Institutional Equities - Online Share Trading

Institutional Equities - Online Share Trading

Institutional Equities - Online Share Trading

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Institutional</strong> <strong>Equities</strong><br />

1QFY12 performance<br />

Revenue growth was flat due to lower sub-contracting of large projects (sub-contractors are not getting<br />

sufficient funds from banks). Project execution rate declined by 5-10%, implying loss of revenue worth Rs<br />

2bn.<br />

EBITDA margin slipped by 170bps to 7.4% due to slower project execution, sharp increase in raw material<br />

costs and non-billing of some water segment projects, where billing of cost escalation is allowed only after<br />

24 months.<br />

Net profit declined by 85% to Rs42mn due to lower EBITDA margin and higher interest costs.<br />

Current order book at Rs230bn (includes L1 orders worth Rs23 bn and removal of Saudi Arabia project<br />

worth Rs19 bn), is down 9.8% YoY. Water and irrigation projects accounted for 38% of the order book,<br />

followed by 22% share of building projects and 29% of transportation projects.<br />

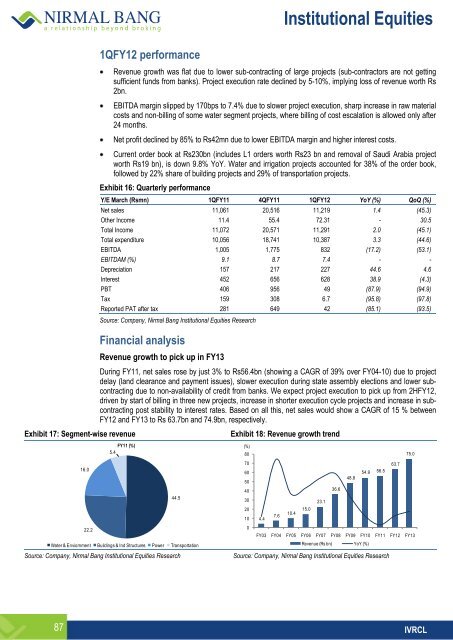

Exhibit 16: Quarterly performance<br />

Y/E March (Rsmn) 1QFY11 4QFY11 1QFY12 YoY (%) QoQ (%)<br />

Net sales 11,061 20,516 11,219 1.4 (45.3)<br />

Other Income 11.4 55.4 72.31 - 30.5<br />

Total Income 11,072 20,571 11,291 2.0 (45.1)<br />

Total expenditure 10,056 18,741 10,387 3.3 (44.6)<br />

EBITDA 1,005 1,775 832 (17.2) (53.1)<br />

EBITDAM (%) 9.1 8.7 7.4 - -<br />

Depreciation 157 217 227 44.6 4.6<br />

Interest 452 656 628 38.9 (4.3)<br />

PBT 406 956 49 (87.9) (94.9)<br />

Tax 159 308 6.7 (95.8) (97.8)<br />

Reported PAT after tax 281 649 42 (85.1) (93.5)<br />

Source: Company, Nirmal Bang <strong>Institutional</strong> <strong>Equities</strong> Research<br />

Financial analysis<br />

Revenue growth to pick up in FY13<br />

During FY11, net sales rose by just 3% to Rs56.4bn (showing a CAGR of 39% over FY04-10) due to project<br />

delay (land clearance and payment issues), slower execution during state assembly elections and lower subcontracting<br />

due to non-availability of credit from banks. We expect project execution to pick up from 2HFY12,<br />

driven by start of billing in three new projects, increase in shorter execution cycle projects and increase in subcontracting<br />

post stability to interest rates. Based on all this, net sales would show a CAGR of 15 % between<br />

FY12 and FY13 to Rs 63.7bn and 74.9bn, respectively.<br />

Exhibit 17: Segment-wise revenue<br />

16.0<br />

22.2<br />

FY11 (%)<br />

5.4<br />

44.5<br />

Water & Enviornment Buildings & Ind Structures Power Transportation<br />

Source: Company, Nirmal Bang <strong>Institutional</strong> <strong>Equities</strong> Research<br />

Exhibit 18: Revenue growth trend<br />

(%)<br />

80<br />

75.0<br />

70<br />

63.7<br />

60<br />

54.9 56.5<br />

48.8<br />

50<br />

40<br />

36.6<br />

30<br />

23.1<br />

20<br />

15.0<br />

10.4<br />

7.6<br />

10 4.4<br />

0<br />

FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13<br />

Revenue (Rs bn) YoY (%)<br />

Source: Company, Nirmal Bang <strong>Institutional</strong> <strong>Equities</strong> Research<br />

87 IVRCL