ATMASphere Aug 2014

ATMASphere Aug 2014

ATMASphere Aug 2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

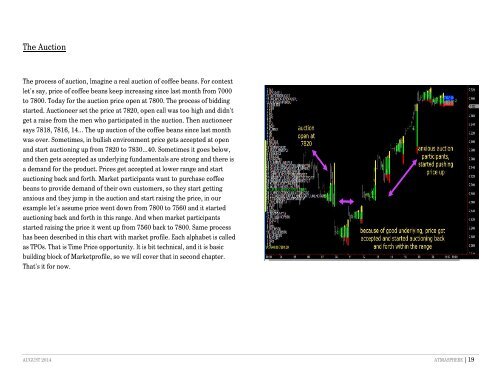

The Auction<br />

The process of auction, Imagine a real auction of coffee beans. For context<br />

let's say, price of coffee beans keep increasing since last month from 7000<br />

to 7800. Today for the auction price open at 7800. The process of bidding<br />

started. Auctioneer set the price at 7820, open call was too high and didn't<br />

get a raise from the men who participated in the auction. Then auctioneer<br />

says 7818, 7816, 14... The up auction of the coffee beans since last month<br />

was over. Sometimes, in bullish environment price gets accepted at open<br />

and start auctioning up from 7820 to 7830...40. Sometimes it goes below,<br />

and then gets accepted as underlying fundamentals are strong and there is<br />

a demand for the product. Prices get accepted at lower range and start<br />

auctioning back and forth. Market participants want to purchase coffee<br />

beans to provide demand of their own customers, so they start getting<br />

anxious and they jump in the auction and start raising the price, in our<br />

example let's assume price went down from 7800 to 7560 and it started<br />

auctioning back and forth in this range. And when market participants<br />

started raising the price it went up from 7560 back to 7800. Same process<br />

has been described in this chart with market profile. Each alphabet is called<br />

as TPOs. That is Time Price opportunity. It is bit technical, and it is basic<br />

building block of Marketprofile, so we will cover that in second chapter.<br />

That's it for now.<br />

AUGUST <strong>2014</strong> ATMASPHERE | 19