lease revenue refunding bonds - City of Norwalk

lease revenue refunding bonds - City of Norwalk

lease revenue refunding bonds - City of Norwalk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> Council February 19, 2013<br />

Resolution No. 13-13 - Issuance <strong>of</strong> Lease Revenue Refunding Page No. 4<br />

Bonds Series 2013A & 2013B<br />

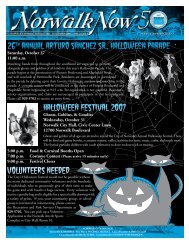

the 2013 Refunding Bonds will be $1.46 million through 2025 and then drop to $615,000<br />

(after the 2013B Bonds are paid <strong>of</strong>f) from 2026 to 2029. The 2013 Refunding Bonds will<br />

be structured to achieve level annual savings relative the original payment schedules for<br />

the 1999 and 2001 Bonds. There will be no change to the final maturity <strong>of</strong> <strong>bonds</strong> which<br />

will remain 2029.<br />

By taking advantage <strong>of</strong> low interest rates currently available in the market, the <strong>City</strong> will<br />

save about $106,000 annually from 2014 to 2025 and then $68,000 annually from 2026 to<br />

2029. Over the life <strong>of</strong> the 2013 Refunding Bonds, the <strong>City</strong> will save over $1.55 million in<br />

interest costs for the General Fund. In today’s dollars, this translates into over $1.36<br />

million <strong>of</strong> present value savings (equal to 8.97% <strong>of</strong> the refunded bond amount). Typically,<br />

municipal issuers set a minimum present value savings goal equal to 3% <strong>of</strong> the refunded<br />

bond amount to determine if a refinancing is worthwhile to pursue. As stipulated in the<br />

bond authorizing resolution, the 2013 Refunding Bonds must be sold at interest rates that<br />

produce at least 3% present value savings to the General Fund.<br />

Projected Annual Savings to the General Fund<br />

1.80<br />

$106K Annual Savings<br />

1.60<br />

1.40<br />

$ Millions<br />

1.20<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

$68K Annual Savings<br />

0.20<br />

0.00<br />

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028*<br />

New Debt Payment<br />

Existing Debt Payment<br />

fund.<br />

* The final payment in 2029 will be paid fully from the re<strong>lease</strong> <strong>of</strong> the bond reserve<br />

The total “all-in” cost <strong>of</strong> issuing the new <strong>refunding</strong> <strong>bonds</strong> is $375,000 or 2.39%, which has<br />

already been factored into the savings stated above.