Downloading - Microfinance Information Exchange

Downloading - Microfinance Information Exchange

Downloading - Microfinance Information Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEATURE ARTICLE<br />

applies to all MFIs for the purposes of<br />

benchmarking. Analysts may also write off loans<br />

after a different number of days (usually 180 or 360<br />

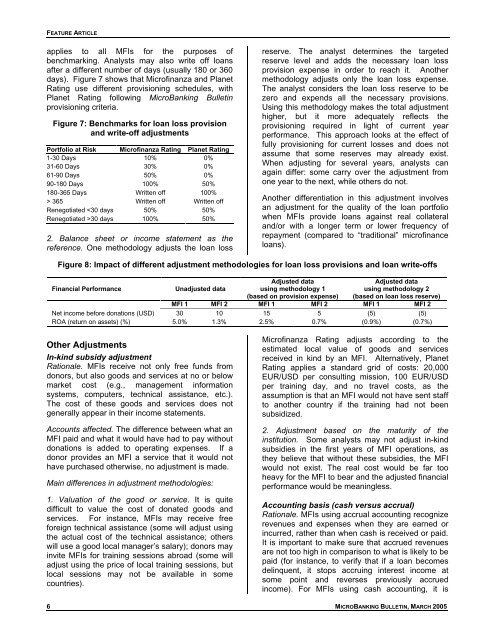

days). Figure 7 shows that Microfinanza and Planet<br />

Rating use different provisioning schedules, with<br />

Planet Rating following MicroBanking Bulletin<br />

provisioning criteria.<br />

Figure 7: Benchmarks for loan loss provision<br />

and write-off adjustments<br />

Portfolio at Risk Microfinanza Rating Planet Rating<br />

1-30 Days 10% 0%<br />

31-60 Days 30% 0%<br />

61-90 Days 50% 0%<br />

90-180 Days 100% 50%<br />

180-365 Days Written off 100%<br />

> 365 Written off Written off<br />

Renegotiated 30 days 100% 50%<br />

2. Balance sheet or income statement as the<br />

reference. One methodology adjusts the loan loss<br />

reserve. The analyst determines the targeted<br />

reserve level and adds the necessary loan loss<br />

provision expense in order to reach it. Another<br />

methodology adjusts only the loan loss expense.<br />

The analyst considers the loan loss reserve to be<br />

zero and expends all the necessary provisions.<br />

Using this methodology makes the total adjustment<br />

higher, but it more adequately reflects the<br />

provisioning required in light of current year<br />

performance. This approach looks at the effect of<br />

fully provisioning for current losses and does not<br />

assume that some reserves may already exist.<br />

When adjusting for several years, analysts can<br />

again differ: some carry over the adjustment from<br />

one year to the next, while others do not.<br />

Another differentiation in this adjustment involves<br />

an adjustment for the quality of the loan portfolio<br />

when MFIs provide loans against real collateral<br />

and/or with a longer term or lower frequency of<br />

repayment (compared to “traditional” microfinance<br />

loans).<br />

Figure 8: Impact of different adjustment methodologies for loan loss provisions and loan write-offs<br />

Financial Performance<br />

Unadjusted data<br />

Adjusted data<br />

using methodology 1<br />

(based on provision expense)<br />

Adjusted data<br />

using methodology 2<br />

(based on loan loss reserve)<br />

MFI 1 MFI 2 MFI 1 MFI 2 MFI 1 MFI 2<br />

Net income before donations (USD) 30 10 15 5 (5) (5)<br />

ROA (return on assets) (%) 5.0% 1.3% 2.5% 0.7% (0.9%) (0.7%)<br />

Other Adjustments<br />

In-kind subsidy adjustment<br />

Rationale. MFIs receive not only free funds from<br />

donors, but also goods and services at no or below<br />

market cost (e.g., management information<br />

systems, computers, technical assistance, etc.).<br />

The cost of these goods and services does not<br />

generally appear in their income statements.<br />

Accounts affected. The difference between what an<br />

MFI paid and what it would have had to pay without<br />

donations is added to operating expenses. If a<br />

donor provides an MFI a service that it would not<br />

have purchased otherwise, no adjustment is made.<br />

Main differences in adjustment methodologies:<br />

1. Valuation of the good or service. It is quite<br />

difficult to value the cost of donated goods and<br />

services. For instance, MFIs may receive free<br />

foreign technical assistance (some will adjust using<br />

the actual cost of the technical assistance; others<br />

will use a good local manager’s salary); donors may<br />

invite MFIs for training sessions abroad (some will<br />

adjust using the price of local training sessions, but<br />

local sessions may not be available in some<br />

countries).<br />

Microfinanza Rating adjusts according to the<br />

estimated local value of goods and services<br />

received in kind by an MFI. Alternatively, Planet<br />

Rating applies a standard grid of costs: 20,000<br />

EUR/USD per consulting mission, 100 EUR/USD<br />

per training day, and no travel costs, as the<br />

assumption is that an MFI would not have sent staff<br />

to another country if the training had not been<br />

subsidized.<br />

2. Adjustment based on the maturity of the<br />

institution. Some analysts may not adjust in-kind<br />

subsidies in the first years of MFI operations, as<br />

they believe that without these subsidies, the MFI<br />

would not exist. The real cost would be far too<br />

heavy for the MFI to bear and the adjusted financial<br />

performance would be meaningless.<br />

Accounting basis (cash versus accrual)<br />

Rationale. MFIs using accrual accounting recognize<br />

revenues and expenses when they are earned or<br />

incurred, rather than when cash is received or paid.<br />

It is important to make sure that accrued revenues<br />

are not too high in comparison to what is likely to be<br />

paid (for instance, to verify that if a loan becomes<br />

delinquent, it stops accruing interest income at<br />

some point and reverses previously accrued<br />

income). For MFIs using cash accounting, it is<br />

6 MICROBANKING BULLETIN, MARCH 2005