Current report on SEC Form 8-K checklist - Center for Corporate ...

Current report on SEC Form 8-K checklist - Center for Corporate ... Current report on SEC Form 8-K checklist - Center for Corporate ...

Checklist for

Checklist for

- Page 1 and 2: Checklist for Current</stro

- Page 3 and 4: Checklist for Current</stro

- Page 5 and 6: Checklist for Current</stro

- Page 7 and 8: Checklist for Current</stro

- Page 9 and 10: Checklist for Current</stro

- Page 11 and 12: Checklist for Current</stro

- Page 13 and 14: Checklist for Current</stro

- Page 15 and 16: Checklist for Current</stro

- Page 17 and 18: Checklist for Current</stro

- Page 19 and 20: Checklist for Current</stro

- Page 21 and 22: Checklist for Current</stro

- Page 23 and 24: Checklist for Current</stro

- Page 25 and 26: Checklist for Current</stro

- Page 27 and 28: Checklist for Current</stro

- Page 29 and 30: Checklist for Current</stro

- Page 31 and 32: Checklist for Current</stro

- Page 33: Checklist for Current</stro

- Page 37 and 38: Checklist for Current</stro

- Page 39 and 40: Checklist for Current</stro

- Page 41 and 42: Checklist for Current</stro

- Page 43 and 44: Checklist for Current</stro

- Page 45: Checklist for Current</stro

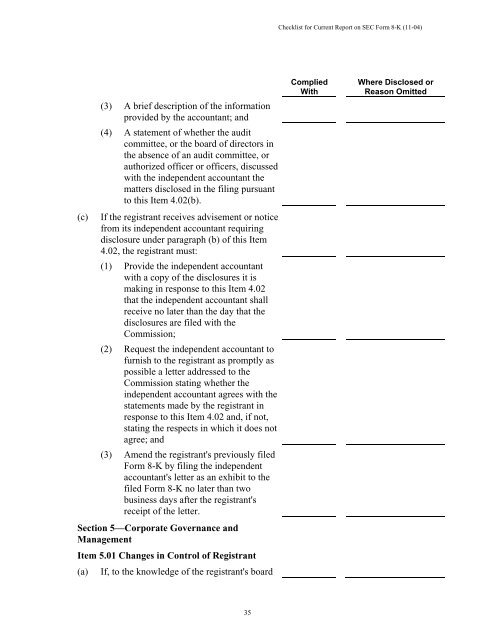

Checklist <strong>for</strong> <str<strong>on</strong>g>Current</str<strong>on</strong>g> Report <strong>on</strong> <strong>SEC</strong> <strong>Form</strong> 8-K (11-04)<br />

(c)<br />

(3) A brief descripti<strong>on</strong> of the in<strong>for</strong>mati<strong>on</strong><br />

provided by the accountant; and<br />

(4) A statement of whether the audit<br />

committee, or the board of directors in<br />

the absence of an audit committee, or<br />

authorized officer or officers, discussed<br />

with the independent accountant the<br />

matters disclosed in the filing pursuant<br />

to this Item 4.02(b).<br />

If the registrant receives advisement or notice<br />

from its independent accountant requiring<br />

disclosure under paragraph (b) of this Item<br />

4.02, the registrant must:<br />

(1) Provide the independent accountant<br />

with a copy of the disclosures it is<br />

making in resp<strong>on</strong>se to this Item 4.02<br />

that the independent accountant shall<br />

receive no later than the day that the<br />

disclosures are filed with the<br />

Commissi<strong>on</strong>;<br />

(2) Request the independent accountant to<br />

furnish to the registrant as promptly as<br />

possible a letter addressed to the<br />

Commissi<strong>on</strong> stating whether the<br />

independent accountant agrees with the<br />

statements made by the registrant in<br />

resp<strong>on</strong>se to this Item 4.02 and, if not,<br />

stating the respects in which it does not<br />

agree; and<br />

(3) Amend the registrant's previously filed<br />

<strong>Form</strong> 8-K by filing the independent<br />

accountant's letter as an exhibit to the<br />

filed <strong>Form</strong> 8-K no later than two<br />

business days after the registrant's<br />

receipt of the letter.<br />

Secti<strong>on</strong> 5—<strong>Corporate</strong> Governance and<br />

Management<br />

Item 5.01 Changes in C<strong>on</strong>trol of Registrant<br />

(a)<br />

If, to the knowledge of the registrant's board<br />

Complied<br />

With<br />

Where Disclosed or<br />

Reas<strong>on</strong> Omitted<br />

35