Statement of Additional Info - Gabelli

Statement of Additional Info - Gabelli

Statement of Additional Info - Gabelli

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

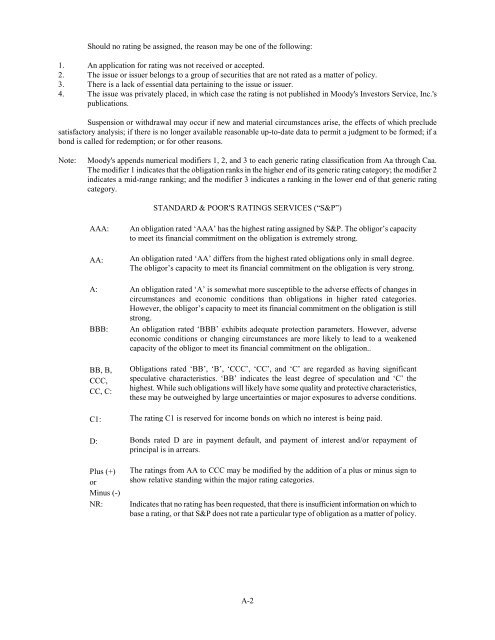

Should no rating be assigned, the reason may be one <strong>of</strong> the following:<br />

1. An application for rating was not received or accepted.<br />

2. The issue or issuer belongs to a group <strong>of</strong> securities that are not rated as a matter <strong>of</strong> policy.<br />

3. There is a lack <strong>of</strong> essential data pertaining to the issue or issuer.<br />

4. The issue was privately placed, in which case the rating is not published in Moody's Investors Service, Inc.'s<br />

publications.<br />

Suspension or withdrawal may occur if new and material circumstances arise, the effects <strong>of</strong> which preclude<br />

satisfactory analysis; if there is no longer available reasonable up-to-date data to permit a judgment to be formed; if a<br />

bond is called for redemption; or for other reasons.<br />

Note:<br />

Moody's appends numerical modifiers 1, 2, and 3 to each generic rating classification from Aa through Caa.<br />

The modifier 1 indicates that the obligation ranks in the higher end <strong>of</strong> its generic rating category; the modifier 2<br />

indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lower end <strong>of</strong> that generic rating<br />

category.<br />

STANDARD & POOR'S RATINGS SERVICES (“S&P”)<br />

AAA:<br />

AA:<br />

An obligation rated ‘AAA’ has the highest rating assigned by S&P. The obligor’s capacity<br />

to meet its financial commitment on the obligation is extremely strong.<br />

An obligation rated ‘AA’ differs from the highest rated obligations only in small degree.<br />

The obligor’s capacity to meet its financial commitment on the obligation is very strong.<br />

A: An obligation rated ‘A’ is somewhat more susceptible to the adverse effects <strong>of</strong> changes in<br />

circumstances and economic conditions than obligations in higher rated categories.<br />

However, the obligor’s capacity to meet its financial commitment on the obligation is still<br />

strong.<br />

BBB: An obligation rated ‘BBB’ exhibits adequate protection parameters. However, adverse<br />

economic conditions or changing circumstances are more likely to lead to a weakened<br />

capacity <strong>of</strong> the obligor to meet its financial commitment on the obligation..<br />

BB, B,<br />

CCC,<br />

CC, C:<br />

Obligations rated ‘BB’, ‘B’, ‘CCC’, ‘CC’, and ‘C’ are regarded as having significant<br />

speculative characteristics. ‘BB’ indicates the least degree <strong>of</strong> speculation and ‘C’ the<br />

highest. While such obligations will likely have some quality and protective characteristics,<br />

these may be outweighed by large uncertainties or major exposures to adverse conditions.<br />

C1: The rating C1 is reserved for income bonds on which no interest is being paid.<br />

D: Bonds rated D are in payment default, and payment <strong>of</strong> interest and/or repayment <strong>of</strong><br />

principal is in arrears.<br />

Plus (+)<br />

or<br />

Minus (-)<br />

NR:<br />

The ratings from AA to CCC may be modified by the addition <strong>of</strong> a plus or minus sign to<br />

show relative standing within the major rating categories.<br />

Indicates that no rating has been requested, that there is insufficient information on which to<br />

base a rating, or that S&P does not rate a particular type <strong>of</strong> obligation as a matter <strong>of</strong> policy.<br />

A-2