lease revenue refunding bonds - City of Norwalk

lease revenue refunding bonds - City of Norwalk

lease revenue refunding bonds - City of Norwalk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CITY COUNCIL<br />

AGENDA REPORT<br />

TO:<br />

FROM:<br />

BY:<br />

Honorable <strong>City</strong> Council<br />

Michael J. Egan, <strong>City</strong> Manager<br />

Jana Stuard, Director <strong>of</strong> Finance/ Treasurer<br />

Date: February 19, 2013<br />

SUBJECT: RESOLUTION NO. 13-13 - APPROVING THE ISSUANCE OF LEASE<br />

REVENUE REFUNDING BONDS SERIES 2013A AND LEASE REVENUE<br />

REFUNDING BONDS SERIES 2013B, TO BE ISSUED BY THE<br />

NORWALK COMMUNITY FACILITIES FINANCING AUTHORITY,<br />

AUTHORIZING AND APPROVING A SITE AND FACILITY SUBLEASE, A<br />

LEASE AGREEMENT, A FIRST AMENDMENT TO LEASE AGREEMENT,<br />

TWO PRELIMINARY OFFICIAL STATEMENTS, TWO FINAL OFFICIAL<br />

STATEMENTS, TWO CONTINUING DISCLOSURE AGREEMENTS, AND<br />

TWO BOND PURCHASE AGREEMENTS; AND AUTHORIZING CERTAIN<br />

OTHER ACTIONS IN CONNECTION THEREWITH<br />

Background:<br />

As part <strong>of</strong> the <strong>City</strong>’s ongoing effort to implement budgetary savings and reduce costs, the<br />

<strong>City</strong> has the opportunity to refinance its 1999 and 2001 Lease Revenue Bonds. Due to<br />

historically low interest rates and the <strong>City</strong>’s good credit rating, the <strong>City</strong> can save about<br />

$1.55 million over the remaining life <strong>of</strong> the <strong>bonds</strong> by refinancing today. As part <strong>of</strong> the<br />

refinancing, the <strong>City</strong> will also be able to re<strong>lease</strong> the civic center parking garage as<br />

collateral pledged to the <strong>bonds</strong>.<br />

Summary <strong>of</strong> Bonds to Be Refinanced<br />

On August 5, 1999, the <strong>City</strong> approved the <strong>Norwalk</strong> Community Facilities Financing<br />

Authority’s (“Financing Authority”) issuance <strong>of</strong> the 1999 Lease Revenue Refunding Bonds<br />

(“1999 Bonds”) in the original amount <strong>of</strong> $10,200,000. The 1999 Bonds were originally<br />

issued to refinance existing 1990 Bonds and pay for capital costs related to the<br />

Transportation Office & Operations Facility and <strong>City</strong> Hall. The 1999 Bonds are currently<br />

outstanding in the amount <strong>of</strong> $7,295,000 with interest rates ranging from 5.10% –<br />

5.375%. The final term <strong>of</strong> the 1999 Bonds is February 1, 2029. The 1999 Bonds can<br />

now be prepaid on August 1, 2013 without any penalty.

<strong>City</strong> Council February 19, 2013<br />

Resolution No. 13-13 - Issuance <strong>of</strong> Lease Revenue Refunding Page No. 2<br />

Bonds Series 2013A & 2013B<br />

On October 31, 2001, the <strong>City</strong> approved the Financing Authority’s issuance <strong>of</strong> the<br />

Refunding Lease Revenue Bonds, 2001 Series A (“2001 Bonds”) in the original amount <strong>of</strong><br />

$12,795,000. The 2001 Bonds were originally issued to refinance existing 1995 Bonds<br />

and pay for construction <strong>of</strong> the civic center parking garage. The 2001 Bonds are currently<br />

outstanding in the amount <strong>of</strong> $7,945,000 with interest rates ranging from 4.125% - 5.25%.<br />

The final term <strong>of</strong> the 2001 Bonds is April 1, 2025. The 2001 Bonds can now be prepaid<br />

on October 1, 2013 without any penalty.<br />

Below is a summary <strong>of</strong> the key components <strong>of</strong> the 1999 Bonds and the 2001 Bonds:<br />

Series 1999 Bonds 2001 Bonds<br />

Amount Outstanding $7,295,000 $7,945,000<br />

Final Year <strong>of</strong> Payment 2029 2025<br />

Interest Rates 5.10% – 5.375% 4.125% – 5.25%<br />

Reserve Fund Cash Funded Bond Surety Policy<br />

Lease Asset <strong>City</strong> Hall Civic Center Parking<br />

Garage<br />

Earliest Prepayment August 1, 2013 October 1, 2013<br />

Date<br />

To Be Refinanced by Series 2013A Bonds Series 2013B Bonds<br />

Financing Structure<br />

The Financing Authority will issue about $15.7 million <strong>of</strong> <strong>refunding</strong> <strong>bonds</strong> to refinance the<br />

1999 and 2001 Bonds (“2013 Refunding Bonds”). The 2013 Refunding Bonds will be<br />

issued with the same final year <strong>of</strong> payment <strong>of</strong> 2025 and 2029 as the 1999 and 2001<br />

Bonds, respectively. The Financing Authority will need to issue the 2013 Refunding<br />

Bonds in two separate bond series (“2013A Bonds” and “2013B Bonds”, collectively the<br />

2013 Refunding Bonds) because each existing bond issue has a different prepayment<br />

date as set forth in the original financing documents.<br />

Like the 1999 and 2001 Bonds, the 2013 Refunding Bonds will be structured as a <strong>lease</strong><strong>lease</strong>back<br />

financing between the <strong>City</strong> and the Financing Authority. The Financing<br />

Authority is a <strong>City</strong>-controlled joint powers authority consisting <strong>of</strong> the <strong>City</strong> and the Parking<br />

Authority and was originally formed to facilitate bond financing. The Financing Authority<br />

has used the same financing structure for its prior <strong>lease</strong> <strong>revenue</strong> bond financings.<br />

Currently, the Financing Authority <strong>lease</strong>s the following assets from (and then back to) the<br />

<strong>City</strong>:<br />

- <strong>City</strong> Hall (<strong>lease</strong> asset for the 1999 Bonds); and<br />

- Civic Center Parking Garage (<strong>lease</strong> asset for the 2001 Bonds).

<strong>City</strong> Council February 19, 2013<br />

Resolution No. 13-13 - Issuance <strong>of</strong> Lease Revenue Refunding Page No. 3<br />

Bonds Series 2013A & 2013B<br />

The 2013 Refunding Bonds will be structured with only <strong>City</strong> Hall as the <strong>lease</strong> asset. The<br />

Civic Center Parking Garage will be re<strong>lease</strong>d from the <strong>bonds</strong> since <strong>City</strong> Hall has sufficient<br />

rental value to stand alone. The 2013 Refunding Bonds will use <strong>City</strong> Hall as the <strong>lease</strong><br />

asset in order to garner the highest credit rating possible leading to lower interest rates.<br />

The 2013 Refunding Bonds will be designed with a “master <strong>lease</strong>” bond structure. Under<br />

this structure, the Financing Authority will be allowed to issue additional <strong>lease</strong> <strong>bonds</strong><br />

secured by the single pool <strong>of</strong> <strong>lease</strong> assets so long as the rental value <strong>of</strong> the pool is<br />

sufficient to cover the existing and new <strong>bonds</strong>. The primary benefit <strong>of</strong> the master <strong>lease</strong><br />

structure is that it enables the <strong>City</strong> to pledge fewer assets over time to effectuate future<br />

<strong>lease</strong> financings. The <strong>City</strong> will have the flexibility to substitute, remove or add other assets<br />

over time under this new structure. The financing structure terms will be the same as the<br />

Financing Authority’s previous <strong>lease</strong> financings in all other respects.<br />

The 2013 Refunding Bonds will also be structured with a smaller bond reserve<br />

requirement equal to 50% <strong>of</strong> the maximum annual bond payment. Lease <strong>revenue</strong> <strong>bonds</strong><br />

are typically sold with a larger bond reserve equal 100% <strong>of</strong> maximum annual bond<br />

payment. However, based on the <strong>City</strong>’s strong financial pr<strong>of</strong>ile, the 2013 Refunding<br />

Bonds will be structured with the lower amount to save on financing costs. Depending the<br />

credit rating outcome and market conditions, the 2013 Refunding Bonds may need to be<br />

structured with a standard reserve requirement equal to 100% <strong>of</strong> the maximum annual<br />

bond payment.<br />

Finance Team<br />

Fulbright & Jaworski LLP will serve as Bond Counsel. Harrell & Company Advisors, LLC<br />

will serve as financial advisor for the proposed bond refinancing. E. J. De La Rosa &<br />

Company will serve as underwriter for the <strong>bonds</strong> which will be sold on a negotiated basis.<br />

Stradling Yocca Carlson & Rauth will serve as Underwriter’s Counsel. Bank <strong>of</strong> New York<br />

Mellon Trust Company will serve as the bond trustee and escrow agent.<br />

Fiscal Impact:<br />

Based on current rates, the <strong>City</strong> will issue about $15.7 million <strong>of</strong> 2013 Refunding Bonds.<br />

The bond authorizing resolution has a combined not-to-exceed issuance amount <strong>of</strong> $20<br />

million for both series <strong>of</strong> proposed <strong>bonds</strong> which provides additional cushion to<br />

accommodate a larger bond reserve sizing and structuring flexibility to achieve the lowest<br />

interest rates.<br />

The 2013 Refunding Bonds are currently projected to be rated “A+” by the Standard &<br />

Poor’s rating agency. Based on current market conditions, the interest rates are expected<br />

to range from 1.20% - 4.10%. The average bond payment is estimated to be $615,000<br />

and $846,000 for the 2013A and 2013B Bonds, respectively. The total bond payment for

<strong>City</strong> Council February 19, 2013<br />

Resolution No. 13-13 - Issuance <strong>of</strong> Lease Revenue Refunding Page No. 4<br />

Bonds Series 2013A & 2013B<br />

the 2013 Refunding Bonds will be $1.46 million through 2025 and then drop to $615,000<br />

(after the 2013B Bonds are paid <strong>of</strong>f) from 2026 to 2029. The 2013 Refunding Bonds will<br />

be structured to achieve level annual savings relative the original payment schedules for<br />

the 1999 and 2001 Bonds. There will be no change to the final maturity <strong>of</strong> <strong>bonds</strong> which<br />

will remain 2029.<br />

By taking advantage <strong>of</strong> low interest rates currently available in the market, the <strong>City</strong> will<br />

save about $106,000 annually from 2014 to 2025 and then $68,000 annually from 2026 to<br />

2029. Over the life <strong>of</strong> the 2013 Refunding Bonds, the <strong>City</strong> will save over $1.55 million in<br />

interest costs for the General Fund. In today’s dollars, this translates into over $1.36<br />

million <strong>of</strong> present value savings (equal to 8.97% <strong>of</strong> the refunded bond amount). Typically,<br />

municipal issuers set a minimum present value savings goal equal to 3% <strong>of</strong> the refunded<br />

bond amount to determine if a refinancing is worthwhile to pursue. As stipulated in the<br />

bond authorizing resolution, the 2013 Refunding Bonds must be sold at interest rates that<br />

produce at least 3% present value savings to the General Fund.<br />

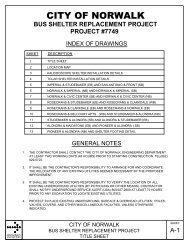

Projected Annual Savings to the General Fund<br />

1.80<br />

$106K Annual Savings<br />

1.60<br />

1.40<br />

$ Millions<br />

1.20<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

$68K Annual Savings<br />

0.20<br />

0.00<br />

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028*<br />

New Debt Payment<br />

Existing Debt Payment<br />

fund.<br />

* The final payment in 2029 will be paid fully from the re<strong>lease</strong> <strong>of</strong> the bond reserve<br />

The total “all-in” cost <strong>of</strong> issuing the new <strong>refunding</strong> <strong>bonds</strong> is $375,000 or 2.39%, which has<br />

already been factored into the savings stated above.

<strong>City</strong> Council February 19, 2013<br />

Resolution No. 13-13 - Issuance <strong>of</strong> Lease Revenue Refunding Page No. 5<br />

Bonds Series 2013A & 2013B<br />

Schedule<br />

The <strong>City</strong> plans to execute the refinancings based on the following schedule:<br />

Milestone<br />

2013A Lease<br />

Bonds<br />

2013B Lease<br />

Bonds<br />

Council approval <strong>of</strong> refinancing and<br />

related documents<br />

Feb. 19<br />

Sell <strong>bonds</strong> (i.e. set interest rates) April 10 April 25<br />

Close <strong>bonds</strong> May 3 July 3<br />

Pay <strong>of</strong>f the prior <strong>bonds</strong> August 1 October 1<br />

Note: Dates are subject to change based on market conditions.<br />

Citizens Advised: N/A<br />

Strategic Plan Implementation: Vision 6, Strategy 4<br />

Recommended Action:<br />

Staff recommends <strong>City</strong> Council adopt Resolution No.13-13 approving the issuance <strong>of</strong><br />

Lease Revenue Refunding Bonds, Series 2013 A and Lease Revenue Refunding Bonds,<br />

Series 2013B, to be issued by the <strong>Norwalk</strong> Community Facilities Financing Authority,<br />

authorizing and approving a Site and Facility Sub<strong>lease</strong>, a Lease Agreement, a First<br />

Amendment to Lease Agreement, two Preliminary Official Statements, two Final Official<br />

Statements, two Continuing Disclosure Agreements, and two Bond Purchase<br />

Agreements; and authorizing certain other actions in connection therewith.<br />

Attachments:<br />

1. Resolution No. 13-13<br />

THE FOLLOWING DOCUMENTS ARE ON FILE IN THE CITY CLERK’S DEPARTMENT<br />

2. Site and Facilities Sub<strong>lease</strong> Dated as <strong>of</strong> March 1, 2013 by and between the <strong>City</strong> <strong>of</strong><br />

<strong>Norwalk</strong> and the <strong>Norwalk</strong> Community Facilities Financing Authority.<br />

3. Lease Agreement Dated as <strong>of</strong> March 1, 2013 by and between the <strong>City</strong> <strong>of</strong> <strong>Norwalk</strong><br />

and the <strong>Norwalk</strong> Community Facilities Financing Authority.<br />

4. First Amendment to Lease Agreement Dated as <strong>of</strong> May 1, 2013 by and between the<br />

<strong>City</strong> <strong>of</strong> <strong>Norwalk</strong> and the <strong>Norwalk</strong> Community Facilities Financing Authority.<br />

(Document provided with the NCFFA packet)

<strong>City</strong> Council February 19, 2013<br />

Resolution No. 13-13 - Issuance <strong>of</strong> Lease Revenue Refunding Page No. 6<br />

Bonds Series 2013A & 2013B<br />

5. Preliminary Official Statement relating to the <strong>Norwalk</strong> Community Facilities<br />

Financing Authority Lease Revenue Bonds, Series 2013A. (Document provided with<br />

the NCFFA packet)<br />

6. Preliminary Official Statement relating to the <strong>Norwalk</strong> Community Facilities<br />

Financing Authority Lease Revenue Bonds, Series 2013B. (Document provided with<br />

the NCFFA packet)<br />

7. <strong>Norwalk</strong> Community Facilities Financing Authority Lease Revenue Bonds, Series<br />

2013A Bond Purchase Agreement. (Document provided with the NCFFA packet)<br />

8. <strong>Norwalk</strong> Community Facilities Financing Authority Lease Revenue Bonds, Series<br />

2013B Bond Purchase Agreement. (Document provided with the NCFFA packet)<br />

9. Continuing Disclosure Agreement relating to the <strong>Norwalk</strong> Community Facilities<br />

Financing Authority Lease Revenue Bonds, Series 2013A.<br />

10. Continuing Disclosure Agreement relating to the <strong>Norwalk</strong> Community Facilities<br />

Financing Authority Lease Revenue Bonds, Series 2013B.

RESOLUTION NO. 13-13<br />

A RESOLUTION OF THE CITY COUNCIL OF THE CITY OF NORWALK,<br />

APPROVING THE ISSUANCE OF LEASE REVENUE REFUNDING<br />

BONDS SERIES 2013A AND LEASE REVENUE REFUNDING BONDS<br />

SERIES 2013B, TO BE ISSUED BY THE NORWALK COMMUNITY<br />

FACILITIES FINANCING AUTHORITY, AUTHORIZING AND<br />

APPROVING A SITE AND FACILITY SUBLEASE, A LEASE<br />

AGREEMENT, A FIRST AMENDMENT TO LEASE AGREEMENT, TWO<br />

PRELIMINARY OFFICIAL STATEMENTS, TWO FINAL OFFICIAL<br />

STATEMENTS, TWO CONTINUING DISCLOSURE AGREEMENTS,<br />

AND TWO BOND PURCHASE AGREEMENTS; AND AUTHORIZING<br />

CERTAIN OTHER ACTIONS IN CONNECTION THEREWITH<br />

WHEREAS, the <strong>City</strong> <strong>of</strong> <strong>Norwalk</strong>, California (the “<strong>City</strong>”) and the <strong>Norwalk</strong> Parking<br />

Authority have heret<strong>of</strong>ore entered into that certain Joint Exercise <strong>of</strong> Powers Agreement,<br />

dated as <strong>of</strong> August 1, 1989 establishing the <strong>Norwalk</strong> Community Facilities Financing<br />

Authority (the “Authority”) for the purpose, among other things, <strong>of</strong> issuing its <strong>bonds</strong> to be<br />

used to provide financing and refinancing for public capital improvements <strong>of</strong> the <strong>City</strong>;<br />

and<br />

WHEREAS, the Authority has previously issued its 1999 Lease Revenue<br />

Refunding Bonds (together, the “1999 Bonds”); and<br />

WHEREAS, in 1999 the <strong>City</strong> and the Authority entered into a <strong>lease</strong> agreement<br />

(the “1999 Lease”), under which the <strong>City</strong> agreed to make base rental payments to the<br />

Authority; and<br />

WHEREAS, pursuant to the 1999 Lease, the <strong>City</strong> has the right to prepay its base<br />

rental payments under the 1999 Lease in an amount sufficient to refund and defease<br />

the 1999 Bonds; and<br />

WHEREAS, the Authority has previously issued its Lease Revenue Bonds<br />

(Parking Improvements Project) 2001 Series A (the “2001 Bonds” and, together with the<br />

1999 Bonds, the “Prior Bonds”); and<br />

WHEREAS, in 2001 the <strong>City</strong> and the Authority entered into a <strong>lease</strong> agreement<br />

(the “2001 Lease”), under which the <strong>City</strong> agreed to make base rental payments to the<br />

Authority; and<br />

WHEREAS, pursuant to the 2001 Lease, the <strong>City</strong> has the right to prepay its base<br />

rental payments under the 2001 Lease in an amount sufficient to refund and defease<br />

the 2001 Bonds; and<br />

WHEREAS, the <strong>City</strong> finds it necessary and desirable to exercise its right under<br />

the 1999 Lease and the 2001 Lease and prepay the remaining unpaid base rental<br />

payments under such <strong>lease</strong>s to realize net present value savings; and

WHEREAS, the <strong>City</strong> has requested that the Authority issue its Lease Revenue<br />

Refunding Bonds Series 2013A (the “2013A Bonds”) and Lease Revenue Refunding<br />

Bonds Series 2013B (the “2013B Bonds” and, together with the 2013A Bonds, the<br />

“Bonds”); and<br />

WHEREAS, the Bonds are to be issued pursuant an Indenture (the “Indenture”),<br />

by and between the Authority and a trustee, and pursuant to the Marks-Roos Local<br />

Bond Pooling Act <strong>of</strong> 1985 (the “Act”), constituting Article 4 (commencing with Section<br />

6584) <strong>of</strong> Chapter 5 <strong>of</strong> Division 7 <strong>of</strong> Title 1 <strong>of</strong> the Government Code <strong>of</strong> the State <strong>of</strong><br />

California and, with respect to the 2013B Bonds, a First Supplemental Indenture; and<br />

WHEREAS, it is proposed that the Bonds be sold on a negotiated basis in<br />

accordance with the terms and provisions <strong>of</strong> bond purchase agreements among the<br />

Authority, the <strong>City</strong> and E. J. De La Rosa & Co., Inc., as underwriter for the 2013A Bonds<br />

and the 2013B Bonds (the “Bond Purchase Agreements”), the proposed forms <strong>of</strong> which<br />

have been presented to this <strong>City</strong> Council; and<br />

WHEREAS, it is proposed that the <strong>City</strong> and the Authority enter into one or more<br />

escrow agreements with an escrow agent to be selected by the <strong>City</strong> (the “Escrow<br />

Agreements”) related to the <strong>refunding</strong> and defeasance <strong>of</strong> the 1999 Bonds and/or the<br />

2001 Bonds, the form <strong>of</strong> which is on file with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong>; and<br />

WHEREAS, it is proposed that the <strong>City</strong> and the Authority enter into a Site and<br />

Facility Sub<strong>lease</strong> (the “Site Lease”) pursuant to which the <strong>City</strong> will <strong>lease</strong> the parking<br />

facility adjacent to the <strong>City</strong>’s Civic Center, <strong>City</strong> Hall or such other property <strong>of</strong> the <strong>City</strong> as<br />

an Authorized Officer (defined hereafter) shall designate (the “Leased Property”) to the<br />

Authority; and<br />

WHEREAS, it is proposed that the <strong>City</strong> and the Authority enter into a Lease<br />

Agreement (the “Lease”) pursuant to which <strong>City</strong> will <strong>lease</strong> back the Leased Property<br />

from the Authority, the form <strong>of</strong> which is on file with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong>; and<br />

WHEREAS, it is proposed that the <strong>City</strong> and the Authority enter into a First<br />

Amendment to Lease Agreement that amends the Lease with respect to the 2013B<br />

Bonds, the form <strong>of</strong> which is on file with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong>; and<br />

WHEREAS, under the Lease and the First Amendment to Lease Agreement, the<br />

<strong>City</strong> will be obligated to make base rental payments to the Authority which the Authority<br />

will use to pay debt service on the Bonds; and<br />

WHEREAS, to fulfill the requirements <strong>of</strong> Rule 15c2-12 promulgated under the<br />

Securities Exchange Act <strong>of</strong> 1934, as amended (the “Rule”), the <strong>City</strong> will enter into<br />

Continuing Disclosure Agreements (the “Continuing Disclosure Agreements”), with<br />

respect to the 2013A Bonds and the 2013B Bonds, respectively, whereby the <strong>City</strong> will<br />

agree to provide disclosure reports and notices <strong>of</strong> certain enumerated events pursuant<br />

to the Rule; and<br />

Resolution No. 13-13 Page 2 <strong>of</strong> 6

WHEREAS, there have been presented to this meeting the proposed forms <strong>of</strong><br />

the following documents:<br />

a) the Site Lease;<br />

b) the Lease;<br />

c) the First Amendment to Lease Agreement;<br />

d) the form <strong>of</strong> Escrow Agreement;<br />

e) the Continuing Disclosure Agreements;<br />

f) the Preliminary Official Statements; and<br />

g) the Bond Purchase Agreements.<br />

WHEREAS, the <strong>City</strong> Council has reviewed the documentation related to the<br />

issuance <strong>of</strong> the Bonds, which documentation is on file with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong> <strong>of</strong><br />

<strong>Norwalk</strong>;<br />

NOW, THEREFORE, THE CITY COUNCIL OF THE CITY HEREBY<br />

DETERMINES, FINDS, AND RESOLVES AS FOLLOWS:<br />

Section 1. Approval <strong>of</strong> Recitals. The <strong>City</strong> hereby finds and determines that the<br />

foregoing recitals are true and correct.<br />

Section 2. Approval <strong>of</strong> Bonds. The <strong>City</strong> hereby authorizes the prepayment <strong>of</strong><br />

the base rental payments in accordance with the 1999 Lease and/or the 2001 Lease,<br />

approves the <strong>refunding</strong> and defeasance <strong>of</strong> all or a portion <strong>of</strong> the Prior Bonds and hereby<br />

approves the issuance by the Authority <strong>of</strong> the Bonds. The 2013A Bonds and the 2013B<br />

Bonds are hereby approved to refund and defease the 1999 Bonds and/or the 2001<br />

Bonds.<br />

Section 3. Approval <strong>of</strong> Site Lease. The Site Lease, in substantially the form on<br />

file with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong> and presented to the <strong>City</strong> Council at this meeting, is<br />

hereby approved. Any one <strong>of</strong> the Mayor, the Vice Mayor in the Mayor’s absence, or the<br />

<strong>City</strong> Manager <strong>of</strong> the <strong>City</strong> (each, an “Authorized Officer”), is hereby authorized and<br />

directed, for and in the name and on behalf <strong>of</strong> the <strong>City</strong>, to execute and deliver, the Site<br />

Lease, with such insertions and changes as may be approved by the Authorized Officer<br />

executing the same, subject to the provisions <strong>of</strong> this Resolution, such approval to be<br />

conclusively evidenced by such execution and delivery, and the <strong>City</strong> Clerk is hereby<br />

authorized to attest to such execution.<br />

Section 4. Approval <strong>of</strong> the Lease. The Lease, in substantially the form on file<br />

with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong> and presented to the <strong>City</strong> Council at this meeting, is<br />

hereby approved. Any Authorized Officer is hereby authorized to execute the Lease in<br />

substantially the form on file, with such revisions, amendments and completions as shall<br />

Resolution No. 13-13 Page 3 <strong>of</strong> 6

e approved by an Authorized Officer, such approval to be conclusively evidenced by<br />

the execution and delivery there<strong>of</strong>, and the <strong>City</strong> Clerk is hereby authorized to attest to<br />

such execution.<br />

Section 5. Approval <strong>of</strong> the First Amendment to Lease Agreement. The First<br />

Amendment to Lease Agreement, in substantially the form on file with the <strong>City</strong> Clerk <strong>of</strong><br />

the <strong>City</strong> and presented to the <strong>City</strong> Council at this meeting, is hereby approved. Any<br />

Authorized Officer is hereby authorized to execute the First Amendment to Lease<br />

Agreement in substantially the form on file, with such revisions, amendments and<br />

completions as shall be approved by an Authorized Officer, such approval to be<br />

conclusively evidenced by the execution and delivery there<strong>of</strong>, and the <strong>City</strong> Clerk is<br />

hereby authorized to attest to such execution.<br />

Section 6. Approval <strong>of</strong> the form <strong>of</strong> Escrow Agreement. The form <strong>of</strong> Escrow<br />

Agreement, in substantially the form on file with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong> and presented<br />

to the <strong>City</strong> Council at this meeting, is hereby approved. Any Authorized Officer is hereby<br />

authorized to execute the one or more Escrow Agreements in connection with the<br />

<strong>refunding</strong> and defeasance <strong>of</strong> the 1999 Bonds and/or the 2001 Bonds in substantially the<br />

form on file, with such revisions, amendments and completions as shall be approved by<br />

an Authorized Officer, such approval to be conclusively evidenced by the execution and<br />

delivery there<strong>of</strong>, and the <strong>City</strong> Clerk is hereby authorized to attest to such execution.<br />

Section 7. Approval <strong>of</strong> the Preliminary Official Statements and the Official<br />

Statements. The Preliminary Official Statements, in substantially the forms on file with<br />

the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong> and presented to the <strong>City</strong> Council at this meeting, are hereby<br />

approved with such revisions, amendments and completions as shall be approved by an<br />

Authorized Officer, in order to make the Preliminary Official Statement final as <strong>of</strong> its<br />

date, except for the omission <strong>of</strong> certain information, as permitted by Section 240.15c2-<br />

12(b)(1) <strong>of</strong> Title 17 <strong>of</strong> the Code <strong>of</strong> Federal Regulations (“Rule 15c2-12”). Any <strong>of</strong> the<br />

Authorized Officers is authorized to execute a certificate relating to the finality <strong>of</strong> the<br />

Preliminary Official Statements under Rule 15c2-12. An Authorized Officer is authorized<br />

and directed to execute and deliver the final Official Statements in substantially the<br />

forms hereby approved, with such additions and changes as may be approved by the<br />

Authorized Officer executing the same, such approval to be conclusively evidenced by<br />

the execution and delivery there<strong>of</strong>.<br />

Section 8. Approval <strong>of</strong> the Continuing Disclosure Agreements. The Continuing<br />

Disclosure Agreements, in substantially the forms on file with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong><br />

and presented to the <strong>City</strong> Council at this meeting, are hereby approved. Any Authorized<br />

Officer is hereby authorized to execute the Continuing Disclosure Agreements in<br />

substantially the forms on file, with such revisions, amendments and completions as<br />

shall be approved by an Authorized Officer, such approval to be conclusively evidenced<br />

by the execution and delivery there<strong>of</strong>.<br />

Section 9. Approval <strong>of</strong> Bond Purchase Agreements. The <strong>City</strong> hereby authorizes<br />

and directs that the Bonds be sold on a negotiated basis. Any Authorized Officer is<br />

hereby authorized to undertake all appropriate steps to implement the sale <strong>of</strong> the<br />

Resolution No. 13-13 Page 4 <strong>of</strong> 6

Bonds. The total principal amount <strong>of</strong> 2013A Bonds shall not exceed $10,000,000 and<br />

the Underwriter’s discount or fee (excluding any original issue discount) shall not<br />

exceed 1.60% <strong>of</strong> the original principal amount <strong>of</strong> the 2013A Bonds. The total principal<br />

amount <strong>of</strong> 2013B Bonds shall not exceed $10,000,000 and the Underwriter’s discount<br />

or fee (excluding any original issue discount) shall not exceed 1.60% <strong>of</strong> the original<br />

principal amount <strong>of</strong> the 2013B Bonds. The net present value savings for a <strong>refunding</strong><br />

accomplished with a portion <strong>of</strong> the proceeds <strong>of</strong> the 2013A Bonds or the 2013B Bonds<br />

shall be no less than 3.00%. The Bond Purchase Agreements, in substantially the forms<br />

on file with the <strong>City</strong> Clerk <strong>of</strong> the <strong>City</strong> and presented to the <strong>City</strong> Council at this meeting,<br />

are hereby approved. Any one <strong>of</strong> the Authorized Officers is hereby authorized and<br />

directed, for and in the name and on behalf <strong>of</strong> the <strong>City</strong>, to execute and deliver each<br />

Bond Purchase Agreement, with such insertions and changes as may be approved by<br />

the Authorized Officer executing the same, subject to the provisions <strong>of</strong> this Resolution,<br />

such approval to be conclusively evidenced by such execution and delivery.<br />

Section 10. Official Actions. The Authorized Officers, the <strong>City</strong> Clerk and all<br />

other <strong>of</strong>ficers <strong>of</strong> the <strong>City</strong> are hereby authorized and directed, for and in the name and on<br />

behalf <strong>of</strong> the <strong>City</strong>, to do any and all things and take any and all other actions, including<br />

the publication <strong>of</strong> any notices necessary or desirable in connection with the sale <strong>of</strong> the<br />

Bonds, procurement <strong>of</strong> municipal bond insurance, and execution and delivery <strong>of</strong> any<br />

and all assignments, certificates, requisitions, agreements, notices, consents,<br />

instruments <strong>of</strong> conveyance, warrants and other documents, which they, or any <strong>of</strong> them,<br />

deem necessary or advisable to consummate the lawful issuance and sale <strong>of</strong> the Bonds<br />

and the consummation <strong>of</strong> the transactions as described herein.<br />

Section 11. Ratification. All actions heret<strong>of</strong>ore taken by any Responsible Officer<br />

or any <strong>of</strong>ficer, employee or agent <strong>of</strong> the <strong>City</strong> with respect to the issuance, delivery and<br />

sale <strong>of</strong> the Bonds or in connection with or related to any <strong>of</strong> the agreements referred to<br />

herein, are hereby approved, confirmed and ratified.<br />

Section 12. Effective Date. This Resolution shall become effective immediately<br />

upon adoption.<br />

Section 13. Certification. The <strong>City</strong> Clerk shall certify to the adoption <strong>of</strong> this<br />

Resolution, and thenceforth and thereafter the same shall be in full force and effect.<br />

Notwithstanding the foregoing, such certification and any <strong>of</strong> the other duties and<br />

responsibilities assigned to the <strong>City</strong> Clerk pursuant to this Resolution may be performed<br />

by a Deputy <strong>City</strong> Clerk with the same force and effect as if performed by the <strong>City</strong> Clerk<br />

hereunder.<br />

Resolution No. 13-13 Page 5 <strong>of</strong> 6

PASSED AND ADOPTED on this 19 th day <strong>of</strong> February 2013.<br />

CHERI KELLEY<br />

MAYOR<br />

ATTEST:<br />

____________________________________<br />

THERESA DEVOY<br />

CITY CLERK<br />

Resolution No. 13-13 Page 6 <strong>of</strong> 6