Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ... Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics: Indonesia Economics – Markets – Strategy The government will struggle with its deficit; oil rationing programs will not be effective In short, unless oil prices ease at least 10% in the near term and hold at those levels, and/ or the rupiah appreciates, the government is only just keeping its head above water where its fiscal thresholds are concerned. To a degree, plans to ration fuel consumption via the use of smart cards will help ease the total subsidy burden. But this program will be rolled out only from September, and will reportedly only be introduced in Jakarta and surrounding areas in Java. It remains to be seen how effective this system will be at curbing consumption, and Chart 3: Deficit/subsidy to GDP % of GDP 4 3 2 1 0 2003 2004 2005 2006 2007 Oil sub % of GDP Subsidized fuel prices lifted 126% Budget balance % of GDP even smuggling activity – the larger the subsidy on a good, the larger the distortion on consumption behaviour. Indeed, even after fuel prices were hiked a senior energy ministry said that consumption of subsidized gasoline is likely to rise by over 5% this year, to 20.4mn kilolitres. Next year, subsidized diesel oil consumption is expected to increase by 6%, to 12.6mn kl from an estimated 11.9mn kl this year. Table 2: Subsidy scenarios after May fuel price hike (sub % of GDP) 2008 USD/IDR Nymex 1mth 9100 9200 9300 9400 9500 95 2.5 2.5 2.6 2.6 2.7 100 2.7 2.7 2.8 2.8 2.9 105 2.9 2.9 3.0 3.0 3.1 110 3.1 3.1 3.2 3.2 3.3 115 3.3 3.4 3.4 3.5 3.5 120 3.5 3.6 3.6 3.7 3.7 125 3.7 3.8 3.8 3.9 3.9 130 3.9 4.0 4.0 4.1 4.1 135 4.1 4.2 4.2 4.3 4.3 Further hikes in subsidized fuel prices cannot be ruled out Ultimately, nothing will alleviate the strain on Indonesia’s deficit – or curb the consumption of subsidized fuel - as quickly or directly as cutting subsidies. And this might just be the path Indonesia will continue to take. To its credit, since implementing the fuel price hike in May, the government has repeatedly emphasized that it could not rule out further increases in fuel prices ahead of next year’s Presidential elections. How much will fuel prices have to be further lifted by? As it stands, even after the May hike, domestic prices are still significantly below global market prices. For example, subsidized premium fuel now sells for IDR 6,000/ltr; if we make the conventional assumption that crude oil accounts for half the pump price, then theoretically premium fuel should be retailing at above IDR 13,000! Needless to say the government would never consider scrapping fuel prices all at one go, particularly not when the elections are less than a year away. But our simulations suggest that the government may have some really tough decisions to make in the months ahead if things turn ugly - if we assume a crude oil average of USD 102

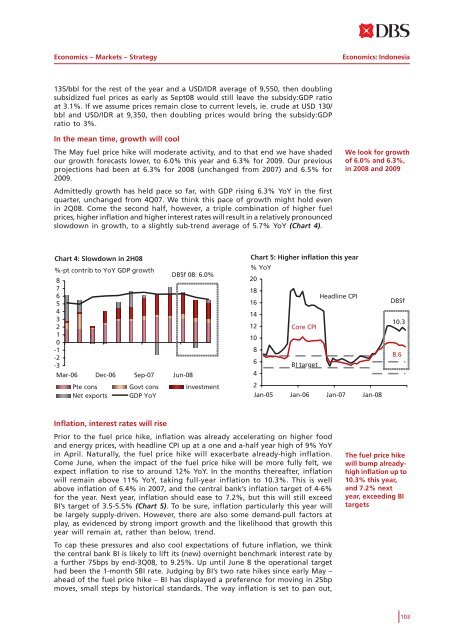

Economics – Markets – Strategy Economics: Indonesia 135/bbl for the rest of the year and a USD/IDR average of 9,550, then doubling subsidized fuel prices as early as Sept08 would still leave the subsidy:GDP ratio at 3.1%. If we assume prices remain close to current levels, ie. crude at USD 130/ bbl and USD/IDR at 9,350, then doubling prices would bring the subsidy:GDP ratio to 3%. In the mean time, growth will cool The May fuel price hike will moderate activity, and to that end we have shaded our growth forecasts lower, to 6.0% this year and 6.3% for 2009. Our previous projections had been at 6.3% for 2008 (unchanged from 2007) and 6.5% for 2009. We look for growth of 6.0% and 6.3%, in 2008 and 2009 Admittedly growth has held pace so far, with GDP rising 6.3% YoY in the first quarter, unchanged from 4Q07. We think this pace of growth might hold even in 2Q08. Come the second half, however, a triple combination of higher fuel prices, higher inflation and higher interest rates will result in a relatively pronounced slowdown in growth, to a slightly sub-trend average of 5.7% YoY (Chart 4). Chart 4: Slowdown in 2H08 %-pt contrib to YoY GDP growth 8 7 6 5 4 3 2 1 0 -1 -2 -3 Mar-06 Dec-06 Sep-07 Jun-08 DBSf 08: 6.0% Pte cons Govt cons Investment Net exports GDP YoY Chart 5: Higher inflation this year % YoY 20 18 Headline CPI 16 14 12 Core CPI 10 8 6 BI target 4 2 Jan-05 Jan-06 Jan-07 Jan-08 DBSf 10.3 8.6 Inflation, interest rates will rise Prior to the fuel price hike, inflation was already accelerating on higher food and energy prices, with headline CPI up at a one and a-half year high of 9% YoY in April. Naturally, the fuel price hike will exacerbate already-high inflation. Come June, when the impact of the fuel price hike will be more fully felt, we expect inflation to rise to around 12% YoY. In the months thereafter, inflation will remain above 11% YoY, taking full-year inflation to 10.3%. This is well above inflation of 6.4% in 2007, and the central bank’s inflation target of 4-6% for the year. Next year, inflation should ease to 7.2%, but this will still exceed BI’s target of 3.5-5.5% (Chart 5). To be sure, inflation particularly this year will be largely supply-driven. However, there are also some demand-pull factors at play, as evidenced by strong import growth and the likelihood that growth this year will remain at, rather than below, trend. The fuel price hike will bump alreadyhigh inflation up to 10.3% this year, and 7.2% next year, exceeding BI targets To cap these pressures and also cool expectations of future inflation, we think the central bank BI is likely to lift its (new) overnight benchmark interest rate by a further 75bps by end-3Q08, to 9.25%. Up until June 8 the operational target had been the 1-month SBI rate. Judging by BI’s two rate hikes since early May – ahead of the fuel price hike – BI has displayed a preference for moving in 25bp moves, small steps by historical standards. The way inflation is set to pan out, 103

- Page 53 and 54: Economics - Markets - Strategy Yiel

- Page 55 and 56: Economics - Markets - Strategy Yiel

- Page 57 and 58: Economics - Markets - Strategy Yiel

- Page 59 and 60: Economics - Markets - Strategy Asia

- Page 61 and 62: Economics - Markets - Strategy Asia

- Page 63 and 64: Economics - Markets - Strategy Asia

- Page 65 and 66: Economics - Markets - Strategy Asia

- Page 67 and 68: Economics - Markets - Strategy Asia

- Page 69 and 70: Economics - Markets - Strategy Asia

- Page 71 and 72: Economics - Markets - Strategy Asia

- Page 73 and 74: Economics - Markets - Strategy Econ

- Page 75 and 76: Economics - Markets - Strategy Econ

- Page 77 and 78: Economics - Markets - Strategy Econ

- Page 79 and 80: Economics - Markets - Strategy Econ

- Page 81 and 82: Economics - Markets - Strategy Econ

- Page 83 and 84: Economics - Markets - Strategy Econ

- Page 85 and 86: Economics - Markets - Strategy Econ

- Page 87 and 88: Economics - Markets - Strategy Econ

- Page 89 and 90: Economics - Markets - Strategy Econ

- Page 91 and 92: Economics - Markets - Strategy Econ

- Page 93 and 94: Economics - Markets - Strategy Econ

- Page 95 and 96: Economics - Markets - Strategy Econ

- Page 97 and 98: Economics - Markets - Strategy Econ

- Page 99 and 100: Economics - Markets - Strategy Econ

- Page 101 and 102: Economics - Markets - Strategy Econ

- Page 103: Economics - Markets - Strategy Econ

- Page 107 and 108: Economics - Markets - Strategy Econ

- Page 109 and 110: Economics - Markets - Strategy Econ

- Page 111 and 112: Economics - Markets - Strategy Econ

- Page 113 and 114: Economics - Markets - Strategy Econ

- Page 115 and 116: Economics - Markets - Strategy Econ

- Page 117 and 118: Economics - Markets - Strategy Econ

- Page 119 and 120: Economics - Markets - Strategy Econ

- Page 121 and 122: Economics - Markets - Strategy Econ

- Page 123 and 124: Economics - Markets - Strategy Econ

- Page 125 and 126: Economics - Markets - Strategy Econ

- Page 127 and 128: Economics - Markets - Strategy Econ

- Page 129 and 130: Economics - Markets - Strategy Econ

- Page 131 and 132: Economics - Markets - Strategy Econ

- Page 133 and 134: Economics - Markets - Strategy Econ

- Page 135 and 136: Economics - Markets - Strategy Econ

- Page 137 and 138: Economics - Markets - Strategy Econ

- Page 139 and 140: Economics - Markets - Strategy Econ

- Page 141 and 142: Economics - Markets - Strategy Econ

- Page 143 and 144: Economics - Markets - Strategy Econ

- Page 145 and 146: Economics - Markets - Strategy Econ

- Page 147 and 148: Economics - Markets - Strategy Econ

- Page 149 and 150: Economics - Markets - Strategy Econ

- Page 151 and 152: Economics - Markets - Strategy Econ

- Page 153 and 154: Economics - Markets - Strategy Econ

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong><br />

<strong>Economics</strong>: Indonesia<br />

135/bbl for <strong>the</strong> rest of <strong>the</strong> year and a USD/IDR average of 9,550, <strong>the</strong>n doubling<br />

subsidized fuel prices as early as Sept08 would still leave <strong>the</strong> subsidy:GDP ratio<br />

at 3.1%. If we assume prices remain close to current levels, ie. crude at USD 130/<br />

bbl and USD/IDR at 9,350, <strong>the</strong>n doubling prices would bring <strong>the</strong> subsidy:GDP<br />

ratio to 3%.<br />

In <strong>the</strong> mean time, growth will cool<br />

The May fuel price hike will moderate activity, and to that end we have shaded<br />

our growth forecasts lower, to 6.0% this year and 6.3% for 2009. Our previous<br />

projections had been at 6.3% for 2008 (unchanged from 2007) and 6.5% for<br />

2009.<br />

We look for growth<br />

of 6.0% and 6.3%,<br />

in 2008 and 2009<br />

Admittedly growth has held pace so far, with GDP rising 6.3% YoY in <strong>the</strong> first<br />

quarter, unchanged from 4Q07. We think this pace of growth might hold even<br />

in 2Q08. Come <strong>the</strong> second half, however, a triple combination of higher fuel<br />

prices, higher inflation and higher interest rates will result in a relatively pronounced<br />

slowdown in growth, to a slightly sub-trend average of 5.7% YoY (Chart 4).<br />

Chart 4: Slowdown in 2H08<br />

%-pt contrib to YoY GDP growth<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

Mar-06 Dec-06 Sep-07 Jun-08<br />

<strong>DBS</strong>f 08: 6.0%<br />

Pte cons Govt cons Investment<br />

Net exports GDP YoY<br />

Chart 5: Higher inflation this year<br />

% YoY<br />

20<br />

18<br />

Headline CPI<br />

16<br />

14<br />

12<br />

Core CPI<br />

10<br />

8<br />

6<br />

BI target<br />

4<br />

2<br />

Jan-05 Jan-06 Jan-07 Jan-08<br />

<strong>DBS</strong>f<br />

10.3<br />

8.6<br />

Inflation, interest rates will rise<br />

Prior to <strong>the</strong> fuel price hike, inflation was already accelerating on higher food<br />

and energy prices, with headline CPI up at a one and a-half year high of 9% YoY<br />

in April. Naturally, <strong>the</strong> fuel price hike will exacerbate already-high inflation.<br />

Come June, when <strong>the</strong> impact of <strong>the</strong> fuel price hike will be more fully felt, we<br />

expect inflation to rise to around 12% YoY. In <strong>the</strong> months <strong>the</strong>reafter, inflation<br />

will remain above 11% YoY, taking full-year inflation to 10.3%. This is well<br />

above inflation of 6.4% in 2007, and <strong>the</strong> central bank’s inflation target of 4-6%<br />

for <strong>the</strong> year. Next year, inflation should ease to 7.2%, but this will still exceed<br />

BI’s target of 3.5-5.5% (Chart 5). To be sure, inflation particularly this year will<br />

be largely supply-driven. However, <strong>the</strong>re are also some demand-pull factors at<br />

play, as evidenced by strong import growth and <strong>the</strong> likelihood that growth this<br />

year will remain at, ra<strong>the</strong>r than below, trend.<br />

The fuel price hike<br />

will bump alreadyhigh<br />

inflation up to<br />

10.3% this year,<br />

and 7.2% next<br />

year, exceeding BI<br />

targets<br />

To cap <strong>the</strong>se pressures and also cool expectations of future inflation, we think<br />

<strong>the</strong> central bank BI is likely to lift its (new) overnight benchmark interest rate by<br />

a fur<strong>the</strong>r 75bps by end-3Q08, to 9.25%. Up until June 8 <strong>the</strong> operational target<br />

had been <strong>the</strong> 1-month SBI rate. Judging by BI’s two rate hikes since early May –<br />

ahead of <strong>the</strong> fuel price hike – BI has displayed a preference for moving in 25bp<br />

moves, small steps by historical standards. The way inflation is set to pan out,<br />

103