Strategic Acquisition: OmniSource Corporation - Steel Dynamics, Inc.

Strategic Acquisition: OmniSource Corporation - Steel Dynamics, Inc.

Strategic Acquisition: OmniSource Corporation - Steel Dynamics, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Strategic</strong> <strong>Acquisition</strong>:<br />

<strong>OmniSource</strong> <strong>Corporation</strong><br />

Investor Presentation<br />

October 2, 2007

Forward-Looking Statements<br />

This presentation contains predictive statements about future events, including statements related to<br />

conditions in the steel marketplace and the future growth of <strong>Steel</strong> <strong>Dynamics</strong>’ and <strong>OmniSource</strong>’s<br />

revenues and profitability.<br />

These statements are intended to be made as “forward-looking” within the safe harbor protections of<br />

the Private Securities Litigation Reform Act of 1995. Such predictive statements are not guarantees of<br />

future performance, and actual results could differ materially from our current expectations.<br />

We refer you to our detailed explanation of the many factors and risks that may cause such predictive<br />

statements to turn out differently, as set forth in the most recent <strong>Steel</strong> <strong>Dynamics</strong>’ Annual Report on<br />

Form 10-K and in other reports which we from time to time file with the Securities and Exchange<br />

Commission, available publicly on the SEC’s web site at www.sec.gov and on our Web site at<br />

www.steeldynamics.com.<br />

2<br />

October 2, 2007

Management Participants<br />

Keith Busse<br />

Chairman and CEO<br />

<strong>Steel</strong> <strong>Dynamics</strong>, <strong>Inc</strong>.<br />

Danny Rifkin<br />

President and CEO<br />

<strong>OmniSource</strong> <strong>Corporation</strong><br />

3<br />

October 2, 2007

Transaction Overview<br />

<strong>Steel</strong> <strong>Dynamics</strong> (“SDI”) acquires <strong>OmniSource</strong> for approximately $1 billion in a 50/50<br />

cash/stock transaction<br />

_<br />

_<br />

_<br />

_<br />

$425 million of cash<br />

9.3 million SDI shares valued at $425 million<br />

400,000 SDI shares valued at $18 million reflecting the shared benefits of a favorable<br />

tax structure with an estimated present value of $106 million to SDI<br />

Assumption of approx. $210 million of <strong>OmniSource</strong> net debt expected at closing<br />

Financed with cash on hand and debt<br />

<strong>OmniSource</strong> President and CEO, Danny Rifkin, will continue to lead <strong>OmniSource</strong> and will<br />

also re-join SDI’s Board of Directors<br />

_<br />

As an EVP of SDI, Danny Rifkin will lead all of the company’s ferrous and non-ferrous<br />

processing and brokerage activities<br />

Potential annual run-rate pretax synergies of $15 million<br />

<strong>Acquisition</strong> expected to be accretive to 2008 excluding synergies<br />

Closing expected early in fourth quarter 2007<br />

4<br />

October 2, 2007

<strong>Strategic</strong> Rationale<br />

Tremendous platform for future growth<br />

_ Scrap industry fundamentals are very strong and are expected to remain strong for<br />

the foreseeable future<br />

_ <strong>OmniSource</strong>’s size and acquisition track record provide SDI a strong platform to<br />

make further acquisitions within the highly fragmented North American scrap<br />

industry<br />

Unites pre-eminent steel producer with pre-eminent scrap processor<br />

Vertical integration – uniquely enables SDI to capture value on every step of the value<br />

chain and provides unencumbered access to scrap<br />

_ In conjunction with SDI’s Mesabi Nugget investment, helps insulate SDI from<br />

extreme scrap and iron ore pricing volatility<br />

Low risk transaction – <strong>OmniSource</strong> is the ideal partner for SDI<br />

_ Complementary geographic footprint – provides for significant potential<br />

transportation synergies<br />

_ Opportunity for significant working capital savings<br />

_ Long and rich history – <strong>OmniSource</strong> was instrumental in helping launch SDI and is<br />

one of SDI’s largest scrap suppliers<br />

5<br />

October 2, 2007

Ferrous Scrap Market Overview<br />

Highly fragmented industry with many family-owned businesses<br />

Over the last several years, scrap values have increased significantly, driven by:<br />

_<br />

_<br />

The rise in global steel production<br />

Consolidation among scrap processors<br />

_ Reduced availability of prime industrial scrap resources due to reduced domestic<br />

manufacturing activity and improved industrial and automotive efficiencies<br />

Although scrap prices will continue to be volatile, they are expected to remain strong for<br />

the foreseeable future<br />

_ Scrap is a semi-finite resource with limited availability<br />

_ The number of scrap vendors available to scrap buyers has been reduced<br />

_ Continued exports of scrap from the U.S. to overseas steel producers<br />

_ De-linking of finished steel prices and scrap prices<br />

As a result, scrap industry fundamentals are expected to remain strong<br />

6<br />

October 2, 2007

<strong>OmniSource</strong> Overview<br />

Founded in 1943 by Irving Rifkin and headquartered in Fort Wayne, Indiana<br />

One of the largest processors and distributors of scrap and secondary metals in North<br />

America<br />

Engages in scrap metal processing, transportation, marketing, brokerage, management<br />

and consulting in North America<br />

<strong>Strategic</strong> relationships with industrial scrap generators and consumers<br />

Relationships include automotive OEMs and suppliers, steel processors, steel mills,<br />

foundries, wire and cable producers, utilities and telephone networks<br />

Designed, installed and managed customized programs for industrial manufacturing<br />

companies as part of scrap management and consulting practice<br />

Employs 2,000 people in 42 facilities located in the eastern U.S. and Canada<br />

In fiscal 2006 (1) , processed 5.7 million tons of ferrous and 800 million lbs. of non-ferrous<br />

metals, generating sales of $2.3Bn and EBITDA of $159MM<br />

7<br />

(1) Based on <strong>OmniSource</strong> fiscal year 2006 ending September 30, 2006; pro forma for acquisitions completed in FY2006; includes joint venture<br />

income and excludes non-recurring items<br />

October 2, 2007

<strong>OmniSource</strong> Products and Services<br />

Ferrous Products – produces an array of ferrous<br />

scrap products for foundry and steel mill<br />

applications<br />

Non-Ferrous Products – produces an array of nonferrous<br />

scrap products (e.g., aluminum, brass,<br />

copper, stainless steel etc.) for use in foundry, mill,<br />

refining and smelting applications<br />

Superior Aluminum – produces specification<br />

aluminum alloys in the form of ingots, sows and<br />

molten metal<br />

Scrap Management – develops and manages<br />

custom-designed facilities for scrap handling,<br />

disposal and/or procurement for scrap generators<br />

and consumers<br />

Brokerage and Trading – includes ferrous and nonferrous<br />

scrap, scrap alternatives, secondary and<br />

primary metals<br />

Transportation – coordinates all freight and logistics<br />

by truck, rail or river barge<br />

Non-<br />

Ferrous<br />

2006 Sales By Scrap Type<br />

Stainless<br />

32%<br />

6%<br />

62%<br />

Ferrous<br />

8<br />

October 2, 2007

<strong>OmniSource</strong> <strong>Acquisition</strong>s and Joint Ventures: 1998 – Present<br />

<strong>OmniSource</strong> has an excellent track record of identifying, executing and<br />

integrating value-accretive acquisitions and joint ventures<br />

<strong>OmniSource</strong> represents a strong growth platform for SDI<br />

10/98<br />

<strong>Acquisition</strong> of<br />

Jackson Fibers<br />

1/98<br />

<strong>Acquisition</strong> of<br />

Jackson Iron &<br />

Metal<br />

3/99<br />

<strong>Acquisition</strong> of Midstates<br />

<strong>Steel</strong> Handling<br />

4/01<br />

<strong>Acquisition</strong> of Dobrow<br />

Industries<br />

6/04<br />

<strong>Acquisition</strong> of Admetco<br />

Acquired 50% interest in<br />

Carolinas Recycling Group<br />

4/03<br />

<strong>Acquisition</strong> of Abe<br />

Sposeep & Sons<br />

3/06<br />

<strong>Acquisition</strong> of K&F<br />

Industries + 1/3 MKO<br />

Interest<br />

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

2008 &<br />

Beyond<br />

3/98<br />

<strong>Acquisition</strong> of<br />

A. Edelstein<br />

1/99<br />

<strong>Acquisition</strong> of<br />

Industrial Scrap<br />

5/99<br />

<strong>Acquisition</strong> of Scrap<br />

Assets from Midwest<br />

Pipe & <strong>Steel</strong><br />

10/02<br />

<strong>Acquisition</strong> of Loef<br />

Metal Cos.<br />

3/04<br />

<strong>Acquisition</strong> of<br />

H. Hirschfield & Sons<br />

8/04<br />

<strong>Acquisition</strong> of L.<br />

Surath & Sons<br />

12/06<br />

<strong>Acquisition</strong> of<br />

Kokomo and Tipton +<br />

1/3 MKO Interest<br />

9<br />

October 2, 2007

Complementary <strong>Strategic</strong> Facility Locations<br />

<strong>OmniSource</strong>’s facility<br />

locations are highly<br />

complementary to SDI’s<br />

manufacturing facilities<br />

Toledo<br />

Provides significant potential<br />

for transportation synergies<br />

Key to symbols<br />

St. Louis<br />

Indianapolis<br />

<strong>OmniSource</strong> Facilities<br />

<strong>OmniSource</strong> Affiliate (1)<br />

Recycled South (2)<br />

SDI <strong>Steel</strong> Processing Facilities<br />

SDI <strong>Steel</strong> Mills<br />

SDI Scrap Facilities<br />

Atlanta<br />

Jacksonville<br />

1<br />

(1) Represents Cumberland Recycling Group facilities<br />

(2) Recycled South LLC (CRG/ASAP/<strong>OmniSource</strong> facilities<br />

October 2, 2007

SDI and <strong>OmniSource</strong> History<br />

SDI and <strong>OmniSource</strong> have a long and rich history<br />

_<br />

_<br />

_<br />

_<br />

_<br />

<strong>OmniSource</strong>’s Rifkin family was among the original investors and helped launch<br />

SDI in 1993<br />

<strong>OmniSource</strong> initially served as SDI’s exclusive scrap agent and has continued to<br />

be a supplier to SDI since 1993<br />

<strong>OmniSource</strong> is currently one of SDI’s largest scrap suppliers<br />

Leonard Rifkin, current <strong>OmniSource</strong> Chairman, was one of the original SDI<br />

Board members, serving as a Director from 1994 to 2002<br />

Danny Rifkin will rejoin SDI’s Board of Directors after previously serving as a<br />

Director from 2002 to 2003<br />

SDI and <strong>OmniSource</strong> have discussed a strategic combination for many years<br />

The historic relationship between SDI and <strong>OmniSource</strong> helps mitigate the risk of the<br />

transaction<br />

11<br />

October 2, 2007

Fiscal 2006 (1) Financial Summary<br />

($ and Tonnage in millions)<br />

Tons Shipped / Processed<br />

<strong>Steel</strong> <strong>Dynamics</strong><br />

4.7<br />

<strong>OmniSource</strong><br />

5.3 (2)<br />

Revenue<br />

$3,239<br />

$2,255<br />

EBITDA (3) $777<br />

$159<br />

EBIT (3) $662<br />

$134<br />

12<br />

(1) <strong>Steel</strong> <strong>Dynamics</strong> fiscal year ending December 31, 2006. <strong>OmniSource</strong> fiscal year ending September 30, 2006.<br />

(2) <strong>OmniSource</strong> tonnage represents ferrous processed; in fiscal 2006 <strong>OmniSource</strong> also processed 774 million lbs. of non-ferrous metals<br />

(3) Pro forma for acquisitions completed in FY2006; includes joint venture income and excludes non-recurring items<br />

October 2, 2007

Pro Forma <strong>Steel</strong> <strong>Dynamics</strong><br />

SDI’s s History of <strong>Acquisition</strong>s<br />

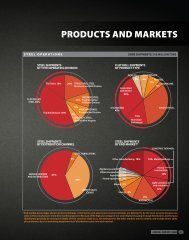

Pro Forma 2006 Revenue Mix<br />

<strong>Steel</strong> Fabrication<br />

5%<br />

Resources 39%<br />

56%<br />

<strong>Steel</strong> Production<br />

Pro Forma 2006 Shipments Mix<br />

<strong>Steel</strong> Fabrication<br />

2%<br />

• October 2007 – Announced<br />

<strong>OmniSource</strong> acquisition<br />

• July 2007 – Acquired The Techs<br />

• April 2007 – Purchased two Tennessee<br />

scrap yards<br />

• April 2006 – Acquired Roanoke Electric<br />

<strong>Steel</strong> <strong>Corporation</strong><br />

• March 2003 – Acquired Jeffersonville,<br />

Indiana, galvanizing plant<br />

• September 2002 – Acquired Pittsboro,<br />

Indiana, SBQ mill<br />

Resources<br />

43%<br />

55%<br />

<strong>Steel</strong> Production<br />

13<br />

October 2, 2007

Transaction Summary<br />

Provides strong platform for future growth in both steel production and scrap<br />

processing<br />

_<br />

_<br />

SDI and <strong>OmniSource</strong> expect to continue to grow their respective relationships<br />

with other scrap suppliers and steel mills<br />

Continued opportunity for growth both on greenfield and M&A basis<br />

Enables SDI to capture value on every step of the value chain<br />

In conjunction with SDI’s recent Mesabi Nugget investment, insulates SDI from<br />

extreme scrap and iron ore pricing volatility<br />

Low risk transaction – ideal partners<br />

_<br />

_<br />

Complementary geographic footprints<br />

Long and rich history<br />

Financially attractive acquisition<br />

_<br />

_<br />

_<br />

Accretive to 2008E earnings excluding synergies<br />

Potential annual run-rate pretax synergies of $15MM<br />

Maintains financial flexibility post-transaction<br />

14<br />

October 2, 2007

Fiscal 2006 EBITDA Reconciliation (1)<br />

($ in millions)<br />

<strong>Steel</strong> <strong>Dynamics</strong> <strong>OmniSource</strong><br />

<strong>Inc</strong>ome Before <strong>Inc</strong>ome Taxes<br />

$631.6<br />

$116.3<br />

Interest Expense, Net<br />

31.0<br />

11.1<br />

EBIT (2) 662.5<br />

134.1<br />

Adjustments<br />

--<br />

6.7<br />

(1)<br />

Depreciation & Amortization<br />

114.8<br />

25.0<br />

EBITDA (2) 777.3<br />

159.1<br />

Adjustments:<br />

15<br />

Gain on Sale of Assets<br />

Excess Compensation and Severance<br />

Unrealized Gain on Hedging Activities<br />

Reversal of Allowances<br />

Expensed Capital and Related Party Lease Expense<br />

Other Expenses<br />

Annualized <strong>Acquisition</strong>s, Joint Ventures and Divestitures<br />

Total Adjustments<br />

(1) <strong>Steel</strong> <strong>Dynamics</strong>’ fiscal year end is December 31, 2006; <strong>OmniSource</strong>’s fiscal year end is September 30, 2006<br />

(2) Numbers may not add up due to rounding<br />

(11.3)<br />

5.9<br />

(7.1)<br />

1.2<br />

5.5<br />

3.9<br />

8.6<br />

6.7<br />

October 2, 2007