Loxley - OSK

Loxley - OSK

Loxley - OSK

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RHB Research 27 Mar 2013<br />

THAILAND EQUITY<br />

Investment Research<br />

Daily<br />

Thailand Research<br />

66 2862 9755<br />

Initiating Coverage<br />

<strong>Loxley</strong><br />

Trading Buy<br />

Target<br />

THB10.60<br />

Previous<br />

Price<br />

THB6.95<br />

Telecommunications<br />

<strong>Loxley</strong> is a Thai conglomerate companies<br />

that involves in ICT business, Trading,<br />

Service and investments in JV companies<br />

Stock Statistics<br />

Bloomberg Ticker <strong>Loxley</strong> TB<br />

Market Cap THB13,755m<br />

USD469m<br />

52 wk H/L price 8.05 3.10<br />

3m ADT<br />

THB554m<br />

YTD Returns (%) 29.7<br />

Beta (x) 1.32<br />

Major Shareholders (%)<br />

Ekpavee Co. Ltd 26.49<br />

Thai NVDR 3.94<br />

Share Price Performance (%)<br />

Month Absolute Relative<br />

1m 0.8 1.9<br />

3m 24.8 14.2<br />

6m 46.2 27.8<br />

12m 67.9 40.3<br />

6-month Share Price Performance<br />

8.6<br />

7.6<br />

Price Close<br />

Relative to Stock Exchange of Thailand Index (RHS)<br />

199<br />

179<br />

Integrating The Future<br />

We initiate coverage on <strong>Loxley</strong> with a TRADING BUY and our FV at<br />

THB10.60, based on 3.6x FY13 P/BV. As a leading ICT contractor, the<br />

company is set to benefit from the rising investments in the ICT sector,<br />

which will provide it ample opportunity to further grow its backlog. Its<br />

ability to secure more backlog is not a worry, but the execution risks in<br />

turning the extra backlog into profit remains a key concern.<br />

An integrated ICT contractor. Despite having diversified exposure in several<br />

core business segments, <strong>Loxley</strong> can be more appropriately classified as an<br />

integrated ICT contractor, as about 70% of its revenue comes from its ICT<br />

business. With a growing backlog, its exposure to the ICT sector is set to<br />

increase further to the point where its ICT segment will continue to be the key<br />

driver for the group’s future prospects.<br />

Strong backlog, with further room to grow. As at early-FY13, <strong>Loxley</strong>’s ICT<br />

and project backlog stood at around THB8bn. 70% of it will be recognized as<br />

revenue in FY13 due to the short-term nature of the ICT contracts. <strong>Loxley</strong> has<br />

also identified THB28bn worth of high-potential projects from its existing and<br />

new clients from which it stands a good chance of capturing and adding on to<br />

its backlog in FY13.<br />

TRADING BUY. We initiate coverage on <strong>Loxley</strong> with a TRADING BUY and a FV<br />

of THB10.60, based on 3.6x FY13 P/BV, which is equivalent to a 10% discount<br />

to the average P/BV of its peers AIT and SAMART. While <strong>Loxley</strong> is an integrated<br />

ICT contractor, just like AIT and SAMART, we think the discount is reasonable,<br />

taking into account that <strong>Loxley</strong> is a diversified conglomerate, compared to its<br />

pure ICT peers. The discount also accounts for its relatively lower profitability,<br />

compared to its peers.<br />

6.6<br />

159<br />

5.6<br />

139<br />

4.6<br />

119<br />

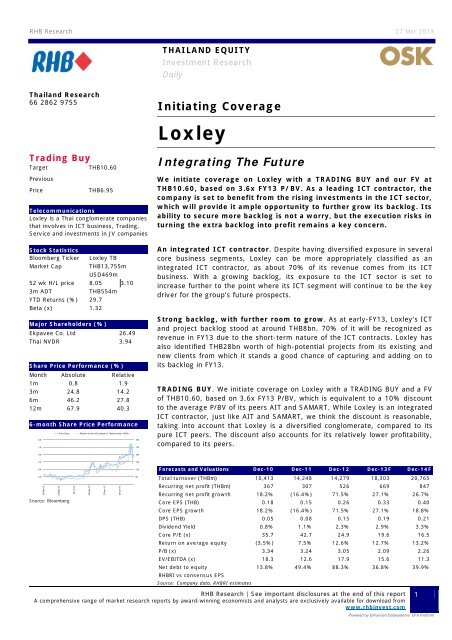

Forecasts and Valuations Dec-10 Dec-11 Dec-12 Dec-13F Dec-14F<br />

3.6<br />

99<br />

Total turnover (THBm) 10,413 14,248 14,279 18,303 20,765<br />

2.6<br />

26-Mar-12<br />

25-May-12<br />

26-Jul-12<br />

Source: Bloomberg<br />

26-Sep-12<br />

27-Nov-12<br />

28-Jan-13<br />

79<br />

Recurring net profit (THBm) 367 307 526 669 847<br />

Recurring net profit growth 18.2% (16.4%) 71.5% 27.1% 26.7%<br />

Core EPS (THB) 0.18 0.15 0.26 0.33 0.40<br />

Core EPS growth 18.2% (16.4%) 71.5% 27.1% 18.8%<br />

DPS (THB) 0.05 0.08 0.15 0.19 0.21<br />

Dividend Yield 0.8% 1.1% 2.3% 2.9% 3.3%<br />

Core P/E (x) 35.7 42.7 24.9 19.6 16.5<br />

Return on average equity (3.5%) 7.5% 12.6% 12.7% 13.2%<br />

P/B (x) 3.34 3.24 3.05 2.09 2.26<br />

EV/EBITDA (x) 18.3 12.6 17.9 15.6 11.3<br />

Net debt to equity 13.8% 49.4% 88.3% 36.8% 39.9%<br />

RHBRI vs consensus EPS<br />

Source: Company data, RHBRI estimates<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

1<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

COMPANY BACKGROUND<br />

Brief history. <strong>Loxley</strong> began as a trading company in 1939 under the name <strong>Loxley</strong> Rice Company<br />

(Bangkok), as a JV between Ng Yok Long Lamsam and WR <strong>Loxley</strong> of Hong Kong. The original<br />

activities were the export of rice and lumber. By 1957, its main business shifted to selling imported<br />

industrial products, including those with advanced technology of the day. On 1 April 1993, it went<br />

public under the name of <strong>Loxley</strong> Public Company Limited, and was subsequently listed on the Stock<br />

Exchange of Thailand on 25 Jan 1994. Today with dozens of subsidiary and associated investments,<br />

its business activities can be divided into four main business groups namely: i) ICT and projects, ii)<br />

trading, iii) services, and iv) joint ventures and associate investments. <strong>Loxley</strong>’s ICT and project<br />

business can be broken down into three subdivisions: i) ICT and telecommunications, ii) projects,<br />

and iii) technology.<br />

An integrated ICT contractor. Despite having diversified exposure in several core segments, we<br />

think <strong>Loxley</strong> can be more appropriately classified as an integrated ICT & telecom-related contractor,<br />

where around 70% of its revenue is from the ICT business segment. With a growing ICT backlog,<br />

its exposure to the ICT sector is set to increase further to the point where the segment will<br />

continue to be the key driver for the company’s future growth.<br />

Figure 1: <strong>Loxley</strong>’s business and organizational structure<br />

Source: Bloomberg<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

2<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

SEGMENTAL OVERVIEW<br />

ICT & PROJECT BUSINESS<br />

ICT & Telecom business<br />

The ICT business is divided into two business divisions comprising Telecommunications and<br />

Computer products. The Telecommunications unit is responsible for complete telecommunications<br />

infrastructure services, telecommunications equipment distribution and wireless broadband internet<br />

services, while the Computer Products division is responsible for IT installations for the government<br />

as well as private sector. Apart from that, it has reoccurring revenues for the maintenance,<br />

expansion and modification of systems nationwide. <strong>Loxley</strong> is expected to help maintain ToT’s 3G<br />

Phase 1 network as part of a concession, as well as for a submarine cable in the Gulf of Thailand<br />

which connects up the country’s gas rigs that stretches to the Songkla province in the South of<br />

Thailand.<br />

Figure 2: <strong>Loxley</strong>’s products and services offered under its ICT business<br />

Computer and Telecommunication products and software sales<br />

Wireless Broadband Solutions & Products<br />

IT Total Solution Provider, Internet System Integration, Outsourcing, e-Service, e-Biz<br />

Consulting/IT Training, Web-based Integration System Management<br />

Provides e-Learning service<br />

Provides complete solutions for e-Commerce, information security, ATM and smart cards<br />

Teleservice Solution Provider, call center service, telemarketing service<br />

Provides Satellite Images, GIS software system and service<br />

Developed and delivered many computer systems and services to government and public<br />

sectors in finance, automotive, heavy industry, hospital, manufacturing, chemical, education,<br />

entertainment, transportation and electronics<br />

Provides the real-time integrated services for fleet management, which covers real-time<br />

tracking, driving route setting and driving behavior, and also combines GSM networks, GPS<br />

Satellites and Digital Map technologies for call center monitoring<br />

Develops and offers sales management system under the name of MCE (Mobile Convergence<br />

Expert)<br />

Distributes products and services in site survey, system design, procurement, installation,<br />

test, commissioning and warranty for large scale telecommunication systems including fiber<br />

optic, microwave, satellite earth station, mobile SNG and base station systems for mobile<br />

phones.<br />

Front-end survey application for automobile claim services. The system provides all the<br />

necessary applications and synchronizes the information amongst all the three involved<br />

parties, namely, the call center, the claim agent and the claim expert.<br />

Sales data synchronization application between handheld mobile devices to the corporate<br />

computer network via advanced communication technologies<br />

Design and implement open source software for government agencies and corporations<br />

Source: <strong>Loxley</strong><br />

Project business<br />

<strong>Loxley</strong> is involved in operations such as TV and Radio communications, energy processes, electrical<br />

systems and waste water management, amongst others. These are all assigned by the government<br />

and usually awarded in an auction. The company’s project business broadly encompasses all that is<br />

not related to telecommunications and is mostly ICT-related. Currently, its project business comes<br />

from government institutions. It is the representative of authorized dealers of TV and radio<br />

transmitter equipment, as well as equipment associated with TV and radio broadcasting such as<br />

Studio. The company is also a systems integrator for large bidding projects. This includes<br />

designing, installing and building radio and TV stations for government agencies, state enterprises<br />

and private organizations.<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

3<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

Technology business<br />

For its technology division, <strong>Loxley</strong> provides services and procures technology products, e.g. it is a<br />

3G mobile service reseller and distributes mobile phones and related products as well. It also<br />

provides services and sales of printing products, installs systems for expressway management and<br />

railway, as well as provides real estate management services. The company was chosen by ToT to<br />

be a 3G mobile phone ‘reseller’ or a Mobile Virtual Network Operator (MVNO) and is licensed by the<br />

National Broadcasting and Telecommunications Commission (NBTC) to operate under the Type 1<br />

telecommunications service. Its iKool Real 3G mobile service brand has been operating for two<br />

years, albeit at a loss. <strong>Loxley</strong> has been selling mobile phone devices and is the distributor of Sony<br />

Ericsson phones and is also an importer and distributor of tablets from Apple as well as other<br />

brands.<br />

TRADING BUSINESS<br />

The group’s trading division engages in manufacturing and distribution of equipment for the<br />

consumer, industrial chemical, computer, and telecommunications industries. It also distributes<br />

construction equipment and services, as well as automobile and other specialized procurement<br />

services.<br />

Figure 3: Products under <strong>Loxley</strong>’s trading division<br />

Source: <strong>Loxley</strong><br />

SERVICE BUSINESS<br />

The group offers security services at the Suvarnabhumi Airport, security equipment and systems<br />

for office buildings, hotels, and hospitals, as well as businesses in media, education and<br />

entertainment. Its trading business is anchored by Asia Security Management (ASM), a JV between<br />

<strong>Loxley</strong> and ICTS Europe Holdings, a leading security provider in Europe.<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

4<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

JV BUSINESS<br />

BP-Castrol (45%)<br />

<strong>Loxley</strong> has partnered with BP Oil to jointly form a business that manufactures and distributes<br />

engine lubricants for the CASTROL and BP brands. While both products have different market<br />

potential, they are both well-perceived. As raw materials are mostly sourced from Thailand, there is<br />

some security to the supply chain, and the product costs incurred may be potentially lower<br />

periodically. BP Castrol (Thailand) is among the top five leaders, commanding a 65% market share,<br />

while the remaining 35% is split among 200 small domestic brands.<br />

Thai Fiber Optics (40%)<br />

Thai Fiber Optics Co (TFOC) is a JV with Bangkok Telecom, a leading copper telephone cable<br />

manufacturer in Thailand which offers fibre optics design and manufacturing services supervised by<br />

world leader Furakawa Electric of Japan. TFOC has been involved in projects to install 3G<br />

infrastructures for ToT’s Phase1 network, broadband internet and WIFI networks. The company will<br />

supply materials for the network should <strong>Loxley</strong> win the project for Phase 2 of its expansion.<br />

BlueScope Steel & BlueScope Lysaght (25%)<br />

BlueScope Steel (Thailand) and BlueScope Lysaght (Thailand) are JVs between <strong>Loxley</strong> Plc and<br />

BlueScope Steel. BlueScope is an Australian world leader in coated steel and has its largest<br />

overseas investment in Thailand, where it manufactures and distributes zinc-coated steel, prepainted<br />

steel and aluminium/zinc alloy-coated steel. The company’s steel production plant is<br />

located at Map Ta Phut and includes metallic coating lines and a painting operation. This plant is<br />

the sole manufacturer of ZINCALUME, which provides a protective barrier for zinc alloy-coated steel<br />

and has up to four times the life of galvanized steel. CRP ANTIBACTERIAL, another Thai innovation,<br />

is a pre-painted galvanized steel product specially designed for a cool room panel application for<br />

the food industry. The product is designed to meet USDA requirements.<br />

L Solar 1 (45%)<br />

The company has been constructing its 8.7MW solar energy power plant on 215 rai of land in<br />

Bothong District, Kabinburi, Prachinburi where generation capability is 11m-12m kWh. The<br />

company’s operations are supported by the government, e.g. promotions for investments in the<br />

solar energy power plant by the Board of Investment of Thailand (BOI), with additional benefits<br />

from the Provincial Electricity Authority (PEA) for renewable energy producers. <strong>Loxley</strong> can also<br />

supply power transmission lines from solar panels to the Provincial Electricity Authority (PEA), and<br />

provide consultations as well as install equipment for private solar farms.<br />

<strong>Loxley</strong> GTECH Technology (LGT)<br />

The company is a JV between <strong>Loxley</strong> and GTECH Corporation group. It is the provider of the Online<br />

Lottery System Service Contract for the Government Lottery Office (GLO). The contract includes<br />

the design, procuring, implementing and operating of the Online Lottery System. The system<br />

consists of the two Data Centers (one for primary and the other for backup), an online<br />

communication network system, and the installation of terminals to retailers selected by GLO. The<br />

lottery contract was signed in 2006. LGT invested THB2bn in machine installation. The company will<br />

receive 75 satang in returns per transaction. Lottery ticket sales total THB3bn per draw, which<br />

translates into a profit of THB1.5bn a year.<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

5<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

FINANCIALS<br />

ICT & projects the biggest revenue contributor. In FY12, <strong>Loxley</strong>’s ICT & projects segment<br />

contributed the lion’s share to the group’s topline, accounting for about 67% of total revenue. This<br />

was followed by its trading and services segments which contributed about 27% and 6% of the<br />

total revenue respectively. Revenue contribution from ICT & projects has been on an uptrend over<br />

the last few years, up from 50% of total revenue in FY08 to 67% last year, owing to the higher<br />

backlog as the company secured more contracts. While the ICT & projects segment recorded a<br />

8.8% y-o-y growth in FY12, the group’s total revenue was relatively unchanged y-o-y due to the<br />

16.1% y-o-y contraction in revenue from its trading business, partly due to the impact from the<br />

devastating floods in late 2011.<br />

Figure 4: FY12 revenue breakdown<br />

Source: <strong>Loxley</strong><br />

Figure 5: Historical breakdown of revenue by segment since 2008<br />

Source: <strong>Loxley</strong><br />

JVs the biggest bottomline contributor in FY12. On the whole, <strong>Loxley</strong>’s subsidiaries did not<br />

contribute any EBIT for FY12. However, according the notes to its financial statements, there are<br />

slim margins of around 3% for its key ICT & projects business, as well as for its services segment.<br />

Its trading division appeared to be in the red, partly due to the impact from the post-flood crisis<br />

coupled with the extremely thin margins characteristic of this business. As such, all of <strong>Loxley</strong>’s net<br />

profit in FY12 came from its JV and associates business, driven by strong earnings growth from BP<br />

Castrol, BlueScope and L-Solar 1. In FY12, <strong>Loxley</strong>’s JV and associate companies generated a total<br />

net profit of THB2.2bn, of which THB702m was earnings from its equities.<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

6<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

Figure 6: Total and equity profit from <strong>Loxley</strong>’s JV and associate companies in FY12<br />

Source: <strong>Loxley</strong><br />

Figure 7: Equity profit structure from <strong>Loxley</strong>’s JV and associate companies in FY12<br />

Source: <strong>Loxley</strong><br />

Decent balance sheet with room for improvement. At a D/E ratio of 1.8x as at end-FY12,<br />

<strong>Loxley</strong>’s balance sheet was relatively highly-geared due to its high borrowings to finance its<br />

expansion and investments. Nevertheless we think the balance is decent enough, and has some<br />

scope for further improvement as the company explores other avenues to raise capital for future<br />

expansion and investments, such as through the upcoming public offering (PO) of 165m new<br />

shares which is expected to raise about THB1bn. The proceeds from the PO will be utilized for<br />

additional project investments both locally and abroad, as well as to fund working capital.<br />

Figure 8: <strong>Loxley</strong>’s consolidated balance sheet for FY12<br />

Source: <strong>Loxley</strong><br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

7<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

KEY INVESTMENT HIGHLIGHTS<br />

SURFING HIGH ON ICT BOOM<br />

Strong backlog with further upside to grow. As at early-FY13, <strong>Loxley</strong>’s ICT & Projects backlog<br />

stood at around THB8bn. 70% of it will be recognized as revenue in FY13 due to the short-term<br />

nature of the ICT contracts. <strong>Loxley</strong> has also identified THB28bn worth of high-potential prospective<br />

projects from its existing and new clients where it stands a good chance of winning them. Among<br />

them are ToT’s 3G infrastructure roll-out Phase 2 worth THB10bn, as well as a THB9bn fibre optics<br />

project in Myanmar. It also has indentified the THB4.5bn Water Resources Management Platform<br />

(WRMP) project, which is part the government’s THB350bn flood prevention and management<br />

initiative. WRMP will involve centralizing and implementing the country’s water management via a<br />

desktop computer, whether it is increasing water flows to agricultural fields in the Central Plains or<br />

diverting water to the sea from retention centers. Supported by its strong working relationship with<br />

its government agency clients, we believe <strong>Loxley</strong> should be able to win some of those high potential<br />

projects and thus further expand its backlog. Apart from high revenue visibility arising from the<br />

high backlog, the company should be able to benefit from economies of scale, especially in<br />

procuring devices and technology.<br />

Figure 9: Breakdown of <strong>Loxley</strong>’s current THB8bn ICT & Projects backlog<br />

Source: <strong>Loxley</strong><br />

Figure 10: Strong ICT backlog with plenty of room to grow<br />

Source: <strong>Loxley</strong><br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

8<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

Smart Thailand project. <strong>Loxley</strong> is also eyeing some portion of the government’s THB80bn ICT<br />

infrastructure project aimed at improving the broadband network across the country, known as the<br />

Smart Thailand project. Under the project, the government aims to expand the coverage of<br />

broadband network to 80% of the population in three years, and 95% of the population by 2020.<br />

The project is divided into two phases. The first phase, which is set to kick-start this year and be<br />

completed in 2015, will involve upgrading the existing telecom networks to reach 80% of the total<br />

population. The second phase, which will span from 2016 until 2020, will entail the installment of<br />

broadband network in areas where fibre-optic network is not yet available. Under the Smart<br />

Thailand project, the fibre optic network will be used as the main broadband network nationwide,<br />

including in public areas such as schools, hospitals and government places, while the Internet<br />

connection will be provided at affordable costs or free of charge. In addition, the government will<br />

initiate free Wi-Fi projects in collaboration with service providers to offer the service in remote<br />

areas. In view of its strong track record, we think <strong>Loxley</strong> stands a good chance of being selected to<br />

participate in the rollout of the Smart Thailand project.<br />

Benefiting from massive 3G investment. In preparation for Thailand’s first 3G wave, the<br />

government has allocated THB7.6bn for the ICT sector in FY13, up 102% y-o-y. While the amount<br />

may be small, it signals the government’s increasing attention on the sector, which has high<br />

potential for growth. We believe the budget for the sector will continue to grow in the future, as<br />

state telcos and private players are ramping up upgrades on their existing networks. As such, we<br />

think <strong>Loxley</strong>, being one of the leading players in the field coupled with its strong track record and<br />

experience, stands to benefit from the new systems integration and upgrading works of existing<br />

systems.<br />

Figure 11: Timeline of TOT’s 3G installation<br />

Source: SAMART<br />

Digital TV. According to Thailand’s latest National Radio and Television Broadcasting Act, there is a<br />

possibility that broadcasting will move to digital technology. This will help stimulate broadcasters to<br />

expand their businesses by going digital. In this sense, the potential for growth is vast. The shift in<br />

broadcasting devices to digital TV systems for five networks in Thailand is estimated to be worth<br />

around THB15bn. Moreover, the government controls the majority of TV stations and <strong>Loxley</strong> has a<br />

high chance of winning a good deal of the bids. Customers include the Public Relations Department,<br />

Royal Thai Army Radio and Television, MCOT Pcl, Parliament Radio and Television Station and the<br />

Military’s broadcasting channel as well as the Military Development Office.<br />

New opportunities in neighbouring countries. Supported by its vast experience in the<br />

domestic ICT sector, <strong>Loxley</strong>’s management sees opportunities to provide ICT services abroad as<br />

part of its expansion strategy. It is collaborating with AIT in a 50:50 joint venture named <strong>Loxley</strong> &<br />

AIT Holdings Co Ltd, which will be investing in new projects abroad as well as at home. One of<br />

these is the THB9bn fibre optic cable project in Myanmar, which is expected to be finalized soon.<br />

Other than that, <strong>Loxley</strong> is also keeping an eye on potential ICT projects in Cambodia, Vietnam and<br />

Laos.<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

9<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

FAVOURABLE OUTLOOK FOR TRADING BUSINESS<br />

Construction materials trading division to benefit from construction boom. Currently, the<br />

backlog for its construction materials trading division stands at THB2.74bn, most of which comes<br />

from mass transit-related projects. As a leading construction materials trading company in<br />

Thailand, <strong>Loxley</strong> is expected to reap benefits from a booming construction sector in Thailand as well<br />

as the expansion of the mass transit routes in the Greater Bangkok region. Apart from the domestic<br />

construction materials market, it has also cast its sights on the opportunities in supplying<br />

construction materials to tap into the construction boom in Myanmar.<br />

Bringing Thai brands to China. <strong>Loxley</strong>’s China office has been helping Thailand’s small and<br />

medium enterprises (SMEs) to introduce their products to the Chinese market. As it is not very<br />

cost-effective for Thai SMEs to self-market their products overseas, <strong>Loxley</strong> provides the distribution<br />

channels by leveraging on its existing network in China. To further tap into the vast Chinese<br />

market, it plans to set up booths marketing Thai products in petrol stations in China by this year.<br />

As such, <strong>Loxley</strong> is expected to sign a co-operative agreement with Sinopec to create a “Thai corner”<br />

in the latter’s petrol stations in China. The booths will sell products from both <strong>Loxley</strong> and Thai<br />

SMEs. As Sinopec has over 10,000 petrol stations located across four provinces and two cities in<br />

China, we think the co-operation with Sinopec will widen <strong>Loxley</strong>’s distribution network in China.<br />

Figure 12: Sinopec’s petrol stations network in China<br />

Source: <strong>Loxley</strong><br />

UNLOCKING VALUE VIA LISTING ITS SUBSIDIARY<br />

Over the next five years, <strong>Loxley</strong> is likely to list some of its subsidiaries if they show attractive<br />

enough profits. This is an incentive for the company to improve its cost-saving measures, or it may<br />

have to raise more working capital to adequately partake in the array of opportunities available. We<br />

do not rule out the possibility that the listing process might begin by end-FY13. Two of <strong>Loxley</strong>’s<br />

subsidiaries, <strong>Loxley</strong> Wire Company (LWC) and LOXBIT, are the prime candidates for listing on the<br />

SET.<br />

<strong>Loxley</strong> Wireless Company<br />

<strong>Loxley</strong> Wireless is a 99%-held subsidiary. We believe that this company is a prime candidate for<br />

listing on the SET. <strong>Loxley</strong> actually has several potential candidates to be floating on the stock<br />

market, and is likely to follow the same path as Samart in listing its business units are that deemed<br />

practical in unlocking value for providing an additional catalyst for its share price.<br />

LWC’s business is divided into three main areas:<br />

i) Distribution of carrier-grade equipment by Huawei and Alcatel-Lucent as well as Aastra’s<br />

enterprise product, e.g. PABX including installation and after-service.<br />

2) Distribution of wireless transmission and networking hardware such as radio frequency repeaters<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

10<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

and dead signal area antennas.<br />

3) High speed data communications for the corporate world. This was a business that LOXLEY<br />

retained when it sold off its holdings in what is now CS Loxinfo to Thaicom (THCOM). They also<br />

install CCTVs and Virtual Private Networks (VPN).<br />

LWC’s business is similar to Advanced Info Technology (AIT)’s except that AIT focuses on one<br />

supplier, CISCO. AIT provides inroads into strong relationships with the public sector in exchange<br />

for being the key partner for CISCO products in Thailand. Both companies focus primarily on<br />

government-related customers such as the Communications Authority of Thailand (CAT) and the<br />

Telephone Organisation of Thailand (TOT). LWC works, rather than competes, with AIT.<br />

A key on-going project at this time is CAT’s submarine cable system to handle telecommunications<br />

between land and oil rigs in the Gulf of Thailand, stretching 1,340 km and extending to Songkla in<br />

the south of Thailand. The 3G project belonging to the ToT also falls under LWC’s purview.<br />

LOXBIT – IT Specialist<br />

LOXBIT is another prime candidate for a SET listing over the next 18months. The company is a<br />

systems integrator dealing with consumer IT developments and machines for automated processes<br />

such as electronic payments, ATM’s, cheque clearing and achieving systems (ICAS) and for risk<br />

management for the Bank of Thailand. The company provides procurement, installation and longterm<br />

maintenance services as part of its contract. Not surprisingly, it has the largest percentage to<br />

sales for recurring revenues. It also authorizes the manufacturing of products.<br />

Competition for LOXBIT is intense due to the rapid changes in technology and customer<br />

requirements, including new and international standards. However, a positive is that progressive<br />

regulatory rules mean new contracts for modification, for LOXBIT. One competitive advantage for<br />

this company is that it can share the expertise of its pool of highly-experienced engineers and IT<br />

consultants which a smaller company or pure distributor may not have.<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

11<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research 06 Mar 2013<br />

KEY INVESTMENT RISKS<br />

Execution risks. <strong>Loxley</strong>, as a leading ICT player, will benefit from the massive investments being<br />

pumped into the sector in Thailand as well as the region. While there are no concerns over its<br />

ability to grow its backlog, its ability to turn its new backlog into earnings remains rather<br />

questionable judging from its past track record. The historical gross profit margin for the company<br />

had been decent at around 15%-18%. However, high selling and administrative expenses have<br />

dragged down profitability. The same can also be said about its trading and services segments. As<br />

such, we believe that the concerns over the company’s execution risks are rather valid.<br />

Uncertainties over the online lottery project. The online lottery project was part of former<br />

prime minister Thaksin Shinawatra’s policy to clamp down black market lotteries, legalizing it while<br />

generating additional revenue for the government. <strong>Loxley</strong>’s JV company, LGT, was given the award<br />

to roll out the installation of the online lottery back in 2006. Due political turmoil, the<br />

implementation of online lottery has been delayed indefinitely. So far, LGT has invested around<br />

THB1.5bn, with 6000 machines installed nationwide. While the current government plans to<br />

proceed with the roll out of the online lottery, there are still uncertainties over the actual execution<br />

given the politically-sensitive nature of the issue. While the company has set aside some provisions<br />

in the event that the project gets scrapped, we think there is always a possibility that the<br />

provisions are insufficient and it may need to inject additional funds into the investment. Even so,<br />

the negative news flow in regard to the potential cancellation of the project will result in pessimistic<br />

sentiment on the stock price.<br />

Political risks. Given that most of <strong>Loxley</strong>’s ICT contracts are from the government and<br />

government agencies, the contracts flows are highly dependent on the political stability whereby<br />

any change in political leadership could hamper the progress in awarding these contracts. As such,<br />

we think <strong>Loxley</strong>’s high dependency on government-related contracts expose the company to<br />

political risks, and under a less-than-ideal situation, it might not being able to replenish its backlog<br />

due to the delay in the implementation of government projects.<br />

Heavy balance sheet and earnings dilution. Due to the company’s high borrowings, it incurred<br />

a rather significant finance cost amounting to over THB230m in FY12. While its operating gross<br />

profit margin was rather healthy and comparable to its peers, its high finance costs have been<br />

eating into its bottomline over the last few years. We believe its highly-geared balance sheet leaves<br />

the company limited room to gear up further, in the event it needs to raise capital. While the<br />

proposed PO could provide additional capital for the company without having to increase its<br />

borrowings, we think it is very important for the company to channel the proceeds into earningsaccretive<br />

projects to minimize the impact of the earnings dilution from the enlarged share base.<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

12<br />

Powered by Enhanced Datasystems’ EFA Platform

RHB Research<br />

FORECAST & RECOMMENDATION<br />

Decent top- and bottomline growth. We expect revenue to grow by about 28% y-o-y in FY13,<br />

largely driven by the strong revenue recognition from its existing ICT & projects backlog as well as<br />

from new contract wins. As such, the ICT & projects segment is set to remain its biggest revenue<br />

contributor, bringing in over 70% of its total revenue. <strong>Loxley</strong>’s trading and service businesses<br />

contribute less than 30% to its total revenue. We expect the gross margin for its core business to<br />

improve slightly in FY13, with further improvements in FY14 onwards as the company achieves<br />

greater economic of scales from the high backlog of its ICT business segment. Overall, we expect<br />

net profit to grow at around 27% over the next few years, in line with revenue growth as well the<br />

higher equity profit contributions from its JVs and associate companies. Conservatively, we have not<br />

factored in contributions from its online lottery business in our forecast due to the uncertainties<br />

surrounding the issue.<br />

Initiate with TRADING BUY. We initiate coverage on <strong>Loxley</strong> with a Trading Buy call and a FV of<br />

THB10.60, based on 3.6x FY13 P/BV. This is equivalent to a 10% discount to the average P/BV of<br />

its peers AIT and SAMART. While <strong>Loxley</strong> is an integrated ICT contractor just like AIT and SAMART,<br />

we think the discount is reasonable, taking into account its position as a diversified conglomerate<br />

compared to its peers, who are pure ICT players. The discount also factors in its relatively lower<br />

profitability compared to its peers. Nevertheless, as one of the leading ICT contractors, we think<br />

<strong>Loxley</strong> is set to benefit from the sector’s favourable outlook, supported by the abundance of highpotential<br />

opportunities available. However, the execution risk it faces in turning the high backlog<br />

into profit remains a key concern.<br />

Figure 3: <strong>Loxley</strong>’s P/BV trading band since 2003<br />

Source: Bloomberg<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

13

RHB Research<br />

FINANCIAL<br />

Profit & Loss (THBm) Dec-10 Dec-11 Dec-12 Dec-13F Dec-14F<br />

Total turnover 10,413 14,248 14,279 18,303 20,765<br />

Cost of sales (8,652) (12,087) (12,093) (15,530) (17,452)<br />

Gross profit 1,761 2,160 2,185 2,773 3,313<br />

Gen & admin expenses (1,749) (1,946) (2,016) (2,260) (2,542)<br />

Other operating costs (181) (206)<br />

Operating profit 12 214 169 332 565<br />

Operating EBITDA 135 343 312 479 720<br />

Depreciation of fixed assets (123) (128) (143) (147) (155)<br />

Operating EBIT 12 214 169 332 565<br />

Net income from investments 357 376 701 750 750<br />

Interest expense (115) (158) (232) (240) (250)<br />

Exceptional income - net (343) (12) - - -<br />

Pre-tax profit (89) 420 638 842 1,065<br />

Taxation (42) (115) (115) (168) (213)<br />

Minority interests (8) (7) 3 (5) (5)<br />

Profit after tax & minorities (139) 298 526 669 847<br />

Net income to ord equity (139) 298 526 669 847<br />

Recurring net profit 367 307 526 669 847<br />

Source: Company data, RHBRI<br />

Balance Sheet (THBm) Dec-10 Dec-11 Dec-12 Dec-13F Dec-14F<br />

Total cash and equivalents 869 983 560 2,301 2,127<br />

Inventories 665 1,316 1,233 1,504 1,706<br />

Accounts receivable 2,332 2,208 1,885 2,356 2,632<br />

Other current assets 1,106 2,726 4,196 4,510 5,064<br />

Total current assets 4,973 7,233 7,874 10,671 11,530<br />

Total investments 3,563 3,572 3,974 4,045 4,145<br />

Tangible fixed assets 975 1,066 1,121 1,177 1,236<br />

Intangible assets 36 45 57 58 58<br />

Total other assets 247 336 303 320 333<br />

Total non-current assets 4,820 5,019 5,456 5,600 5,772<br />

Total assets 9,793 12,252 13,330 16,271 17,302<br />

Short-term debt 1,117 1,956 3,214 3,300 3,400<br />

Accounts payable 1,796 2,827 2,001 2,573 2,919<br />

Other current liabilities 1,988 1,610 1,785 1,991 2,195<br />

Total current liabilities 4,901 6,393 7,000 7,864 8,515<br />

Total long-term debt 324 1,129 1,323 1,386 1,428<br />

Other liabilities 433 475 505 549 594<br />

Total non-current liabilities 757 1,604 1,829 1,935 2,022<br />

Total liabilities 5,658 7,996 8,828 9,799 10,537<br />

Share capital 2,000 2,000 2,000 2,265 2,265<br />

Retained earnings reserve 366 551 905 1,173 1,511<br />

Other reserves 1,554 1,496 1,395 2,833 2,786<br />

Shareholders' equity 3,920 4,047 4,300 6,270 6,563<br />

Minority interests 215 209 202 202 202<br />

Other equity - (0) (0) (0) (0)<br />

Total equity 4,135 4,256 4,502 6,472 6,765<br />

Total liabilities & equity 9,793 12,252 13,330 16,271 17,302<br />

Source: Company data, RHBRI<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

14

RHB Research<br />

Cashflow (THBm) Dec-10 Dec-11 Dec-12 Dec-13F Dec-14F<br />

Operating profit 12 214 169 332 565<br />

Depreciation & amortisation 123 128 143 147 155<br />

Change in working capital 1,425 (1,529) (1,865) (359) (583)<br />

Other operating cashflow (1,063) 451 (74) 391 464<br />

Operating cashflow 497 (734) (1,628) 511 601<br />

Interest received 7 11 10 20 20<br />

Interest paid (115) (158) (232) (240) (250)<br />

Dividends received 348 364 374 375 375<br />

Tax paid 3 (132) (106) (163) (211)<br />

Cashflow from operations 739 (651) (1,582) 503 535<br />

Other investing cashflow 97 119 154 270 236<br />

Cashflow from investing activities 97 119 154 270 236<br />

Dividends paid - (100) (150) (300) (381)<br />

Proceeds from issue of shares - - - 1,155 -<br />

Increase in debt (875) 1,643 1,453 - -<br />

Other financing cashflow 544 (809) (247) 210 273<br />

Cashflow from financing activities (331) 735 1,056 1,065 (108)<br />

Cash at beginning of period 594 857 976 558 2,299<br />

Total cash generated 506 203 (372) 1,838 663<br />

Implied cash at end of period 1,099 1,060 604 2,397 2,962<br />

Source: Company data, RHBRI<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

15

RHB Guide to Investment Ratings<br />

Buy: Share price may exceed 10% over the next 12 months<br />

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain<br />

Neutral: Share price may fall within the range of +/- 10% over the next 12 months<br />

Take Profit: Target price has been attained. Look to accumulate at lower levels<br />

Sell: Share price may fall by more than 10% over the next 12 months<br />

Not Rated: Stock is not within regular research coverage<br />

Disclosure & Disclaimer<br />

All research is based on material compiled from data considered to be reliable at the time of writing, but RHB does not make any<br />

representation or warranty, express or implied, as to its accuracy, completeness or correctness. No part of this report is to be<br />

construed as an offer or solicitation of an offer to transact any securities or financial instruments whether referred to herein or<br />

otherwise. This report is general in nature and has been prepared for information purposes only. It is intended for circulation to the<br />

clients of RHB and its related companies. Any recommendation contained in this report does not have regard to the specific<br />

investment objectives, financial situation and the particular needs of any specific addressee. This report is for the information of<br />

addressees only and is not to be taken in substitution for the exercise of judgment by addressees, who should obtain separate legal<br />

or financial advice to independently evaluate the particular investments and strategies.<br />

RHB, its affiliates and related companies, their respective directors, associates, connected parties and/or employees may own or<br />

have positions in securities of the company(ies) covered in this research report or any securities related thereto, and may from<br />

time to time add to, or dispose off, or may be materially interested in any such securities. Further, RHB, its affiliates and related<br />

companies do and seek to do business with the company(ies) covered in this research report and may from time to time act as<br />

market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them or buy them from<br />

customers on a principal basis and may also perform or seek to perform significant investment banking, advisory or underwriting<br />

services for or relating to such company(ies), as well as solicit such investment, advisory or other services from any entity<br />

mentioned in this research report.<br />

RHB and its employees and/or agents do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or<br />

damages that may arise from any reliance based on this report or further communication given in relation to this report.<br />

The term “RHB” shall denote where applicable, the relevant entity distributing the report in the particular jurisdiction mentioned<br />

specifically herein below and shall refer to RHB Research Institute Sdn Bhd, its holding company, affiliates, subsidiaries and related<br />

companies.<br />

All Rights Reserved. This report is for the use of intended recipients only and may not be reproduced, distributed or published for<br />

any purpose without prior consent of RHB and RHB accepts no liability whatsoever for the actions of third parties in this respect.<br />

Malaysia<br />

This report is published and distributed in Malaysia by RHB Research Institute Sdn Bhd (233327-M), Level 11, Tower One, RHB<br />

Centre, Jalan Tun Razak, 50400 Kuala Lumpur, a wholly-owned subsidiary of RHB Investment Bank Berhad (RHBIB), which in turn<br />

is a wholly-owned subsidiary of RHB Capital Berhad.<br />

As of 25 Mar 2013, RHBIB does not have proprietary positions in the subject companies, except for:<br />

a) -<br />

As of 25 Mar 2013, none of the analysts who covered the stock in this report has an interest in the subject companies covered in<br />

this report, except for:<br />

a) -<br />

Singapore<br />

This report is published and distributed in Singapore by DMG & Partners Research Pte Ltd (Reg. No. 200808705N), a wholly-owned<br />

subsidiary of DMG & Partners Securities Pte Ltd, a joint venture between <strong>OSK</strong> Investment Bank Berhad, Malaysia (“<strong>OSK</strong>IB”) and<br />

Deutsche Asia Pacific Holdings Pte Ltd (a subsidiary of Deutsche Bank Group). DMG & Partners Securities Pte Ltd is a Member of<br />

the Singapore Exchange Securities Trading Limited and is a subsidiary of <strong>OSK</strong>IB, which in turn is a wholly-owned subsidiary of RHB<br />

Capital Berhad. DMG & Partners Securities Pte Ltd may have received compensation from the company covered in this report for its<br />

corporate finance or its dealing activities; this report is therefore classified as a non-independent report.<br />

As of 25 Mar 2013, DMG & Partners Securities Pte Ltd and its subsidiaries, including DMG & Partners Research Pte Ltd do not have<br />

proprietary positions in the subject companies, except for:<br />

a) -<br />

As of 25 Mar 2013, none of the analysts who covered the stock in this report has an interest in the subject companies covered in<br />

this report, except for:<br />

a) -<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

16

Special Distribution by RHB<br />

Where the research report is produced by an RHB entity (excluding DMG & Partners Research Pte Ltd) and distributed in Singapore,<br />

it is only distributed to "Institutional Investors", "Expert Investors" or "Accredited Investors" as defined in the Securities and<br />

Futures Act, CAP. 289 of Singapore. If you are not an "Institutional Investor", "Expert Investor" or "Accredited Investor", this<br />

research report is not intended for you and you should disregard this research report in its entirety. In respect of any matters<br />

arising from, or in connection with this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte Ltd.<br />

Hong Kong<br />

This report is published and distributed in Hong Kong by <strong>OSK</strong> Securities Hong Kong Limited (“<strong>OSK</strong>SHK”), a subsidiary of <strong>OSK</strong><br />

Investment Bank Berhad, Malaysia (“<strong>OSK</strong>IB”), which in turn is a wholly-owned subsidiary of RHB Capital Berhad.<br />

<strong>OSK</strong>SHK, <strong>OSK</strong>IB and/or other affiliates may beneficially own a total of 1% or more of any class of common equity securities of the<br />

subject company. <strong>OSK</strong>SHK, <strong>OSK</strong>IB and/or other affiliates may, within the past 12 months, have received compensation and/or<br />

within the next 3 months seek to obtain compensation for investment banking services from the subject company.<br />

Risk Disclosure Statements<br />

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become<br />

valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities. Past<br />

performance is not a guide to future performance. <strong>OSK</strong>SHK does not maintain a predetermined schedule for publication of research<br />

and will not necessarily update this report<br />

Indonesia<br />

This report is published and distributed in Indonesia by PT <strong>OSK</strong> Nusadana Securities Indonesia, a subsidiary of <strong>OSK</strong> Investment<br />

Bank Berhad, Malaysia, which in turn is a wholly-owned subsidiary of RHB Capital Berhad.<br />

Thailand<br />

This report is published and distributed in Thailand by <strong>OSK</strong> Securities (Thailand) PCL, a subsidiary of <strong>OSK</strong> Investment Bank Berhad,<br />

Malaysia, which in turn is a wholly-owned subsidiary of RHB Capital Berhad.<br />

Other Jurisdictions<br />

In any other jurisdictions, this report is intended to be distributed to qualified, accredited and professional investors, in compliance<br />

with the law and regulations of the jurisdictions.<br />

Kuala Lumpur Hong Kong Singapore<br />

Malaysia Research Office<br />

RHB Research Institute Sdn Bhd<br />

Level 11, Tower One, RHB Centre<br />

Jalan Tun Razak<br />

Kuala Lumpur<br />

Malaysia<br />

Tel : +(60) 3 9280 2185<br />

Fax : +(60) 3 9284 8693<br />

<strong>OSK</strong> Securities<br />

Hong Kong Ltd.<br />

12 th Floor<br />

World-Wide House<br />

19 Des Voeux Road<br />

Central, Hong Kong<br />

Tel : +(852) 2525 1118<br />

Fax : +(852) 2810 0908<br />

DMG & Partners<br />

Securities Pte. Ltd.<br />

10 Collyer Quay<br />

#09-08 Ocean Financial Centre<br />

Singapore 049315<br />

Tel : +(65) 6533 1818<br />

Fax : +(65) 6532 6211<br />

Jakarta Shanghai Phnom Penh<br />

PT <strong>OSK</strong> Nusadana<br />

Securities Indonesia<br />

Plaza CIMB Niaga<br />

14th Floor<br />

Jl. Jend. Sudirman Kav.25<br />

Jakarta Selatan 12920, Indonesia<br />

Tel : +(6221) 2598 6888<br />

Fax : +(6221) 2598 6777<br />

<strong>OSK</strong> (China) Investment<br />

Advisory Co. Ltd.<br />

Suite 4005, CITIC Square<br />

1168 Nanjing West Road<br />

Shanghai 20041<br />

China<br />

Tel : +(8621) 6288 9611<br />

Fax : +(8621) 6288 9633<br />

Bangkok<br />

<strong>OSK</strong> Securities (Thailand) PCL<br />

10th Floor ,Sathorn Square Office Tower<br />

98, North Sathorn Road,Silom<br />

Bangrak, Bangkok 10500<br />

Thailand<br />

Tel: +(66) 862 9999<br />

Fax : +(66) 108 0999<br />

<strong>OSK</strong> Indochina Securities Limited<br />

No. 1-3, Street 271<br />

Sangkat Toeuk Thla, Khan Sen Sok<br />

Phnom Penh<br />

Cambodia<br />

Tel: +(855) 23 969 161<br />

Fax: +(855) 23 969 171<br />

RHB Research | See important disclosures at the end of this report<br />

A comprehensive range of market research reports by award-winning economists and analysts are exclusively available for download from<br />

www.rhbinvest.com<br />

17