Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ... Economics Markets Strategy - the DBS Vickers Securities Equities ...

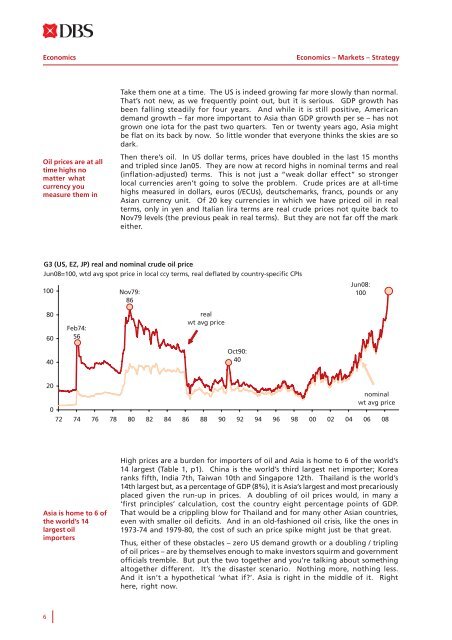

Economics Economics – Markets – Strategy Oil prices are at all time highs no matter what currency you measure them in Take them one at a time. The US is indeed growing far more slowly than normal. That’s not new, as we frequently point out, but it is serious. GDP growth has been falling steadily for four years. And while it is still positive, American demand growth – far more important to Asia than GDP growth per se – has not grown one iota for the past two quarters. Ten or twenty years ago, Asia might be flat on its back by now. So little wonder that everyone thinks the skies are so dark. Then there’s oil. In US dollar terms, prices have doubled in the last 15 months and tripled since Jan05. They are now at record highs in nominal terms and real (inflation-adjusted) terms. This is not just a “weak dollar effect” so stronger local currencies aren’t going to solve the problem. Crude prices are at all-time highs measured in dollars, euros (/ECUs), deutschemarks, francs, pounds or any Asian currency unit. Of 20 key currencies in which we have priced oil in real terms, only in yen and Italian lira terms are real crude prices not quite back to Nov79 levels (the previous peak in real terms). But they are not far off the mark either. G3 (US, EZ, JP) real and nominal crude oil price Jun08=100, wtd avg spot price in local ccy terms, real deflated by country-specific CPIs 100 Nov79: 86 Jun08: 100 80 60 Feb74: 56 real wt avg price 40 Oct90: 40 20 0 nominal wt avg price 72 74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 Asia is home to 6 of the world’s 14 largest oil importers High prices are a burden for importers of oil and Asia is home to 6 of the world’s 14 largest (Table 1, p1). China is the world’s third largest net importer; Korea ranks fifth, India 7th, Taiwan 10th and Singapore 12th. Thailand is the world’s 14th largest but, as a percentage of GDP (8%), it is Asia’s largest and most precariously placed given the run-up in prices. A doubling of oil prices would, in many a ‘first principles’ calculation, cost the country eight percentage points of GDP. That would be a crippling blow for Thailand and for many other Asian countries, even with smaller oil deficits. And in an old-fashioned oil crisis, like the ones in 1973-74 and 1979-80, the cost of such an price spike might just be that great. Thus, either of these obstacles – zero US demand growth or a doubling / tripling of oil prices – are by themselves enough to make investors squirm and government officials tremble. But put the two together and you’re talking about something altogether different. It’s the disaster scenario. Nothing more, nothing less. And it isn’t a hypothetical ‘what if?’. Asia is right in the middle of it. Right here, right now. 6

Economics – Markets – Strategy Economics And yet, something is going right. Asia is in the middle of the disaster scenario and nothing is turning out disastrous. On the contrary, growth is stronger than it should be even on a clear day. Singapore reported 6.7% YoY growth in the first quarter. That’s one-third faster than what the government reckons to be potential. And it’s faster than it was three years ago, when US growth was 4% YoY (chart below) and oil prices were one-third what they are today. Talk about bucking headwinds. But Hong Kong did even better. It reported 7.1% growth in the first quarter when 4.5% is normal for a clear day. China grew by 10.6%, probably above it’s potential rate, India by nearly 9%. Korea and Taiwan grew by about 6%, well above potential for economies of their income and technological levels. And Malaysia grew by 7.1% YoY! That’s faster than at any time in the last three years save for 4Q07 when it grew by 7.3%. Likewise for Thailand, which grew by 6.1%, its fastest rate in two years and nearly its fastest in three. Asia is in the middle of the disaster scenario and nothing is turning out disastrous Income and demand growth – Asia & US % YoY, 2qma, simple average 8 7 6 5 4 3 Asia 10 GDP Asia 8 GDP (ex-CH, IN) 7% 6.3% 2 1 US domestic demand 1.5% 1.6% 0 Dec-04 Jun-05 Dec-05 Jun-06 Dec-06 Jun-07 Dec-07 What’s really interesting is that the skies didn’t darken just last night. The US has slowed – steadily and extensively – over the past 3.5 years (chart above). Oil prices are 3 times higher than they were three years ago. And economic growth in Asia is either still running above potential and/or, in the cases of Thailand and Malaysia, faster than at any time in the last 2-3 years. That isn’t impressive. It’s surreal. The environment is hell, the outcome sublime. What is Asia doing right? How can Asia be growing so well when US demand growth is zero and oil prices have tripled? The answer to both questions, we think, is demand. Asian demand mostly. Asian demand is driving Asian growth in the absence of the US. And Asian demand is key to the growth in global petroleum demand that appears to be mainly responsible for today’s higher oil prices. What explains the puzzle? Demand growth, mostly Asian 7

- Page 1 and 2: Economics Markets Strategy 3Q 2008

- Page 3 and 4: Economics - Markets - Strategy June

- Page 5 and 6: Economics - Markets - Strategy June

- Page 7: Economics - Markets - Strategy Econ

- Page 11 and 12: Economics - Markets - Strategy Econ

- Page 13 and 14: Economics - Markets - Strategy Econ

- Page 15 and 16: Economics - Markets - Strategy Econ

- Page 17 and 18: Economics - Markets - Strategy Econ

- Page 19 and 20: Economics - Markets - Strategy Econ

- Page 21 and 22: Economics - Markets - Strategy Econ

- Page 23 and 24: Economics - Markets - Strategy Econ

- Page 25 and 26: Economics - Markets - Strategy Curr

- Page 27 and 28: Economics - Markets - Strategy Curr

- Page 29 and 30: Economics - Markets - Strategy Curr

- Page 31 and 32: Economics - Markets - Strategy Curr

- Page 33 and 34: Economics - Markets - Strategy Curr

- Page 35 and 36: Economics - Markets - Strategy Curr

- Page 37 and 38: Economics - Markets - Strategy Curr

- Page 39 and 40: Economics - Markets - Strategy Curr

- Page 41 and 42: Economics - Markets - Strategy Curr

- Page 43 and 44: Economics - Markets - Strategy Curr

- Page 45 and 46: Economics - Markets - Strategy Yiel

- Page 47 and 48: Economics - Markets - Strategy Yiel

- Page 49 and 50: Economics - Markets - Strategy Yiel

- Page 51 and 52: Economics - Markets - Strategy Yiel

- Page 53 and 54: Economics - Markets - Strategy Yiel

- Page 55 and 56: Economics - Markets - Strategy Yiel

- Page 57 and 58: Economics - Markets - Strategy Yiel

<strong>Economics</strong><br />

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong><br />

Oil prices are at all<br />

time highs no<br />

matter what<br />

currency you<br />

measure <strong>the</strong>m in<br />

Take <strong>the</strong>m one at a time. The US is indeed growing far more slowly than normal.<br />

That’s not new, as we frequently point out, but it is serious. GDP growth has<br />

been falling steadily for four years. And while it is still positive, American<br />

demand growth – far more important to Asia than GDP growth per se – has not<br />

grown one iota for <strong>the</strong> past two quarters. Ten or twenty years ago, Asia might<br />

be flat on its back by now. So little wonder that everyone thinks <strong>the</strong> skies are so<br />

dark.<br />

Then <strong>the</strong>re’s oil. In US dollar terms, prices have doubled in <strong>the</strong> last 15 months<br />

and tripled since Jan05. They are now at record highs in nominal terms and real<br />

(inflation-adjusted) terms. This is not just a “weak dollar effect” so stronger<br />

local currencies aren’t going to solve <strong>the</strong> problem. Crude prices are at all-time<br />

highs measured in dollars, euros (/ECUs), deutschemarks, francs, pounds or any<br />

Asian currency unit. Of 20 key currencies in which we have priced oil in real<br />

terms, only in yen and Italian lira terms are real crude prices not quite back to<br />

Nov79 levels (<strong>the</strong> previous peak in real terms). But <strong>the</strong>y are not far off <strong>the</strong> mark<br />

ei<strong>the</strong>r.<br />

G3 (US, EZ, JP) real and nominal crude oil price<br />

Jun08=100, wtd avg spot price in local ccy terms, real deflated by country-specific CPIs<br />

100<br />

Nov79:<br />

86<br />

Jun08:<br />

100<br />

80<br />

60<br />

Feb74:<br />

56<br />

real<br />

wt avg price<br />

40<br />

Oct90:<br />

40<br />

20<br />

0<br />

nominal<br />

wt avg price<br />

72 74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08<br />

Asia is home to 6 of<br />

<strong>the</strong> world’s 14<br />

largest oil<br />

importers<br />

High prices are a burden for importers of oil and Asia is home to 6 of <strong>the</strong> world’s<br />

14 largest (Table 1, p1). China is <strong>the</strong> world’s third largest net importer; Korea<br />

ranks fifth, India 7th, Taiwan 10th and Singapore 12th. Thailand is <strong>the</strong> world’s<br />

14th largest but, as a percentage of GDP (8%), it is Asia’s largest and most precariously<br />

placed given <strong>the</strong> run-up in prices. A doubling of oil prices would, in many a<br />

‘first principles’ calculation, cost <strong>the</strong> country eight percentage points of GDP.<br />

That would be a crippling blow for Thailand and for many o<strong>the</strong>r Asian countries,<br />

even with smaller oil deficits. And in an old-fashioned oil crisis, like <strong>the</strong> ones in<br />

1973-74 and 1979-80, <strong>the</strong> cost of such an price spike might just be that great.<br />

Thus, ei<strong>the</strong>r of <strong>the</strong>se obstacles – zero US demand growth or a doubling / tripling<br />

of oil prices – are by <strong>the</strong>mselves enough to make investors squirm and government<br />

officials tremble. But put <strong>the</strong> two toge<strong>the</strong>r and you’re talking about something<br />

altoge<strong>the</strong>r different. It’s <strong>the</strong> disaster scenario. Nothing more, nothing less.<br />

And it isn’t a hypo<strong>the</strong>tical ‘what if?’. Asia is right in <strong>the</strong> middle of it. Right<br />

here, right now.<br />

6