BORDER ROADS ORGANISATION

BORDER ROADS ORGANISATION

BORDER ROADS ORGANISATION

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

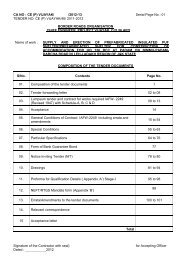

CA NO: CDR/760TF/ / 2012-13 Ser Page No: 52<br />

(ii) The contractor shall within a reasonable time of his becoming aware of variation in<br />

percentage rates and / or imposition of any “taxes” directly related to contract value give written<br />

notice thereof to the OC contract stating that the same is given pursuant to this special condition<br />

together ith all informations relating there to which he may be in a position to supply. The<br />

contractor shall submit the other documentary proof/ informations as the OC Contract may<br />

require.<br />

(iii) The contractor shall, for the purpose of this condition keeps such books of account and<br />

other documents as are necessary and shall allow inspection of the same by a duly authorized<br />

representative of Govt., and shall further, at the request of the OC contract furnish, verified in<br />

such a manner as the OC contract may require, any documents so kept and such other<br />

information as the OC contract may require.<br />

(iv) Reimbursement for increase in percentage rates/ imposition of “taxes directly related to<br />

contract value” shall be made only if the contractor necessarily & properly pays additional “ taxes<br />

directly related to contract value” to the Govt. without getting the same adjusted, against any other<br />

tax liability or without getting the same refunded from the concerned Govt. Authority and submit<br />

documentary proof for the same as the OC contract may require.”<br />

30 Payment of Work<br />

30.1 The payment will be released through E-Payment mode, for which the contractor is<br />

required to submit the NEFT/RTGS Mandate Form (enclosed at Appx ‘B’) duly filled in the specified<br />

details. Otherwise, it will be released through A/c Payee Cheque.<br />

30.2 In case where the payment is released through cheque it will be sent by post to the<br />

Contractor for which the postage charges will be deducted from the net amount due to the<br />

Contractor.<br />

31. REGISTRATION: Contractor is required to get his firm registered with Sales Tax Department and<br />

Asst Labour commissioner Srinagar/ Jammu under contract labour ( R&A) Act and Building and other<br />

construction workers Act 1996 . A copy of valid registration certificate issued by the Sales Tax<br />

Department will be forwarded to Chief Engineer Project Beacon and Commander contract.<br />

32. LEGAL JURISDICTION: Legal jurisdiction for this Contract Agreement shall be “SRINAGAR<br />

COURT”<br />

___________________________<br />

(Signature of contractor with seal)<br />

sd/- xxx<br />

SW<br />

For Accepting Officer