2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Sacramento, California<br />

San Diego, California<br />

Contact<br />

<strong>NAI</strong> Aguer Havelock<br />

+1 916 563 7555<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

2,182,119<br />

2,314,016<br />

1,099,661<br />

$86,934<br />

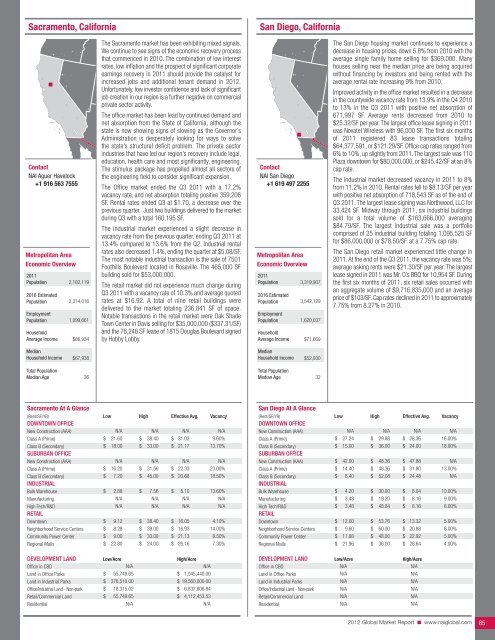

The Sacramento market has been exhibiting mixed signals.<br />

We continue to see signs of the economic recovery process<br />

that commenced in 2010. The combination of low interest<br />

rates, low inflation and the prospect of significant corporate<br />

earnings recovery in 2011 should provide the catalyst for<br />

increased jobs and additional tenant demand in <strong>2012</strong>.<br />

Unfortunately, low investor confidence and lack of significant<br />

job creation in our region is a further negative on commercial<br />

private sector activity.<br />

The office market has been lead by continued demand and<br />

net absorption from the State of California, although the<br />

state is now showing signs of slowing as the Governor’s<br />

Administration is desperately looking for ways to solve<br />

the state’s structural deficit problem. The private sector<br />

industries that have led our region’s recovery include legal,<br />

education, health care and most significantly, engineering.<br />

The stimulus package has propelled almost all sectors of<br />

the engineering field to consider significant expansion.<br />

The Office market ended the Q3 2011 with a 17.2%<br />

vacancy rate, and net absorption totaling positive 359,206<br />

SF. Rental rates ended Q3 at $1.70, a decrease over the<br />

previous quarter. Just two buildings delivered to the market<br />

during Q3 with a total 160,195 SF.<br />

The industrial market experienced a slight decrease in<br />

vacancy rate from the previous quarter, ending Q3 2011 at<br />

13.4% compared to 13.6% from the Q2. Industrial rental<br />

rates also decreased 1.4%, ending the quarter at $5.08/SF.<br />

The most notable industrial transaction is the sale of 7501<br />

Foothills Boulevard located in Roseville. The 465,000 SF<br />

building sold for $53,000,000.<br />

The retail market did not experience much change during<br />

Q3 2011 with a vacancy rate of 10.3% and average quoted<br />

rates at $16.92. A total of nine retail buildings were<br />

delivered to the market totaling 236,841 SF of space.<br />

Notable transactions in the retail market were Oak Shade<br />

Town Center in Davis selling for $35,000,000 ($337.31/SF)<br />

and the 76,248 SF lease of 1815 Douglas Boulevard signed<br />

by Hobby Lobby.<br />

Contact<br />

<strong>NAI</strong> San Diego<br />

+1 619 497 2255<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

3,319,907<br />

3,542,129<br />

1,620,037<br />

$71,669<br />

The San Diego housing market continues to experience a<br />

decrease in housing prices, down 5.8% from 2010 with the<br />

average single family home selling for $369,000. Many<br />

houses selling near the median price are being acquired<br />

without financing by investors and being rented with the<br />

average rental rate increasing 9% from 2010.<br />

Improved activity in the office market resulted in a decrease<br />

in the countywide vacancy rate from 13.9% in the Q4 2010<br />

to 13% in the Q3 2011 with positive net absorption of<br />

671,997 SF. Average rents decreased from 2010 to<br />

$25.32/SF per year. The largest office lease signing in 2011<br />

was Novatel Wireless with 96,000 SF. The first six months<br />

of 2011 registered 83 lease transactions totaling<br />

$64,377,591, or $121.29/SF. Office cap rates ranged from<br />

6% to 10%, up slightly from 2011. The largest sale was 110<br />

Plaza downtown for $80,000,000, or $245.42/SF at an 8%<br />

cap rate.<br />

The industrial market decreased vacancy in 2011 to 8%<br />

from 11.2% in 2010. Rental rates fell to $8.13/SF per year<br />

with positive net absorption of 718,543 SF as of the end of<br />

Q3 2011. The largest lease signing was Northwood, LLC for<br />

33,424 SF. Midway through 2011, six industrial buildings<br />

sold for a total volume of $163,666,000 averaging<br />

$84.79/SF. The largest industrial sale was a portfolio<br />

comprised of 25 industrial building totaling 1,095,525 SF<br />

for $86,000,000 or $78.50/SF. at a 7.75% cap rate.<br />

The San Diego retail market experienced little change in<br />

2011. At the end of the Q3 2011, the vacancy rate was 5%;<br />

average asking rents were $21.30/SF per year. The largest<br />

lease signed in 2011 was Mr. O’s BBQ for 10,954 SF. During<br />

the first six months of 2011, six retail sales occurred with<br />

an aggregate volume of $9,716,835,000 and an average<br />

price of $103/SF. Cap rates declined in 2011 to approximately<br />

7.75% from 8.27% in 2010.<br />

Median<br />

Household Income<br />

$67,938<br />

Median<br />

Household Income<br />

$52,930<br />

Total Population<br />

Median Age<br />

36<br />

Total Population<br />

Median Age<br />

32<br />

Sacramento At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

21.60<br />

18.00<br />

N/A<br />

16.20<br />

7.20<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

38.40<br />

33.00<br />

N/A<br />

31.56<br />

45.00<br />

N/A<br />

$ 31.03<br />

$ 21.17<br />

N/A<br />

$ 22.33<br />

$ 20.68<br />

N/A<br />

9.60%<br />

13.70%<br />

N/A<br />

23.00%<br />

18.50%<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

$ 2.88<br />

N/A<br />

N/A<br />

$ 7.56<br />

N/A<br />

N/A<br />

$ 5.10<br />

N/A<br />

N/A<br />

13.60%<br />

N/A<br />

N/A<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

$<br />

$<br />

$<br />

$<br />

9.12<br />

8.28<br />

9.00<br />

22.80<br />

$<br />

$<br />

$<br />

$<br />

38.40<br />

39.00<br />

33.00<br />

24.00<br />

$ 16.05<br />

$ 16.93<br />

$ 21.13<br />

$ 26.16<br />

4.10%<br />

14.00%<br />

8.50%<br />

7.30%<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

$<br />

N/A<br />

55,749.65<br />

N/A<br />

$ 1,045,440.00<br />

Land in Industrial Parks<br />

$ 376,510.00 $ 19,560,000.00<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

$<br />

$<br />

18,315.02<br />

55,749.65<br />

N/A<br />

$ 6,837,606.84<br />

$ 4,112,453.53<br />

N/A<br />

San Diego At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

27.24<br />

15.00<br />

42.00<br />

14.40<br />

8.40<br />

$<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

29.88<br />

36.00<br />

48.36<br />

48.36<br />

52.08<br />

N/A<br />

$ 28.36<br />

$ 24.00<br />

$ 47.88<br />

$ 31.80<br />

$ 24.48<br />

N/A<br />

16.00%<br />

18.00%<br />

N/A<br />

13.00%<br />

N/A<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

$<br />

$<br />

$<br />

4.20<br />

3.48<br />

3.48<br />

$<br />

$<br />

$<br />

30.00<br />

19.20<br />

48.84<br />

$<br />

$<br />

$<br />

8.04<br />

8.16<br />

8.16<br />

10.00%<br />

9.00%<br />

8.00%<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

$<br />

$<br />

$<br />

$<br />

12.00<br />

9.60<br />

11.88<br />

21.96<br />

$<br />

$<br />

$<br />

$<br />

53.76<br />

60.00<br />

48.00<br />

36.00<br />

$ 13.32<br />

$ 20.88<br />

$ 22.92<br />

$ 26.64<br />

5.00%<br />

8.00%<br />

5.00%<br />

4.00%<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 85