2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

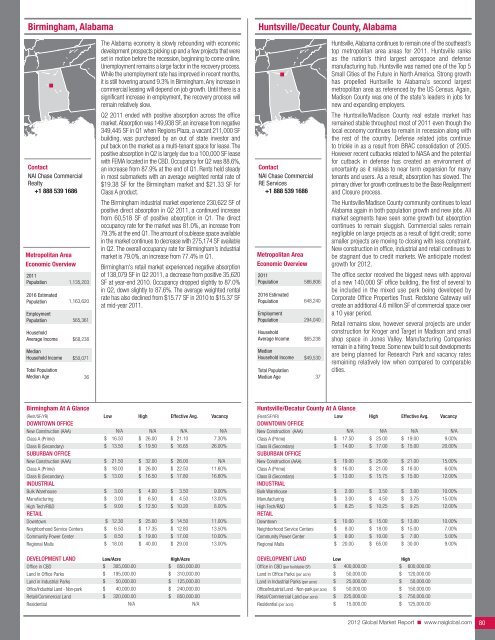

Birmingham, Alabama<br />

Huntsville/Decatur County, Alabama<br />

Contact<br />

<strong>NAI</strong> Chase Commercial<br />

Realty<br />

+1 888 539 1686<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

Total Population<br />

Median Age<br />

1,135,203<br />

1,163,620<br />

565,361<br />

$68,238<br />

$50,071<br />

36<br />

The Alabama economy is slowly rebounding with economic<br />

development prospects picking up and a few projects that were<br />

set in motion before the recession, beginning to come online.<br />

Unemployment remains a large factor in the recovery process.<br />

While the unemployment rate has improved in recent months,<br />

it is still hovering around 9.3% in Birmingham. Any increase in<br />

commercial leasing will depend on job growth. Until there is a<br />

significant increase in employment, the recovery process will<br />

remain relatively slow.<br />

Q2 2011 ended with positive absorption across the office<br />

market. Absorption was 149,938 SF, an increase from negative<br />

349,445 SF in Q1 when Regions Plaza, a vacant 211,000 SF<br />

building, was purchased by an out of state investor and<br />

put back on the market as a multi-tenant space for lease. The<br />

positive absorption in Q2 is largely due to a 100,000 SF lease<br />

with FEMA located in the CBD. Occupancy for Q2 was 88.6%,<br />

an increase from 87.9% at the end of Q1. Rents held steady<br />

in most submarkets with an average weighted rental rate of<br />

$19.38 SF for the Birmingham market and $21.33 SF for<br />

Class A product.<br />

The Birmingham industrial market experience 230,622 SF of<br />

positive direct absorption in Q2 2011, a continued increase<br />

from 60,518 SF of positive absorption in Q1. The direct<br />

occupancy rate for the market was 81.0%, an increase from<br />

79.3% at the end Q1. The amount of sublease space available<br />

in the market continues to decrease with 275,174 SF available<br />

in Q2. The overall occupancy rate for Birmingham’s industrial<br />

market is 79.0%, an increase from 77.4% in Q1.<br />

Birmingham's retail market experienced negative absorption<br />

of 138,079 SF in Q2 2011, a decrease from positive 35,620<br />

SF at year-end 2010. Occupancy dropped slightly to 87.0%<br />

in Q2, down slightly to 87.6%. The average weighted rental<br />

rate has also declined from $15.77 SF in 2010 to $15.37 SF<br />

at mid-year 2011.<br />

Contact<br />

<strong>NAI</strong> Chase Commercial<br />

RE Services<br />

+1 888 539 1686<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

Total Population<br />

Median Age<br />

586,806<br />

648,240<br />

294,040<br />

$65,238<br />

$49,530<br />

37<br />

Huntsville, Alabama continues to remain one of the southeast’s<br />

top metropolitan area areas for 2011. Huntsville ranks<br />

as the nation’s third largest aerospace and defense<br />

manufacturing hub. Huntsville was named one of the Top 5<br />

Small Cities of the Future in North America. Strong growth<br />

has propelled Huntsville to Alabama’s second largest<br />

metropolitan area as referenced by the US Census. Again,<br />

Madison County was one of the state's leaders in jobs for<br />

new and expanding employers.<br />

The Huntsville/Madison County real estate market has<br />

remained stable throughout most of 2011 even though the<br />

local economy continues to remain in recession along with<br />

the rest of the country. Defense related jobs continue<br />

to trickle in as a result from BRAC consolidation of 2005.<br />

However recent cutbacks related to NASA and the potential<br />

for cutback in defense has created an environment of<br />

uncertainty as it relates to near term expansion for many<br />

tenants and users. As a result, absorption has slowed. The<br />

primary driver for growth continues to be the Base Realignment<br />

and Closure process.<br />

The Huntsville/Madison County community continues to lead<br />

Alabama again in both population growth and new jobs. All<br />

market segments have seen some growth but absorption<br />

continues to remain sluggish. Commercial sales remain<br />

negligible on large projects as a result of tight credit; some<br />

smaller projects are moving to closing with less constraint.<br />

New construction in office, industrial and retail continues to<br />

be stagnant due to credit markets. We anticipate modest<br />

growth for <strong>2012</strong>.<br />

The office sector received the biggest news with approval<br />

of a new 140,000 SF office building, the first of several to<br />

be included in the mixed use park being developed by<br />

Corporate Office Properties Trust. Redstone Gateway will<br />

create an additional 4.6 million SF of commercial space over<br />

a 10 year period.<br />

Retail remains slow, however several projects are under<br />

construction for Kroger and Target in Madison and small<br />

shop space in Jones Valley. Manufacturing Companies<br />

remain in a hiring freeze. Some new build to suit developments<br />

are being planned for Research Park and vacancy rates<br />

remaining relatively low when compared to comparable<br />

cities.<br />

Birmingham At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

16.50<br />

13.50<br />

21.50<br />

18.00<br />

13.00<br />

N/A<br />

$ 26.00<br />

$ 19.50<br />

$ 32.00<br />

$ 26.00<br />

$ 16.50<br />

N/A<br />

$ 21.10<br />

$ 16.65<br />

$ 26.00<br />

$ 22.50<br />

$ 17.80<br />

N/A<br />

7.30%<br />

26.00%<br />

N/A<br />

11.60%<br />

16.60%<br />

Bulk Warehouse<br />

Manufacturing<br />

$<br />

$<br />

3.00<br />

3.00<br />

$<br />

$<br />

4.00<br />

6.50<br />

$<br />

$<br />

3.50<br />

4.50<br />

9.00%<br />

13.00%<br />

High Tech/R&D<br />

retaIl<br />

$ 9.00 $ 12.50 $ 10.20 8.00%<br />

Downtown<br />

$ 12.30 $ 25.00 $ 14.50 11.00%<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

$<br />

$<br />

$<br />

6.50<br />

8.50<br />

18.00<br />

$ 17.35<br />

$ 19.00<br />

$ 40.00<br />

$ 12.80<br />

$ 17.00<br />

$ 29.00<br />

13.50%<br />

10.00%<br />

13.00%<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

$<br />

$<br />

$<br />

$<br />

$<br />

305,000.00<br />

195,000.00<br />

50,000.00<br />

40,000.00<br />

320,000.00<br />

N/A<br />

$<br />

$<br />

$<br />

$<br />

$<br />

850,000.00<br />

310,000.00<br />

125,000.00<br />

240,000.00<br />

850,000.00<br />

N/A<br />

Huntsville/Decatur County At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

17.50<br />

14.00<br />

19.00<br />

16.00<br />

13.00<br />

N/A<br />

$ 25.00<br />

$ 17.00<br />

$ 25.00<br />

$ 21.00<br />

$ 15.75<br />

N/A<br />

$ 19.00<br />

$ 15.00<br />

$ 21.00<br />

$ 18.00<br />

$ 15.00<br />

N/A<br />

9.00%<br />

20.00%<br />

15.00%<br />

6.00%<br />

12.00%<br />

Bulk Warehouse<br />

Manufacturing<br />

$<br />

$<br />

2.00<br />

3.00<br />

$<br />

$<br />

3.50<br />

4.50<br />

$<br />

$<br />

3.00<br />

3.75<br />

10.00%<br />

15.00%<br />

High Tech/R&D<br />

retaIl<br />

$ 8.25 $ 10.25 $ 9.25 12.00%<br />

Downtown<br />

Neighborhood Service Centers<br />

$<br />

$<br />

10.00<br />

8.00<br />

$ 15.00<br />

$ 18.00<br />

$ 13.00<br />

$ 15.00<br />

10.00%<br />

7.00%<br />

Community Power Center<br />

$ 8.00 $ 10.00 $ 7.00 5.00%<br />

Regional Malls<br />

$ 20.00 $ 65.00 $ 30.00 9.00%<br />

deVeloPment land Low High<br />

Office in CBD (per buildable SF)<br />

Land in Office Parks (per acre)<br />

Land in Industrial Parks (per acre)<br />

Office/Industrial Land - Non-park (per acre)<br />

Retail/Commercial Land (per acre)<br />

Residential (per acre)<br />

$ 400,000.00 $ 600,000.00<br />

$ 50,000.00 $ 120,000.00<br />

$ 25,000.00 $ 50,000.00<br />

$ 50,000.00 $ 150,000.00<br />

$ 225,000.00 $ 750,000.00<br />

$ 15,000.00 $ 125,000.00<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 80