Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Virginia</strong> <strong>Dealer</strong>’s <strong>Manual</strong><br />

October 1, 2009<br />

4.1.5 How to Calculate the SUT<br />

a. Calculate SUT as follows: Actual Vehicle or Manufactured Home Sales Price<br />

and dealer processing fee, if applicable x 0.03= amount due for SUT.<br />

b. If a dealer discount is given, the sales tax would be based on the vehicle price less<br />

the dealer discount. No reduction <strong>of</strong> the sale price for calculating SUT is allowed<br />

for trade-in, any “over allowance” included as part <strong>of</strong> the trade-in or any rebate.<br />

4.1.6 Refund for Tax Paid<br />

When a vehicle owner has already paid SUT but cannot at the time he applies to title the<br />

vehicle present adequate evidence <strong>of</strong> payment, he must pay the full amount <strong>of</strong> tax due to<br />

<strong>Virginia</strong>. If within three years <strong>of</strong> the date the title is issued the owner can present<br />

evidence <strong>of</strong> an earlier payment for tax, a refund will be made. Application for refund can<br />

be made by completing and filing with the DMV Form SUT 2.<br />

4.1.7 Exemptions from SUT<br />

• Code <strong>of</strong> <strong>Virginia</strong> § 58.1-2403<br />

Certain types <strong>of</strong> title transactions are exempt from the entire SUT. The chart in<br />

procedure DLR 410 lists the types <strong>of</strong> transactions which are exempt, and can be used as a<br />

general reference when you are performing titling transactions for your dealership, or on<br />

behalf <strong>of</strong> your customers. See Exemptions Chart in Chapter 9.<br />

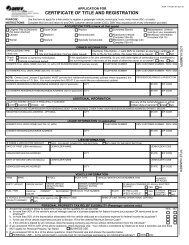

4.2 DLR 405-DMV TITLE FEE<br />

4.2.1 When the <strong>Dealer</strong> Must Collect the DMV Title Fee<br />

When you act on behalf <strong>of</strong> your customer and file the application for vehicle title,<br />

generally you must collect from the customer and submit to DMV the appropriate title<br />

fee, as listed below.<br />

4.2.2 DMV Title Fee Chart<br />

TRANSACTION<br />

FEE<br />

Titling a used vehicle $10.00<br />

Titling a new or used manufactured vehicle $10.00<br />

<strong>Department</strong> <strong>of</strong> Housing and Community Development (DHCD) $10.00<br />

Obtaining a replacement title $5.00<br />

Recording a name change at the time <strong>of</strong> titling<br />

no fee<br />

Recording 1 st lien on an existing Title (after 30 days from date <strong>of</strong> $6.00<br />

Original applications<br />

Recording supplemental lien on title $6.00<br />

Recording release ( or satisfaction) <strong>of</strong> lien<br />

no fee<br />

Substitute title (change in data) $10.00<br />

Transferring lien on title $6.00<br />

- 53 - <strong>Virginia</strong> <strong>Department</strong> <strong>of</strong> <strong>Motor</strong> <strong>Vehicles</strong>