2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Washington, District of Columbia<br />

Bradenton, Florida<br />

Contact<br />

<strong>NAI</strong> KLNB<br />

+1 202 375 7500<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

Total Population<br />

Median Age<br />

5,692,986<br />

6,142,565<br />

3,181,058<br />

$115,089<br />

$87,202<br />

35<br />

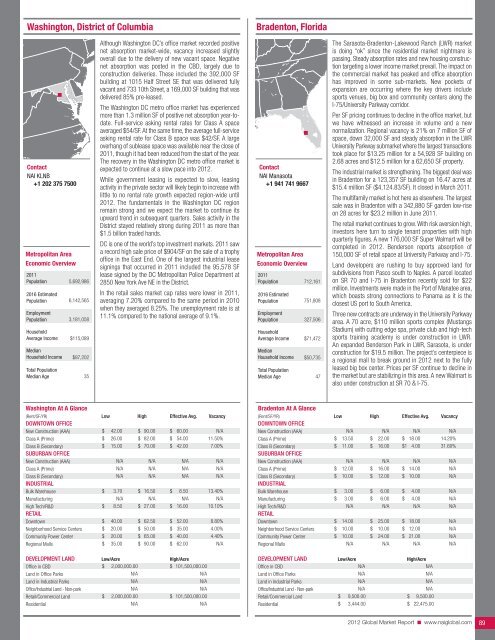

Although Washington DC’s office market recorded positive<br />

net absorption market-wide, vacancy increased slightly<br />

overall due to the delivery of new vacant space. Negative<br />

net absorption was posted in the CBD, largely due to<br />

construction deliveries. These included the 392,000 SF<br />

building at 1015 Half Street SE that was delivered fully<br />

vacant and 733 10th Street, a 169,000 SF building that was<br />

delivered 85% pre-leased.<br />

The Washington DC metro office market has experienced<br />

more than 1.3 million SF of positive net absorption year-todate.<br />

Full-service asking rental rates for Class A space<br />

averaged $54/SF. At the same time, the average full-service<br />

asking rental rate for Class B space was $42/SF. A large<br />

overhang of sublease space was available near the close of<br />

2011, though it had been reduced from the start of the year.<br />

The recovery in the Washington DC metro office market is<br />

expected to continue at a slow pace into <strong>2012</strong>.<br />

While government leasing is expected to slow, leasing<br />

activity in the private sector will likely begin to increase with<br />

little to no rental rate growth expected region-wide until<br />

<strong>2012</strong>. The fundamentals in the Washington DC region<br />

remain strong and we expect the market to continue its<br />

upward trend in subsequent quarters. Sales activity in the<br />

District stayed relatively strong during 2011 as more than<br />

$1.5 billion traded hands.<br />

DC is one of the world’s top investment markets. 2011 saw<br />

a record high sale price of $904/SF on the sale of a trophy<br />

office in the East End. One of the largest industrial lease<br />

signings that occurred in 2011 included the 95,578 SF<br />

lease signed by the DC Metropolitan Police Department at<br />

2850 New York Ave NE in the District.<br />

In the retail sales market cap rates were lower in 2011,<br />

averaging 7.20% compared to the same period in 2010<br />

when they averaged 8.25%. The unemployment rate is at<br />

11.1% compared to the national average of 9.1%.<br />

Contact<br />

<strong>NAI</strong> Manasota<br />

+1 941 741 9667<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

Total Population<br />

Median Age<br />

712,161<br />

751,808<br />

327,506<br />

$71,472<br />

$50,735<br />

47<br />

The Sarasota-Bradenton-Lakewood Ranch (LWR) market<br />

is doing “ok” since the residential market nightmare is<br />

passing. Steady absorption rates and new housing construction<br />

targeting a lower income market prevail. The impact on<br />

the commercial market has peaked and office absorption<br />

has improved in some sub-markets. New pockets of<br />

expansion are occurring where the key drivers include<br />

sports venues, big box and community centers along the<br />

I-75/University Parkway corridor.<br />

Per SF pricing continues to decline in the office market, but<br />

we have witnessed an increase in volume and a new<br />

normalization. Regional vacancy is 21% on 7 million SF of<br />

space, down 32,000 SF and steady absorption in the LWR<br />

University Parkway submarket where the largest transactions<br />

took place for $13.25 million for a 54,928 SF building on<br />

2.68 acres and $12.5 million for a 62,650 SF property.<br />

The industrial market is strengthening. The biggest deal was<br />

in Bradenton for a 123,357 SF building on 16.47 acres at<br />

$15.4 million SF ($4,124.83/SF). It closed in March 2011.<br />

The multifamily market is hot here as elsewhere. The largest<br />

sale was in Bradenton with a 342,880 SF garden low-rise<br />

on 28 acres for $23.2 million in June 2011.<br />

The retail market continues to grow. With risk aversion high,<br />

investors here turn to single tenant properties with high<br />

quarterly figures. A new 176,000 SF Super Walmart will be<br />

completed in <strong>2012</strong>. Benderson <strong>report</strong>s absorption of<br />

150,000 SF of retail space at University Parkway and I-75.<br />

Land developers are rushing to buy approved land for<br />

subdivisions from Pasco south to Naples. A parcel located<br />

on SR 70 and I-75 in Bradenton recently sold for $22<br />

million. Investments were made in the Port of Manatee area,<br />

which boasts strong connections to Panama as it is the<br />

closest US port to South America.<br />

Three new contracts are underway in the University Parkway<br />

area. A 70 acre, $110 million sports complex (Mustangs<br />

Stadium) with cutting edge spa, private club and high-tech<br />

sports training academy is under construction in LWR.<br />

An expanded Benderson Park in LWR, Sarasota, is under<br />

construction for $19.5 million. The project’s centerpiece is<br />

a regional mall to break ground in <strong>2012</strong> next to the fully<br />

leased big box center. Prices per SF continue to decline in<br />

the market but are stabilizing in this area. A new Walmart is<br />

also under construction at SR 70 & I-75.<br />

Washington At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

42.00<br />

26.00<br />

15.00<br />

N/A<br />

N/A<br />

N/A<br />

$ 90.00<br />

$ 82.00<br />

$ 70.00<br />

N/A<br />

N/A<br />

N/A<br />

$ 60.00<br />

$ 54.00<br />

$ 42.00<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

11.50%<br />

7.00%<br />

N/A<br />

N/A<br />

N/A<br />

Bulk Warehouse<br />

Manufacturing<br />

$ 3.70<br />

N/A<br />

$ 16.50<br />

N/A<br />

$ 8.50<br />

N/A<br />

13.40%<br />

N/A<br />

High Tech/R&D<br />

retaIl<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

$<br />

$<br />

$<br />

$<br />

$<br />

8.50<br />

40.00<br />

20.00<br />

20.00<br />

35.00<br />

$ 27.00<br />

$ 62.50<br />

$ 50.00<br />

$ 65.00<br />

$ 90.00<br />

$ 16.00<br />

$ 52.00<br />

$ 35.00<br />

$ 40.00<br />

$ 62.00<br />

10.10%<br />

8.80%<br />

4.00%<br />

4.40%<br />

N/A<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

$<br />

$<br />

2,000,000.00<br />

N/A<br />

N/A<br />

N/A<br />

2,000,000.00<br />

N/A<br />

$ 101,500,000.00<br />

N/A<br />

N/A<br />

N/A<br />

$ 101,500,000.00<br />

N/A<br />

Bradenton At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

13.50<br />

11.00<br />

N/A<br />

12.00<br />

10.00<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

22.00<br />

16.00<br />

N/A<br />

16.00<br />

12.00<br />

N/A<br />

$ 18.00<br />

$1 4.00<br />

N/A<br />

$ 14.00<br />

$ 10.00<br />

N/A<br />

14.20%<br />

31.60%<br />

N/A<br />

N/A<br />

N/A<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

$<br />

$<br />

3.00<br />

3.00<br />

N/A<br />

$<br />

$<br />

6.00<br />

6.00<br />

N/A<br />

$<br />

$<br />

4.00<br />

4.00<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

$<br />

$<br />

$<br />

14.00<br />

10.00<br />

10.00<br />

N/A<br />

$<br />

$<br />

$<br />

25.00<br />

10.00<br />

24.00<br />

N/A<br />

$ 18.00<br />

$ 12.00<br />

$ 21.00<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

$<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

9,500.00 $<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

9,500.00<br />

Residential<br />

$ 3,444.00 $ 22,475.00<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 89