Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Virginia</strong> <strong>Dealer</strong>’s <strong>Manual</strong><br />

October 1, 2009<br />

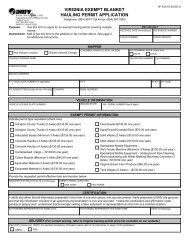

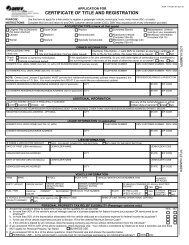

7.3.3 When to Issue a Temporary Registration Receipt<br />

You may issue a temporary registration receipt to a customer when they purchase a<br />

vehicle from you and transfer previously issued metal plates from a traded or junked<br />

vehicle to his newly purchased vehicle.<br />

7.3.4 Provisions & Restrictions Concerning Temporary Registration Receipts<br />

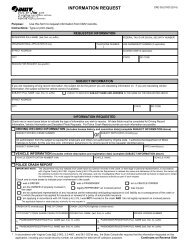

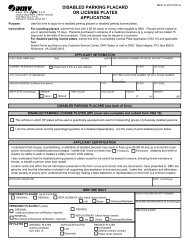

a. VSA-27 “Receipt for Money Paid for Transfer <strong>of</strong> License Plates” (Commonly<br />

called a temporary registration receipt) serves at the same time as:<br />

1. an application; for transfer <strong>of</strong> plates (instead <strong>of</strong> the usually required VSA-14)<br />

2. a receipt for the transfer <strong>of</strong> plate’s fee<br />

3. a temporary registration card for the vehicle<br />

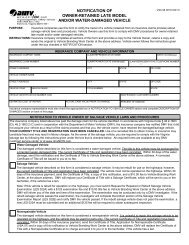

b. You, the <strong>Dealer</strong>, are not required to maintain and issue temporary registration<br />

receipts, although you may choose to do so as a convenience for your customers. If<br />

you do issue temporary registration receipts, it is your responsibility to:<br />

1. Be sure the vehicle purchaser meets all DMV requirements to be eligible to<br />

transfer license plates from a previously owned vehicle to his newly<br />

purchased vehicle.<br />

2. Submit all DMV-related paperwork made necessary by the sale transaction<br />

including title application and transfer <strong>of</strong> license application (VSA-27).<br />

3. Collect and submit to DMV all required fees including the title and transfer <strong>of</strong><br />

license fees, sales and use tax, and uninsured motor vehicle fee (if applicable).<br />

4. Temporary registration receipts are made available by DMV to your<br />

customers who are eligible for them. You cannot charge the customer a fee<br />

for the receipt.<br />

5. You may issue a temporary registration receipt only on the date <strong>of</strong> the sale <strong>of</strong><br />

the vehicle.<br />

6. The receipts are valid for 30 calendar days form date <strong>of</strong> issue.<br />

7. You cannot issue a temporary registration receipt for a vehicle sold to an<br />

individual by another dealer, or for a vehicle sold directly by one individual to<br />

another.<br />

8. You the dealer, must have in your possession a valid title or a valid<br />

manufacturer’s certificate <strong>of</strong> origin for the vehicle, which you have reassigned<br />

to the purchaser.<br />

- 78 - <strong>Virginia</strong> <strong>Department</strong> <strong>of</strong> <strong>Motor</strong> <strong>Vehicles</strong>