Download File - TCL Group

Download File - TCL Group

Download File - TCL Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31ST DECEMBER, 2010<br />

(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)<br />

(Continued)<br />

22. Financial risk management (continued)<br />

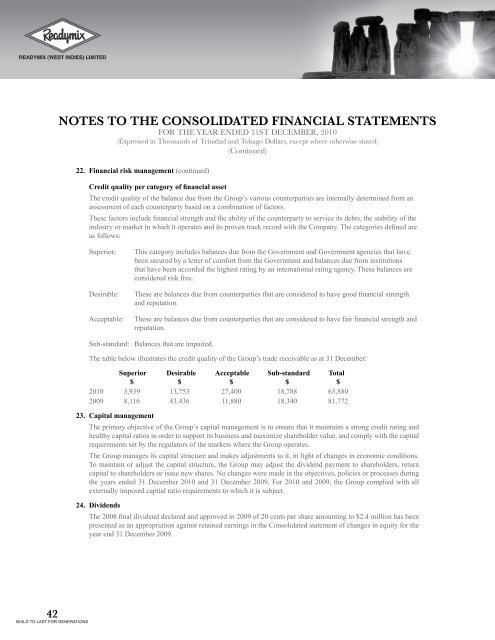

Credit quality per category of financial asset<br />

The credit quality of the balance due from the <strong>Group</strong>’s various counterparties are internally determined from an<br />

assessment of each counterparty based on a combination of factors.<br />

These factors include financial strength and the ability of the counterparty to service its debts, the stability of the<br />

industry or market in which it operates and its proven track record with the Company. The categories defined are<br />

as follows:<br />

Superior:<br />

Desirable:<br />

Acceptable:<br />

This category includes balances due from the Government and Government agencies that have<br />

been secured by a letter of comfort from the Government and balances due from institutions<br />

that have been accorded the highest rating by an international rating agency. These balances are<br />

considered risk free.<br />

These are balances due from counterparties that are considered to have good financial strength<br />

and reputation.<br />

These are balances due from counterparties that are considered to have fair financial strength and<br />

reputation.<br />

Sub-standard: Balances that are impaired.<br />

The table below illustrates the credit quality of the <strong>Group</strong>’s trade receivable as at 31 December:<br />

Superior Desirable Acceptable Sub-standard Total<br />

$ $ $ $ $<br />

2010 3,939 13,753 27,400 18,788 63,880<br />

2009 8,116 43,436 11,880 18,340 81,772<br />

23. Capital management<br />

The primary objective of the <strong>Group</strong>’s capital management is to ensure that it maintains a strong credit rating and<br />

healthy capital ratios in order to support its business and maximize shareholder value, and comply with the capital<br />

requirements set by the regulators of the markets where the <strong>Group</strong> operates.<br />

The <strong>Group</strong> manages its capital structure and makes adjustments to it, in light of changes in economic conditions.<br />

To maintain or adjust the capital structure, the <strong>Group</strong> may adjust the dividend payment to shareholders, return<br />

capital to shareholders or issue new shares. No changes were made in the objectives, policies or processes during<br />

the years ended 31 December 2010 and 31 December 2009. For 2010 and 2009, the <strong>Group</strong> complied with all<br />

externally imposed capital ratio requirements to which it is subject.<br />

24. Dividends<br />

The 2008 final dividend declared and approved in 2009 of 20 cents per share amounting to $2.4 million has been<br />

presented as an appropriation against retained earnings in the Consolidated statement of changes in equity for the<br />

year end 31 December 2009.<br />

42<br />

BUILD TO LAST FOR GENERATIONS