Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ... Economics Markets Strategy - the DBS Vickers Securities Equities ...

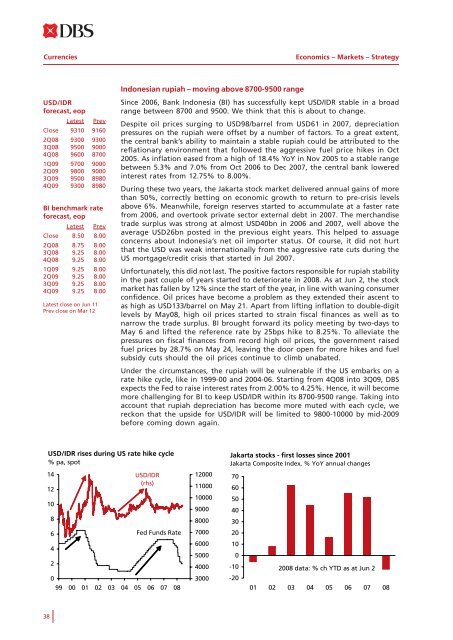

Currencies Economics – Markets – Strategy Indonesian rupiah – moving above 8700-9500 range USD/IDR forecast, eop Latest Prev Close 9310 9160 2Q08 9300 9300 3Q08 9500 9000 4Q08 9600 8700 1Q09 9700 9000 2Q09 9800 9000 3Q09 9500 8980 4Q09 9300 8980 BI benchmark rate forecast, eop Latest Prev Close 8.50 8.00 2Q08 8.75 8.00 3Q08 9.25 8.00 4Q08 9.25 8.00 1Q09 9.25 8.00 2Q09 9.25 8.00 3Q09 9.25 8.00 4Q09 9.25 8.00 Latest close on Jun 11 Prev close on Mar 12 Since 2006, Bank Indonesia (BI) has successfully kept USD/IDR stable in a broad range between 8700 and 9500. We think that this is about to change. Despite oil prices surging to USD98/barrel from USD61 in 2007, depreciation pressures on the rupiah were offset by a number of factors. To a great extent, the central bank’s ability to maintain a stable rupiah could be attributed to the reflationary environment that followed the aggressive fuel price hikes in Oct 2005. As inflation eased from a high of 18.4% YoY in Nov 2005 to a stable range between 5.3% and 7.0% from Oct 2006 to Dec 2007, the central bank lowered interest rates from 12.75% to 8.00%. During these two years, the Jakarta stock market delivered annual gains of more than 50%, correctly betting on economic growth to return to pre-crisis levels above 6%. Meanwhile, foreign reserves started to accummulate at a faster rate from 2006, and overtook private sector external debt in 2007. The merchandise trade surplus was strong at almost USD40bn in 2006 and 2007, well above the average USD26bn posted in the previous eight years. This helped to assuage concerns about Indonesia’s net oil importer status. Of course, it did not hurt that the USD was weak internationally from the aggressive rate cuts during the US mortgage/credit crisis that started in Jul 2007. Unfortunately, this did not last. The positive factors responsible for rupiah stability in the past couple of years started to deteriorate in 2008. As at Jun 2, the stock market has fallen by 12% since the start of the year, in line with waning consumer confidence. Oil prices have become a problem as they extended their ascent to as high as USD133/barrel on May 21. Apart from lifting inflation to double-digit levels by May08, high oil prices started to strain fiscal finances as well as to narrow the trade surplus. BI brought forward its policy meeting by two-days to May 6 and lifted the reference rate by 25bps hike to 8.25%. To alleviate the pressures on fiscal finances from record high oil prices, the government raised fuel prices by 28.7% on May 24, leaving the door open for more hikes and fuel subsidy cuts should the oil prices continue to climb unabated. Under the circumstances, the rupiah will be vulnerable if the US embarks on a rate hike cycle, like in 1999-00 and 2004-06. Starting from 4Q08 into 3Q09, DBS expects the Fed to raise interest rates from 2.00% to 4.25%. Hence, it will become more challenging for BI to keep USD/IDR within its 8700-9500 range. Taking into account that rupiah depreciation has become more muted with each cycle, we reckon that the upside for USD/IDR will be limited to 9800-10000 by mid-2009 before coming down again. USD/IDR rises during US rate hike cycle % pa, spot 14 12 10 8 6 4 2 USD/IDR (rhs) Fed Funds Rate 0 99 00 01 02 03 04 05 06 07 08 12000 11000 10000 9000 8000 7000 6000 5000 4000 3000 Jakarta stocks - first losses since 2001 Jakarta Composite Index, % YoY annual changes 70 60 50 40 30 20 10 0 -10 -20 2008 data: % ch YTD as at Jun 2 01 02 03 04 05 06 07 08 38

Economics – Markets – Strategy Currencies Philippine peso – deep retracement on less favorable fundamentals In our last quarterly, we expected USD/PHP to head up in 2Q08, as it normally does during the second quarter of the year. We also reined in our bullish PHP expectations because the factors that were responsible for the PHP’s three-year rally between 2005 and 2007 have started to weaken. The deterioration was, however, not severe enough for us to abandon our expectations for PHP to appreciate for a fourth year. Back then, the USD continued to be stressed by the US mortgage/credit crisis. Nonetheless, the PHP’s weakness in 2Q08 turned out to be more significant than we had expected. Unlike past years, Bangko Sentral ng Pilipinas’ (BSP) interventions were aimed at curbing currency depreciation, and not to slow appreciation. More worryingly, USD/PHP traded above the accelerating depreciation band that it has been tracking during 2005-2007. After reviewing the factors that were responsible for the PHP’s appreciation during 2005-2007, our findings suggest that the PHP is no longer likely to appreciate for a fourth straight year in 2008. What changed? The PHP’s rally during 2005-2007 was characterized by rising economic growth and falling inflation. Both the budget and current account balances improved significantly. Foreign reserves increased sharply, thanks also to strong contributions from overseas foreign worker remittances. As investor confidence increased, the stock market entered into a bull run. The USD was also weak against Asian currencies, especially after China abandoned its currency peg in Jul 2005. In 2008, these fundamentals turned less favorable. The economy is unlikely to repeat last year’s stellar performance. To support growth, the Arroyo government abandoned its goal to balance the budget in 2008. Slower growth propsects are likely to pressure the budget deficit wider by slowing revenue collection and increasing government spending. Meanwhile, inflation reared its ugly head, no thanks to higher international commodity prices. Owing to more expensive food and energy imports, the trade deficit has already widened to USD2.1bn in 1Q08. On a positive note, OFW remittances are still growing, and this should take some pressure off the current account. Historically, USD/PHP is known to retrace about 45% of large moves, like it did in 1997/98 and 2000/01. Like these two episodes, the PHP is currently confronting an uncertain global economy. Assuming that the same 45% retracement takes place, USD/PHP could extend its rise to 47 before entering into a broad consolidation, possibly between 41 and 47. If export competitiveness becomes a priority with the government, the consolidation range could be narrow at 45-47 instead. USD/PHP forecast, eop Latest Prev Close 44.2 41.2 2Q08 44.5 42.5 3Q08 45.0 41.0 4Q08 47.0 39.0 1Q09 45.0 41.0 2Q09 45.0 41.0 3Q09 43.0 41.0 4Q09 43.0 41.0 BSP o/n call rate forecast, eop Latest Prev Close 5.25 5.00 2Q08 5.25 5.00 3Q08 5.75 5.00 4Q08 6.00 5.00 1Q09 6.00 5.00 2Q09 6.00 5.00 3Q09 6.00 5.00 4Q09 6.00 5.00 Latest close on Jun 11 Prev close on Mar 12 USD/PHP - 45% retracements after big currency moves, before entering into a consolidation 60 55 45% retracement of 1999-00 rise 50 45 45% retracement of 1997-98 rise 40 35 30 25 47% retracement of 1993-94 fall 20 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 39

- Page 1 and 2: Economics Markets Strategy 3Q 2008

- Page 3 and 4: Economics - Markets - Strategy June

- Page 5 and 6: Economics - Markets - Strategy June

- Page 7 and 8: Economics - Markets - Strategy Econ

- Page 9 and 10: Economics - Markets - Strategy Econ

- Page 11 and 12: Economics - Markets - Strategy Econ

- Page 13 and 14: Economics - Markets - Strategy Econ

- Page 15 and 16: Economics - Markets - Strategy Econ

- Page 17 and 18: Economics - Markets - Strategy Econ

- Page 19 and 20: Economics - Markets - Strategy Econ

- Page 21 and 22: Economics - Markets - Strategy Econ

- Page 23 and 24: Economics - Markets - Strategy Econ

- Page 25 and 26: Economics - Markets - Strategy Curr

- Page 27 and 28: Economics - Markets - Strategy Curr

- Page 29 and 30: Economics - Markets - Strategy Curr

- Page 31 and 32: Economics - Markets - Strategy Curr

- Page 33 and 34: Economics - Markets - Strategy Curr

- Page 35 and 36: Economics - Markets - Strategy Curr

- Page 37 and 38: Economics - Markets - Strategy Curr

- Page 39: Economics - Markets - Strategy Curr

- Page 43 and 44: Economics - Markets - Strategy Curr

- Page 45 and 46: Economics - Markets - Strategy Yiel

- Page 47 and 48: Economics - Markets - Strategy Yiel

- Page 49 and 50: Economics - Markets - Strategy Yiel

- Page 51 and 52: Economics - Markets - Strategy Yiel

- Page 53 and 54: Economics - Markets - Strategy Yiel

- Page 55 and 56: Economics - Markets - Strategy Yiel

- Page 57 and 58: Economics - Markets - Strategy Yiel

- Page 59 and 60: Economics - Markets - Strategy Asia

- Page 61 and 62: Economics - Markets - Strategy Asia

- Page 63 and 64: Economics - Markets - Strategy Asia

- Page 65 and 66: Economics - Markets - Strategy Asia

- Page 67 and 68: Economics - Markets - Strategy Asia

- Page 69 and 70: Economics - Markets - Strategy Asia

- Page 71 and 72: Economics - Markets - Strategy Asia

- Page 73 and 74: Economics - Markets - Strategy Econ

- Page 75 and 76: Economics - Markets - Strategy Econ

- Page 77 and 78: Economics - Markets - Strategy Econ

- Page 79 and 80: Economics - Markets - Strategy Econ

- Page 81 and 82: Economics - Markets - Strategy Econ

- Page 83 and 84: Economics - Markets - Strategy Econ

- Page 85 and 86: Economics - Markets - Strategy Econ

- Page 87 and 88: Economics - Markets - Strategy Econ

- Page 89 and 90: Economics - Markets - Strategy Econ

Currencies<br />

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong><br />

Indonesian rupiah – moving above 8700-9500 range<br />

USD/IDR<br />

forecast, eop<br />

Latest Prev<br />

Close 9310 9160<br />

2Q08 9300 9300<br />

3Q08 9500 9000<br />

4Q08 9600 8700<br />

1Q09 9700 9000<br />

2Q09 9800 9000<br />

3Q09 9500 8980<br />

4Q09 9300 8980<br />

BI benchmark rate<br />

forecast, eop<br />

Latest Prev<br />

Close 8.50 8.00<br />

2Q08 8.75 8.00<br />

3Q08 9.25 8.00<br />

4Q08 9.25 8.00<br />

1Q09 9.25 8.00<br />

2Q09 9.25 8.00<br />

3Q09 9.25 8.00<br />

4Q09 9.25 8.00<br />

Latest close on Jun 11<br />

Prev close on Mar 12<br />

Since 2006, Bank Indonesia (BI) has successfully kept USD/IDR stable in a broad<br />

range between 8700 and 9500. We think that this is about to change.<br />

Despite oil prices surging to USD98/barrel from USD61 in 2007, depreciation<br />

pressures on <strong>the</strong> rupiah were offset by a number of factors. To a great extent,<br />

<strong>the</strong> central bank’s ability to maintain a stable rupiah could be attributed to <strong>the</strong><br />

reflationary environment that followed <strong>the</strong> aggressive fuel price hikes in Oct<br />

2005. As inflation eased from a high of 18.4% YoY in Nov 2005 to a stable range<br />

between 5.3% and 7.0% from Oct 2006 to Dec 2007, <strong>the</strong> central bank lowered<br />

interest rates from 12.75% to 8.00%.<br />

During <strong>the</strong>se two years, <strong>the</strong> Jakarta stock market delivered annual gains of more<br />

than 50%, correctly betting on economic growth to return to pre-crisis levels<br />

above 6%. Meanwhile, foreign reserves started to accummulate at a faster rate<br />

from 2006, and overtook private sector external debt in 2007. The merchandise<br />

trade surplus was strong at almost USD40bn in 2006 and 2007, well above <strong>the</strong><br />

average USD26bn posted in <strong>the</strong> previous eight years. This helped to assuage<br />

concerns about Indonesia’s net oil importer status. Of course, it did not hurt<br />

that <strong>the</strong> USD was weak internationally from <strong>the</strong> aggressive rate cuts during <strong>the</strong><br />

US mortgage/credit crisis that started in Jul 2007.<br />

Unfortunately, this did not last. The positive factors responsible for rupiah stability<br />

in <strong>the</strong> past couple of years started to deteriorate in 2008. As at Jun 2, <strong>the</strong> stock<br />

market has fallen by 12% since <strong>the</strong> start of <strong>the</strong> year, in line with waning consumer<br />

confidence. Oil prices have become a problem as <strong>the</strong>y extended <strong>the</strong>ir ascent to<br />

as high as USD133/barrel on May 21. Apart from lifting inflation to double-digit<br />

levels by May08, high oil prices started to strain fiscal finances as well as to<br />

narrow <strong>the</strong> trade surplus. BI brought forward its policy meeting by two-days to<br />

May 6 and lifted <strong>the</strong> reference rate by 25bps hike to 8.25%. To alleviate <strong>the</strong><br />

pressures on fiscal finances from record high oil prices, <strong>the</strong> government raised<br />

fuel prices by 28.7% on May 24, leaving <strong>the</strong> door open for more hikes and fuel<br />

subsidy cuts should <strong>the</strong> oil prices continue to climb unabated.<br />

Under <strong>the</strong> circumstances, <strong>the</strong> rupiah will be vulnerable if <strong>the</strong> US embarks on a<br />

rate hike cycle, like in 1999-00 and 2004-06. Starting from 4Q08 into 3Q09, <strong>DBS</strong><br />

expects <strong>the</strong> Fed to raise interest rates from 2.00% to 4.25%. Hence, it will become<br />

more challenging for BI to keep USD/IDR within its 8700-9500 range. Taking into<br />

account that rupiah depreciation has become more muted with each cycle, we<br />

reckon that <strong>the</strong> upside for USD/IDR will be limited to 9800-10000 by mid-2009<br />

before coming down again.<br />

USD/IDR rises during US rate hike cycle<br />

% pa, spot<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

USD/IDR<br />

(rhs)<br />

Fed Funds Rate<br />

0<br />

99 00 01 02 03 04 05 06 07 08<br />

12000<br />

11000<br />

10000<br />

9000<br />

8000<br />

7000<br />

6000<br />

5000<br />

4000<br />

3000<br />

Jakarta stocks - first losses since 2001<br />

Jakarta Composite Index, % YoY annual changes<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

2008 data: % ch YTD as at Jun 2<br />

01 02 03 04 05 06 07 08<br />

38