Institutional Equities - Online Share Trading

Institutional Equities - Online Share Trading

Institutional Equities - Online Share Trading

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Institutional</strong> <strong>Equities</strong><br />

Investment Arguments<br />

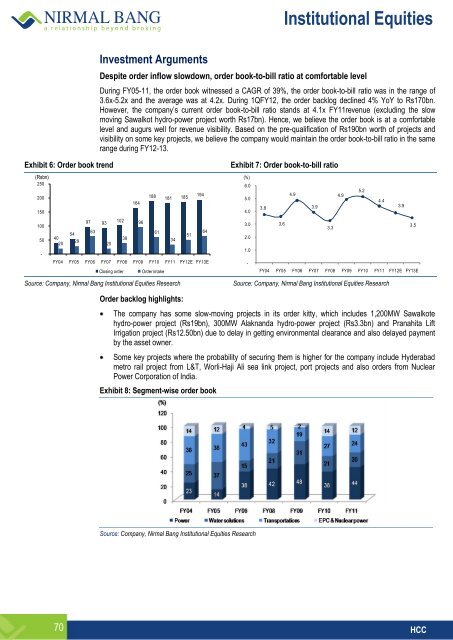

Despite order inflow slowdown, order book-to-bill ratio at comfortable level<br />

During FY05-11, the order book witnessed a CAGR of 39%, the order book-to-bill ratio was in the range of<br />

3.6x-5.2x and the average was at 4.2x. During 1QFY12, the order backlog declined 4% YoY to Rs170bn.<br />

However, the company’s current order book-to-bill ratio stands at 4.1x FY11revenue (excluding the slow<br />

moving Sawalkot hydro-power project worth Rs17bn). Hence, we believe the order book is at a comfortable<br />

level and augurs well for revenue visibility. Based on the pre-qualification of Rs190bn worth of projects and<br />

visibility on some key projects, we believe the company would maintain the order book-to-bill ratio in the same<br />

range during FY12-13.<br />

Exhibit 6: Order book trend<br />

(Rsbn)<br />

250<br />

200<br />

150<br />

97 93<br />

102<br />

100<br />

63<br />

54<br />

50<br />

40<br />

39<br />

20<br />

29<br />

20<br />

-<br />

188<br />

194<br />

181 185<br />

164<br />

96<br />

61<br />

64<br />

51<br />

34<br />

FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12E FY13E<br />

Closing order Order intake<br />

Source: Company, Nirmal Bang <strong>Institutional</strong> <strong>Equities</strong> Research<br />

Exhibit 7: Order book-to-bill ratio<br />

(%)<br />

6.0<br />

5.2<br />

5.0<br />

4.9<br />

4.9<br />

4.4<br />

3.8<br />

3.9<br />

3.9<br />

4.0<br />

3.0<br />

3.6<br />

3.3<br />

3.5<br />

2.0<br />

1.0<br />

-<br />

FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12E FY13E<br />

Source: Company, Nirmal Bang <strong>Institutional</strong> <strong>Equities</strong> Research<br />

Order backlog highlights:<br />

The company has some slow-moving projects in its order kitty, which includes 1,200MW Sawalkote<br />

hydro-power project (Rs19bn), 300MW Alaknanda hydro-power project (Rs3.3bn) and Pranahita Lift<br />

Irrigation project (Rs12.50bn) due to delay in getting environmental clearance and also delayed payment<br />

by the asset owner.<br />

Some key projects where the probability of securing them is higher for the company include Hyderabad<br />

metro rail project from L&T, Worli-Haji Ali sea link project, port projects and also orders from Nuclear<br />

Power Corporation of India.<br />

Exhibit 8: Segment-wise order book<br />

Source: Company, Nirmal Bang <strong>Institutional</strong> <strong>Equities</strong> Research<br />

70 HCC