Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles

Virginia Dealer Manual - Virginia Department of Motor Vehicles

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

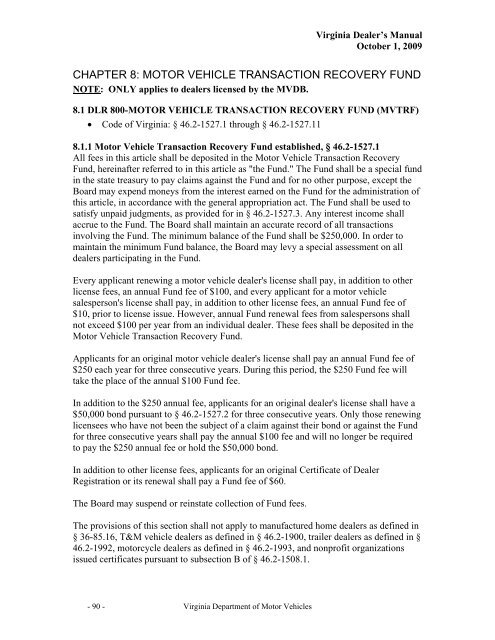

<strong>Virginia</strong> <strong>Dealer</strong>’s <strong>Manual</strong><br />

October 1, 2009<br />

CHAPTER 8: MOTOR VEHICLE TRANSACTION RECOVERY FUND<br />

NOTE: ONLY applies to dealers licensed by the MVDB.<br />

8.1 DLR 800-MOTOR VEHICLE TRANSACTION RECOVERY FUND (MVTRF)<br />

• Code <strong>of</strong> <strong>Virginia</strong>: § 46.2-1527.1 through § 46.2-1527.11<br />

8.1.1 <strong>Motor</strong> Vehicle Transaction Recovery Fund established, § 46.2-1527.1<br />

All fees in this article shall be deposited in the <strong>Motor</strong> Vehicle Transaction Recovery<br />

Fund, hereinafter referred to in this article as "the Fund." The Fund shall be a special fund<br />

in the state treasury to pay claims against the Fund and for no other purpose, except the<br />

Board may expend moneys from the interest earned on the Fund for the administration <strong>of</strong><br />

this article, in accordance with the general appropriation act. The Fund shall be used to<br />

satisfy unpaid judgments, as provided for in § 46.2-1527.3. Any interest income shall<br />

accrue to the Fund. The Board shall maintain an accurate record <strong>of</strong> all transactions<br />

involving the Fund. The minimum balance <strong>of</strong> the Fund shall be $250,000. In order to<br />

maintain the minimum Fund balance, the Board may levy a special assessment on all<br />

dealers participating in the Fund.<br />

Every applicant renewing a motor vehicle dealer's license shall pay, in addition to other<br />

license fees, an annual Fund fee <strong>of</strong> $100, and every applicant for a motor vehicle<br />

salesperson's license shall pay, in addition to other license fees, an annual Fund fee <strong>of</strong><br />

$10, prior to license issue. However, annual Fund renewal fees from salespersons shall<br />

not exceed $100 per year from an individual dealer. These fees shall be deposited in the<br />

<strong>Motor</strong> Vehicle Transaction Recovery Fund.<br />

Applicants for an original motor vehicle dealer's license shall pay an annual Fund fee <strong>of</strong><br />

$250 each year for three consecutive years. During this period, the $250 Fund fee will<br />

take the place <strong>of</strong> the annual $100 Fund fee.<br />

In addition to the $250 annual fee, applicants for an original dealer's license shall have a<br />

$50,000 bond pursuant to § 46.2-1527.2 for three consecutive years. Only those renewing<br />

licensees who have not been the subject <strong>of</strong> a claim against their bond or against the Fund<br />

for three consecutive years shall pay the annual $100 fee and will no longer be required<br />

to pay the $250 annual fee or hold the $50,000 bond.<br />

In addition to other license fees, applicants for an original Certificate <strong>of</strong> <strong>Dealer</strong><br />

Registration or its renewal shall pay a Fund fee <strong>of</strong> $60.<br />

The Board may suspend or reinstate collection <strong>of</strong> Fund fees.<br />

The provisions <strong>of</strong> this section shall not apply to manufactured home dealers as defined in<br />

§ 36-85.16, T&M vehicle dealers as defined in § 46.2-1900, trailer dealers as defined in §<br />

46.2-1992, motorcycle dealers as defined in § 46.2-1993, and nonpr<strong>of</strong>it organizations<br />

issued certificates pursuant to subsection B <strong>of</strong> § 46.2-1508.1.<br />

- 90 - <strong>Virginia</strong> <strong>Department</strong> <strong>of</strong> <strong>Motor</strong> <strong>Vehicles</strong>