Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ... Economics Markets Strategy - the DBS Vickers Securities Equities ...

Yield Economics – Markets – Strategy Hong Kong: Still credibly pegged As the HKD remains credibly pegged against the USD, HKD rates continue to track USD rates. Moreover, as USD/HKD forwards continue to reflect a HKD appreciation bias, Hibor-Libor spreads continue to be steady and a sharp rise in Hibors relative to Libors is unlikely (Charts 7 & 8). Chart 7: USD/HKD Spot & Forwards HKD per 1 USD 7.90 7.85 7.80 7.75 Current forward path for USD/HKD 7.70 Jan-06 Jan-07 Jan-08 Jan-09 Chart 8: USD/HKD Spot - 7.75 vs Libor-Hibor 12M pips 1200 1000 800 600 400 200 USD/HKD Spot - 7.75 Libor 12M -Hibor 12M (RHS) 0 Jan-07 Jul-07 Jan-08 bps 160 140 120 100 80 60 40 20 0 -20 Hence, our outlook for Fed Funds implies that Hibors are likely to rise in 4Q08 and 2009. Moreover, as Treasuries are likely to sell-off sharply in 2H08 in anticipation of substantial Fed tightening, Exchange Fund Notes too will be under upward pressure in the coming months. In other words, we expect the notes to continue to track our rough fair value estimates (defined as UST yield - 12M money market rates differential) higher (Charts 9 & 10). Chart 9: EFN 2Y Yield %pa 5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 +50bps -50bps 2Y EFN Yield 0.5 Fair Value (2Y UST - 12M Libor/Hibor 0.0 May-05 May-06 May-07 May-08 Chart 10: EFN 10Y Yield %pa 5.5 +50bps 5.0 4.5 4.0 3.5 3.0 -50bps 10Y EFN Yield 2.5 2.0 Fair Value (10Y UST - 12M Libor/Hibor spread) 1.5 May-05 May-06 May-07 May-08 Korea: Rate cuts needed? Stagflation dynamics are keeping the Bank of Korea on hold and the market guessing whether the next move from the central bank will be up or down. Until May the market was leaning towards rate cuts, but non-action and the absence of any rate cut signal from the BOK at the May 8 monetary policy 46

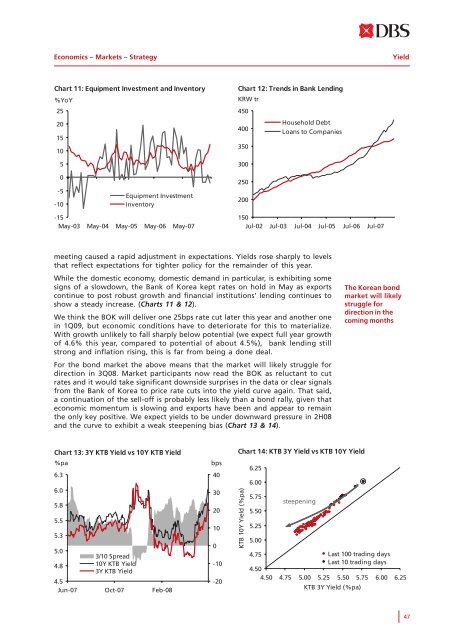

Economics – Markets – Strategy Yield Chart 11: Equipment Investment and Inventory %YoY 25 20 15 10 5 Chart 12: Trends in Bank Lending KRW tr 450 400 350 300 Household Debt Loans to Companies 0 -5 -10 Equipment Investment Inventory 250 200 -15 May-03 May-04 May-05 May-06 May-07 150 Jul-02 Jul-03 Jul-04 Jul-05 Jul-06 Jul-07 meeting caused a rapid adjustment in expectations. Yields rose sharply to levels that reflect expectations for tighter policy for the remainder of this year. While the domestic economy, domestic demand in particular, is exhibiting some signs of a slowdown, the Bank of Korea kept rates on hold in May as exports continue to post robust growth and financial institutions’ lending continues to show a steady increase. (Charts 11 & 12). We think the BOK will deliver one 25bps rate cut later this year and another one in 1Q09, but economic conditions have to deteriorate for this to materialize. With growth unlikely to fall sharply below potential (we expect full year growth of 4.6% this year, compared to potential of about 4.5%), bank lending still strong and inflation rising, this is far from being a done deal. For the bond market the above means that the market will likely struggle for direction in 3Q08. Market participants now read the BOK as reluctant to cut rates and it would take significant downside surprises in the data or clear signals from the Bank of Korea to price rate cuts into the yield curve again. That said, a continuation of the sell-off is probably less likely than a bond rally, given that economic momentum is slowing and exports have been and appear to remain the only key positive. We expect yields to be under downward pressure in 2H08 and the curve to exhibit a weak steepening bias (Chart 13 & 14). The Korean bond market will likely struggle for direction in the coming months Chart 13: 3Y KTB Yield vs 10Y KTB Yield %pa 6.3 6.0 5.8 5.5 5.3 5.0 4.8 3/10 Spread 10Y KTB Yield 3Y KTB Yield 4.5 Jun-07 Oct-07 Feb-08 bps 40 30 20 10 0 -10 -20 Chart 14: KTB 3Y Yield vs KTB 10Y Yield KTB 10Y Yield (%pa) 6.25 6.00 5.75 5.50 5.25 5.00 steepening 4.75 Last 100 trading days Last 10 trading days 4.50 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 KTB 3Y Yield (%pa) 47

- Page 1 and 2: Economics Markets Strategy 3Q 2008

- Page 3 and 4: Economics - Markets - Strategy June

- Page 5 and 6: Economics - Markets - Strategy June

- Page 7 and 8: Economics - Markets - Strategy Econ

- Page 9 and 10: Economics - Markets - Strategy Econ

- Page 11 and 12: Economics - Markets - Strategy Econ

- Page 13 and 14: Economics - Markets - Strategy Econ

- Page 15 and 16: Economics - Markets - Strategy Econ

- Page 17 and 18: Economics - Markets - Strategy Econ

- Page 19 and 20: Economics - Markets - Strategy Econ

- Page 21 and 22: Economics - Markets - Strategy Econ

- Page 23 and 24: Economics - Markets - Strategy Econ

- Page 25 and 26: Economics - Markets - Strategy Curr

- Page 27 and 28: Economics - Markets - Strategy Curr

- Page 29 and 30: Economics - Markets - Strategy Curr

- Page 31 and 32: Economics - Markets - Strategy Curr

- Page 33 and 34: Economics - Markets - Strategy Curr

- Page 35 and 36: Economics - Markets - Strategy Curr

- Page 37 and 38: Economics - Markets - Strategy Curr

- Page 39 and 40: Economics - Markets - Strategy Curr

- Page 41 and 42: Economics - Markets - Strategy Curr

- Page 43 and 44: Economics - Markets - Strategy Curr

- Page 45 and 46: Economics - Markets - Strategy Yiel

- Page 47: Economics - Markets - Strategy Yiel

- Page 51 and 52: Economics - Markets - Strategy Yiel

- Page 53 and 54: Economics - Markets - Strategy Yiel

- Page 55 and 56: Economics - Markets - Strategy Yiel

- Page 57 and 58: Economics - Markets - Strategy Yiel

- Page 59 and 60: Economics - Markets - Strategy Asia

- Page 61 and 62: Economics - Markets - Strategy Asia

- Page 63 and 64: Economics - Markets - Strategy Asia

- Page 65 and 66: Economics - Markets - Strategy Asia

- Page 67 and 68: Economics - Markets - Strategy Asia

- Page 69 and 70: Economics - Markets - Strategy Asia

- Page 71 and 72: Economics - Markets - Strategy Asia

- Page 73 and 74: Economics - Markets - Strategy Econ

- Page 75 and 76: Economics - Markets - Strategy Econ

- Page 77 and 78: Economics - Markets - Strategy Econ

- Page 79 and 80: Economics - Markets - Strategy Econ

- Page 81 and 82: Economics - Markets - Strategy Econ

- Page 83 and 84: Economics - Markets - Strategy Econ

- Page 85 and 86: Economics - Markets - Strategy Econ

- Page 87 and 88: Economics - Markets - Strategy Econ

- Page 89 and 90: Economics - Markets - Strategy Econ

- Page 91 and 92: Economics - Markets - Strategy Econ

- Page 93 and 94: Economics - Markets - Strategy Econ

- Page 95 and 96: Economics - Markets - Strategy Econ

- Page 97 and 98: Economics - Markets - Strategy Econ

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong> Yield<br />

Chart 11: Equipment Investment and Inventory<br />

%YoY<br />

25<br />

20<br />

15<br />

10<br />

5<br />

Chart 12: Trends in Bank Lending<br />

KRW tr<br />

450<br />

400<br />

350<br />

300<br />

Household Debt<br />

Loans to Companies<br />

0<br />

-5<br />

-10<br />

Equipment Investment<br />

Inventory<br />

250<br />

200<br />

-15<br />

May-03 May-04 May-05 May-06 May-07<br />

150<br />

Jul-02 Jul-03 Jul-04 Jul-05 Jul-06 Jul-07<br />

meeting caused a rapid adjustment in expectations. Yields rose sharply to levels<br />

that reflect expectations for tighter policy for <strong>the</strong> remainder of this year.<br />

While <strong>the</strong> domestic economy, domestic demand in particular, is exhibiting some<br />

signs of a slowdown, <strong>the</strong> Bank of Korea kept rates on hold in May as exports<br />

continue to post robust growth and financial institutions’ lending continues to<br />

show a steady increase. (Charts 11 & 12).<br />

We think <strong>the</strong> BOK will deliver one 25bps rate cut later this year and ano<strong>the</strong>r one<br />

in 1Q09, but economic conditions have to deteriorate for this to materialize.<br />

With growth unlikely to fall sharply below potential (we expect full year growth<br />

of 4.6% this year, compared to potential of about 4.5%), bank lending still<br />

strong and inflation rising, this is far from being a done deal.<br />

For <strong>the</strong> bond market <strong>the</strong> above means that <strong>the</strong> market will likely struggle for<br />

direction in 3Q08. Market participants now read <strong>the</strong> BOK as reluctant to cut<br />

rates and it would take significant downside surprises in <strong>the</strong> data or clear signals<br />

from <strong>the</strong> Bank of Korea to price rate cuts into <strong>the</strong> yield curve again. That said,<br />

a continuation of <strong>the</strong> sell-off is probably less likely than a bond rally, given that<br />

economic momentum is slowing and exports have been and appear to remain<br />

<strong>the</strong> only key positive. We expect yields to be under downward pressure in 2H08<br />

and <strong>the</strong> curve to exhibit a weak steepening bias (Chart 13 & 14).<br />

The Korean bond<br />

market will likely<br />

struggle for<br />

direction in <strong>the</strong><br />

coming months<br />

Chart 13: 3Y KTB Yield vs 10Y KTB Yield<br />

%pa<br />

6.3<br />

6.0<br />

5.8<br />

5.5<br />

5.3<br />

5.0<br />

4.8<br />

3/10 Spread<br />

10Y KTB Yield<br />

3Y KTB Yield<br />

4.5<br />

Jun-07 Oct-07 Feb-08<br />

bps<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

Chart 14: KTB 3Y Yield vs KTB 10Y Yield<br />

KTB 10Y Yield (%pa)<br />

6.25<br />

6.00<br />

5.75<br />

5.50<br />

5.25<br />

5.00<br />

steepening<br />

4.75<br />

Last 100 trading days<br />

Last 10 trading days<br />

4.50<br />

4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25<br />

KTB 3Y Yield (%pa)<br />

47