Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ... Economics Markets Strategy - the DBS Vickers Securities Equities ...

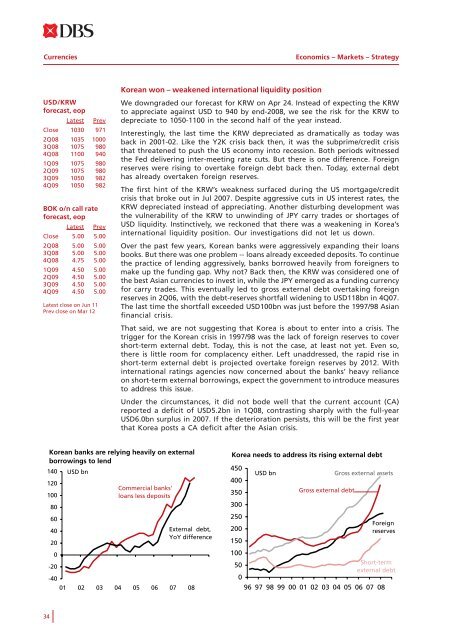

Currencies Economics – Markets – Strategy USD/KRW forecast, eop Latest Prev Close 1030 971 2Q08 1035 1000 3Q08 1075 980 4Q08 1100 940 1Q09 1075 980 2Q09 1075 980 3Q09 1050 982 4Q09 1050 982 BOK o/n call rate forecast, eop Latest Prev Close 5.00 5.00 2Q08 5.00 5.00 3Q08 5.00 5.00 4Q08 4.75 5.00 1Q09 4.50 5.00 2Q09 4.50 5.00 3Q09 4.50 5.00 4Q09 4.50 5.00 Latest close on Jun 11 Prev close on Mar 12 Korean won – weakened international liquidity position We downgraded our forecast for KRW on Apr 24. Instead of expecting the KRW to appreciate against USD to 940 by end-2008, we see the risk for the KRW to depreciate to 1050-1100 in the second half of the year instead. Interestingly, the last time the KRW depreciated as dramatically as today was back in 2001-02. Like the Y2K crisis back then, it was the subprime/credit crisis that threatened to push the US economy into recession. Both periods witnessed the Fed delivering inter-meeting rate cuts. But there is one difference. Foreign reserves were rising to overtake foreign debt back then. Today, external debt has already overtaken foreign reserves. The first hint of the KRW’s weakness surfaced during the US mortgage/credit crisis that broke out in Jul 2007. Despite aggressive cuts in US interest rates, the KRW depreciated instead of appreciating. Another disturbing development was the vulnerability of the KRW to unwinding of JPY carry trades or shortages of USD liquidity. Instinctively, we reckoned that there was a weakening in Korea’s international liquidity position. Our investigations did not let us down. Over the past few years, Korean banks were aggressively expanding their loans books. But there was one problem -- loans already exceeded deposits. To continue the practice of lending aggressively, banks borrowed heavily from foreigners to make up the funding gap. Why not? Back then, the KRW was considered one of the best Asian currencies to invest in, while the JPY emerged as a funding currency for carry trades. This eventually led to gross external debt overtaking foreign reserves in 2Q06, with the debt-reserves shortfall widening to USD118bn in 4Q07. The last time the shortfall exceeded USD100bn was just before the 1997/98 Asian financial crisis. That said, we are not suggesting that Korea is about to enter into a crisis. The trigger for the Korean crisis in 1997/98 was the lack of foreign reserves to cover short-term external debt. Today, this is not the case, at least not yet. Even so, there is little room for complacency either. Left unaddressed, the rapid rise in short-term external debt is projected overtake foreign reserves by 2012. With international ratings agencies now concerned about the banks’ heavy reliance on short-term external borrowings, expect the government to introduce measures to address this issue. Under the circumstances, it did not bode well that the current account (CA) reported a deficit of USD5.2bn in 1Q08, contrasting sharply with the full-year USD6.0bn surplus in 2007. If the deterioration persists, this will be the first year that Korea posts a CA deficit after the Asian crisis. Korean banks are relying heavily on external borrowings to lend 140 USD bn 120 100 80 60 40 20 0 -20 -40 Commercial banks' loans less deposits External debt, YoY difference 01 02 03 04 05 06 07 08 Korea needs to address its rising external debt 450 400 350 300 250 200 150 100 50 0 USD bn Gross external debt Gross external assets Foreign reserves Short-term external debt 96 97 98 99 00 01 02 03 04 05 06 07 08 34

Economics – Markets – Strategy Currencies Singapore dollar – a higher USD/SGD is not inconsistent with a rising SGD NEER Based on our expectations for the USD to recover some lost ground, as well as continued weakness in Asian currencies, we now see upside risks for USD/SGD to rise towards 1.44 in the next 6-12 months. Over the past two years, the market has become accustomed to associating a lower USD/SGD with a strong SGD NEER (nominal effective exchange rate) policy. More so after USD/SGD increased the pace of its fall with each tightening at its last two Monetary Authority of Singapore (MAS) policy reviews 1/ . We have no problem with this association as long as the USD is depreciating against the SGD NEER’s trade-weighted basket of currencies. At this point, we would also like to remind readers that USD/SGD can head up despite a strong SGD NEER policy. For example, USD/SGD rose from 1.6327 to 1.6627 in 2005, even after MAS shifted in Apr 2004 to a policy of appreciating the SGD NEER at a modest and gradual pace. During 2005, after USD/SGD bottomed at 1.6180 on Mar 10, it surged 5.3% to 1.7051 on Nov 14 before resuming its downtrend. The reason for this was simple. The USD was firm because the US was in the process of raising interest rates from 1.00% to 5.25%. This led to a broad-based USD recovery against both major currencies and Asian currencies. Like today, record high oil prices became a problem for some Asian economies, and forcing neighbouring countries like Indonesia to cut fuel subsidies. Currently, we see upside risks in USD/SGD coming mainly from major currencies. Since the outbreak of the US subprime/credit crisis in Jul 2007, the SGD has broken ranks with Asian currencies and closely followed the major currencies stronger. To facilitate this dichotomous behaviour, the MAS had to re-center its SGD NEER policy band at its policy review in April. USD/SGD forecast, eop Latest Prev Close 1.37 1.38 2Q08 1.37 1.41 3Q08 1.38 1.38 4Q08 1.40 1.35 1Q09 1.42 1.38 2Q09 1.44 1.37 3Q09 1.42 1.37 4Q09 1.40 1.36 3M Sibor forecast, eop Latest Prev Close 1.44 1.31 2Q08 1.16 1.13 3Q08 1.31 1.14 4Q08 1.52 1.13 1Q09 1.94 1.49 2Q09 2.31 2.79 3Q09 2.67 2.30 4Q09 2.64 2.60 Latest close on Jun 11 Prev close on Mar 12 This goes some way to explain why the MYR/SGD cross rate has weakened below its 0425-0.452 range, while the EUR/SGD cross rate appears to be establishing stable 2.10-2.18 trading range. This should not come as a surprise since Malaysia is still Singapore’s largest trading partner in Asia, while Eurozone has overtaken the US as the largest amongst the developed economies. Unless the MAS is seeking to re-center its band before its next policy review in October, we urge readers to pay close attention to EUR/USD, whose fall is likely to push up USD/SGD. 1/ In Oct 2007, the MAS “slightly” increased the appreciation pace of the SGD NEER policy band. This was followed by a re-centering of the SGD NEER band in Apr 2008. Both tightening were aimed at reining in inflation, which rose to a 26-year high of 7.5% in Apr08. SGD has been tracking major currencies since the start of the US crisis 104 Performance of USD vs currencies Indexed: 15 Jul 07 = 100 102 100 98 96 94 92 90 88 86 Major currencies (implied by DXY index) Asian currencies (implied by ADXY index) SGD Jul-07 Oct-07 Jan-08 Apr-08 USD/SGD & SGD NEER can diverge occasionally 108 106 104 102 100 98 96 94 2005 US rate hike cycle Re-centering Appreciation pace increased USD/SGD (rhs) Start of strong SGD policy Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 SGD NEER (lhs) 1.75 1.70 1.65 1.60 1.55 1.50 1.45 1.40 1.35 1.30 35

- Page 1 and 2: Economics Markets Strategy 3Q 2008

- Page 3 and 4: Economics - Markets - Strategy June

- Page 5 and 6: Economics - Markets - Strategy June

- Page 7 and 8: Economics - Markets - Strategy Econ

- Page 9 and 10: Economics - Markets - Strategy Econ

- Page 11 and 12: Economics - Markets - Strategy Econ

- Page 13 and 14: Economics - Markets - Strategy Econ

- Page 15 and 16: Economics - Markets - Strategy Econ

- Page 17 and 18: Economics - Markets - Strategy Econ

- Page 19 and 20: Economics - Markets - Strategy Econ

- Page 21 and 22: Economics - Markets - Strategy Econ

- Page 23 and 24: Economics - Markets - Strategy Econ

- Page 25 and 26: Economics - Markets - Strategy Curr

- Page 27 and 28: Economics - Markets - Strategy Curr

- Page 29 and 30: Economics - Markets - Strategy Curr

- Page 31 and 32: Economics - Markets - Strategy Curr

- Page 33 and 34: Economics - Markets - Strategy Curr

- Page 35: Economics - Markets - Strategy Curr

- Page 39 and 40: Economics - Markets - Strategy Curr

- Page 41 and 42: Economics - Markets - Strategy Curr

- Page 43 and 44: Economics - Markets - Strategy Curr

- Page 45 and 46: Economics - Markets - Strategy Yiel

- Page 47 and 48: Economics - Markets - Strategy Yiel

- Page 49 and 50: Economics - Markets - Strategy Yiel

- Page 51 and 52: Economics - Markets - Strategy Yiel

- Page 53 and 54: Economics - Markets - Strategy Yiel

- Page 55 and 56: Economics - Markets - Strategy Yiel

- Page 57 and 58: Economics - Markets - Strategy Yiel

- Page 59 and 60: Economics - Markets - Strategy Asia

- Page 61 and 62: Economics - Markets - Strategy Asia

- Page 63 and 64: Economics - Markets - Strategy Asia

- Page 65 and 66: Economics - Markets - Strategy Asia

- Page 67 and 68: Economics - Markets - Strategy Asia

- Page 69 and 70: Economics - Markets - Strategy Asia

- Page 71 and 72: Economics - Markets - Strategy Asia

- Page 73 and 74: Economics - Markets - Strategy Econ

- Page 75 and 76: Economics - Markets - Strategy Econ

- Page 77 and 78: Economics - Markets - Strategy Econ

- Page 79 and 80: Economics - Markets - Strategy Econ

- Page 81 and 82: Economics - Markets - Strategy Econ

- Page 83 and 84: Economics - Markets - Strategy Econ

- Page 85 and 86: Economics - Markets - Strategy Econ

Currencies<br />

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong><br />

USD/KRW<br />

forecast, eop<br />

Latest Prev<br />

Close 1030 971<br />

2Q08 1035 1000<br />

3Q08 1075 980<br />

4Q08 1100 940<br />

1Q09 1075 980<br />

2Q09 1075 980<br />

3Q09 1050 982<br />

4Q09 1050 982<br />

BOK o/n call rate<br />

forecast, eop<br />

Latest Prev<br />

Close 5.00 5.00<br />

2Q08 5.00 5.00<br />

3Q08 5.00 5.00<br />

4Q08 4.75 5.00<br />

1Q09 4.50 5.00<br />

2Q09 4.50 5.00<br />

3Q09 4.50 5.00<br />

4Q09 4.50 5.00<br />

Latest close on Jun 11<br />

Prev close on Mar 12<br />

Korean won – weakened international liquidity position<br />

We downgraded our forecast for KRW on Apr 24. Instead of expecting <strong>the</strong> KRW<br />

to appreciate against USD to 940 by end-2008, we see <strong>the</strong> risk for <strong>the</strong> KRW to<br />

depreciate to 1050-1100 in <strong>the</strong> second half of <strong>the</strong> year instead.<br />

Interestingly, <strong>the</strong> last time <strong>the</strong> KRW depreciated as dramatically as today was<br />

back in 2001-02. Like <strong>the</strong> Y2K crisis back <strong>the</strong>n, it was <strong>the</strong> subprime/credit crisis<br />

that threatened to push <strong>the</strong> US economy into recession. Both periods witnessed<br />

<strong>the</strong> Fed delivering inter-meeting rate cuts. But <strong>the</strong>re is one difference. Foreign<br />

reserves were rising to overtake foreign debt back <strong>the</strong>n. Today, external debt<br />

has already overtaken foreign reserves.<br />

The first hint of <strong>the</strong> KRW’s weakness surfaced during <strong>the</strong> US mortgage/credit<br />

crisis that broke out in Jul 2007. Despite aggressive cuts in US interest rates, <strong>the</strong><br />

KRW depreciated instead of appreciating. Ano<strong>the</strong>r disturbing development was<br />

<strong>the</strong> vulnerability of <strong>the</strong> KRW to unwinding of JPY carry trades or shortages of<br />

USD liquidity. Instinctively, we reckoned that <strong>the</strong>re was a weakening in Korea’s<br />

international liquidity position. Our investigations did not let us down.<br />

Over <strong>the</strong> past few years, Korean banks were aggressively expanding <strong>the</strong>ir loans<br />

books. But <strong>the</strong>re was one problem -- loans already exceeded deposits. To continue<br />

<strong>the</strong> practice of lending aggressively, banks borrowed heavily from foreigners to<br />

make up <strong>the</strong> funding gap. Why not? Back <strong>the</strong>n, <strong>the</strong> KRW was considered one of<br />

<strong>the</strong> best Asian currencies to invest in, while <strong>the</strong> JPY emerged as a funding currency<br />

for carry trades. This eventually led to gross external debt overtaking foreign<br />

reserves in 2Q06, with <strong>the</strong> debt-reserves shortfall widening to USD118bn in 4Q07.<br />

The last time <strong>the</strong> shortfall exceeded USD100bn was just before <strong>the</strong> 1997/98 Asian<br />

financial crisis.<br />

That said, we are not suggesting that Korea is about to enter into a crisis. The<br />

trigger for <strong>the</strong> Korean crisis in 1997/98 was <strong>the</strong> lack of foreign reserves to cover<br />

short-term external debt. Today, this is not <strong>the</strong> case, at least not yet. Even so,<br />

<strong>the</strong>re is little room for complacency ei<strong>the</strong>r. Left unaddressed, <strong>the</strong> rapid rise in<br />

short-term external debt is projected overtake foreign reserves by 2012. With<br />

international ratings agencies now concerned about <strong>the</strong> banks’ heavy reliance<br />

on short-term external borrowings, expect <strong>the</strong> government to introduce measures<br />

to address this issue.<br />

Under <strong>the</strong> circumstances, it did not bode well that <strong>the</strong> current account (CA)<br />

reported a deficit of USD5.2bn in 1Q08, contrasting sharply with <strong>the</strong> full-year<br />

USD6.0bn surplus in 2007. If <strong>the</strong> deterioration persists, this will be <strong>the</strong> first year<br />

that Korea posts a CA deficit after <strong>the</strong> Asian crisis.<br />

Korean banks are relying heavily on external<br />

borrowings to lend<br />

140 USD bn<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

Commercial banks'<br />

loans less deposits<br />

External debt,<br />

YoY difference<br />

01 02 03 04 05 06 07 08<br />

Korea needs to address its rising external debt<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

USD bn<br />

Gross external debt<br />

Gross external assets<br />

Foreign<br />

reserves<br />

Short-term<br />

external debt<br />

96 97 98 99 00 01 02 03 04 05 06 07 08<br />

34