 August 2000<br />

Norman Waterhouse 1,114.50 5.60 September 2003<br />

Colliers Jardine (SA) Pty Ltd 1,217.00 6.10 August 2002<br />

Location: The property is located in the centre of the Adelaide CBD on the southside of Pirie Street.<br />

Title Details: The property is on one title with a site area of 3,308 square metres.<br />

Description: The property is a modern 19 level premium grade office building with basement car parking.<br />

SRA Building, 32 Lee Street, Sydney, NSW<br />

Estimated Completion September 2000<br />

Net Lettable Area<br />

Office<br />

13,500 sqm<br />

Retail<br />

891 sqm<br />

Total<br />

14,391 sqm<br />

Typical Floor Area 2,070 sqm<br />

Car Parking<br />

90 spaces<br />

Occupancy<br />

Office<br />

100% to SRA<br />

Retail<br />

Under negotiation<br />

Current Valuation $4,550,000 site value<br />

$51,000,000 upon completion<br />

Major Tenants<br />

Tenant Area Let (sqm) % Area Let Expiry<br />

<strong>State</strong> Rail Authority 13,511 94.20 March 2010<br />

Location: The property is located in the southern sector of the Sydney CBD, approximately 2 kilometres south of the<br />

Sydney GPO in the Central Railway Station precinct. The development is on the eastern side of Lee Street<br />

abutting Central Railway Station.<br />

Title Details: The property is on a site area of approximately 3,464 square metres.<br />

Description: It is proposed that a development of an eight level retail and office building with a net lettable area of<br />

approximately 14,390 square metres will be constructed on the site. Offices will account for 94.2% of<br />

net lettable area. All of the office area is to be leased to the <strong>State</strong> Rail Authority for a period of 10 years.<br />

The lower two floors will contain some retail space. The Trust has purchased a 99 year lease of the site<br />

and will make a further single payment for the building upon completion. The total purchase price will<br />

be $50,925,000.<br />

19

4. <strong>Property</strong> Portfolio<br />

The Portfolio (continued)<br />

Grand Plaza Shopping Centre<br />

Location<br />

South-West Brisbane<br />

Type<br />

Sub-Regional Shopping Centre<br />

Ownership 50%<br />

Current Valuation $71,000,000 (November 1998)<br />

Capitalisation Rate 8.50%<br />

Lettable Area<br />

38,209 sqm<br />

Car Parking 2,300<br />

Number of Tenants 116<br />

Major Tenants<br />

Tenant Area Let (sqm) % Lettable Area Expiry (excl. options)<br />

Target 7,102 18.59 2014<br />

Big W 6,599 17.27 2014<br />

Woolworths 4,844 12.68 2014<br />

Coles 3,880 10.15 2014<br />

Birch Caroll & Coyle 3,593 9.40 2014<br />

Best & Less 1,142 2.99 2004<br />

Location: Grand Plaza Shopping Centre is located approximately 26 kilometres south of the Brisbane CBD within<br />

the City of Logan.<br />

Title Details: The property is contained on one title with a site area of approximately 18 hectares.<br />

Description:<br />

Grand Plaza Shopping Centre opened in October 1994. It is a fully enclosed, air conditioned, single level<br />

sub-regional centre with a number of free standing fast food restaurants. Major tenants are Woolworths, Coles,<br />

Big W, Target, Best and Less and Birch Carroll & Coyle (cinemas). There are approximately 110 specialty stores.<br />

Brimbank Central<br />

Location<br />

Western Melbourne<br />

Type<br />

Sub-Regional Shopping Centre<br />

Ownership 100%<br />

Current Valuation $82,500,000 (May 1999)<br />

Capitalisation Rate 9.25%<br />

Net Lettable Area 35,667 sqm<br />

Car Parking 1,900<br />

Number of Tenants 109<br />

Major Tenants<br />

Tenant Area Let (sqm) % Lettable Area Expiry (excl. options)<br />

Kmart 7,440 20.86 2012<br />

Target 7,123 19.97 2016<br />

Safeway 3,688 10.28 2004<br />

Bi-Lo Megafresh 3,520 9.87 2011<br />

Franklins 1,625 4.56 2010<br />

Location: Brimbank Central Shopping Centre is located within the suburb of Deer Park, approximately 18 kilometres<br />

to the west of the Melbourne CBD.<br />

Title Details: The property is on a single title with a site area of approximately 10.9 hectares.<br />

Description:<br />

The centre was originally constructed in 1979 and underwent extensive refurbishment and extension in<br />

1997. The present configuration provides a modern sub-regional shopping centre incorporating a Target and<br />

Kmart Discount Department Store, Safeway, Franklins and Bi Lo Mega Fresh Supermarket, Target and<br />

Kmart Garden Centres and 79 specialty shops.<br />

20

Thornlie Square Shopping Centre<br />

Location<br />

South East Perth<br />

Type<br />

Community Shopping Centre<br />

Ownership 100%<br />

Current Valuation $21,750,000 (September 1998)<br />

Capitalisation Rate 11.50%<br />

Lettable Area<br />

13,030 sqm<br />

Car Parking 874<br />

Number of Tenants 54<br />

Major Tenants<br />

Tenant Area Let (sqm) % Lettable Area Expiry (excl. options)<br />

Coles 4,959 38.06 2013<br />

Farmer Jacks 2,774 21.29 2007<br />

Location: Thornlie Square Shopping Centre is located within the suburb of Thornlie, approximately 18 kilometres<br />

south-east of the Perth CBD.<br />

Title Details: The property is on one title, with a site area of approximately 4.8 hectares.<br />

Description:<br />

Thornlie Square Shopping Centre was completed in the early 1970s and was extended and refurbished<br />

in 1987. The centre is constructed over a single level, and the malls are fully enclosed and airconditioned.<br />

The centre is anchored by a Coles supermarket, Farmer Jacks Supermarket, 44 specialty shops and a service<br />

station.<br />

Corio Village Shopping Centre<br />

Location<br />

Geelong, Victoria<br />

Type<br />

Sub-Regional Shopping Centre<br />

Ownership 100%<br />

Current Valuation $48,000,000 (February 1999)<br />

Capitalisation Rate 10.50%<br />

Net Lettable Area 30,371 sqm<br />

Car Parking 1,565<br />

Number of Tenants 107<br />

Major Tenants<br />

Tenant Area Let (sqm) % Lettable Area Expiry (excl. options)<br />

Kmart 6,503 21.41 2004<br />

Coles 3,716 12.24 2005<br />

Harris Scarfe 2,799 9.22 2005<br />

Franklins 2,726 8.98 2010<br />

Location: Corio Village Shopping Centre is located on an island site on the corner of Bacchus Marsh Road and<br />

Purnell Road in Corio. Corio is located approximately 7 kilometres north of the City of Geelong and<br />

enjoys a dominant position within the immediate market.<br />

Title Details: The property is contained on three separate titles and has a combined site area of approximately<br />

8.7 hectares.<br />

Description: Originally constructed in 1973, the property comprises a sub-regional shopping centre featuring a Kmart<br />

and Harris Scarfe Discount Department Stores, Coles and Franklins Supermarkets, 80 specialty shops,<br />

three kiosks and 14 office suites. The centre has been extended and refurbished since it first opened in 1973.<br />

21

4. <strong>Property</strong> Portfolio<br />

The Portfolio (continued)<br />

Castle Plaza Shopping Centre<br />

Location<br />

Edwardstown, Southern Adelaide<br />

Type<br />

Sub-Regional Shopping Centre<br />

Ownership 100%<br />

Current Valuation $57,800,000 (November 1998)<br />

Capitalisation Rate 10%<br />

Net Lettable Area 22,766 sqm<br />