Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong> Yield<br />

Chart 3: 2Y UST Yield - FFR vs 10Y UST Yield - FFR<br />

Chart 4: 10Y UST Yield vs 2Y UST Yield - FFR<br />

Y = 10Y UST Yield - Fed Funds (bps)<br />

350<br />

y = 0.666x + 157.56<br />

300<br />

250<br />

Forecast<br />

200<br />

from 30 Apr 08<br />

150<br />

100<br />

last 60 trading days<br />

50<br />

0<br />

-200 -100 0 100 200 300<br />

X = 2Y UST Yield - Fed Funds (bps)<br />

10Y UST Yield (%pa)<br />

5.50<br />

5.00<br />

4.50<br />

A<br />

Forecast<br />

Current<br />

4.00<br />

B C<br />

A: Jun07 to Dec07<br />

3.50<br />

B: Dec07 to Mar08<br />

C: Mar08 to Currnet<br />

3.00<br />

-200 -150 -100 -50 0 50 100 150 200 250<br />

2Y UST Yield - Fed Funds (bps)<br />

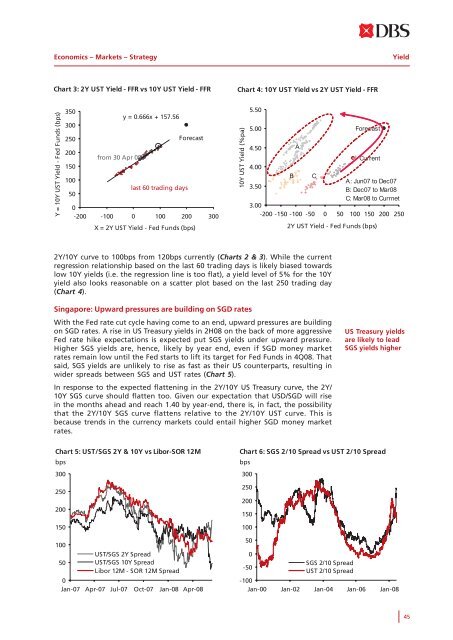

2Y/10Y curve to 100bps from 120bps currently (Charts 2 & 3). While <strong>the</strong> current<br />

regression relationship based on <strong>the</strong> last 60 trading days is likely biased towards<br />

low 10Y yields (i.e. <strong>the</strong> regression line is too flat), a yield level of 5% for <strong>the</strong> 10Y<br />

yield also looks reasonable on a scatter plot based on <strong>the</strong> last 250 trading day<br />

(Chart 4).<br />

Singapore: Upward pressures are building on SGD rates<br />

With <strong>the</strong> Fed rate cut cycle having come to an end, upward pressures are building<br />

on SGD rates. A rise in US Treasury yields in 2H08 on <strong>the</strong> back of more aggressive<br />

Fed rate hike expectations is expected put SGS yields under upward pressure.<br />

Higher SGS yields are, hence, likely by year end, even if SGD money market<br />

rates remain low until <strong>the</strong> Fed starts to lift its target for Fed Funds in 4Q08. That<br />

said, SGS yields are unlikely to rise as fast as <strong>the</strong>ir US counterparts, resulting in<br />

wider spreads between SGS and UST rates (Chart 5).<br />

In response to <strong>the</strong> expected flattening in <strong>the</strong> 2Y/10Y US Treasury curve, <strong>the</strong> 2Y/<br />

10Y SGS curve should flatten too. Given our expectation that USD/SGD will rise<br />

in <strong>the</strong> months ahead and reach 1.40 by year-end, <strong>the</strong>re is, in fact, <strong>the</strong> possibility<br />

that <strong>the</strong> 2Y/10Y SGS curve flattens relative to <strong>the</strong> 2Y/10Y UST curve. This is<br />

because trends in <strong>the</strong> currency markets could entail higher SGD money market<br />

rates.<br />

US Treasury yields<br />

are likely to lead<br />

SGS yields higher<br />

Chart 5: UST/SGS 2Y & 10Y vs Libor-SOR 12M<br />

bps<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

UST/SGS 2Y Spread<br />

UST/SGS 10Y Spread<br />

Libor 12M - SOR 12M Spread<br />

0<br />

Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08<br />

Chart 6: SGS 2/10 Spread vs UST 2/10 Spread<br />

bps<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

-50<br />

SGS 2/10 Spread<br />

UST 2/10 Spread<br />

-100<br />

Jan-00 Jan-02 Jan-04 Jan-06 Jan-08<br />

45