2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chicago, Illinois<br />

Springfield, Illinois<br />

Contact<br />

<strong>NAI</strong> Hiffman<br />

+630 932 1234<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income$80,589<br />

Median<br />

Household Income<br />

9,574,523<br />

9,577,417<br />

5,025,583<br />

$65,761<br />

Chicago is the third largest metropolitan area in the US and<br />

the most influential economic region between the east and<br />

west coasts. Chicago’s advantageous location at the<br />

heart of the nation has fostered its development into an<br />

international center for banking, securities, high technology,<br />

distribution, business services, retail trade and manufacturing.<br />

Chicago is one of the principal trading centers for<br />

commodities, financial and derivative futures products with<br />

the Chicago Mercantile Exchange and Board of Trade.<br />

Historic buildings and modern high-rises define Chicago’s<br />

famous skyline, home to several of the tallest buildings in<br />

the country. Conditions in the downtown office market have<br />

been improving for the past year, the beginning of a modest<br />

recovery following a nearly two year period of rising vacancy<br />

rates when more than 5.3 million SF of vacant space was<br />

added to the market. During the year since, more than 43%<br />

of that vacant space has been absorbed through new leases<br />

and tenants expanding, pushing the vacancy rate down<br />

more than 160 basis points from its 17% peak.<br />

The Chicago suburban office market is comprised of several<br />

scattered pockets of corporate parks and high-rise office<br />

towers. Suburban vacancy rates, typically higher and more<br />

volatile than downtown, have not responded as favorably to<br />

the recovery as downtown rates have, as the market<br />

continues to respond to the overall economic situation. Any<br />

positive traction has been witnessed among high quality<br />

Class A properties, while Class B and Class C buildings<br />

continue to witness climbing vacancy rates and weak<br />

demand.<br />

The second largest industrial market and the most important<br />

transportation hub in the country, the Chicago industrial<br />

market has now been in a recovery phase for more than a<br />

year, evidenced by the absorption of vacant space and a<br />

declining vacancy rate. During the economic downturn and<br />

the months following its official end, 29.5 million SF of<br />

vacant space was introduced to the market between 2008<br />

and 2010. Nearly half of that space has been recovered<br />

since. The area’s intermodal developments continue to play<br />

an active role in the recovery, and now provide service with<br />

both the BNSF and Union Pacific Railroads.<br />

Contact<br />

<strong>NAI</strong> True<br />

+1 217 787 2800<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

247,487<br />

254,511<br />

132,665<br />

$66,782<br />

$53,268<br />

Springfield, the capitol of Illinois, accounts for approximately<br />

half of the population in the metropolitan areas of Sangamon<br />

and Menard counties. Springfield’s major employment<br />

sectors are government, medical, public service and small<br />

business. Money for commercial real estate loans is readily<br />

available. Springfield’s current economy has been impacted<br />

similar to that of the national economy.<br />

Government is the largest employer in the Springfield area.<br />

The two largest private employers in the region are St. Johns<br />

Hospital and Memorial Hospital, including SIU School of<br />

Medicine. Completed commercial developments in 2011<br />

include a new Westside YMCA/Memorial Sports Care facility<br />

with rehabilitation services and two new construction<br />

satellite medical clinics. Ground breaking for a new skilled<br />

care nursing rehab facility took place in October 2011.<br />

Higher education opportunities include the University of<br />

Illinois at Springfield, Southern Illinois University School of<br />

Medicine and Lincoln Land Community College. Robert<br />

Morris University and Benedictine University at Springfield<br />

are the private colleges in the area.<br />

Retail growth in Springfield is recovering slowly with the<br />

opening of Scheels sporting goods chain in August of 2011.<br />

National chain stores and big box users like Super Walmart,<br />

Menards and Gander Mountain have opened within the past<br />

36 months. An outlet shopping mall of 80 plus retailers<br />

encompassing +/- 340,000 SF is anticipated to break<br />

ground in the Q4 of 2011. Pepsi is relocating and expanding<br />

by building a new 50,000 SF facility on Springfield’s east<br />

side. Other national chain stores will continue to locate in<br />

Springfield.<br />

Farm land sale prices per acre are at a record high,<br />

approaching $12,000 per acre.<br />

Springfield has consistently been one of the most affordable<br />

communities in Illinois. Recreation opportunities in<br />

Springfield are plentiful with over 30 public parks offering<br />

tennis courts, ice rings and swimming pools. There are nine<br />

public golf courses, two country club golf courses,<br />

indoor/outdoor theatre venues and a 4,235 acre lake.<br />

Abraham Lincoln Museum and Library are two prestigious<br />

visitor/tourist attractions in Springfield.<br />

Total Population<br />

Median Age<br />

35<br />

Total Population<br />

Median Age<br />

40<br />

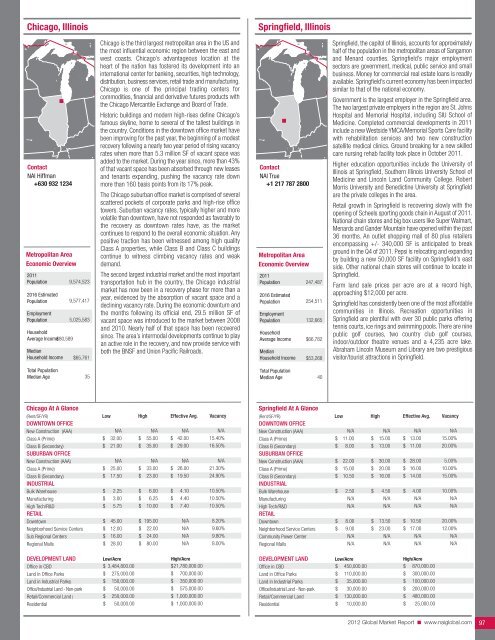

Chicago At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

Downtown<br />

Neighborhood Service Centers<br />

Sub Regional Centers<br />

Regional Malls<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks)<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land )<br />

Residential<br />

N/A N/A N/A N/A<br />

$ 32.00 $ 55.00 $ 42.00 15.40%<br />

$ 21.00 $ 35.00 $ 29.00 16.50%<br />

N/A N/A N/A N/A<br />

$ 25.00 $ 33.00 $ 26.00 21.30%<br />

$ 17.50 $ 23.00 $ 19.50 24.90%<br />

$ 2.25 $ 6.00 $ 4.10 10.50%<br />

$ 3.00 $ 6.25 $ 4.40 10.50%<br />

$ 5.75 $ 10.00 $ 7.40 10.50%<br />

$ 45.00 $ 195.00 N/A 8.20%<br />

$ 12.00 $ 22.00 N/A 9.60%<br />

$ 16.00 $ 24.00 N/A 9.80%<br />

$ 28.00 $ 80.00 N/A 8.00%<br />

$ 3,484,800.00 $21,780,000.00<br />

$ 275,000.00 $ 700,000.00<br />

$ 150,000.00 $ 350,000.00<br />

$ 50,000.00 $ 575,000.00<br />

$ 250,000.00 $ 1,000,000.00<br />

$ 50,000.00 $ 1,000,000.00<br />

Springfield At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

N/A N/A N/A N/A<br />

$ 11.00 $ 15.00 $ 13.00 15.00%<br />

$ 8.00 $ 13.00 $ 11.00 20.00%<br />

$ 22.00 $ 30.00 $ 28.00 5.00%<br />

$ 15.00 $ 20.00 $ 16.00 10.00%<br />

$ 10.50 $ 16.00 $ 14.00 15.00%<br />

$ 2.50 $ 4.50 $ 4.00 10.00%<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

$ 8.00 $ 13.50 $ 10.50 20.00%<br />

$ 9.00 $ 23.00 $ 17.00 12.00%<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

$ 450,000.00 $ 870,000.00<br />

$ 110,000.00 $ 300,000.00<br />

$ 35,000.00 $ 100,000.00<br />

$ 30,000.00 $ 200,000.00<br />

$ 130,000.00 $ 480,000.00<br />

$ 10,000.00 $ 25,000.00<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 97