Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer’s Manual October 1, 2009 4.4.5 Non-profit Organizations & Public Services American Red Cross - owned TRANSACTION American Red Cross – leased NOTE: Application for title must include a copy of the lease agreement to prove that the agreement assigns responsibility for SUT to the American Red Cross. Charitable organization - Vehicles donated to or sold to these organizations are exempt if registered under § 501(C)(3) of the Internal Revenue Code. NOTE: If the charitable organization registers the vehicle, the SUT is due. Charitable organizations who distribute food, clothing, medicines and other necessities of life and provide shelter for needy persons in the United States and throughout the world and registered under § 501(C)(3) of the Internal Revenue Code are exempt from the SUT even if registering the vehicle. Church-owned bus or other vehicle designed to transport 10 or more passengers, bought for non-profit use NOTE: "Church" includes all religious organizations, such as synagogues, mosques, or Christian churches. Non-profit (volunteer) fire department or rescue squad - registered by NOTE: If purchasing to use as a prize such as a raffle, the non-profit fire department or rescue department must pay the SUT. Private non-profit institution of learning with vehicle loaned or leased by a dealership solely for use in driver's education as part of the curriculum for full-time students NOTE: Must submit a letter to DMV from the lienholder, if any, or otherwise from the dealer as proof that the vehicle is loaned for driver education purposes and that the school is responsible for no payment. A copy of the lease agreement, if any, is also required showing that no payment is required. Self-contained mobile computerized axial topography (CAT) scanner rented or used by a non-profit hospital or cooperative hospital service organization NOTE: Exemption applies to self-propelled units and trailer units, but would not apply to a power unit (tractor) that pulls the trailer unit. Self-contained mobile unit designed solely for human diagnostic or therapeutic service sold to, rented to or used by a non-profit hospital or cooperative hospital service organization NOTE: Exemption applies to self-propelled units and trailer units, but would not apply to a power unit (tractor) that pulls the trailer unit. Urban or suburban bus line - Owned vehicle with more than 7 passenger seats, when most of the passengers make trips on the bus(es) of less than 40 miles one way in one day PAY SUT NO REFERENCES 58.1-2403 (1) 10/85 AG Memo NO 58.1-2403 (1) NO 58.1-2403 (21) NO 58.1-2403 (22) NO 58.1-2403 (14) NO 58.1-2403 (3) NO 58.1-2403 (15) NO 58.1-2403 (18) NO 58.1-2403 (20) NO 58.1-2403 (12) All other non-profit organizations not covered under this heading. (even YES 58.1-2403 - 57 - Virginia Department of Motor Vehicles

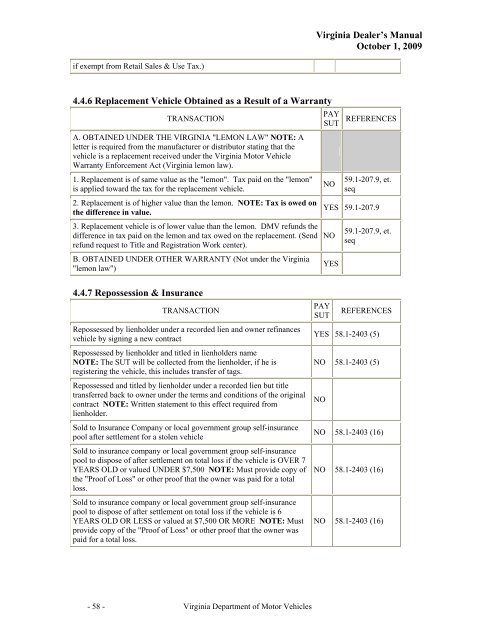

Virginia Dealer’s Manual October 1, 2009 if exempt from Retail Sales & Use Tax.) 4.4.6 Replacement Vehicle Obtained as a Result of a Warranty TRANSACTION A. OBTAINED UNDER THE VIRGINIA "LEMON LAW" NOTE: A letter is required from the manufacturer or distributor stating that the vehicle is a replacement received under the Virginia Motor Vehicle Warranty Enforcement Act (Virginia lemon law). 1. Replacement is of same value as the "lemon". Tax paid on the "lemon" is applied toward the tax for the replacement vehicle. 2. Replacement is of higher value than the lemon. NOTE: Tax is owed on the difference in value. 3. Replacement vehicle is of lower value than the lemon. DMV refunds the difference in tax paid on the lemon and tax owed on the replacement. (Send refund request to Title and Registration Work center). B. OBTAINED UNDER OTHER WARRANTY (Not under the Virginia "lemon law") PAY SUT NO REFERENCES 59.1-207.9, et. seq YES 59.1-207.9 NO YES 59.1-207.9, et. seq 4.4.7 Repossession & Insurance TRANSACTION Repossessed by lienholder under a recorded lien and owner refinances vehicle by signing a new contract Repossessed by lienholder and titled in lienholders name NOTE: The SUT will be collected from the lienholder, if he is registering the vehicle, this includes transfer of tags. Repossessed and titled by lienholder under a recorded lien but title transferred back to owner under the terms and conditions of the original contract NOTE: Written statement to this effect required from lienholder. Sold to Insurance Company or local government group self-insurance pool after settlement for a stolen vehicle Sold to insurance company or local government group self-insurance pool to dispose of after settlement on total loss if the vehicle is OVER 7 YEARS OLD or valued UNDER $7,500 NOTE: Must provide copy of the "Proof of Loss" or other proof that the owner was paid for a total loss. Sold to insurance company or local government group self-insurance pool to dispose of after settlement on total loss if the vehicle is 6 YEARS OLD OR LESS or valued at $7,500 OR MORE NOTE: Must provide copy of the "Proof of Loss" or other proof that the owner was paid for a total loss. PAY SUT REFERENCES YES 58.1-2403 (5) NO 58.1-2403 (5) NO NO 58.1-2403 (16) NO 58.1-2403 (16) NO 58.1-2403 (16) - 58 - Virginia Department of Motor Vehicles

- Page 21 and 22: Virginia Dealer’s Manual October

- Page 23 and 24: Virginia Dealer’s Manual October

- Page 25 and 26: Virginia Dealer’s Manual October

- Page 27 and 28: Virginia Dealer’s Manual October

- Page 29 and 30: Virginia Dealer’s Manual October

- Page 31 and 32: Virginia Dealer’s Manual October

- Page 33 and 34: To apply you should submit to DMV/M

- Page 35 and 36: Virginia Dealer’s Manual October

- Page 37 and 38: Virginia Dealer’s Manual October

- Page 39 and 40: Virginia Dealer’s Manual October

- Page 41 and 42: Virginia Dealer’s Manual October

- Page 43 and 44: Virginia Dealer’s Manual October

- Page 45 and 46: Virginia Dealer’s Manual October

- Page 47 and 48: Virginia Dealer’s Manual October

- Page 49 and 50: Virginia Dealer’s Manual October

- Page 51 and 52: Virginia Dealer’s Manual October

- Page 53 and 54: Virginia Dealer’s Manual October

- Page 55 and 56: Virginia Dealer’s Manual October

- Page 57 and 58: Virginia Dealer’s Manual October

- Page 59 and 60: Virginia Dealer’s Manual October

- Page 61 and 62: d. Certificate of Sales of Seized P

- Page 63 and 64: Virginia Dealer’s Manual October

- Page 65 and 66: Virginia Dealer’s Manual October

- Page 67 and 68: Virginia Dealer’s Manual October

- Page 69 and 70: Virginia Dealer’s Manual October

- Page 71: Virginia Dealer’s Manual October

- Page 75 and 76: Purchase of a vehicle by the lessee

- Page 77 and 78: 5.2 DLR 505-OBTAINING AN OWNER’S

- Page 79 and 80: REISSUE FEE CHART FEES For REISSUE

- Page 81 and 82: Virginia Dealer’s Manual October

- Page 83 and 84: Virginia Dealer’s Manual October

- Page 85 and 86: Virginia Dealer’s Manual October

- Page 87 and 88: Virginia Dealer’s Manual October

- Page 89 and 90: Virginia Dealer’s Manual October

- Page 91 and 92: Virginia Dealer’s Manual October

- Page 93 and 94: Virginia Dealer’s Manual October

- Page 95 and 96: Virginia Dealer’s Manual October

- Page 97 and 98: 2) DSD-5, “Temporary Certificate

- Page 99 and 100: Virginia Dealer’s Manual October

- Page 101 and 102: Virginia Dealer’s Manual October

- Page 103 and 104: Virginia Dealer’s Manual October

- Page 105 and 106: Virginia Dealer’s Manual October

- Page 107 and 108: Virginia Dealer’s Manual October

- Page 109 and 110: Virginia Dealer’s Manual October

- Page 111 and 112: Virginia Dealer’s Manual October

- Page 113 and 114: Virginia Dealer’s Manual October

- Page 115 and 116: Virginia Dealer’s Manual October

- Page 117 and 118: Quarterly License Plates Truck or T

- Page 119 and 120: Virginia Dealer’s Manual October

- Page 121 and 122: Virginia Dealer’s Manual October

<strong>Virginia</strong> <strong>Dealer</strong>’s <strong>Manual</strong><br />

October 1, 2009<br />

if exempt from Retail Sales & Use Tax.)<br />

4.4.6 Replacement Vehicle Obtained as a Result <strong>of</strong> a Warranty<br />

TRANSACTION<br />

A. OBTAINED UNDER THE VIRGINIA "LEMON LAW" NOTE: A<br />

letter is required from the manufacturer or distributor stating that the<br />

vehicle is a replacement received under the <strong>Virginia</strong> <strong>Motor</strong> Vehicle<br />

Warranty Enforcement Act (<strong>Virginia</strong> lemon law).<br />

1. Replacement is <strong>of</strong> same value as the "lemon". Tax paid on the "lemon"<br />

is applied toward the tax for the replacement vehicle.<br />

2. Replacement is <strong>of</strong> higher value than the lemon. NOTE: Tax is owed on<br />

the difference in value.<br />

3. Replacement vehicle is <strong>of</strong> lower value than the lemon. DMV refunds the<br />

difference in tax paid on the lemon and tax owed on the replacement. (Send<br />

refund request to Title and Registration Work center).<br />

B. OBTAINED UNDER OTHER WARRANTY (Not under the <strong>Virginia</strong><br />

"lemon law")<br />

PAY<br />

SUT<br />

NO<br />

REFERENCES<br />

59.1-207.9, et.<br />

seq<br />

YES 59.1-207.9<br />

NO<br />

YES<br />

59.1-207.9, et.<br />

seq<br />

4.4.7 Repossession & Insurance<br />

TRANSACTION<br />

Repossessed by lienholder under a recorded lien and owner refinances<br />

vehicle by signing a new contract<br />

Repossessed by lienholder and titled in lienholders name<br />

NOTE: The SUT will be collected from the lienholder, if he is<br />

registering the vehicle, this includes transfer <strong>of</strong> tags.<br />

Repossessed and titled by lienholder under a recorded lien but title<br />

transferred back to owner under the terms and conditions <strong>of</strong> the original<br />

contract NOTE: Written statement to this effect required from<br />

lienholder.<br />

Sold to Insurance Company or local government group self-insurance<br />

pool after settlement for a stolen vehicle<br />

Sold to insurance company or local government group self-insurance<br />

pool to dispose <strong>of</strong> after settlement on total loss if the vehicle is OVER 7<br />

YEARS OLD or valued UNDER $7,500 NOTE: Must provide copy <strong>of</strong><br />

the "Pro<strong>of</strong> <strong>of</strong> Loss" or other pro<strong>of</strong> that the owner was paid for a total<br />

loss.<br />

Sold to insurance company or local government group self-insurance<br />

pool to dispose <strong>of</strong> after settlement on total loss if the vehicle is 6<br />

YEARS OLD OR LESS or valued at $7,500 OR MORE NOTE: Must<br />

provide copy <strong>of</strong> the "Pro<strong>of</strong> <strong>of</strong> Loss" or other pro<strong>of</strong> that the owner was<br />

paid for a total loss.<br />

PAY<br />

SUT<br />

REFERENCES<br />

YES 58.1-2403 (5)<br />

NO 58.1-2403 (5)<br />

NO<br />

NO 58.1-2403 (16)<br />

NO 58.1-2403 (16)<br />

NO 58.1-2403 (16)<br />

- 58 - <strong>Virginia</strong> <strong>Department</strong> <strong>of</strong> <strong>Motor</strong> <strong>Vehicles</strong>