Institutional Equities - Online Share Trading

Institutional Equities - Online Share Trading

Institutional Equities - Online Share Trading

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Institutional</strong> <strong>Equities</strong><br />

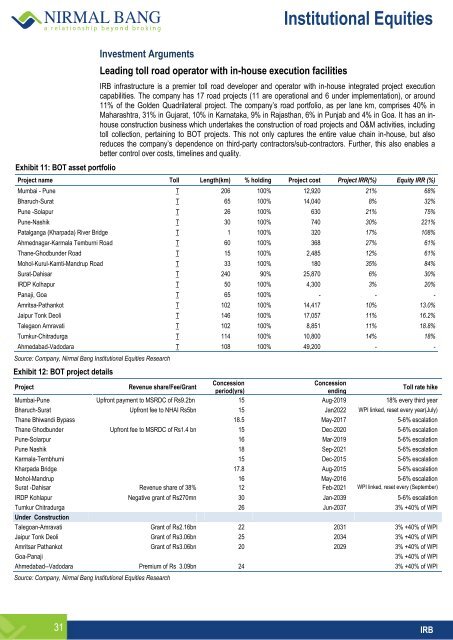

Exhibit 11: BOT asset portfolio<br />

Investment Arguments<br />

Leading toll road operator with in-house execution facilities<br />

IRB infrastructure is a premier toll road developer and operator with in-house integrated project execution<br />

capabilities. The company has 17 road projects (11 are operational and 6 under implementation), or around<br />

11% of the Golden Quadrilateral project. The company’s road portfolio, as per lane km, comprises 40% in<br />

Maharashtra, 31% in Gujarat, 10% in Karnataka, 9% in Rajasthan, 6% in Punjab and 4% in Goa. It has an inhouse<br />

construction business which undertakes the construction of road projects and O&M activities, including<br />

toll collection, pertaining to BOT projects. This not only captures the entire value chain in-house, but also<br />

reduces the company’s dependence on third-party contractors/sub-contractors. Further, this also enables a<br />

better control over costs, timelines and quality.<br />

Project name Toll Length(km) % holding Project cost Project IRR(%) Equity IRR (%)<br />

Mumbai - Pune T 206 100% 12,920 21% 68%<br />

Bharuch-Surat T 65 100% 14,040 8% 32%<br />

Pune -Solapur T 26 100% 630 21% 75%<br />

Pune-Nashik T 30 100% 740 30% 221%<br />

Patalganga (Kharpada) River Bridge T 1 100% 320 17% 108%<br />

Ahmednagar-Karmala Temburni Road T 60 100% 368 27% 61%<br />

Thane-Ghodbunder Road T 15 100% 2,485 12% 61%<br />

Mohol-Kurul-Kamti-Mandrup Road T 33 100% 180 35% 84%<br />

Surat-Dahisar T 240 90% 25,870 6% 30%<br />

IRDP Kolhapur T 50 100% 4,300 3% 20%<br />

Panaji, Goa T 65 100% - - -<br />

Amritsa-Pathankot T 102 100% 14,417 10% 13.0%<br />

Jaipur Tonk Deoli T 146 100% 17,057 11% 16.2%<br />

Talegaon Amravati T 102 100% 8,851 11% 18.8%<br />

Tumkur-Chitradurga T 114 100% 10,800 14% 18%<br />

Ahmedabad-Vadodara T 108 100% 49,200 - -<br />

Source: Company, Nirmal Bang <strong>Institutional</strong> <strong>Equities</strong> Research<br />

Exhibit 12: BOT project details<br />

Project<br />

Revenue share/Fee/Grant<br />

Concession<br />

Concession<br />

period(yrs)<br />

ending<br />

Toll rate hike<br />

Mumbai-Pune Upfront payment to MSRDC of Rs9.2bn 15 Aug-2019 18% every third year<br />

Bharuch-Surat Upfront fee to NHAI Rs5bn 15 Jan2022 WPI linked, reset every year(July)<br />

Thane Bhiwandi Bypass 18.5 May-2017 5-6% escalation<br />

Thane Ghodbunder Upfront fee to MSRDC of Rs1.4 bn 15 Dec-2020 5-6% escalation<br />

Pune-Solarpur 16 Mar-2019 5-6% escalation<br />

Pune Nashik 18 Sep-2021 5-6% escalation<br />

Karmala-Tembhurni 15 Dec-2015 5-6% escalation<br />

Kharpada Bridge 17.8 Aug-2015 5-6% escalation<br />

Mohol-Mandrup 16 May-2016 5-6% escalation<br />

Surat -Dahisar Revenue share of 38% 12 Feb-2021 WPI linked, reset every (September)<br />

IRDP Kohlapur Negative grant of Rs270mn 30 Jan-2039 5-6% escalation<br />

Tumkur Chitradurga 26 Jun-2037 3% +40% of WPI<br />

Under Construction<br />

Talegoan-Amravati Grant of Rs2.16bn 22 2031 3% +40% of WPI<br />

Jaipur Tonk Deoli Grant of Rs3.06bn 25 2034 3% +40% of WPI<br />

Amritsar Pathankot Grant of Rs3.06bn 20 2029 3% +40% of WPI<br />

Goa-Panaji<br />

3% +40% of WPI<br />

Ahmedabad--Vadodara Premium of Rs 3.09bn 24 3% +40% of WPI<br />

Source: Company, Nirmal Bang <strong>Institutional</strong> <strong>Equities</strong> Research<br />

31 IRB