Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

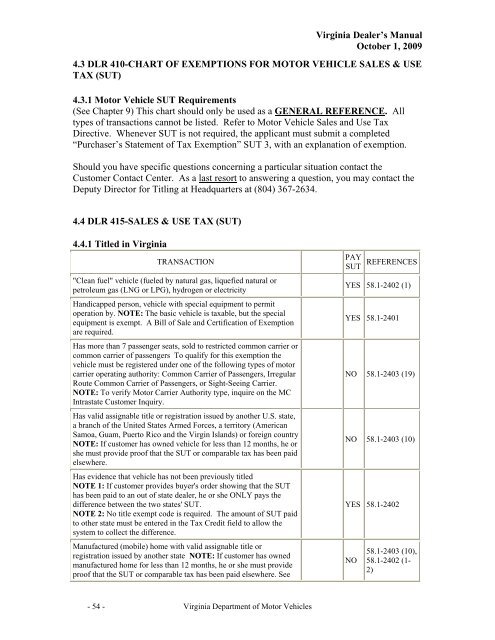

<strong>Virginia</strong> <strong>Dealer</strong>’s <strong>Manual</strong><br />

October 1, 2009<br />

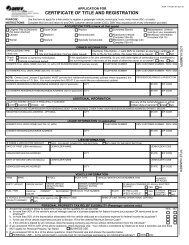

4.3 DLR 410-CHART OF EXEMPTIONS FOR MOTOR VEHICLE SALES & USE<br />

TAX (SUT)<br />

4.3.1 <strong>Motor</strong> Vehicle SUT Requirements<br />

(See Chapter 9) This chart should only be used as a GENERAL REFERENCE. All<br />

types <strong>of</strong> transactions cannot be listed. Refer to <strong>Motor</strong> Vehicle Sales and Use Tax<br />

Directive. Whenever SUT is not required, the applicant must submit a completed<br />

“Purchaser’s Statement <strong>of</strong> Tax Exemption” SUT 3, with an explanation <strong>of</strong> exemption.<br />

Should you have specific questions concerning a particular situation contact the<br />

Customer Contact Center. As a last resort to answering a question, you may contact the<br />

Deputy Director for Titling at Headquarters at (804) 367-2634.<br />

4.4 DLR 415-SALES & USE TAX (SUT)<br />

4.4.1 Titled in <strong>Virginia</strong><br />

TRANSACTION<br />

"Clean fuel" vehicle (fueled by natural gas, liquefied natural or<br />

petroleum gas (LNG or LPG), hydrogen or electricity<br />

Handicapped person, vehicle with special equipment to permit<br />

operation by. NOTE: The basic vehicle is taxable, but the special<br />

equipment is exempt. A Bill <strong>of</strong> Sale and Certification <strong>of</strong> Exemption<br />

are required.<br />

Has more than 7 passenger seats, sold to restricted common carrier or<br />

common carrier <strong>of</strong> passengers To qualify for this exemption the<br />

vehicle must be registered under one <strong>of</strong> the following types <strong>of</strong> motor<br />

carrier operating authority: Common Carrier <strong>of</strong> Passengers, Irregular<br />

Route Common Carrier <strong>of</strong> Passengers, or Sight-Seeing Carrier.<br />

NOTE: To verify <strong>Motor</strong> Carrier Authority type, inquire on the MC<br />

Intrastate Customer Inquiry.<br />

Has valid assignable title or registration issued by another U.S. state,<br />

a branch <strong>of</strong> the United States Armed Forces, a territory (American<br />

Samoa, Guam, Puerto Rico and the Virgin Islands) or foreign country<br />

NOTE: If customer has owned vehicle for less than 12 months, he or<br />

she must provide pro<strong>of</strong> that the SUT or comparable tax has been paid<br />

elsewhere.<br />

Has evidence that vehicle has not been previously titled<br />

NOTE 1: If customer provides buyer's order showing that the SUT<br />

has been paid to an out <strong>of</strong> state dealer, he or she ONLY pays the<br />

difference between the two states' SUT.<br />

NOTE 2: No title exempt code is required. The amount <strong>of</strong> SUT paid<br />

to other state must be entered in the Tax Credit field to allow the<br />

system to collect the difference.<br />

Manufactured (mobile) home with valid assignable title or<br />

registration issued by another state NOTE: If customer has owned<br />

manufactured home for less than 12 months, he or she must provide<br />

pro<strong>of</strong> that the SUT or comparable tax has been paid elsewhere. See<br />

PAY<br />

SUT REFERENCES<br />

YES 58.1-2402 (1)<br />

YES 58.1-2401<br />

NO 58.1-2403 (19)<br />

NO 58.1-2403 (10)<br />

YES 58.1-2402<br />

NO<br />

58.1-2403 (10),<br />

58.1-2402 (1-<br />

2)<br />

- 54 - <strong>Virginia</strong> <strong>Department</strong> <strong>of</strong> <strong>Motor</strong> <strong>Vehicles</strong>