EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUROPEAN COMMISSION<br />

DIRECTORATE GENERAL<br />

TAXATION AND CUSTOMS UNION<br />

Indirect Taxation and Tax administration<br />

Environment and other indirect taxes<br />

REF 1031<br />

July 2010<br />

• • • • • • • • • • • •<br />

<strong>EXCISE</strong> <strong>DUTY</strong> <strong>TABLES</strong><br />

Part III – Manufactured Tobacco<br />

• • • • • • • • • • • •<br />

Can be consulted on DG TAXUD new Web site:<br />

http://ec.europa.eu/taxation_customs/index_en.htm#<br />

(Shows the situation as at 1 July 2010)<br />

© European Commission 2010<br />

Reproduction is authorised, provided the source and web address<br />

(http://ec.europa.eu/taxation_customs/index_en.htm#) are acknowledged.<br />

B-1049 Brussels - Belgium - Office: SPA3 5/69A.<br />

Telephone: direct line (+32-2)295.83.70, switchboard 299.11.11.<br />

Internet: maria.makropoulou@ec.europa.eu

July 2010<br />

INTRODUCTORY NOTE<br />

In collaboration with the Member States, the European Commission<br />

has established the “<strong>EXCISE</strong> <strong>DUTY</strong> <strong>TABLES</strong>” showing rates in<br />

force in the Member States of the European Union .<br />

As from 1 January 2007 this publication:<br />

* covers the 27 Member States of the EU;<br />

* has been divided into three different sections:<br />

I Alcoholic Beverages<br />

II Energy products and Electricity<br />

III Manufactured Tobacco.<br />

This publication aims to provide up-to-date information on Member<br />

States main excise duty rates as they apply to typical products. The<br />

information is supplied by the respective Member States. The<br />

Commission cannot be held responsible for its accuracy or<br />

completeness, neither does its publication imply an endorsement by<br />

the Commission of those Member States' legal provisions.<br />

It is intended that Member States will regularly communicate to the<br />

Commission all modifications of the rates covered by this<br />

publication and that revised editions of the tables will be published<br />

twice a year.<br />

To this end, it is vital that all changes to duty structures or rates are<br />

advised by Member States to the Commission as soon as possible so<br />

that they may be incorporated in the tables with the least possible<br />

delay. All details should be sent to Mrs Maria Makropoulou:<br />

e-mail..............Maria.Makropoulou@ec.europa.eu<br />

telephone.........Int-32-2-295.83.70.<br />

This document together with general information about the Taxation and Customs Union<br />

can be found at:<br />

http://ec.europa.eu/taxation_customs/index_en.htm#<br />

For further or more detailed information, please contact directly<br />

the Member States concerned (see list of contact persons at the<br />

end of this document)<br />

2

3<br />

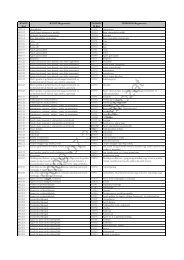

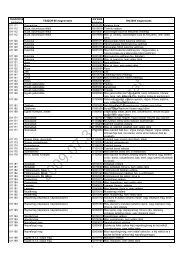

UPDATE SITUATION - <strong>EXCISE</strong> <strong>DUTY</strong> <strong>TABLES</strong><br />

July 2010<br />

1 July 2010 New start<br />

CZ Cigarettes<br />

DE Cigarettes<br />

ES Cigarettes, Cigars & Cigarillos, Find Cut Smoking tobacco, Other smoking tobaccos, VAT rate<br />

IE Contacts<br />

HU Contacts<br />

NL Cigarettes, Fine Cut Smoking Tobacco, Other smoking tobaccos<br />

PT Cigarettes, Cigars & Cigarillos, Find Cut Smoking tobacco, Other smoking tobaccos, VAT rate<br />

RO Cigarettes, Cigars & Cigarillos, Find Cut Smoking tobacco, Other smoking tobaccos, VAT rate<br />

SK Cigarettes<br />

FI Cigarettes, Cigars & Cigarillos, Find Cut Smoking tobacco, Other smoking tobaccos, VAT rate,<br />

Contacts

July 2010<br />

INDEX<br />

INTRODUCTORY NOTE 2<br />

UPDATE SITUATION 3<br />

EUR exchange rate as of 1 OCTOBER 2009 5<br />

MANUFACTURED TOBACCO 6<br />

Cigarettes 7<br />

Cigarettes – Additional comments 8<br />

Graphs - Cigarettes 9<br />

Cigars and cigarillos 11<br />

Fine cut tobacco 12<br />

Other smoking tobaccos 13<br />

CONTACT POINTS 14<br />

4

EUR Exchange Rates<br />

Value of National Currency in EUR at 1 October 2009*<br />

Member State National Currency Currency value<br />

BG BGN 1,9558<br />

CZ CZK 25,420<br />

DK DKK 7,4449<br />

EE EEK 15,6466<br />

LV LVL 0,7083<br />

LT LTL 3,4528<br />

HU HUF 270,26<br />

PL PLN 4,2450<br />

RO RON 4,2688<br />

SE SEK 10,1890<br />

UK GBP 0,91085<br />

*Rates published in the Official Journal of the European Union - C 237 of 2/10/2009.<br />

The Slovak koruna "SKK" irrevocably fixed as of 1 January 2009 (=30,1260 SKK to 1 euro) – Official Journal L 195, 24/7/2008, Council Regulation (EC) No 694/2008 of 8 July<br />

2008 amending Regulation (EC) No 2866/98<br />

The Cyprus pound "CYP" irrevocably fixed as of 1 January 2008(=0,585274 CYP to 1 euro) – Official Journal L256, 2/10/2007, Council Regulation (EC) No 1135/2007 amending<br />

Council Regulation (EC) No 2866/98.<br />

The Maltese lira "MTL" irrevocably fixed as of 1 January 2008 (=0,429300 MTL to 1 euro) – Official Journal L256, 2/10/2007, Council Regulation (EC) No 1134/2007 amending<br />

Council Regulation (EC) No 2866/98.<br />

The Slovenian tolar "SIT" irrevocably fixed as of 1 January 2007 (=239.640 SIT to 1 euro) – Official Journal L195, 15/7/2006, Council Regulation (EC) No 1086/2006<br />

amending Council Regulation (EC) No 2866/98.<br />

5

July 2010<br />

MANUFACTURED TOBACCO<br />

6

“TIRSP”<br />

Retail Selling<br />

Price, all<br />

Taxes<br />

Included<br />

Cigarettes Situation as at 1 July 2010<br />

Specific Excise (1000 pieces)<br />

NatCurr EUR as % of<br />

TIRSP<br />

As % of<br />

Total<br />

taxation<br />

(specific<br />

+ad valorem<br />

+VAT)<br />

Ad Valorem<br />

Excise<br />

(as % of TIRSP<br />

VAT %<br />

(as % of<br />

TIRSP<br />

Ad<br />

Valorem<br />

Excise<br />

+ VAT<br />

(as % of<br />

TIRSP<br />

Total Tax<br />

(incl VAT)<br />

(as % of<br />

TIRSP<br />

Current MPPC<br />

per 1000 cigarettes<br />

Excise<br />

yield<br />

NatCurr EUR (EUR<br />

per 1000<br />

Cigarettes)<br />

Minimum<br />

excise duty<br />

pursuant<br />

to<br />

Article 16 (5)<br />

Dir. 95/59<br />

EUR/1000 cig.<br />

Overall<br />

Minimum<br />

Excise Duty<br />

as % of TIRSP<br />

Specific<br />

+<br />

ad valorem<br />

(excl.VAT)<br />

MS 1 2 3 4 5 6 7 8 9 10 11 12 13<br />

BE 15,9295 6,58% 8,62% 52,41% 17,36% 69,77% 76,34% 242,11 142,81 124,79 58,99%<br />

BG 101,00 51,64 49,03% 55,28% 23,00% 16,67% 39,67% 88,70% 206,00 105,33 75,87 75,67 72,03%<br />

*CZ 1070,00 42,09 33,97% 43,20% 28,00% 16,67% 44,67% 78,64 % 3150,00 123,92 76,79 79,07 61,97%<br />

DK 629,80 84,59 34,04% 45,49% 20,80% 20,00% 40,80% 74,84% 1850,00 248,49 136,28 123,10 54,84%<br />

DE 82,70 33,43% 45,14% 24,66% 15,97% 40,63% 74,06% 247,37 143,70 *143,70 58,09%<br />

EE 525,00 33,55 32,91% 39,85% 33,00% 16,67% 49,67% 82,57% 1595,50 101,97 67,20 64,00 65,91%<br />

EL 13,712 8,57% 10,00% 58,43% 18,70% 77,13% 85,70% 160,00 107,20 80,40 67,00%<br />

*ES 10,20 6,00% 7,67% 57,00% 15,25% 72,25% 78,25% 170,00 107,10 91,30 63,00%<br />

FR 16,8810 6,03% 7,50% 57,97% 16,39% 74,36% 80,39% 280,000 179,20 164,00 64,00%<br />

*IE 183,42 43,16% 54,79% 18,25% 17,36% 35,61% 78,77% 425,00 260,98 61,41%<br />

*IT 6,95 3,76% 5,00% 54,74% 16,67% 71,41% 75,17% 185,00 108,23 108,23 58,50%<br />

CY 20,50 14,54% 20,17% 44,50% 13,04% 57,54% 72,08% 141,00 83,25 83,25 59,04%<br />

*LV 22,50 31,77 29,61% 36,34% 34,50% 17,36% 51,86% 81,46% **76,00 **107,30 68,78 67,77 64,11%<br />

LT 132,00 38,23 34,74% 45,06% 25,00% 17,36% 42,36% 77,09% 380,00 110,06 65,74 59,74%<br />

*LU 16,8914 9,18% 13,10% 47,84% 13,04% 60,88% 70,06% 184,00 104,92 96,52 57,02%<br />

HU 9350,00 34,60 30,63% 38,81% 28,30% 20,00% 48,30% 78,93% 30526,32 112,95 66,56 64,12 58,93%<br />

*MT 22,00 11,00% 14,43% 50,00% 15,25% 65,25% 76,25%, 200,00 122,00 117,00 61,00%<br />

NL 92,17 36,48% 50,00% 20,52% 15,97% 36,49% 72,97% 252,63 144,00 144,00 57,00%<br />

AT 26,69 13,35% 18,28% 43,00% 16,67% 59,67% 73,02% 200,00 112,69 *101,42 56,35%<br />

PL 146,83 34,59 36,94% 42,76% 31,41% 18,03% 49,44% 86,38% 397,50 93,64 64,00 64,00 68,35%<br />

*PT 67,58 38,62% 48,90% 23,00% 17,36% 40,36% 78,97% 175,00 107,83 107,83 61,62%<br />

RO 207,04 48,50 41,83% 50,28% 22,00% 19,35% 41,35% 83,18% 495,00 115,96 74,01 71,04 63,83%<br />

*SI 18,9667 15,17% 20,00% 44,0267% 16,67% 60,69% 75,87% 125,00 74,00 74,00 59,20%<br />

*SK 52,44 43,32% 52,01% 24,00% 15,97% 39,97% 83,29% 121,05 81,49 81,32 67,32%<br />

FI 17,50 7,95% 10,11% 52,00% 18,70% 70,70% 78,65% 220,00 131,90 129,00 59,95%<br />

SE 310,00 30,42 12,40% 17,32% 39,20% 20,00% 59,20% 71,60% 2500,00 245,36 126,61 126,61 51,60%<br />

*UK 119,03 130,68 37,85% 49,32% 24,00% 14,89% 38,89% 76,74% 314,50 345,28 213,55 61,85%<br />

This table has been modified in order to take account of the minimum excise duty on cigarettes provided for by Article 16(5) of Council Directive 95/59/EC.<br />

BE: as of 1 st February 2010<br />

CZ as of 1 st July 2010<br />

DE: *) Dynamic total tax for TIRSP below the MPPC: 17,586 Cent per piece less the VAT of the taxed cigarette, maximum rate 14,370 cent per piece.<br />

*EL as of 3 May 2010.<br />

*ES: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

IE: as of 14 January 2010.<br />

IT: Figures modified as of 1/10/2008. New MPPC rate (EUR 180,00)<br />

AT: *) minimum 90 % of total excise duty burden on MPPC, at least 83,00 €/1.000 pieces<br />

PT Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

RO: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

*SI: Figures modified as of 1/4/2010.<br />

FI: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

*UK: New Budget 2010 as of 24 March 2010.<br />

7

Cigarettes – Additional comments<br />

Situation as at 1 July 2010<br />

CZ<br />

New MPPC rate CZK 3150 (EUR 123,92) per 1000 cigarettes.<br />

EE New MPPC rate EEK 1609 (EUR 102,83) per 1000 cigarettes<br />

*ES: New MPPC rate as of 1/6/2010 EUR 170,00 per 1000 cigarettes<br />

LU Figures modified as of 1/02/2010<br />

LV:<br />

* Although Latvia is allowed to postpone until 31/12/2009 the application of a minimum excise duty rates on cigarettes, at 1 st January 2009 Latvia reaches the EU minimum<br />

level.<br />

** The most popular price of cigarettes in period 01/01/2009 – 30/11/2009<br />

MT:<br />

PT:<br />

In Malta the excise tax structure is 50% of the retail price + EUR 22,00 per 1000 cigarettes but not less than EUR 117,00 per 1000 cigarettes.<br />

Portugal may apply a reduced rate of up to 50% less than the overall minimum rate to cigarettes consumed in the most remote regions of the Azores and Madeira, made by small-scale<br />

manufacturers each of whose annual production does not exceed 500 tonnes (Art. 3.2 of Dir. 92/79/EEC).<br />

SK New MPPC rate EUR 121,05 per 1000 cigarettes.<br />

UK: New MPPC rate £ 314,50 (EUR 345,28) per 1000 cigarettes as of 24/03/2010.<br />

8

% of Retail Selling<br />

Price<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

Cigarettes<br />

Overall Minimum Excise Duty<br />

Situation as at 1 July 2010<br />

10<br />

0<br />

BE<br />

BGCZDKDEEEELESFRIEITCYLVLTLUHUMTNLATPLPTRO<br />

SISKFISEUK<br />

Member states<br />

Specific Excise<br />

Ad Valorem Excise<br />

9

values in EUR at 1/10/2009<br />

300<br />

Cigarettes<br />

Excise Yield<br />

Situation as at 1 July 2010<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

BE BG CZ DK DE EE EL ES FR IE IT CY LV LT LU HU MT NL AT PL PT RO SI SK FI SE UK<br />

Member states<br />

10

“TIRSP“<br />

Retail Selling<br />

Price, all<br />

Taxes Included<br />

Cigars and Cigarillos<br />

Specific Excise<br />

Ad<br />

Valorem<br />

Excise<br />

VAT %<br />

Ad Valorem<br />

Excise<br />

+ VAT<br />

Situation as at 1 July 2010<br />

Minimum duty<br />

(Article 3.1<br />

Dir. 92/80)<br />

MS<br />

NatCurr EUR (as % of (as % of (as % of<br />

TIRSP TIRSP TIRSP<br />

EUR/kg or 1000 cig.<br />

BE 0 10,00% 17,36% 27,36% 61,60<br />

BG 270,00 138,05 16,67% 16,67%<br />

CZ 1150,00 45,24 0% 16,67% 16,67%<br />

DK 198,00 26,54 10,00% 20,00% 30,00%<br />

DE 14,00 1,47% 15,97% 17,44%<br />

EE 2500,00 159,78 N/A 16,67% 16,67%<br />

EL 0 34,00% 18,70% 52,70%<br />

*ES 0 14,50% 15,25% 29,75%<br />

FR 0 27,57% 16,39% 43,96% 89,00<br />

IE 261,066 0,00% 17,36% 17,36%<br />

IT 0 23,00% 16,67% 39,67%<br />

CY 68,34 0% 15,00% N/A<br />

LV 11,00 15,53 N/A 17,36% N/A<br />

LT 38,00 11,01 17,36% 17,36%<br />

*LU 10,00% 13,04% 23,04%<br />

HU 28,50% 20,00% 48,50%<br />

MT 16,25 15,25% 15,25%<br />

NL 0 5,00% 15,97% 20,97%<br />

AT 0 13,00% 16,67% 29,67% 32,70<br />

PL 235,00 55,36 0% 18,03% 18,03%<br />

PT 0 12,35% 17,36% 29,71%<br />

RO 273,20 64,00 0% 19,35% 19,35%<br />

SI 0 5,00% 16,67% 21,67%<br />

SK 69,70 15,97% 15,97%<br />

FI 0 25,00% 18,70% 43,70%<br />

SE 1120,00* 109,92 0% 20,00% 20,00%<br />

UK 180,28 197,93 0% 14,89% 14,89%<br />

This table has been modified in order to take account of the minimum amount of excise duty on manufactured tobacco other than cigarettes provided for by Article 3(1) of Council Directive 92/80 EEC.<br />

Specific excise/per 1000 items: CZ, DK, DE, LV, MT, PL, SK, SE, BG, RO.<br />

Specific excise/per kg: CY, LT.<br />

SK: Only the specific excise is set per 1000 items.<br />

Minimum duty/per 1000 items: CZ, BE<br />

BE: as of 1 st February 2010<br />

*EL as of 3 May 2010.<br />

*ES: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

*LU: as of 01/01/2009<br />

PT Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

RO: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

FI: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

*UK: New Budget 2010 as of 24 March 2010.<br />

11

“TIRSP“<br />

Retail Selling<br />

Price, all<br />

Taxes Included<br />

Fine Cut Smoking Tobacco (intended for the rolling of cigarettes)<br />

Specific Excise<br />

Ad<br />

Valorem<br />

Excise<br />

NatCurr EUR (as % of<br />

TIRSP<br />

VAT %<br />

(as % of<br />

TIRSP<br />

Ad Valorem<br />

Excise<br />

+ VAT<br />

(as % of<br />

TIRSP<br />

Situation as at 1 July 2010<br />

Minimum duty<br />

(Article 3.1<br />

Dir. 92/80)<br />

EUR/kg<br />

MS<br />

BE 7,9610 31,50% 17,36% 48,86% 41,39<br />

BG 100,00 51,13 16,67% 16,67%<br />

*CZ 1340,00 52,71 0% 16,67% 16,67%<br />

DK 572,50 76,90 0% 20,00% 20,00%<br />

DE 34,06 18,57% 15,97% 34,54% 53,28<br />

EE 501,00 32,02 N/A 16,67% 16,67%<br />

EL 0 69,00% 18,70% 87,70%<br />

*ES 6,00 41,50% 15,25% 56,75% 50,00<br />

FR 0 58,57% 16,39% 74,96% 97,00<br />

IE 220,301 0% 17,36% 17,36%<br />

*IT 0 56,00% 16,67% 72,67%<br />

CY 34,17 0% 15,00% N/A<br />

LV 23,00 32,47 N/A 17,36% N/A<br />

LT 111,00 32,15 17,36% 17,36%<br />

*LU 4,00 31,50% 13,04% 44,54% 38,89<br />

HU 52,00% 20,00% 72,00% 26,94<br />

MT 72,50 15,25% 15,25%<br />

NL 39,48 16,33% 15,97% 32,30% 59,44<br />

AT 0 47,00% 16,67% 63,67%<br />

PL 95,00 22,38 31,41% 18,03% 49,44%<br />

PT 0 49,77% 17,36% 67,13%<br />

RO 345,77 81,00 0% 19,35% 19,35%<br />

SI 35,00 0% 16,67% 16,67%<br />

SK 64,06 15,97% 15,97%<br />

FI 8,50 52,00% 18,70% 70,70% 60,00<br />

SE 1560,00 153,11 0% 20,00% 20,00%<br />

UK 129,59 142,27 0% 14,89% 14,89%<br />

This table has been modified in order to take account of the minimum amount of excise duty on manufactured tobacco other than cigarettes provided for by Article 3(1) of Council Directive 92/80 EEC.<br />

BE: as of 1 st February 2010<br />

*CZ as of 1 st February 2010<br />

*EL as of 3 May 2010.<br />

*ES: Figures modified as of 1/7/2010 - VAT rate valid as of 1 st July 2010.<br />

*IT: Figures include pipe tobacco<br />

*LU: as of 1/2/2010<br />

PT Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

RO: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

SK: Only the specific excise is set per kg.<br />

FI: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

*UK: New Budget 2010 as of 24 March 2010.<br />

12

Other smoking tobaccos<br />

“TIRSP“<br />

Retail Selling<br />

Price, all<br />

Taxes Included<br />

Specific Excise<br />

Ad<br />

Valorem<br />

Excise<br />

NatCurr EUR (as % of<br />

TIRSP<br />

VAT %<br />

(as % of<br />

TIRSP<br />

Ad Valorem<br />

Excise<br />

+ VAT<br />

(as % of<br />

TIRSP<br />

Situation as at 1 July 2010<br />

Minimum duty<br />

(Article 3.1<br />

Dir. 92/80)<br />

EUR/kg<br />

MS<br />

BE 7,9610 31,50% 17,36% 48,86% 41,39<br />

BG 100,00 51,13 16,67% 16,67%<br />

*CZ 1340,00 52,71 0% 16,67% 16,67%<br />

DK 522,50 70,18 0% 20,00% 20,00%<br />

DE 15,66 13,13% 15,97% 29,10%<br />

EE 501,00 32,02 N/A 16,67% 16,67%<br />

EL 0 69,00% 18,70% 87,70%<br />

*ES 0 26,00% 15,25% 41,25%<br />

FR 0 52,42% 16,39% 68,81% 60,00<br />

IE 181,117 0% 17,36% 17,36%<br />

*IT 0 24,78% 16,67% 41,45%<br />

CY 34,17 0% 15,00% N/A<br />

LV 23,00 32,47 N/A 17,36% N/A<br />

LT 111,00 32,15 17,36% 17,36%<br />

*LU 4,00 31,50% 13,04% 44,54% 38,89<br />

HU 32,50% 20,00% 52,50% 26,94<br />

MT 72,50 15,25% 15,25%<br />

NL 39,48 16,33% 15,97% 32,30% 59,44<br />

AT 0 34,00% 16,67% 50,67%<br />

PL 95,00 22,38 31,41% 18,03% 49,44%<br />

PT 0 41,78% 17,36% 59,14%<br />

RO 345,77 81,00 0% 19,35% 19,35%<br />

SI 22,00 0% 16,67% 16,67%<br />

SK 64,06 15,97% 15,97%<br />

FI 8,50 48,00% 18,70% 66,70%<br />

SE 1560,00 153,11 0,00% 20,00% 20,00%<br />

UK 79,26 87,02 0,00% 14,89% 14,89%<br />

This table has been modified in order to take account of the minimum amount of excise duty on manufactured tobacco other than cigarettes provided for by Article 3 (1) of Council Directive 92/80 EEC.<br />

BE: as of 1 st February 2010<br />

*CZ as of 1 st February 2010<br />

*EL as of 3 May 2010.<br />

*ES: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

*IT Figures refer to snuff and chewing tobaccos<br />

*LU: as of 1/2/2010.<br />

PT Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

RO: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

SK: Only the specific excise is set per kg<br />

FI: Figures modified as of 1/7/2010. - VAT rate valid as of 1 st July 2010.<br />

*UK: New Budget 2010 as of 24 March 2010.<br />

13

CONTACT POINTS FOR <strong>EXCISE</strong> <strong>DUTY</strong> <strong>TABLES</strong> ON ALCOHOL BEVERAGES, ENERGY PRODUCTS AND ELECTRICITY and MANUFACTURED<br />

TOBACCO IN THE 27 MEMBER STATES<br />

STATE ADMINISTRATION CONTACT TELEPHONE N o FAX N o E-MAIL<br />

BE<br />

BG<br />

CZ<br />

Administration des douanes et accises<br />

Service Procédures accisiennes<br />

Ministry of Finance<br />

Tax Policy Directorate<br />

Ministry of Finance<br />

Excise Duty Legislation<br />

Administration centrale - Service Procédures accisiennes +32.2.576.31.35<br />

+32.2.576.31.12<br />

+32.2.579.51.29<br />

+32.2.579.51.29<br />

Mrs Venetka TODOROVA (Alcohol, Tobacco, Energy) +359 2 9859 2866 +359 2 9859 2852 v.todorova@minfin.bg<br />

Ms Marie HRDINOVÁ (Alcohol, Tobacco, Energy)<br />

Mr Vítězslav PÍŠA ( Energy)<br />

+ 420 2 5704 2575<br />

+ 420 2 5704 2639<br />

+ 420 2 5704 3048<br />

+ 420 2 5704 3048<br />

proceduresaccisiennes.douane@minfin.fed.be<br />

marie.hrdinova@mfcr.cz<br />

vitezslav.pisa@mfcr.cz<br />

DK Ministry of Taxation Department of indirect taxes +45 33923392 +45 33149105 pafgft@skm.dk<br />

DE<br />

EE<br />

EL<br />

ES<br />

FR<br />

Bundesministerium der Finanzen<br />

Referat III B 6 / III B 7<br />

Ministry of Finance<br />

Customs & Excise Policy Department<br />

Ministry of Finance<br />

Directorate General of Customs and Excise<br />

Excise Duties Direction<br />

Ministerio de Economía y Hacienda.<br />

Dirección General de Tributos.<br />

Subdirección General de Impuestos Especiales<br />

y Tributos sobre Comercio Exterior<br />

Direction générale des douanes et droits<br />

indirects<br />

Mr. Benjamin HESS (Alcohol, Tobacco)<br />

Ms Eliane MEHNER (Energy)<br />

Ms Heidi VESSEL (Alcohol, Tobacco)<br />

Mr. Lauri LELUMEES (Energy)<br />

Mrs Maria SYLLA (Alcohol)<br />

Ms Maria PROGOULAKI (Energy)<br />

Mrs Chrysa DABAKAKI (Tobacco)<br />

Ministerio de Economía y Hacienda.<br />

Dirección General de Tributos.<br />

Subdirección General de Impuestos Especiales<br />

y Tributos sobre Comercio Exterior<br />

Mme Carin AGOSTINI-VILLEMOT (Alcohol)<br />

Mlle Elisabeth FOYARD (Alcohol)<br />

Mlle Christelle SABIRON (Tobacco)<br />

Mme Marie-Françoise RUBLER (Tobacco)<br />

M. Lionel JANECZEK (Energy)<br />

+49 228 682 40 41<br />

+49 228 682 48 03<br />

+ 372 611 3651<br />

+ 372 611 3059<br />

+30.210.32 45 443<br />

+30.210.32 44 175<br />

+30.210.33 10 948<br />

+49 228 682 22 79<br />

+49 228 682 22 79<br />

+ 372 696 6810<br />

+ 372 696 6810<br />

Benjamin.Hess@bmf.bund.de<br />

Eliane.Mehner@bmf.bund.de<br />

Heidi.vessel@fin.ee<br />

Lauri.Lelumees@fin.ee<br />

+30.210.32 45 460 finexcis@otenet.gr<br />

+34 91 595.82.43/44 +34.91 595.85.58 especiales.tce@tributos.meh.es<br />

+33 1 57 53 40 39<br />

+33 1 57 53 48 40<br />

+33 1 57 53 40 35<br />

+33 1 57 53 41 35<br />

+33 1 57 53 45 82<br />

+33 1 57 53 42 88<br />

+33 1 57 53 42 88<br />

+33 1 57 53 42 88<br />

+33 1 57 53 42 88<br />

+33 1 57 53 40 70<br />

carin.agostini-villemot@douane.finances.gouv.fr<br />

elisabeth.foyard@douane.finances.gouv.fr<br />

christelle.sabiron@douane.finances.gouv.fr<br />

marie-francoise.rubler@douane.finances.gouv.fr<br />

lionel.janeczek@douane.finances.gouv.fr<br />

IE<br />

Office of the Revenue Commissioners<br />

Indirect Taxes Division<br />

Excise Branch<br />

Ms Eadaoin O'DONOVAN (Alcohol)<br />

Ms. Margaret KEENAN (Tobacco)<br />

Mr. Bill McENROE (Energy)<br />

+353 1 674 81 32<br />

+353 1 674 80 51<br />

+353 1 674 86 41<br />

+353 1 6793814<br />

+353 1 6793814<br />

+353 1 6793814<br />

eodonova@revenue.ie<br />

makeenan@revenue.ie<br />

wmcenroe@revenue.ie<br />

IT<br />

Agenzia delle Dogane<br />

Amministrazione Autonoma Monopoli di<br />

Stato<br />

Mrs. Paola APOLLONI (Alcohol, Energy)*<br />

Mr. Stefano BRUNO (Alcohol, Energy)*<br />

Mrs. Concetta DI PIETRO (Tobacco)*<br />

+39.06 5024 2035<br />

+39.06.5024.5087<br />

+39 06 5857.2828<br />

+39 06 5024 2222<br />

+39.06.50957308<br />

+39 06 5857.2829<br />

paola.apolloni@agenziadogane.it *<br />

Stefano.bruno@agenziadogane.it *<br />

Concetta.dipietro@aams.it *<br />

www.agenziadogane.it (Alcohol, Energy)<br />

“Telematic office for public relations”<br />

*contacts only for Commission and delegates<br />

14

STATE ADMINISTRATION CONTACT TELEPHONE N o FAX N o E-MAIL<br />

CY<br />

LV<br />

Ministry of Finance<br />

Dept. of Customs & Excise<br />

Ministry of Finance<br />

Tax Policy Department<br />

Mr. Adonis CHRISTOFI (Energy)<br />

Mrs. Maria CHRISTOFI (Alcohol, Tobacco)<br />

Ms. Gunta PUŽULE (Alcohol, Tobacco, Energy)<br />

Ms. Jana SALMIŅA (Alcohol, Tobacco, Energy)<br />

+357 22601875<br />

+357 22601743<br />

+37 1 6709 55 21<br />

+37 1 6709 55 17<br />

+357 22302031<br />

+357 22302031<br />

+37 1 6709 54 97<br />

+37 1 6709 54 97<br />

achristofi@customs.mof.gov.cy<br />

mchristofi@customs.mof.gov.cy<br />

Gunta.Puzule@fm.gov.lv<br />

Jana.Salmina@fm.gov.lv<br />

LT Ministry of Finance of Lithuania Mr. Žygintas GREKAS + 370 5 2199307 +370 5 2390102 z.grekas@finmin.lt<br />

LU Direction des douanes et accises Mrs Marie-Paule NIEDERWEIS (Alcohol,Tobacco, Energy) +352 290 191 228 +352 48 49 47 marie-paule.niederweis@do.etat.lu<br />

HU Ministry For National Economy Mrs. Zsuzsanna GÖRÖZDI (Alcohol, Tobacco, Energy) +36 1 795 1524 +36 1 795 0316 Zsuzsanna.Gorozdi@ngm.gov.hu<br />

jovedeki@ngm.gov.hu<br />

MT Customs Division Mr. Martin SPITERI (Alcohol, Tobacco, Energy Products)<br />

Mr. Antoine Scalpello (Alcohol, Tobacco, Energy Products)<br />

NL<br />

Ministerie van Financiën<br />

Directie Douane en Verbruiksbelastingen<br />

+356 25 685 227<br />

+356 25 685 227<br />

+356 25 685 118<br />

+356 25 685 118<br />

martin.a.spiteri@gov.mt<br />

antoine.scalpello@gov.mt<br />

Mr. Hans van Herwijnen (Alcohol, Tobacco, Energy) +31 70 342 8245 +31 70 342 7938 J.Herwijnen@minfin.nl<br />

AT Bundesministerium für Finanzen Mr. Helmut SCHAMP (Alcohol, Tobacco, Energy) +43 1 51433 504246 Helmut.schamp@bmf.gv.at<br />

Post.iv-9@bmf.gv.at<br />

PL<br />

PT<br />

RO<br />

Ministry of Finance<br />

Excise Duty and Ecological Tax Department<br />

Direcção Geral das Alfândegas e dos Impostos<br />

Especiais sobre o Consumo (DGAIEC)<br />

Ministry of Public Finance<br />

Excise Duty Legislation Directorate<br />

Ms Aldona KAMOLA(Alcohol, Tobacco, Energy) +48 22 694 56 18 +48 22 694 45 16 Aldona.Kamola@mf.gov.pl<br />

Mr. Jorge Pinheiro (Alcohol, Tobacco, Energy) +351 218 813 714 +351 218 813 982 jfpinheiro@dgaiec.min-financas.pt<br />

Mr. Ciprian MOISEI (Alcohol)<br />

Mrs. Mihaela MILEA (Tobacco, Energy)<br />

Mrs. Ionela BĂLESCU (Tobacco, Energy)<br />

+40.21.226.14.37 +40.21.317.15.45 ciprian.moisei@mfinante.gov.ro<br />

mihaela.d.milea@mfinante.gov.ro<br />

ionela.balescu@mfinante.gov.ro<br />

SI Ministry of Finance Mr. Rok JESIH (Alcohol, Tobacco, Energy) +386 1 369 64 08 +386 1 369 67 19 rok.jesih@mf-rs.si<br />

SK Ministry of Finance Mrs. Janka Bučanová Ingeliová (Alcohol, Tobacco, Energy) +421 2 59583492 +421 2 59583454 jana.ingeliova@mfsr.sk<br />

FI Ministry of Finance Mr. Veli AUVINEN (Alcohol, Tobacco, Energy) +358 9 160 32 501 +358 9 160 34 748 votilastot@vm.fi<br />

SE Ministry of Finance Ms Anna STÅLNACKE (Alcohol, Tobacco)<br />

Mr. .Mats-Olof Hansson (Energy)<br />

UK H.M. Revenue & Customs National Advice Service or<br />

www.hmrc.gsi.gov.uk ‘contact us’<br />

+46 8 405 38 25<br />

+46 8 405 29 77<br />

+46 8 20 28 51<br />

+46 8 20 28 51<br />

anna.stalnacke@finance.ministry.se<br />

mats-olof.hansson@finance.ministry.se<br />

+44 845 010 9000 www.hmrc.gsi.gov.uk<br />

15

EUROPEAN COMMISSION<br />

DIRECTORATE GENERAL<br />

TAXATION AND CUSTOMS UNION<br />

TAX POLICY<br />

Excise duties and transport, environment and energy taxes<br />

REF 1.029<br />

July 2009<br />

• • • • • • • • • • • •<br />

<strong>EXCISE</strong> <strong>DUTY</strong> <strong>TABLES</strong><br />

(Tax receipts – Manufactured Tobacco)<br />

• • • • • • • • • • • •<br />

Can be consulted on DG TAXUD new Web site:<br />

http://ec.europa.eu/taxation_customs/index_en.htm#<br />

The information is supplied by the respective Member States. The<br />

Commission cannot be held responsible for its accuracy or<br />

completeness, neither does its publication imply an endorsement by<br />

the Commission of those Member States' legal provisions.<br />

© European Commission, 2009<br />

Reproduction is authorised, provided the source and web address<br />

(http://ec.europa.eu/taxation_customs/index_en.htm#) are acknowledged.

REVENUES FROM TAXES ON CONSUMPTION

EUR Exchange Rates<br />

Value of National Currencies in EUR 1 January 2005 – 1 January 2006 – 1 January 2007 – 1 January 2008 – 1 January 2009<br />

Member State National Currency EUR EUR EUR EUR EUR<br />

2005 2006 2007 2008 2009<br />

BE EUR<br />

BG BGN ---------- ---------- 1,9558* 1,9558* 1,9558*<br />

CZ CZK 30,361* 29,030* 27,525* 26,364* 26,825*<br />

DK DKK 7,4371* 7,4601* 7,4566* 7,4552* 7,4499*<br />

DE EUR<br />

EE EEK 15,6466* 15,6466* 15,6466* 15,6466* 15,6466*<br />

EL EUR<br />

ES EUR<br />

FR EUR<br />

IE EUR<br />

IT EUR<br />

CY CYP 0,5800* 0,5735* 0,5782*<br />

CY EUR ---------- ---------- ----------<br />

LV LVL 0,6964* 0,6962* 0,6984* 0,6988* 0,7083*<br />

LT LTL 3,4528* 3,4528* 3,4528* 3,4528* 3,4528*<br />

LU EUR<br />

HU HUF 245,58* 252,69* 251,44* 253,22* 265,48*<br />

MT MTL 0,4343* 0,4293* 0,4293*<br />

MT EUR ---------- ---------- ----------<br />

NL EUR<br />

AT EUR<br />

PL PLN 4,0774* 3,8665* 3,8287* 3,6013* 4,1638*<br />

PT EUR<br />

RO RON ---------- ---------- 3,3829* 3,583* 4,035*<br />

SI SIT 239,78* 239,50*<br />

SI EUR ---------- ----------<br />

SK SKK 38,655* 37,865* 34,383* 33,586*<br />

SK EUR ---------- ---------- ---------- ----------<br />

FI EUR<br />

SE SEK 8,9758* 9,3977* 9,0245* 9,4257* 10,8425*<br />

UK GBP 0,70725* 0,68650* 0,67350* 0,7413* 0,961*<br />

* Thirteen national currencies (CZK, DKK, EEK, CYP, LVL, LTL, HUF, MTL, PLN, SIT, SKK, SEK and GBP) not irrevocably fixed. Rates published in the Official Journals of the European Union – C1 of 4/1/2005, C1 of<br />

4/1/2006).<br />

* Fourteen national currencies (BGN, CZK, DKK, EEK, CYP, LVL, LTL, HUF, MTL, PLN, RON, SKK, SEK and GBP) not irrevocably fixed. Rates published in the Official Journal of the European Union – C1 of<br />

4/1/2007).<br />

* Twelve national currencies (BGN, CZK, DKK, EEK, LVL, LTL, HUF, PLN, RON, SKK, SEK and GBP) not irrevocably fixed. Rates published in the Official Journal of the European Union – C1 of 4/1/2008).<br />

* Eleven national currencies (BGN, CZK, DKK, EEK, LVL, LTL, HUF, PLN, RON, SKK and GBP) not irrevocably fixed. Rates published in the Official Journal of the European Union – C1 of 6/1/2009).<br />

The Greek “DRA” irrevocably fixed as of 1 January 2001 (Official Journal L167, 7/7/2000, Council Regulation (EC) No 1478/2000).<br />

The Cyprus pound "CYP" irrevocably fixed as of 1 January 2008(=0,585274 CYP to 1 euro) – Official Journal L256, 2/10/2007, Council Regulation (EC) No 1135/2007 amending Council Regulation (EC) No 2866/98.<br />

The Maltese lira "MTL" irrevocably fixed as of 1 January 2008 (=0,429300 MTL to 1 euro) – Official Journal L256, 2/10/2007, Council Regulation (EC) No 1134/2007 amending Council Regulation (EC) No 2866/98.<br />

The Slovenian tolar "SIT" irrevocably fixed as of 1 January 2007 (=239.640 SIT to 1 euro) – Official Journal L195, 15/7/2006, Council Regulation (EC) No 1086/2006 amending Council Regulation (EC) No 2866/98.<br />

The Slovak koruna "SKK" irrevocably fixed as of 1 January 2009 (=30,1260 SKK to 1 euro) – Official Journal L 195, 24/7/2008, Council Regulation (EC) No 694/2008 amending Council Regulation (EC) No 2866/98.<br />

The remaining 11 national currencies were irrevocably fixed as of 1 January 1999 (Official Journal L359/98, 31/12/1998, Council Regulation (EC) 2866/98).

MANUFACTURED TOBACCO

REVENUE FROM TAXES ON CONSUMPTION (<strong>EXCISE</strong> DUTIES AND SIMILAR CHARGES) OTHER THAN VAT<br />

Manufactured tobacco<br />

(in millions)<br />

I II III IV<br />

MS Year<br />

BE<br />

BG<br />

CZ<br />

DK<br />

DE<br />

EE<br />

EL<br />

NatCurr<br />

Cigarettes Cigars Cigarillos Other smoking tobaccos<br />

NatCurr EUR NatCurr EUR NatCurr EUR NatCurr EUR<br />

2005 EUR -------- 1425,20 -------- 6,90 -------- ------- -------- 224,88<br />

2006 EUR -------- 1459,03 -------- 7,32 *Cigars -------- 260,83<br />

2007 EUR -------- 1559,46 -------- 14,19 *Cigars -------- 246,50<br />

2008 EUR -------- 1532,01 -------- 14,04 *Cigars -------- 210,01<br />

2007 BGN 1344,40 687,39 2,40 1,23 *Cigars *Cigars<br />

2008 BGN 1711,86 875,26 3,18 1,62 *Cigars *Cigars<br />

2005 CZK 25108,61 827,00 34,92 1,15 *Cigars 284,38 9,36<br />

2006 CZK 31854,94 1097,31 42,00 1,45 *Cigars 344,60 11,87<br />

2007 CZK 45881,80 1666,91 48,84 1,77 *Cigars 1066,96 38,76<br />

2008 CZK 37189,18 1410,61 63,61 2,41 *Cigars 253,75 9,62<br />

2005 DKK 6655,04 894,84 54,27 7,30 *Cigars 482,78 64,92<br />

2006 DKK 6850,71 918,31 49,42 6,62 *Cigars 470,58 63,08<br />

2007 DKK 6814,65 913,91 43,93 5,89 *Cigars 388,11 52,05<br />

2008 DKK 6799,50 912,05 40,71 5,46 *Cigars 366,11 49,11<br />

2005 EUR -------- 12386,93 -------- 64,71 *Cigars -------- 1795,48<br />

2006 EUR -------- 12973,75 -------- 83,08 *Cigars -------- 1317,70<br />

2007 EUR -------- 12861,91 -------- 111,04 *Cigars -------- 1274,68<br />

2008 EUR -------- 12260,58 -------- 85,55 *Cigars -------- 1166,92<br />

2005 EEK 1096,00 70,05 95,00** 6,07** 4,00 0,25<br />

2006 EEK 1191,00 76,12 11,00 0,70 *Cigars 5,00 0,32<br />

2007 EEK 1507,00 96,31 12,00 0,77 *Cigars 6,00 0,38<br />

2008 EEK 1500,00 95,87 0,60 0,04 11,6 0,74 8,30 0,53<br />

2005 EUR -------- 2257,08 *Cigarettes *Cigarettes *Cigarettes<br />

2006 EUR -------- 2415,46 *Cigarettes *Cigarettes *Cigarettes<br />

2007 EUR -------- 2581,29 *Cigarettes *Cigarettes *Cigarettes<br />

2008 EUR -------- 2516,18 *Cigarettes *Cigarettes *Cigarettes<br />

(*) = Figure included in...<br />

DE:<br />

EE:<br />

Column IV: “Other smoking tobaccos” includes two categories of tobacco: Fine cut tobacco and Pipe tobacco<br />

**in 2005 the revenue of cigars and cigarillos was altogether 95 million EEK (6,07 million EUR).<br />

5

...Revenues – Manufactured tobacco...<br />

(in millions)<br />

MS Year<br />

ES<br />

FR<br />

IE<br />

IT<br />

CY<br />

LV<br />

LT<br />

NatCurr<br />

I II III IV<br />

Cigarettes Cigars Cigarillos Other smoking tobaccos<br />

NatCurr EUR NatCurr EUR NatCurr EUR NatCurr EUR<br />

2005 EUR -------- 6150,76 ---------- 42,88 *Cigars ---------- 76,68<br />

2006 EUR -------- 6414,59 ---------- 40,41 *Cigars ---------- 72,06<br />

2007 EUR -------- 7169,73 -------- 44,56 *Cigars -------- 92,62<br />

2008 EUR -------- 7429,88 ---------- 44,29 *Cigars ---------- 111,71<br />

2005 EUR -------- 9851,00 *Cigarettes *Cigarettes *Cigarettes<br />

2006 EUR -------- 9437,00 *Cigarettes *Cigarettes *Cigarettes<br />

2007 EUR -------- 9380,00 *Cigarettes *Cigarettes *Cigarettes<br />

2008 EUR -------- 9550,43 *Cigarettes *Cigarettes *Cigarettes<br />

2005 EUR -------- 1067,05 -------- 8,00 *Cigars -------- 4,50<br />

2006 EUR -------- 1089,44 -------- 9,29 *Cigars -------- 4,61<br />

2007 EUR -------- 1177,48 -------- 9,90 *Cigars -------- 4,70<br />

2008 EUR -------- 1132,00 -------- 10,00 *Cigars -------- 4,00<br />

2005 EUR -------- 8912,00 -------- 32,00 -------- 10,00 -------- 44,00<br />

2006 EUR -------- 9623,98 -------- 34,28 -------- 11,54 -------- 53,50<br />

2007 EUR -------- 9938,32 -------- 37,35 -------- 12,24 -------- 64,02<br />

2008 EUR -------- 10256,87 -------- 38,09 -------- 12,85 -------- 80,18<br />

2005 CYP 76,04 131,10 1,43 2,47 *Cigars 0,58 1,00<br />

2006 CYP 100,39 175,04 1,61 2,81 *Cigars 4,18 7,29<br />

2007 CYP 104,30 180,39 1,53 2,65 *Cigars 4,59 7,94<br />

2008 EUR -------- 191,42 -------- 2,66 *Cigars -------- 8,20<br />

2005 LVL 43,13 61,95 0,05 0,07 *Cigars 0,21 0,30<br />

2006 LVL 56,89 81,72 0,06 0,09 *Cigars 0,55 0,79<br />

2007 LVL 73,83 105,71 0,08 0,11 *Cigars **0,33 0,47<br />

2008 LVL 143,10 204,78 0,08 0,11 *Cigars **0,40 0,57<br />

2005 LTL 257,00 74,43 0,20 0,06 *Cigars 1,20 0,35<br />

2006 LTL 350,96 101,64 0,24 0,07 *Cigars 1,47 0,43<br />

2007 LTL 405,52 117,45 0,30 0,09 *Cigars 1,65 0,48<br />

2008 LTL 682,09 197,55 0,30 0,09 *Cigars 1,85 0,54<br />

(*) = Figure included in...<br />

IE :<br />

LV:<br />

Column I «Cigarettes» = includes Fine cut smoking tobacco (intended for the rolling of cigarettes).<br />

(**) included fine-cut smoking tobacco intended for the rolling of cigarettes<br />

6

...Revenues – Manufactured tobacco...<br />

(in millions)<br />

I II III IV<br />

MS Year<br />

LU<br />

HU<br />

MT<br />

NL<br />

AT<br />

PL<br />

PT<br />

NatCurr<br />

Cigarettes Cigars Cigarillos Other smoking tobaccos<br />

NatCurr EUR NatCurr EUR NatCurr EUR NatCurr EUR<br />

2005 EUR -------- 372,42 -------- 1,11 *Cigars -------- 65,12<br />

2006 EUR -------- 414,30 -------- 0,827 *Cigars -------- 63,60<br />

2007 EUR -------- 415,03 -------- 1,070 *Cigars -------- 84,43<br />

2008 EUR -------- 439,12 -------- 1,080 *Cigars -------- 77,21<br />

2005 HUF 165927,00 675,65 355,00 1,45 323,00 1,32 6957 28,33<br />

2006 HUF 209674,00 829,77 404,00 1,60 437,00 1,73 6468,00 25,60<br />

2007 HUF 240573,00 956,78 330,00 1,31 689,00 2,74 12833,00 51,04<br />

2008 HUF 253400,00 1000,71 333,00 1,32 587,00 2,32 17820,00 70,37<br />

2005 MTL 26,160 60,234 * * 0,934 2,151<br />

2006 MTL 26,899 62,658 * * 0,799 1,861<br />

2007 MTL 24,358 56,739 * * 0,828 1,929<br />

2008 EUR -------- 60,382 -------- * -------- * -------- 1,730<br />

2005 EUR -------- 1409,38 -------- 7,79 *Cigars -------- 449,44<br />

2006 EUR -------- 1681,10 -------- 8,18 *Cigars -------- 485,72<br />

2007 EUR -------- 1709,77 -------- 7,48 *Cigars -------- 485,66<br />

2008 EUR -------- 1771,62 -------- 7,21 *Cigars -------- 498,99<br />

2005 EUR -------- 1339,70 *Cigarettes *Cigarettes *Cigarettes<br />

2006 EUR -------- 1408,50 *Cigarettes *Cigarettes *Cigarettes<br />

2007 EUR -------- 1446,16 *Cigarettes *Cigarettes *Cigarettes<br />

2008 EUR -------- 1424,49 *Cigarettes *Cigarettes *Cigarettes<br />

2005 PLN 9819,73 2408,33 *Cigarettes *Cigarettes *Cigarettes<br />

2006 PLN 11247,98 2909,09 *Cigarettes *Cigarettes *Cigarettes<br />

2007 PLN 13483,03 3521,57 *Cigarettes *Cigarettes *Cigarettes<br />

2008 PLN 13460,10 3737,57 *Cigarettes *Cigarettes *Cigarettes<br />

2005 EUR -------- 1309,78 -------- 3,05 *Cigars -------- 9,84<br />

2006 EUR -------- 1410,48 -------- 3,08 *Cigars -------- 13,38<br />

2007 EUR -------- 1209,19 -------- 3,30 *Cigars -------- 12,17<br />

2008 EUR -------- 1276,06 -------- 3,10 *Cigars -------- 16,72<br />

(*) = Figure included in...<br />

*MT:<br />

Column II (Cigars) and Column III (Cigarillos) are both included in Column IV<br />

7

...Revenues – Manufactured tobacco...<br />

(in millions)<br />

I II III IV<br />

MS Year<br />

RO<br />

SI<br />

SK<br />

FI<br />

SE<br />

UK<br />

NatCurr<br />

Cigarettes Cigars Cigarillos Other smoking tobaccos<br />

NatCurr EUR NatCurr EUR NatCurr EUR NatCurr EUR<br />

2007 RON 3107,81 918,69 *Cigarettes *Cigarettes *Cigarettes<br />

2008 RON 3873,92 1081,19 *Cigarettes *Cigarettes *Cigarettes<br />

2005 SIT 59187,01 247,04 32,99 0,14 *Cigars 153,66 0,64<br />

2006 SIT 69482,82 290,12 34,87 0,15 *Cigars 175,78 0,73<br />

2007 EUR -------- 299,58 -------- 0,16 *Cigars -------- 0,85<br />

2008 EUR -------- 341,75 -------- 0,16 *Cigars -------- 0,90<br />

2005 SKK 11194,195 289,592 *Cigarettes *Cigarettes *Cigarettes<br />

2006 SKK 11432,345 301,923 *Cigarettes *Cigarettes *Cigarettes<br />

2007 SKK 23580,000 685,804 *Cigarettes *Cigarettes *Cigarettes<br />

2008 SKK 13048,36 388,50 *Cigarettes *Cigarettes *Cigarettes<br />

2005 EUR -------- 544,16 -------- 10,21 *Cigars -------- 46,14<br />

2006 EUR -------- 562,80 -------- 10,92 *Cigars -------- 43,79<br />

2007 EUR -------- 563,46 -------- 11,30 *Cigars -------- 41,88<br />

2008 EUR -------- 570,08 -------- 11,75 *Cigars -------- 40,45<br />

2005 SEK 6560,89 730,95 26,22 2,92 *Cigars 608,40 67,78<br />

2006 SEK 6969,31 741,60 27,72 2,95 *Cigars 615,84 65,53<br />

2007 SEK 7434,08 823,77 48,38 5,36 *Cigars 659,44 73,07<br />

2008 SEK 7534,35 799,34 48,64 5,16 *Cigars 390,43 41,42<br />

2005 GBP 7597,00 10741,60 114,00 161,19 *Cigars 372,00 525,98<br />

2006 GBP 7504,00 10930,81 104,00 151,49 *Cigars 401,00 584,12<br />

2007 GBP 7508,00 11147,74 97,00 151,49 *Cigars 440,00 653,30<br />

2008 GBP 7585,00 10232,02 86,00 116,01 *Cigars 500,00 674,49<br />

(*) = Figure included in...<br />

RO<br />

SI:<br />

UK:<br />

(*) included in Column I<br />

(*) included in Column II<br />

Column IV: “Other smoking tobaccos” includes two categories of tobacco: tobacco : Handrolling and Pipe tobacco.<br />

2005 : Handrolling: = 339 GBP (479,32 EUR) and Pipe tobacco : = 33 GBP (46,66 EUR)<br />

2006 : Handrolling: = 372 GBP (541,88 EUR) and Pipe tobacco : = 29 GBP (42,24 EUR)<br />

2007 : Handrolling: = 412 GBP (611,73 EUR) and Pipe tobacco : =28 GBP (41,57 EUR)<br />

2008 : Handrolling: = 473 GBR(638,07 EUR) and Pipe tobacco : = 27 GBP (36,42 EUR)<br />

B-1049 Brussels – Belgium – Office: MO59 4/15.<br />

Telephone: direct line (+32-2)295.83.70, switchboard 299.11.11.<br />

e-mail : maria.makropoulou@ec.europa.eu<br />

8