review their beneficiary designations - AccessAllstate

review their beneficiary designations - AccessAllstate

review their beneficiary designations - AccessAllstate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LIFE ESSENTIALS<br />

You take care of them now –<br />

take care of them later too.<br />

REVIEW YOUR BENEFICIARY DESIGNATIONS TODAY<br />

LBL8060

Things change. Have your<br />

beneficiaries changed, too?<br />

Make sure you’re providing for the ones you love.<br />

Review your list of designated beneficiaries now, to<br />

ensure you’re providing for those you leave behind.<br />

There are many events that may require a change in your<br />

beneficiaries. For example:<br />

n<br />

n<br />

n<br />

A change in your marital status<br />

The birth of children or grandchildren<br />

A death in the family<br />

n Marriage or divorce of beneficiaries 1<br />

n<br />

Change of support for a nonprofit or charitable organization<br />

The worksheet on the following page is provided for your<br />

convenience. After listing potential beneficiaries, discuss it with<br />

your financial professional to help ensure that your life insurance<br />

will be there for the people who count on you the most. It’s one of<br />

the most thoughtful things you can do.<br />

A few reminders<br />

n<br />

n<br />

Your beneficiaries will divide<br />

the proceeds equally unless you<br />

specify percentages.<br />

If you plan to name minor<br />

children as your <strong>beneficiary</strong>,<br />

consider designating a custodian.<br />

Under a state's Uniform Transfer<br />

to Minors Act (UTMA), payment<br />

may be expedited and may<br />

eliminate the need for a courtappointed<br />

guardian. 2<br />

n<br />

Consider adding a secondary<br />

<strong>beneficiary</strong>, in case your primary<br />

<strong>beneficiary</strong> predeceases you.<br />

n<br />

Adding a contingent <strong>beneficiary</strong><br />

other than your estate may help<br />

you avoid probate.<br />

Please note that completion of this questionnaire does not change your current beneficiaries.<br />

It is necessary to complete and send to the Home office a Change of Beneficiary form for<br />

acceptance to make a <strong>beneficiary</strong> change.<br />

1 Some states revoke spouses as beneficiaries at time of divorce. Please consult a legal<br />

professional.<br />

2 In South Carolina and Vermont, referred to as Uniform Gifts to Minors Act (UGMA).<br />

LBL8060

Lincoln Benefit Life Company<br />

THIS FORM NOT TO BE USED WITH SECTION 401 OR 403(b) CONTRACTS P.O. Box 80469, Lincoln, NE 68501-0469<br />

TEL: 1-800-525-9287<br />

Use ball point pen when completing form<br />

FAX: (Annuities) 1-877-525-2689 (Life) 1-866-525-5433<br />

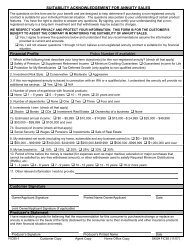

STEP 1 - CONTRACT/POLICY INFORMATION (ALL FIELDS MUST BE COMPLETED). Only one policy number<br />

and Insured/Annuitant per change form. Submit a separate change of <strong>beneficiary</strong> form for each policy.<br />

Owner’s Name Owner’s SSN/TIN Contract/Policy #<br />

Joint Owner’s Name (if applicable)<br />

Insured or Annuitant’s Name<br />

Name and Date of Trust<br />

Name of Current Trustee<br />

Trust Tax ID Number<br />

Joint Owner’s SSN/TIN<br />

Insured or Annuitant’s SSN/TIN<br />

STEP 2 - PRIMARY BENEFICIARY (IES) – If more than 2 Primary Beneficiaries, please use a separate sheet of paper and<br />

attach to this form. Percentages must add up to 100%.<br />

If the Contract Owner is the TRUST then the Beneficiary should also be the TRUST.<br />

A. Individual, Corporation or Estate<br />

Name of Primary Beneficiary #1<br />

Name of Primary Beneficiary #2<br />

NOTE: Please use WHOLE Percentages ONLY<br />

NOTE: Please use WHOLE Percentages ONLY<br />

Street Address<br />

Street Address<br />

City/State/Zip<br />

City/State/Zip<br />

SSN/TIN<br />

Date of Birth (MM/DD/YYYY) SSN/TIN<br />

Date of Birth (MM/DD/YYYY)<br />

Relationship<br />

Relationship<br />

B. Trust as Primary Beneficiary (NOT Under Last Will)<br />

Street Address City State Zip<br />

C. Trust as Primary Beneficiary (Trust Within Last Will)<br />

To the trustee of the trust created pursuant to the Last Will and Testament of ____________________________ as admitted<br />

Name<br />

to probate provided the trustee submits a written claim within six months of the death of the person that triggered payment<br />

under the policy. If no such claim is made by the trustee, the proceeds shall be paid to _______________________________.<br />

Name<br />

STEP 3 - CONTINGENT BENEFICIARY(IES) – If more than 2 Contingent Beneficiaries, please use a separate sheet<br />

of paper and attach to this form. Percentages must add up to 100%.<br />

Name of Contingent Beneficiary #1<br />

Name of Contingent Beneficiary #2<br />

NOTE: Please use WHOLE Percentages ONLY<br />

NOTE: Please use WHOLE Percentages ONLY<br />

Street Address<br />

Street Address<br />

City/State/Zip<br />

City/State/Zip<br />

SSN/TIN<br />

Date of Birth (MM/DD/YYYY) SSN/TIN<br />

Date of Birth (MM/DD/YYYY)<br />

Relationship<br />

Relationship<br />

FIC77LBL-2 Page 4 of 5 (08/09)<br />

Review your beneficiaries.<br />

Name and relationship<br />

of <strong>beneficiary</strong><br />

Are they currently a<br />

<strong>beneficiary</strong>? How much<br />

will they receive?<br />

What do you hope<br />

this person will do<br />

with the proceeds? 3<br />

Is action needed?<br />

Example:<br />

Connie Johnson<br />

Wife of 20 years<br />

Yes<br />

$400,000<br />

Pay off all debts and<br />

put the kids through<br />

college, without having<br />

to work full time.<br />

Yes. Based on our<br />

current expenses, I<br />

need to increase her<br />

share of the proceeds<br />

to $550,000.<br />

If you answered anything other than 'No' in this column, then action is needed.<br />

Make an appointment with your financial professional today to<br />

discuss how to help protect your loved ones in the future.<br />

REQUEST FOR<br />

CHANGE OF BENEFICIARY (PAYEE)<br />

❑ Equally OR ❑ Percentage %<br />

❑ Equally OR ❑ Percentage %<br />

Use our Change of Beneficiary form (FIC77LBL)<br />

to update the beneficiaries on your LBL policies.<br />

❑ Equally OR ❑ Percentage %<br />

❑ Equally OR ❑ Percentage %<br />

3 Beneficiaries may use proceeds for any purpose and are under no contractual obligation to carry out the owner's desires.<br />

LBL8060

The Strength of Lincoln Benefit Life<br />

For more than 70 years, Lincoln Benefit Life Company (Lincoln Benefit Life) has been an<br />

innovator in bringing insurance and annuity products to policyholders nationwide. Lincoln<br />

Benefit Life was acquired in 1984 by Allstate Life Insurance Company (Allstate Life).<br />

Lincoln Benefit Life and Allstate Life have more than 120 years of combined experience and<br />

are subsidiaries of the Allstate Corporation, a Fortune 100 company that provides insurance<br />

protection to approximately 17 million U.S. families.<br />

Lincoln Benefit Life prides itself on strength, stability and integrity, as well as its ability to<br />

provide product solutions and professional assistance to help you and your family achieve<br />

your lifelong dreams.<br />

800-525-9287<br />

n Not FDIC, NCUA/NCUSIF insured n Not insured by any federal government agency n Not a deposit n Not guaranteed by the bank or credit union n May go down in value<br />

Please note that neither Lincoln Benefit Life Company nor its agents or representatives can give legal or tax advice.<br />

This information is provided for general consumer educational purposes by Lincoln Benefit Life Company (Lincoln Benefit Life), Home Office, Lincoln, NE, and<br />

is not intended to provide legal, tax or investment advice. Lincoln Benefit Life issues fixed and variable insurance products that are sold through agreements<br />

with affiliated or unaffiliated broker-dealers or agencies. Lincoln Benefit Life’s variable products are sold by registered representatives, investment advisors,<br />

and agents or bank employees who are licensed insurance agents. ALFS, Inc., serves as principal underwriter of SEC-registered contracts for Lincoln Benefit<br />

Life. ALFS, Inc., and Lincoln Benefit Life are subsidiaries of Allstate Life Insurance Company, Home Office, Northbrook, IL.<br />

Date of first issue: 03/10<br />

LBL8060<br />

©2010 Allstate Insurance Company