2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Tijuana, Baja California, Mexico<br />

Contact<br />

<strong>NAI</strong> Mexico<br />

+1 619 690 3029<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

758,449<br />

Tijuana is located in Northwest Mexico in the state of Baja<br />

California. With its shared border with San Diego, CA, it is the<br />

busiest border crossing in the world. Tijuana has hosted the<br />

largest concentration of foreign manufacturing firms in Mexico<br />

for over 40 years due to its position to ship overnight to most<br />

parts of the Western US. Tijuana is a bi-cultural border city<br />

with a population of 2 million people.<br />

Tijuana’s industrial market is comprised of 72.5 million SF.<br />

More than 900 global firms are established in Tijuana’s 45<br />

industrial parks in sectors ranging from aerospace, medical<br />

devices, electronics and general industrial. By the end of<br />

2011, vacancy rates had fallen from 12.6% to 11.72%,<br />

despite continued consolidations creating vacant space.<br />

Vacancy rates for <strong>2012</strong> are forecasted to fall below 8%. 2011<br />

continued as a tenant’s market with lease rates remaining at<br />

their lowest levels in 20 years. The 15% to 25% discounts<br />

have been well received by firms trading older space for lower<br />

rates in newer projects. Net absorption of 1.2 million SF was<br />

driven by projects such as INZI (192,000 SF), Energy Labs<br />

(288,000 SF), Ryerson (80,000 SF), Elektra (80,000 SF),<br />

Andrea (110,000 SF) and Samsung (225,000 SF). These<br />

firms are expanding to take advantage of the cost differential<br />

between Mexico and home markets. New construction during<br />

2011 included Andrea, INZI, Samsung and Ryerson. New<br />

construction is expected for build-to-suit project for other<br />

Samsung suppliers during <strong>2012</strong> in or nearby the El Florido<br />

Industrial Park. Lease rates will rise during <strong>2012</strong> in<br />

submarkets lacking sufficient inventory to support new<br />

demand. <strong>2012</strong> is expected to continue as a tenant’s market<br />

in submarkets with excess inventory.<br />

Two Class A office towers were completed during 2011;<br />

Corporativo Tapachula and World Trade Center. Office lease<br />

rates remained flat. <strong>2012</strong> will reflect clients relocating to trade<br />

for better quality space and/or to consolidate from other<br />

locations in Tijuana.<br />

Retail investment from domestic and international firms<br />

continued during 2011. <strong>2012</strong> will see a limited amount<br />

of new commercial centers with the biggest projects<br />

concentrated in the southeast and south (Blvd 2000).<br />

The critical mass of industrial firms, well developed industrial<br />

clusters with a proximity to western US markets and a 40 year<br />

history with foreign manufacturers, makes Tijuana a strong<br />

market for investors.<br />

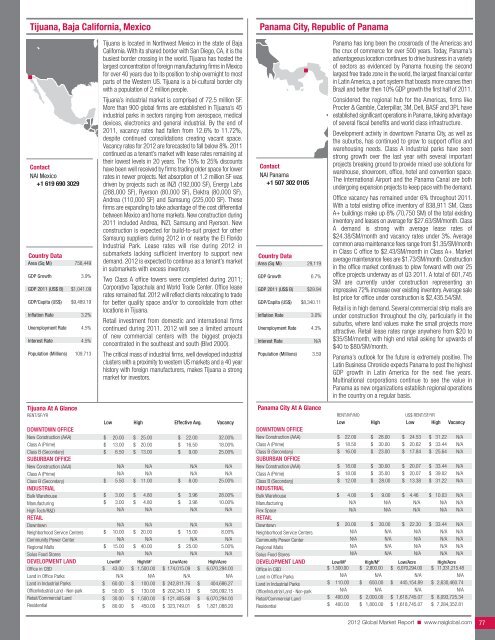

Tijuana At A Glance<br />

RENT/SF/YR<br />

low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

$<br />

20.00<br />

13.00<br />

6.50<br />

N/A<br />

N/A<br />

5.50<br />

$ 25.00<br />

$ 20.00<br />

$ 13.00<br />

N/A<br />

N/A<br />

$ 11.00<br />

$<br />

$<br />

$<br />

$<br />

22.00<br />

16.50<br />

9.00<br />

N/A<br />

N/A<br />

8.00<br />

32.00%<br />

18.00%<br />

25.00%<br />

N/A<br />

N/A<br />

25.00%<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

Downtown<br />

$<br />

$<br />

3.00<br />

3.00<br />

N/A<br />

N/A<br />

$<br />

$<br />

4.80<br />

4.80<br />

N/A<br />

N/A<br />

$<br />

$<br />

3.96<br />

3.96<br />

N/A<br />

N/A<br />

28.00%<br />

10.00%<br />

N/A<br />

N/A<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

Solus Food Stores<br />

$<br />

$<br />

10.00<br />

N/A<br />

15.00<br />

N/A<br />

$ 20.00<br />

N/A<br />

$ 40.00<br />

N/A<br />

$<br />

$<br />

15.00<br />

N/A<br />

25.00<br />

N/A<br />

8.00%<br />

N/A<br />

5.00%<br />

N/A<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

3.9%<br />

$1,041.09<br />

$9,489.19<br />

3.2%<br />

4.5%<br />

4.5%<br />

109.713<br />

$ 43.00 $ 1,500.00 $ 174,015.09 $ 6,070,294.00<br />

N/A N/A N/A N/A<br />

$ 60.00 $ 100.00 $ 242,811.76 $ 404,686.27<br />

$ 50.00 $ 130.00 $ 202,343.13 $ 526,092.15<br />

$ 30.00 $ 1,500.00 $ 121,405.88 $ 6,070,294.00<br />

$ 80.00 $ 450.00 $ 323,749.01 $ 1,821,088.20<br />

Panama City, Republic of Panama<br />

Contact<br />

<strong>NAI</strong> Panama<br />

+1 507 302 0105<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

Panama City At A Glance<br />

Panama has long been the crossroads of the Americas and<br />

the crux of commerce for over 500 years. Today, Panama’s<br />

advantageous location continues to drive business in a variety<br />

of sectors as evidenced by Panama housing the second<br />

largest free trade zone in the world, the largest financial center<br />

in Latin America, a port system that boasts more cranes then<br />

Brazil and better then 10% GDP growth the first half of 2011.<br />

Considered the regional hub for the Americas, firms like<br />

Procter & Gamble, Caterpillar, 3M, Dell, BASF and 3PL have<br />

established significant operations in Panama, taking advantage<br />

of several fiscal benefits and world class infrastructure.<br />

Development activity in downtown Panama City, as well as<br />

the suburbs, has continued to grow to support office and<br />

warehousing needs. Class A industrial parks have seen<br />

strong growth over the last year with several important<br />

projects breaking ground to provide mixed use solutions for<br />

warehouse, showroom, office, hotel and convention space.<br />

The International Airport and the Panama Canal are both<br />

undergoing expansion projects to keep pace with the demand.<br />

Office vacancy has remained under 6% throughout 2011.<br />

With a total existing office inventory of 838,911 SM, Class<br />

A+ buildings make up 8% (70,750 SM) of the total existing<br />

inventory and leases on average for $27.63/SM/month. Class<br />

A demand is strong with average lease rates of<br />

$24.38/SM/month and vacancy rates under 3%. Average<br />

common area maintenance fees range from $1.35/SM/month<br />

in Class C office to $2.43/SM/month in Class A+. <strong>Market</strong><br />

average maintenance fees are $1.73/SM/month. Construction<br />

in the office market continues to plow forward with over 25<br />

office projects underway as of Q3 2011. A total of 601,745<br />

SM are currently under construction representing an<br />

impressive 72% increase over existing inventory. Average sale<br />

list price for office under construction is $2,435.54/SM.<br />

Retail is in high demand. Several commercial strip malls are<br />

under construction throughout the city, particularly in the<br />

suburbs, where land values make the small projects more<br />

attractive. Retail lease rates range anywhere from $20 to<br />

$35/SM/month, with high end retail asking for upwards of<br />

$40 to $80/SM/month.<br />

Panama’s outlook for the future is extremely positive. The<br />

Latin Business Chronicle expects Panama to post the highest<br />

GDP growth in Latin America for the next five years.<br />

Multinational corporations continue to see the value in<br />

Panama as new organizations establish regional operations<br />

in the country on a regular basis.<br />

RENT/M 2 /MO<br />

US$ RENT/SF/YR<br />

low High low High Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

Flex Space<br />

retaIl<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

Solus Food Stores<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

22.00<br />

18.50<br />

16.00<br />

18.00<br />

18.00<br />

12.00<br />

4.00<br />

N/A<br />

N/A<br />

20.00<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

28.00<br />

30.00<br />

23.00<br />

30.00<br />

35.00<br />

28.00<br />

9.00<br />

N/A<br />

N/A<br />

30.00<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

24.53<br />

20.62<br />

17.84<br />

20.07<br />

20.07<br />

13.38<br />

4.46<br />

N/A<br />

N/A<br />

22.30<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

$ 31.22<br />

$ 33.44<br />

$ 25.64<br />

$ 33.44<br />

$ 39.02<br />

$ 31.22<br />

$ 10.03<br />

N/A<br />

N/A<br />

$ 33.44<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

29,119<br />

6.7%<br />

$29.94<br />

$8,340.11<br />

3.0%<br />

4.3%<br />

N/A<br />

3.59<br />

$ 1,500.00 $ 2,800.00 $ 6,070,294.00 $ 11,331,215.48<br />

N/A N/A N/A N/A<br />

$ 110.00 $ 650.00 $ 445,154.89 $ 2,630,460.74<br />

N/A N/A N/A N/A<br />

$ 400.00 $ 2,000.00 $ 1,618,745.07 $ 8,093,725.34<br />

$ 400.00 $ 1,800.00 $ 1,618,745.07 $ 7,284,352.81<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 77