2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Lima, Peru<br />

Caracas, Venezuela<br />

Contact<br />

<strong>NAI</strong> Peru Rosecorp<br />

+511 440 2630<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

496,225<br />

6.0%<br />

$162.48<br />

$5,414.27<br />

2.5%<br />

7.5%<br />

4.3%<br />

30.009<br />

Peru’s 2011 growth rate is expected to be 6.3%, a decrease<br />

from 8.8% in 2010 due to repercussions from the change<br />

in government and economic policies and also the US and<br />

European financial crises. However, the World Bank predicts<br />

Peru will continue as a growth leader in Latin America<br />

through 2013. Following this line, the Latin Business Index<br />

highlights the country has the second best macroeconomic<br />

environment in the region. The S&P credit rating improved<br />

from BBB- to BBB.<br />

The industrial sector demand for space keeps growing as<br />

do the rents and this market remains unsatisfied. Sale prices<br />

in Lima for Class A properties are $800 to $1,300/SM and<br />

lease rates in this Class are $4.00 to $7.00/SM. The trend<br />

of industrial migration and relocation continues from central<br />

parts of the main cities due to residential and commercial<br />

developments moving a few kilometers beyond their periphery.<br />

Examples are the district of Cerro Colorado in Arequipa y La<br />

Esperanza en Trujillo and Chilca in Lima; where a new 250<br />

Ha Industrial Park is now being developed at a price of<br />

$30/SM.<br />

The office market has shown a steady increase in rent<br />

throughout the year, a consequence of the supply backlog<br />

and pressure on the ideal land available for office building<br />

projects. The total increase was 9.1% from an average of<br />

$16.5/SM up to $18/SM in the prime office sector. The<br />

vacancy for this segment is at 4.5% in delivered space,<br />

although 51,730 SM was delivered during 2011. By the end<br />

of <strong>2012</strong> or mid 2013, a large number of projects are<br />

expected to be delivered. About 40% of prime buildings<br />

announced over the next two years they will seek LEED<br />

certification, showing an encouraging trend towards<br />

sustainable construction.<br />

The 2011 retail sector growth was steady and continued its<br />

galloping rhythm in all formats. Total sales grew by 25%<br />

reaching $4.1 billion. Peru’s <strong>Global</strong> Retail delivers new retail<br />

malls nationwide. It is becoming increasingly difficult to find<br />

suitable land for the development of these projects. In<br />

response to these market conditions, malls began to include<br />

office buildings and hotels within the complex, optimizing<br />

their products. Stand alone stores are located on first floor<br />

office buildings and strip center projects are quickly increasing<br />

in number. Thus, the trend in Lima for <strong>2012</strong> will be<br />

mixed-use malls and buildings as well as a greater number<br />

of neighborhood service centers.<br />

Contact<br />

<strong>NAI</strong> Ferca<br />

+1 58 212 286 8124<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

352,140<br />

0.5%<br />

$296.34<br />

$9,955.48<br />

32.2%<br />

8.1%<br />

17.4%<br />

29.767<br />

Venezuela offers excellent opportunities for investment due<br />

to extraordinary oil revenues. Although oil prices went from<br />

$147 to $98 (October, 2011), oil revenues are still an<br />

important commodity. The level of Venezuela cash reserves<br />

at the beginning of the economic crisis allowed that<br />

macroeconomic imbalances did not translate into a severe<br />

contraction in the market. The oil sector and oil related<br />

industries are the key drivers of the Venezuela economy.<br />

The office market in Caracas, mostly dependent on foreign<br />

companies, has become thin. Sale and rental prices<br />

increased due to very low inventory, while construction of<br />

new projects started but only a few have entered the market<br />

in 2011. More projects are expected to be finished in <strong>2012</strong>,<br />

which will not be enough to catch up with demand for Class<br />

AAA offices.<br />

The industrial real estate market has also seen low inventory<br />

levels in 2011 with rental and sale prices above 2010 levels.<br />

It is expected that this trend will continue through <strong>2012</strong> due<br />

to an increase in oil revenue and plans from the Chavez<br />

administration to reduce unemployment through development<br />

of the manufacturing, construction and agricultural sectors.<br />

Retail has also seen low inventory levels and increased prices.<br />

Vacancy rates at Class AAA shopping centers are extremely<br />

low. The retail sector has benefited from the government policy<br />

of increasing consumption of the lower income population,<br />

which increased the demand of retail outlets.<br />

Investment in real estate among transnational companies<br />

use this type of investment to hedge their Bolivar cash<br />

balances against inflation. Due to the exchange control<br />

system in force since 2006, repatriation of dividends at an<br />

official exchanges rate of $1 to VEF 4.30 is very difficult,<br />

leaving many companies to invest their Bolivar cash surplus<br />

in the office/warehouse market.<br />

Venezuela has the largest oil reserves in the world, a<br />

commodity that will continue to be key to the world economy.<br />

Due to its foreign exchange reserves, it’s estimated that<br />

Venezuela will be able to cope with any temporary variation<br />

of oil price.<br />

The multifamily market has faced strong intervention from<br />

the Venezuelan government. The current deficit is currently<br />

estimated in more than 2,000,000 units. This situation has<br />

caused the Chavez Administration to launch construction<br />

plans financed with public funds and with the cooperation<br />

of foreign countries (Uruguay, Iran and China).<br />

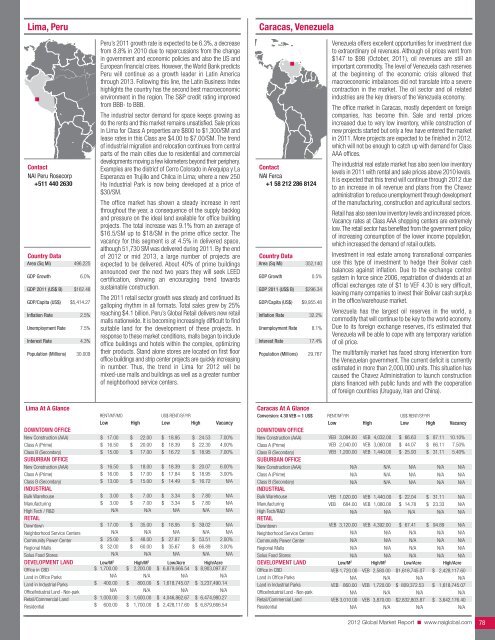

Lima At A Glance<br />

RENT/M 2 /MO<br />

US$ RENT/SF/YR<br />

low High low High Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$ 17.00<br />

$ 16.50<br />

$ 15.00<br />

$ 16.50<br />

$ 16.00<br />

$ 13.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

22.00<br />

20.00<br />

17.00<br />

18.00<br />

17.00<br />

15.00<br />

$ 18.95<br />

$ 18.39<br />

$ 16.72<br />

$ 18.39<br />

$ 17.84<br />

$ 14.49<br />

$ 24.53<br />

$ 22.30<br />

$ 18.95<br />

$ 20.07<br />

$ 18.95<br />

$ 16.72<br />

7.00%<br />

4.00%<br />

7.00%<br />

6.00%<br />

3.00%<br />

N/A<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech / R&D<br />

retaIl<br />

$<br />

$<br />

3.00<br />

3.00<br />

N/A<br />

$<br />

$<br />

7.00<br />

7.00<br />

N/A<br />

$<br />

$<br />

3.34<br />

3.34<br />

N/A<br />

$<br />

$<br />

7.80<br />

7.80<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

Solus Food Stores<br />

$ 17.00<br />

N/A<br />

$ 25.00<br />

$ 32.00<br />

N/A<br />

$<br />

$<br />

$<br />

35.00<br />

N/A<br />

48.00<br />

60.00<br />

N/A<br />

$ 18.95<br />

N/A<br />

$ 27.87<br />

$ 35.67<br />

N/A<br />

$ 39.02<br />

N/A<br />

$ 53.51<br />

$ 66.89<br />

N/A<br />

N/A<br />

N/A<br />

2.00%<br />

3.00%<br />

N/A<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

$ 1,700.00 $ 2,200.00 $ 6,879,666.54 $ 8,903,097.87<br />

N/A N/A N/A N/A<br />

$ 400.00 $ 800.00 $ 1,618,745.07 $ 3,237,490.14<br />

N/A N/A N/A N/A<br />

$ 1,000.00 $ 1,600.00 $ 4,046,862.67 $ 6,474,980.27<br />

$ 600.00 $ 1,700.00 $ 2,428,117.60 $ 6,879,666.54<br />

Caracas At A Glance<br />

conversion: 4.30 Veb = 1 us$ RENT/M 2 /YR US$ RENT/SF/YR<br />

low High low High Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

VEB 3,084.00<br />

VEB 2,040.00<br />

VEB 1,200.00<br />

N/A<br />

N/A<br />

N/A<br />

VEB 1,020.00<br />

VEB 4,032.00<br />

VEB 3,060.00<br />

VEB 1,440.00<br />

N/A<br />

N/A<br />

N/A<br />

VEB 1,440.00<br />

$ 66.63<br />

$ 44.07<br />

$ 25.93<br />

N/A<br />

N/A<br />

N/A<br />

$ 22.04<br />

$ 87.11<br />

$ 66.11<br />

$ 31.11<br />

N/A<br />

N/A<br />

N/A<br />

$ 31.11<br />

10.10%<br />

7.50%<br />

5.40%<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

VEB 684.00<br />

N/A<br />

VEB 1,080.00<br />

N/A<br />

$ 14.78<br />

N/A<br />

$ 23.33<br />

N/A<br />

N/A<br />

N/A<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

Solus Food Stores<br />

VEB 3,120.00<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

VEB 4,392.00<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

$ 67.41<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

$ 94.89<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

VEB 1,720.00 VEB 2,580.00 $1,618,745.07 $ 2,428,117.60<br />

N/A N/A N/A N/A<br />

VEB 860.00 VEB 1,720.00 $ 809,372.53 $ 1,618,745.07<br />

N/A N/A N/A N/A<br />

VEB 3,010.00 VEB 3,870.00 $2,832,803.87 $ 3,642,176.40<br />

N/A N/A N/A N/A<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 78