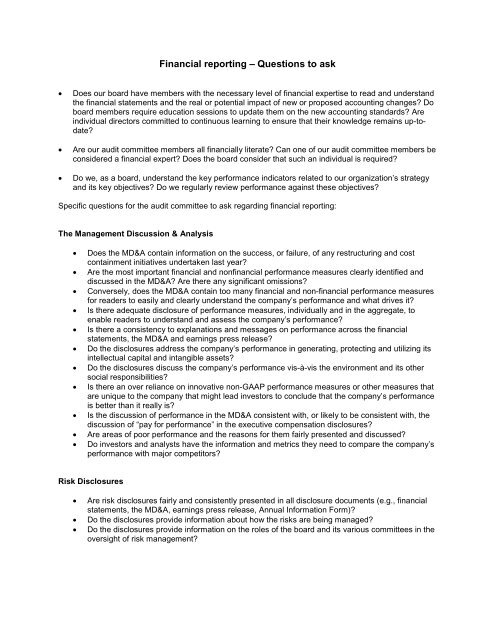

Financial reporting â Questions to ask

Financial reporting â Questions to ask

Financial reporting â Questions to ask

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Financial</strong> <strong>reporting</strong> – <strong>Questions</strong> <strong>to</strong> <strong>ask</strong><br />

• Does our board have members with the necessary level of financial expertise <strong>to</strong> read and understand<br />

the financial statements and the real or potential impact of new or proposed accounting changes? Do<br />

board members require education sessions <strong>to</strong> update them on the new accounting standards? Are<br />

individual direc<strong>to</strong>rs committed <strong>to</strong> continuous learning <strong>to</strong> ensure that their knowledge remains up-<strong>to</strong>date?<br />

• Are our audit committee members all financially literate? Can one of our audit committee members be<br />

considered a financial expert? Does the board consider that such an individual is required?<br />

• Do we, as a board, understand the key performance indica<strong>to</strong>rs related <strong>to</strong> our organization’s strategy<br />

and its key objectives? Do we regularly review performance against these objectives?<br />

Specific questions for the audit committee <strong>to</strong> <strong>ask</strong> regarding financial <strong>reporting</strong>:<br />

The Management Discussion & Analysis<br />

• Does the MD&A contain information on the success, or failure, of any restructuring and cost<br />

containment initiatives undertaken last year?<br />

• Are the most important financial and nonfinancial performance measures clearly identified and<br />

discussed in the MD&A? Are there any significant omissions?<br />

• Conversely, does the MD&A contain <strong>to</strong>o many financial and non-financial performance measures<br />

for readers <strong>to</strong> easily and clearly understand the company’s performance and what drives it?<br />

• Is there adequate disclosure of performance measures, individually and in the aggregate, <strong>to</strong><br />

enable readers <strong>to</strong> understand and assess the company’s performance?<br />

• Is there a consistency <strong>to</strong> explanations and messages on performance across the financial<br />

statements, the MD&A and earnings press release?<br />

• Do the disclosures address the company’s performance in generating, protecting and utilizing its<br />

intellectual capital and intangible assets?<br />

• Do the disclosures discuss the company’s performance vis-à-vis the environment and its other<br />

social responsibilities?<br />

• Is there an over reliance on innovative non-GAAP performance measures or other measures that<br />

are unique <strong>to</strong> the company that might lead inves<strong>to</strong>rs <strong>to</strong> conclude that the company’s performance<br />

is better than it really is?<br />

• Is the discussion of performance in the MD&A consistent with, or likely <strong>to</strong> be consistent with, the<br />

discussion of “pay for performance” in the executive compensation disclosures?<br />

• Are areas of poor performance and the reasons for them fairly presented and discussed?<br />

• Do inves<strong>to</strong>rs and analysts have the information and metrics they need <strong>to</strong> compare the company’s<br />

performance with major competi<strong>to</strong>rs?<br />

Risk Disclosures<br />

• Are risk disclosures fairly and consistently presented in all disclosure documents (e.g., financial<br />

statements, the MD&A, earnings press release, Annual Information Form)?<br />

• Do the disclosures provide information about how the risks are being managed?<br />

• Do the disclosures provide information on the roles of the board and its various committees in the<br />

oversight of risk management?

Executive Compensation<br />

• Have the audit committee and compensation committee identified what might be called<br />

“compensation-related risks” – i.e., those risks which are directly related <strong>to</strong> compensation<br />

philosophy, policies and practices – and reviewed how they are being mitigated?<br />

• Have the audit committee and compensation committee assessed whether the company’s<br />

compensation policies and practices present any material risks <strong>to</strong> the company (e.g., encouraging<br />

excessive risk taking)? If they do, are those risks fairly presented in the disclosures?<br />

• Is there anything in the executive compensation disclosures <strong>to</strong> be provided in the management<br />

information circular that should also be addressed in the year-end disclosure documents?<br />

For further questions <strong>to</strong> <strong>ask</strong> when reviewing your year-end financial filings, please access our 2012<br />

annual financial <strong>reporting</strong> document review guide.